Home>Finance>How Much Is Spinal Fusion Surgery With Insurance?

Finance

How Much Is Spinal Fusion Surgery With Insurance?

Published: November 8, 2023

Discover how much spinal fusion surgery costs with insurance coverage. Get financial insights and find out if your insurance covers this procedure.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Spinal Fusion Surgery

- Factors Affecting the Cost of Spinal Fusion Surgery

- Insurance Coverage for Spinal Fusion Surgery

- How Much Does Spinal Fusion Surgery Cost with Insurance?

- Factors to Consider while Estimating Surgery Costs

- Tips for Managing Spinal Fusion Surgery Costs

- Conclusion

Introduction

Spinal fusion surgery is a complex medical procedure that is often recommended for individuals suffering from conditions such as spinal instability, degenerative disc disease, spondylolisthesis, or spinal fractures. While this surgery can provide relief and improve quality of life for patients, it can also come with a significant financial burden. Understanding the cost of spinal fusion surgery, especially with insurance coverage, is crucial for patients who are considering or have been advised to undergo this procedure.

In this article, we will delve into the factors that influence the cost of spinal fusion surgery, explore the coverage options provided by insurance, and provide insights into estimating the cost of this surgery when insurance is involved. Additionally, we will offer helpful tips for managing and reducing the financial impact of spinal fusion surgery.

It is important to note that the cost of spinal fusion surgery can vary significantly depending on various factors, including the location, the complexity of the procedure, the choice of hospital or surgical facility, the surgeon’s experience, and any additional treatments or tests required before or after the surgery.

While spinal fusion surgery can be an effective solution for chronic back pain and other spinal conditions, it is essential to weigh the benefits against the potential costs involved. By understanding the financial aspects and insurance coverage options, individuals can make informed decisions about their healthcare and prepare themselves financially for this procedure.

