Finance

How Much Is Insurance For A Honda Civic?

Modified: December 30, 2023

Looking for insurance for your Honda Civic? Find out how much it will cost and get the best finance options with our helpful guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

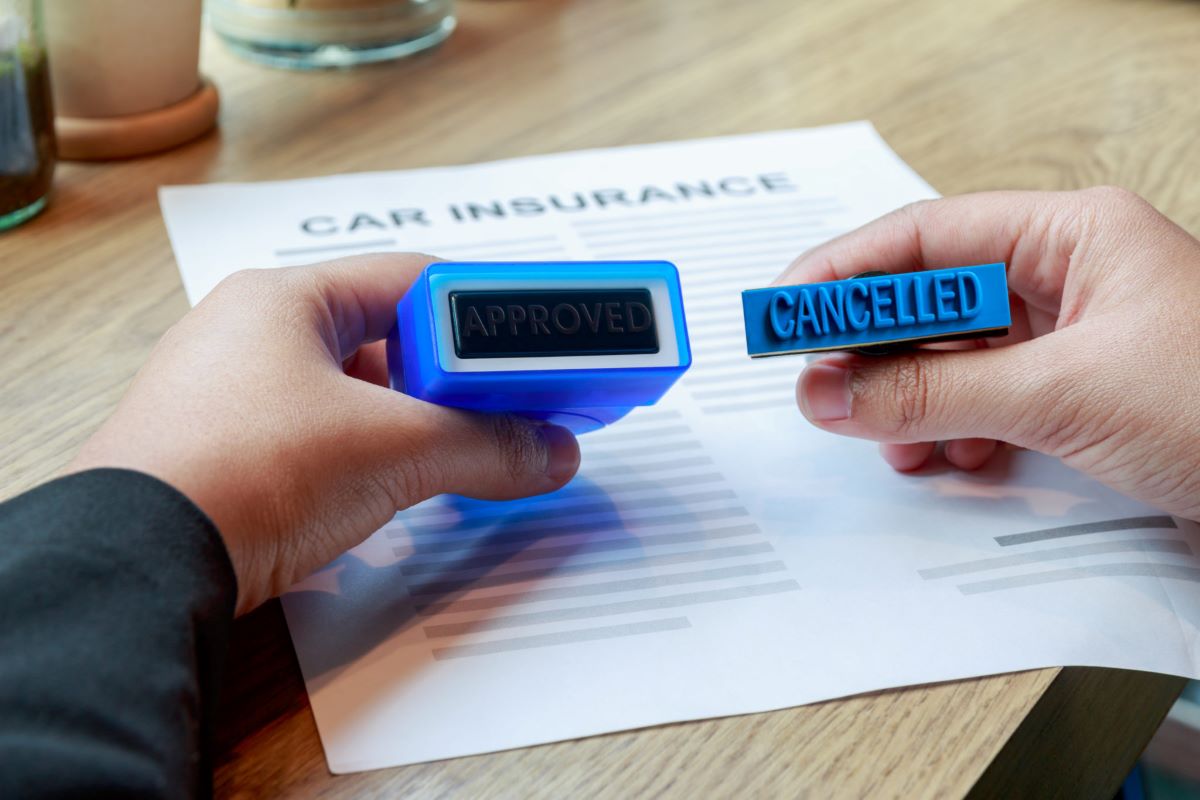

When it comes to purchasing car insurance for a Honda Civic, it’s important to understand the factors that can impact your premium. The cost of insurance can vary based on a variety of factors, including your driving history, the model and year of your Honda Civic, your location, and the coverage options you choose.

The Honda Civic is a popular and reliable car that appeals to a wide range of drivers. Known for its fuel efficiency, safety features, and affordable price point, the Honda Civic is a top choice for many individuals and families. However, it’s crucial to consider the cost of insurance when buying a Honda Civic to ensure you can afford the coverage you need to protect your vehicle and yourself in the event of an accident or other unforeseen circumstances.

In this article, we will delve into the factors that can affect the insurance rates for a Honda Civic and provide tips on how to find affordable insurance options. Whether you are a first-time car owner or an experienced driver, understanding the ins and outs of Honda Civic insurance can help you make informed decisions and potentially save money down the line.

Factors that Affect Honda Civic Insurance Rates

Several factors can influence the cost of insurance for your Honda Civic. Understanding these factors can help you anticipate and manage your insurance expenses more effectively. Here are some key considerations:

- Driving History: Your driving history plays a significant role in determining your insurance premium. If you have a clean driving record with no accidents or traffic violations, you are likely to enjoy lower insurance rates. On the other hand, if you have a history of accidents or traffic violations, your rates may be higher.

- Location: Where you live can impact your insurance rates. Urban areas with higher crime rates and heavy traffic tend to have higher insurance premiums than rural areas. Additionally, states with higher rates of uninsured drivers may also have higher insurance rates overall.

- Age and Gender: Insurance companies often consider age and gender when determining rates. Younger drivers, particularly teenagers, tend to have higher insurance premiums due to their lack of driving experience. Additionally, statistics show that young male drivers are more likely to engage in risky behavior, resulting in higher insurance rates for this demographic.

- Model and Trim Level: The specific model and trim level of your Honda Civic can impact your insurance rates. Higher-end models or sports variants may have higher premiums due to their increased value and potential for theft or vandalism.

