Home>Finance>How Long Of A Grace Period Does State Farm Give You?

Finance

How Long Of A Grace Period Does State Farm Give You?

Published: February 21, 2024

Learn about the grace period provided by State Farm for your finance needs. Understand the flexibility in managing your payments and finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of insurance, where protection and peace of mind go hand in hand. When it comes to managing your insurance policy, staying informed about payment deadlines and grace periods is crucial. In this article, we'll delve into the concept of grace periods, specifically focusing on State Farm's approach. Understanding the grace period offered by State Farm can empower you to make informed decisions and take proactive steps to manage your insurance payments effectively.

Navigating the intricacies of insurance policies can be overwhelming, but with the right knowledge, you can confidently steer through the process. Let's embark on a journey to unravel the significance of grace periods, explore State Farm's specific policies, and gain insights into the importance of timely payments. Whether you're a seasoned policyholder or a newcomer to the realm of insurance, this article aims to provide valuable information that can enhance your financial literacy and contribute to a stress-free insurance experience. So, sit back, relax, and let's embark on this enlightening exploration of grace periods and their relevance within the realm of insurance.

Understanding Grace Periods

Grace periods serve as a crucial component of insurance policies, offering a window of time beyond the due date during which a payment can be made without facing penalties or policy cancellation. This grace period provides policyholders with a valuable opportunity to ensure that their coverage remains uninterrupted, even if they are unable to make the payment by the initial due date.

It’s important to note that grace periods vary depending on the insurance provider and the type of policy. Typically, grace periods range from a few days to a month, allowing policyholders the flexibility to manage their payments within a reasonable timeframe. During this period, the insurance coverage remains in effect, providing a safety net for the policyholder and their assets.

Understanding the specifics of the grace period outlined in your insurance policy is essential for maintaining financial security. By familiarizing yourself with the duration of the grace period and any associated terms, you can effectively plan your payments and avoid potential disruptions in coverage.