Understanding Spinal Fusion Surgery

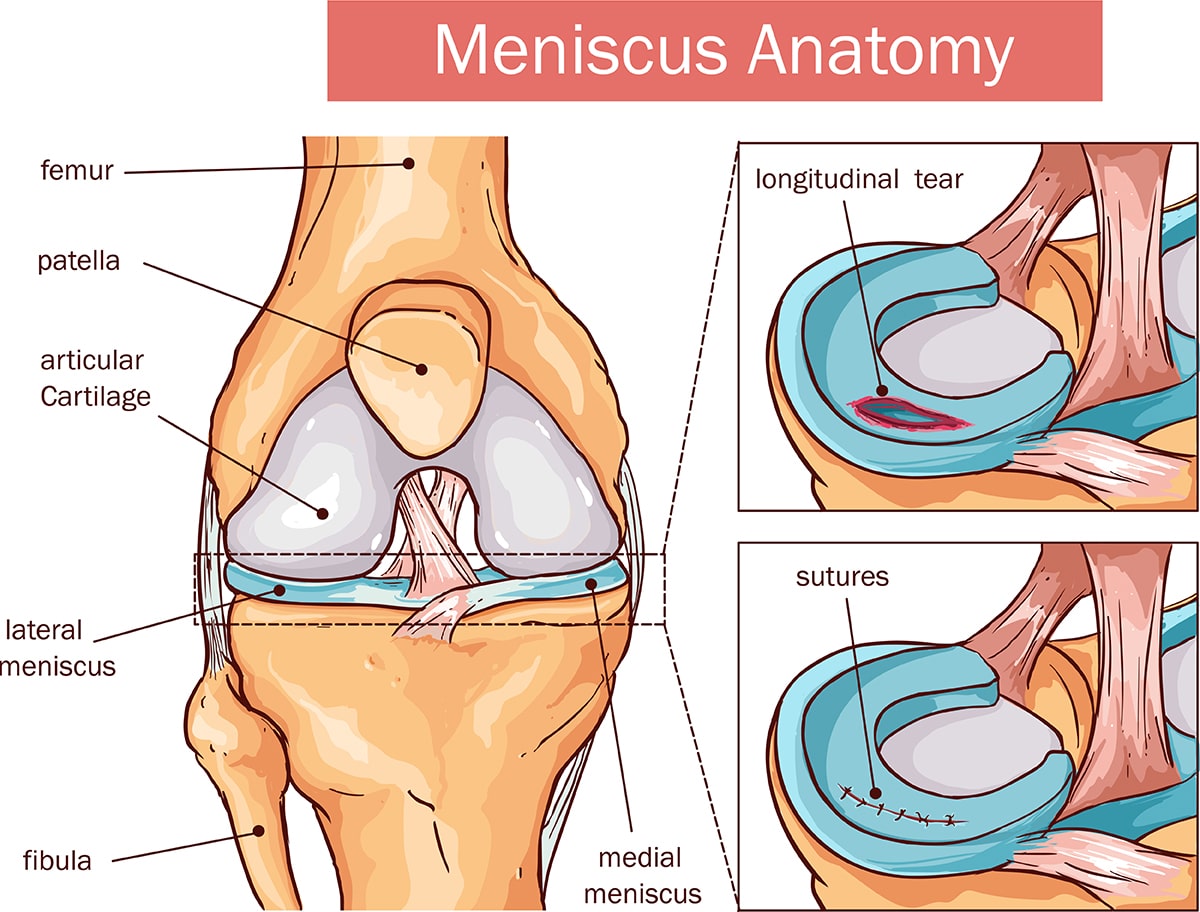

Spinal fusion surgery is a surgical procedure aimed at joining two or more vertebrae in the spine to stabilize and immobilize them. The goal of this procedure is to alleviate pain, correct deformities, improve spinal alignment, and restore spinal function. It involves the use of various techniques and materials, such as bone grafts, screws, rods, plates, or cages, to promote fusion between the targeted vertebrae.

Before undergoing spinal fusion surgery, patients will undergo a thorough assessment, which may include diagnostic imaging tests like X-rays, CT scans, or MRIs. These tests help the surgeon evaluate the extent of the spinal condition, identify the areas that require fusion, and plan the surgical approach.

During the surgery, the surgeon will make an incision in the back or neck, access the spine, remove any damaged or diseased discs or bones, and then place bone grafts or other fusion materials between the affected vertebrae. The fusion materials stimulate the growth of new bone tissue, allowing the vertebrae to fuse over time. In some cases, additional hardware such as screws, rods, or cages may be used to provide stability during the fusion process.

Recovery from spinal fusion surgery can vary depending on the individual and the extent of the procedure. Generally, patients will need to stay in the hospital for a few days after surgery and will be prescribed pain medications and physical therapy to aid in the healing process. It can take several months for the bones to fully fuse and for the patient to regain their normal activities and mobility.

It is important to note that spinal fusion surgery carries risks and potential complications, including infection, blood clots, nerve damage, fusion failure, or adjacent segment disease. Patients considering this surgery should thoroughly discuss the risks and benefits with their healthcare provider to make an informed decision.

Factors Affecting the Cost of Spinal Fusion Surgery

The cost of spinal fusion surgery can vary widely depending on several factors. Understanding these factors can help patients estimate and prepare for the financial aspect of the procedure. Here are the key factors that influence the cost of spinal fusion surgery:

- Procedure Complexity: The complexity of the spinal fusion surgery plays a significant role in determining its cost. More complex procedures, which may involve multiple levels of the spine or the need for additional hardware, tend to be more expensive.

- Surgeon Experience: The experience and expertise of the surgeon can impact the cost of the surgery. Highly skilled and experienced surgeons may charge higher fees for their services.

- Choice of Hospital or Surgical Facility: The choice of hospital or surgical facility can greatly affect the overall cost. Different facilities may have varying pricing structures, with some being more expensive than others.

- Pre- and Post-Operative Care: The cost of pre- and post-operative care, including consultations, diagnostic tests, medications, physical therapy, and follow-up visits, should be considered when estimating the total expenses.

- Location: The geographical location of the healthcare facility can impact surgery costs. Areas with a higher cost of living or limited access to specialized healthcare may have higher prices for spinal fusion surgery.

- Insurance Coverage: The type and extent of insurance coverage associated with spinal fusion surgery can greatly influence out-of-pocket expenses. Different insurance plans have varying levels of coverage, deductibles, co-pays, and co-insurance, which can significantly impact the final cost.

It is important to consult with the surgeon and the insurance provider to get a clear understanding of the estimated cost and coverage before proceeding with spinal fusion surgery. This will help individuals plan ahead and make informed financial decisions.

Insurance Coverage for Spinal Fusion Surgery

Understanding insurance coverage for spinal fusion surgery is crucial to ensure that patients can manage the financial implications of the procedure. The extent of coverage can vary depending on the insurance provider, the specific insurance plan, and the individual’s policy. Here are some points to consider about insurance coverage for spinal fusion surgery:

- Pre-authorization: Most insurance plans require pre-authorization for spinal fusion surgery. This means that patients need to obtain approval from their insurance company before undergoing the surgery. Failure to obtain pre-authorization may result in denial of coverage or increased out-of-pocket expenses.

