Home>Finance>Delta-Gamma Hedging: Definition, How It Works, Example

Finance

Delta-Gamma Hedging: Definition, How It Works, Example

Modified: January 15, 2024

Learn how delta-gamma hedging works in finance with a definition and example. Gain insights into this risk management strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Delta-Gamma Hedging: Unlocking the Power of Risk Management

Are you ready to dive into the world of advanced risk management strategies? If so, you’re in the right place! In this article, we’ll explore the concept of delta-gamma hedging, how it works, and provide a real-life example to help you better understand its application in the financial markets. So, let’s get started!

Key Takeaways:

- Delta-gamma hedging is a risk management strategy used by investors and traders to minimize exposure to price fluctuations.

- It involves adjusting the portfolio’s delta and gamma by buying or selling options or their underlying assets.

Understanding Delta-Gamma Hedging

In the world of finance, managing risk is paramount. That’s where delta-gamma hedging comes into play. This sophisticated strategy allows investors and traders to mitigate the impact of price movements by adjusting their options positions in response to changes in delta and gamma.

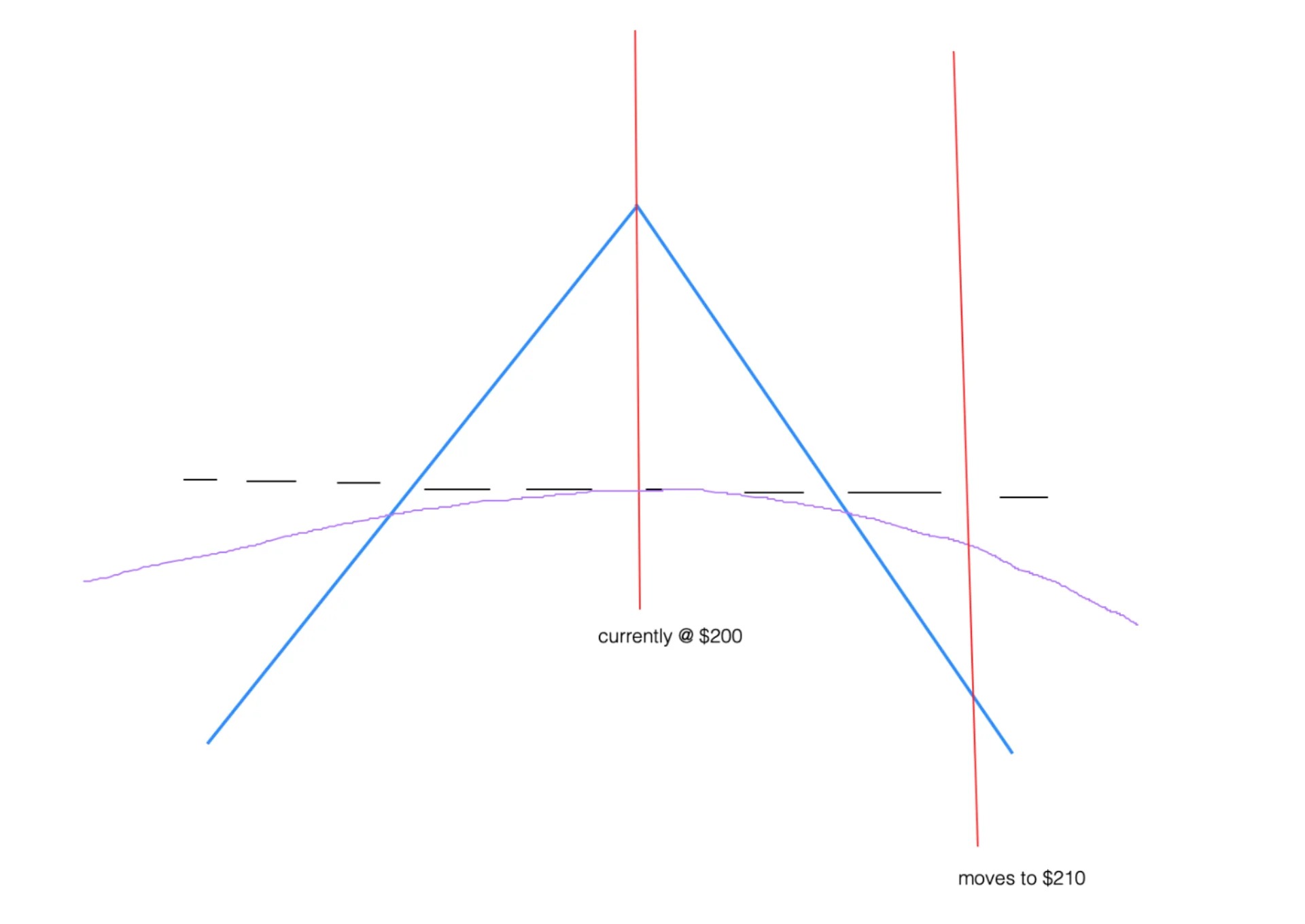

Delta is a measure of an option’s sensitivity to changes in the price of its underlying asset. Gamma, on the other hand, measures the rate at which an option’s delta changes as the price of the underlying asset fluctuates. By monitoring and adjusting both delta and gamma, investors can maintain a more balanced and stable portfolio.

Delta-gamma hedging works by buying or selling options or their underlying assets to maintain a desired risk exposure. Let’s take a closer look at an example to make this concept more tangible.

A Practical Example

Imagine you are an options trader and currently hold a portfolio of call options on a particular stock. The delta of each call option is 0.60, meaning that for every $1 increase in the stock price, the value of each option will increase by $0.60.

Now, let’s say the stock price suddenly drops, causing the delta of your options to decrease. In order to maintain a balanced exposure to price fluctuations, you decide to reduce your risk by selling a portion of the call options or their underlying asset. This adjustment will help you keep your delta and gamma within acceptable levels, protecting your portfolio from potential losses.

On the other hand, if the stock price starts to rise, increasing the delta of your call options, you may choose to buy more call options or their underlying asset to maintain your desired risk exposure.

By actively managing your portfolio through delta-gamma hedging, you can protect yourself from sudden price movements and create a more stable financial position.

Conclusion

Delta-gamma hedging is a powerful tool that allows investors and traders to effectively manage risk and protect their portfolios from unexpected price fluctuations. By carefully monitoring and adjusting both delta and gamma, market participants can maintain a more balanced and stable position in the financial markets.

So, whether you’re an experienced trader or a newbie exploring advanced risk management strategies, delta-gamma hedging is definitely a concept worth exploring!