State Farm’s Grace Period

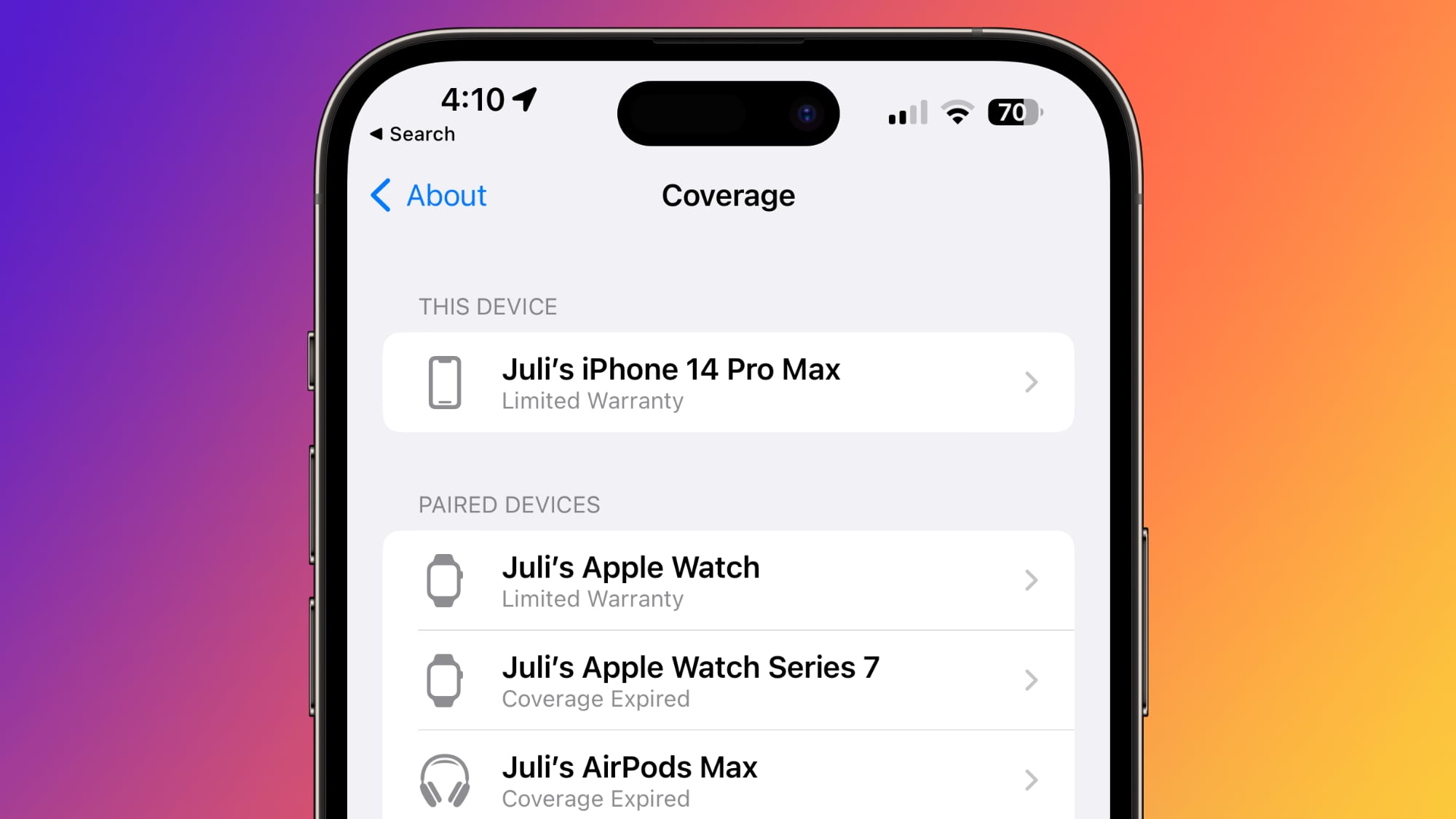

State Farm, a prominent insurance provider known for its commitment to customer satisfaction, offers a grace period to policyholders, ensuring that they have the necessary flexibility to manage their payments. The specifics of State Farm’s grace period can vary based on the type of insurance policy and the regulations in the policyholder’s state of residence.

For auto insurance policies with State Farm, the grace period for late payments is typically around 10 days. During this time, policyholders can submit their overdue payments without experiencing any immediate repercussions, such as policy cancellation or late fees. It’s essential for policyholders to refer to their policy documents or contact their State Farm agent to confirm the exact duration of the grace period applicable to their specific policy.

Similarly, State Farm’s grace period for other types of insurance, such as homeowners or renters insurance, may also follow a similar timeframe, but it’s imperative to verify this information based on the individual policy details.

State Farm’s commitment to providing a reasonable grace period underscores its dedication to customer-centric policies, recognizing that unforeseen circumstances or temporary financial constraints may impact a policyholder’s ability to make timely payments.

By understanding and adhering to the grace period offered by State Farm, policyholders can navigate their insurance payments with confidence, knowing that they have a brief yet valuable window of flexibility to manage their financial obligations without jeopardizing their coverage.

Importance of Paying on Time

Timely payment of insurance premiums is a fundamental aspect of maintaining financial security and uninterrupted coverage. By paying on time, policyholders uphold their end of the insurance contract, ensuring that they continue to benefit from the protection and benefits outlined in their policy. Additionally, paying on time reflects positively on the policyholder’s financial responsibility and reliability, which can have broader implications for their overall financial well-being.

When policyholders consistently make timely payments, they demonstrate their commitment to fulfilling their financial obligations, which can contribute to a positive credit history and score. A strong credit history is invaluable, as it can impact various aspects of the policyholder’s financial life, such as loan approvals, interest rates, and overall financial stability.

Furthermore, paying insurance premiums on time is essential for maintaining continuous coverage. In the event of an unforeseen incident or loss, having uninterrupted coverage ensures that the policyholder can confidently rely on their insurance benefits to mitigate the financial impact of the situation. Without timely payments, the risk of coverage lapses or policy cancellations increases, leaving the policyholder vulnerable to potential financial hardships in the absence of adequate insurance protection.

From a broader perspective, paying insurance premiums on time contributes to the overall stability and sustainability of the insurance industry. Timely payments enable insurance providers to fulfill their commitments to policyholders and efficiently manage their operations, ultimately fostering a reliable and robust insurance ecosystem that benefits all stakeholders.

By recognizing the importance of paying on time and honoring their financial responsibilities, policyholders can cultivate a strong financial reputation, safeguard their coverage, and contribute to the stability of the insurance landscape.

Consequences of Late Payments

While the grace period offers a brief reprieve for late payments, it’s essential for policyholders to understand the potential consequences of consistently missing payment deadlines. Late payments can trigger a cascade of adverse effects that may impact the policyholder’s financial well-being and insurance coverage.