- Medical Necessity: Insurance companies typically require evidence of medical necessity to approve coverage for spinal fusion surgery. This may involve submitting medical records, imaging reports, and documentation from the treating physician to demonstrate that the surgery is necessary to treat a specific condition and improve the patient’s health.

- In-network vs. Out-of-network: Insurance plans often have a network of healthcare providers and facilities that offer discounted rates. It is important to check whether the surgeon and the chosen hospital or surgical facility are within the insurance network. Out-of-network providers may lead to higher out-of-pocket costs or denial of coverage.

- Deductibles and Co-pays: Patients should be aware of their insurance plan’s deductible and co-pay requirements. Deductibles are the amount that the patient must pay out-of-pocket before the insurance coverage kicks in, while co-pays are fixed amounts to be paid for each healthcare service or visit. The patient’s responsibility will depend on the specific insurance plan.

- Co-insurance: Some insurance plans may require co-insurance, which is a percentage of the total cost that the patient is responsible for paying. For example, if the insurance plan has a 20% co-insurance, the patient would be responsible for paying 20% of the total cost of the surgery.

- Out-of-pocket maximum: Insurance plans often have an out-of-pocket maximum, which is the maximum amount the patient has to pay during a certain period. Once this limit is reached, the insurance company covers 100% of the remaining eligible expenses. It is important to be aware of this limit to plan for potential expenses.

It is highly recommended that individuals review their insurance policy, contact their insurance provider, and consult with their healthcare provider to understand the specific coverage details and any potential out-of-pocket costs associated with spinal fusion surgery. Being informed about the insurance coverage will help patients better navigate the financial aspect of the procedure and avoid any unexpected expenses.

How Much Does Spinal Fusion Surgery Cost with Insurance?

The cost of spinal fusion surgery with insurance coverage can vary significantly depending on several factors, including the insurance plan, the specific policy, and the individual’s financial responsibility. While it is challenging to provide an exact figure for the cost of the procedure, we can discuss some general considerations:

1. Insurance Plan Coverage: The extent of insurance coverage plays a crucial role in determining the out-of-pocket expenses for spinal fusion surgery. Different insurance plans may cover a percentage of the cost or require the patient to meet a deductible and co-insurance. It is essential to review the insurance policy documents or contact the insurance provider directly to understand the specific coverage details for spinal fusion surgery.

2. In-network vs. Out-of-network Providers: Insurance plans often have a network of healthcare providers and facilities with negotiated rates. Choosing an in-network surgeon and hospital or surgical facility can result in lower out-of-pocket costs. Out-of-network providers may result in higher expenses or denial of coverage, depending on the insurance plan.

3. Deductibles and Co-pays: Insurance plans typically require patients to meet a deductible, which is the amount they must pay out-of-pocket before the insurance coverage kicks in. Additionally, co-pays may be required for office visits, consultations, and other services related to the surgery. Understanding the deductible and co-pay requirements of the insurance plan is crucial in estimating the overall cost.

4. Coverage Limits: Insurance plans often have coverage limits or maximums, both for a single procedure and for the entire policy period. These limits can impact the out-of-pocket expenses for spinal fusion surgery. Once the coverage limit is reached, the insurance company may cover the remaining eligible expenses. Patients should review their insurance policy to understand these limits and plan accordingly.

5. Prior Authorization: Insurance companies may require pre-authorization for spinal fusion surgery. This involves submitting relevant medical documentation to demonstrate the medical necessity of the procedure. Failure to obtain pre-authorization may result in denial of coverage or higher out-of-pocket costs.

It is crucial for individuals to review their insurance policy, understand the specifics of their coverage, and contact their insurance provider for detailed information about the cost of spinal fusion surgery. Consulting with the surgeon and the insurance company beforehand can help patients make informed decisions and plan for any potential financial responsibilities associated with the procedure.

Factors to Consider while Estimating Surgery Costs

Estimating the cost of spinal fusion surgery involves considering several factors to get a comprehensive understanding of the potential expenses. While the exact cost can vary depending on individual circumstances, here are some key factors to consider:

- Procedure Complexity: The complexity of the spinal fusion surgery, which may involve multiple levels of the spine or the need for additional hardware, can significantly impact the cost. More complex procedures tend to be more expensive.

- Surgeon’s Fee: The fee charged by the surgeon for the procedure can vary depending on their experience, expertise, and reputation. Surgeons with a high level of skill and recognition may charge higher fees.