- Deductible and Coverage Options: The deductible and coverage options you choose can also affect your insurance rates. A higher deductible can lower your premium, but it means you’ll have to pay more out of pocket in the event of an accident. Similarly, comprehensive and collision coverage will increase your premium but provide more extensive coverage.

- Credit History: In some states, insurance companies use credit-based insurance scores to determine rates. Maintaining a good credit history can help you secure lower insurance premiums.

Keep in mind that every insurance company weighs these factors differently, so it’s essential to compare quotes from multiple insurers to find the best rates for your Honda Civic.

Average Cost of Insurance for a Honda Civic

The average cost of insurance for a Honda Civic can vary depending on the factors mentioned earlier. On average, you can expect to pay between $1,200 and $1,800 per year for full coverage insurance for a Honda Civic. However, this is just a rough estimate, and individual rates may differ based on your specific circumstances.

Insurance rates are typically determined by the level of risk that the insurance company associates with insuring a particular vehicle. The Honda Civic generally has lower insurance rates compared to sports cars or luxury vehicles, thanks to its reputation for reliability and safety. Additionally, the Civic’s affordability and widespread availability of spare parts can contribute to lower insurance costs.

The specific model and year of your Honda Civic will also affect the insurance rates. Newer models with advanced safety features could potentially qualify for discounts, as these features reduce the risk of accidents and injuries.

It’s important to note that these are just average insurance costs, and your premium may vary significantly based on your driving history, personal circumstances, and the insurance provider you choose. To get an accurate idea of the cost, it’s recommended to obtain quotes from multiple insurance companies and compare them to find the best rate and coverage for your Honda Civic.

Tips for Finding Affordable Insurance for a Honda Civic

Finding affordable insurance for your Honda Civic doesn’t have to be a daunting task. Here are some tips to help you secure the best rates and coverage:

- Shop Around and Compare Quotes: Don’t settle for the first insurance quote you receive. Take the time to obtain quotes from multiple insurance providers and compare them. Each company has its own pricing structure and discounts, so exploring your options can help you find a better deal.

- Consider Higher Deductibles: Opting for a higher deductible can lower your insurance premium. Keep in mind that you’ll need to have the deductible amount set aside in case of an accident, so choose a deductible that you can afford.

- Bundle Your Policies: Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance, with them. Consider bundling your insurance policies to save money on premiums.

- Take Advantage of Discounts: Inquire about any available discounts and see if you qualify. Insurance providers often offer discounts for safe driving records, completing driver safety courses, being a good student, having anti-theft devices installed in your vehicle, or being a member of certain professional organizations.

- Maintain a Good Credit Score: As mentioned earlier, some insurance companies consider credit-based insurance scores when determining rates. Maintaining a good credit score can help you secure lower insurance premiums, so make sure to pay bills on time and manage your credit responsibly.

Remember, the key to finding affordable insurance for your Honda Civic is to do thorough research, compare quotes, and leverage available discounts. Don’t hesitate to reach out to insurance agents and ask questions to ensure you get the right coverage at a reasonable price.

How to Save Money on Honda Civic Insurance

If you own a Honda Civic and want to save money on your insurance premiums, here are some effective strategies to consider:

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations is crucial to keep your insurance rates low. Safe driving practices not only help you stay safe on the roads but also contribute to lower insurance premiums in the long run.

- Choose a Higher Deductible: Opting for a higher deductible means you’ll have a greater out-of-pocket expense in the event of a claim, but it can also result in lower monthly premiums. Assess your financial situation and choose a deductible that aligns with your budget.

- Consider Usage-Based Insurance: Usage-based insurance programs, such as telematics or pay-as-you-go insurance, monitor your driving habits and offer discounts based on your actual mileage and driving behavior. If you’re a responsible driver, these programs can help you save money on your Honda Civic insurance.

- Take Advantage of Safety Features: The Honda Civic is equipped with numerous safety features, such as anti-lock brakes, stability control, and advanced airbag systems. Not only do these features enhance your safety on the road, but they can also qualify you for discounts on your insurance premiums.

- Ask for Discounts: Don’t hesitate to ask your insurance provider about any available discounts. They may offer discounts for being a loyal customer, having a good credit score, or completing defensive driving courses. Take advantage of these opportunities to reduce your insurance costs.

It’s important to note that not all insurance providers offer the same discounts, so make sure to inquire about the specific discounts and savings opportunities that are available to you.

Lastly, remember to review your insurance coverage periodically. As your Honda Civic ages, you may be able to adjust your coverage and save even more money. Regularly assess your needs and consult with your insurance provider to ensure you have the appropriate coverage at the best possible price.

Conclusion

Insuring your Honda Civic is an essential aspect of responsible car ownership. Understanding the factors that influence insurance rates and knowing how to find affordable coverage can save you money and give you peace of mind on the road.

Factors such as your driving history, location, age, and the model of your Honda Civic can impact the cost of insurance. Shopping around, comparing quotes, and taking advantage of discounts are effective ways to find affordable insurance for your Honda Civic. Additionally, maintaining a clean driving record, choosing a higher deductible, and utilizing safety features can help lower your insurance premiums.

Remember that every insurance provider is unique, so it’s crucial to thoroughly research and compare quotes to find the best coverage and rates for your Honda Civic. Regularly review your coverage and consider adjusting it as your car ages or your circumstances change.

By following these tips and understanding the ins and outs of Honda Civic insurance, you can make informed decisions, secure adequate coverage, and potentially save money in the process. Safeguard your Honda Civic with the right insurance, and enjoy the peace of mind that comes with knowing you’re protected on the road.