One of the immediate consequences of late payments is the accrual of late fees. Insurance providers often impose financial penalties on overdue payments, increasing the overall cost of the policy. These fees can compound over time, further straining the policyholder’s financial resources.

Additionally, repeated late payments can lead to the risk of policy cancellation. If a policyholder fails to bring their payments up to date within the grace period or continues to miss deadlines, the insurance provider may opt to cancel the policy. This can leave the policyholder without coverage, exposing them to significant financial risks in the absence of insurance protection.

Moreover, late payments and potential policy cancellations can have implications beyond the specific insurance policy. They may adversely impact the policyholder’s credit history and score, tarnishing their financial reputation and potentially hindering their ability to secure favorable terms for loans, credit cards, or other financial products in the future.

From a practical standpoint, the absence of insurance coverage resulting from late payments can leave the policyholder vulnerable to unexpected events, such as accidents, natural disasters, or liability claims, without the necessary financial safeguards in place.

Understanding the potential consequences of late payments underscores the significance of prioritizing timely payments and actively managing insurance obligations. By staying informed and proactive, policyholders can mitigate the risks associated with late payments, preserve their financial stability, and safeguard their valuable insurance coverage.

Tips for Managing Your Insurance Payments

Effectively managing insurance payments is essential for maintaining financial stability and uninterrupted coverage. By implementing strategic approaches and staying organized, policyholders can navigate their insurance obligations with confidence and diligence. Here are some valuable tips for managing insurance payments:

- Set Up Automated Payments: Consider enrolling in automated payment systems offered by your insurance provider. Automated payments can help ensure that premiums are deducted from your account on time, minimizing the risk of late payments and associated penalties.

- Utilize Calendar Reminders: Mark your payment due dates on a calendar or set digital reminders on your smartphone or computer. This proactive approach can help you stay mindful of upcoming payments and take timely action to submit them.

- Review Your Policy Regularly: Take the time to review your insurance policy and familiarize yourself with the specifics of the grace period, late payment fees, and potential consequences of missed payments. Understanding these details can empower you to make informed decisions and avoid unnecessary complications.

- Communicate with Your Insurance Agent: Maintain open communication with your insurance agent or representative. If you anticipate challenges in making a payment on time, proactive communication can lead to potential solutions or alternative arrangements to avoid disruptions in coverage.

- Budget for Insurance Payments: Incorporate your insurance premiums into your budgeting process. By prioritizing these payments and allocating funds accordingly, you can ensure that they are given the necessary financial consideration.

- Explore Payment Flexibility: Inquire about potential payment flexibility options with your insurance provider. Some companies may offer alternative payment schedules or arrangements during challenging financial circumstances.

- Seek Financial Counseling if Needed: If you encounter persistent challenges in managing your insurance payments or overall financial obligations, consider seeking guidance from a financial counselor or advisor. They can provide personalized strategies to help you navigate financial difficulties effectively.

By implementing these proactive strategies and staying informed about your insurance payments, you can cultivate a disciplined approach to managing your financial responsibilities and safeguarding your valuable insurance coverage.

Conclusion

Understanding the nuances of grace periods and the significance of timely insurance payments is pivotal for every policyholder. Whether you’re insured with State Farm or another provider, the principles of financial responsibility and proactive payment management remain universally essential.

By familiarizing yourself with the grace period offered by your insurance provider, such as State Farm, and staying informed about the potential consequences of late payments, you can navigate your insurance obligations with confidence and diligence. The grace period serves as a valuable buffer, offering flexibility during unforeseen circumstances or temporary financial constraints.

It’s crucial to recognize that paying insurance premiums on time extends beyond mere financial transactions; it reflects your commitment to upholding the terms of the insurance contract and maintaining uninterrupted coverage. Timely payments contribute to your financial stability, creditworthiness, and overall peace of mind.

As you embark on your journey to manage your insurance payments effectively, consider leveraging automated payment systems, setting calendar reminders, and maintaining open communication with your insurance provider. These proactive measures can empower you to navigate potential challenges and uphold your financial responsibilities with confidence.

Ultimately, the proactive management of insurance payments is an integral component of your broader financial strategy. By prioritizing timely payments, staying informed about your policy details, and seeking assistance when needed, you can cultivate a resilient and responsible approach to safeguarding your financial well-being and valuable insurance coverage.

Embracing these principles will not only enhance your financial literacy but also contribute to a seamless and stress-free insurance experience, allowing you to focus on the moments that matter, knowing that you have a reliable safety net in place.