- Hospital or Surgical Facility Fees: The choice of hospital or surgical facility can affect the cost. Different facilities may have varying pricing structures, and certain facilities may be more expensive than others. It is essential to consider this when estimating surgery costs.

- Anesthesia Costs: Anesthesia is often required for spinal fusion surgery. The cost of anesthesia will depend on factors such as the duration of the surgery and the type of anesthesia administered.

- Diagnostic Tests and Imaging: Pre-operative diagnostic tests such as X-rays, CT scans, or MRIs may be necessary to evaluate the spine and determine the surgical approach. The cost of these tests should be considered in the overall estimation.

- Post-operative Care: The cost of post-operative care, including pain medications, physical therapy, follow-up appointments, and any required medical equipment or supplies, should also be factored into the estimation.

- Insurance Coverage: The extent of insurance coverage, including deductibles, co-pays, and co-insurance, will impact the overall out-of-pocket expense for the patient. Reviewing the insurance policy and understanding the coverage details is essential in estimating surgery costs.

- Geographical Location: The geographical location can influence the cost of spinal fusion surgery. Areas with a higher cost of living or limited access to specialized healthcare may have higher prices for the procedure.

It is important to consult with the surgeon and the insurance provider to get a more accurate estimation of the surgery costs based on individual circumstances. Additionally, exploring financing options and discussing payment plans with the healthcare provider can help manage the financial aspect of spinal fusion surgery.

Tips for Managing Spinal Fusion Surgery Costs

Managing the costs associated with spinal fusion surgery can be challenging, but there are several strategies patients can employ to help alleviate the financial burden. Here are some tips for managing spinal fusion surgery costs:

- Review Insurance Coverage: Familiarize yourself with the details of your insurance coverage, including deductibles, co-pays, and coverage limits. Understand what expenses you are responsible for and what will be covered by insurance.

- Pre-Authorization and Documentation: Ensure that you obtain pre-authorization from your insurance company before the surgery. Provide all necessary documentation to demonstrate that the procedure is medically necessary.

- Choose In-Network Providers: Opt for surgeons and hospitals that are in-network with your insurance plan. This can help minimize out-of-pocket expenses by taking advantage of negotiated rates and reduced costs.

- Compare Costs: Research and compare the costs of different surgeons and surgical facilities. Consider seeking multiple opinions and estimates to find the most affordable option without compromising on quality of care.

- Explore Financial Assistance: Inquire about financial assistance programs offered by hospitals, nonprofit organizations, or government agencies. These programs may provide grants, subsidies, or payment plans to help manage surgery costs.

- Ask for Discounts and Payment Plans: Negotiate with healthcare providers for discounts or inquire about flexible payment plans. Many providers are willing to work with patients to find manageable payment arrangements.

- Consider Second Opinions: Seek second opinions from other orthopedic surgeons to ensure the necessity and appropriateness of the spinal fusion surgery. This can help avoid unnecessary procedures and potential additional costs.

- Utilize Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs): If available, contribute to an HSA or FSA to set aside pre-tax dollars specifically for medical expenses. Consult with a financial advisor to understand the tax advantages and flexibility of these accounts.

- Explore Alternative Financing Options: Research healthcare-specific loans, medical credit cards, or personal loans to spread out the cost of the surgery over time. Compare interest rates and repayment terms to select the option that best suits your financial situation.

- Follow Pre- and Post-Operative Instructions: Adhere to the pre- and post-operative guidelines provided by your surgeon. Properly preparing for the surgery and following the recovery protocols can help minimize complications and reduce the need for additional medical interventions and costs.

Remember to discuss these tips with your healthcare provider, insurance company, and financial advisor to ensure that you make informed decisions regarding managing your spinal fusion surgery costs. By taking proactive measures and exploring available resources, you can better navigate the financial aspect of the procedure and focus on your recovery and overall well-being.

Conclusion

Spinal fusion surgery can provide much-needed relief and improved quality of life for individuals suffering from spinal conditions. However, it is important to understand the cost implications and potential financial burden associated with the procedure. By considering various factors such as the complexity of the surgery, insurance coverage, choice of surgeon, and facility fees, patients can estimate and plan for the expenses involved.

Insurance coverage plays a key role in managing the cost of spinal fusion surgery. Understanding the specific details of your insurance policy, including deductibles, co-pays, and coverage limits, is crucial in estimating your out-of-pocket expenses. Additionally, choosing in-network providers and obtaining pre-authorization can help minimize costs.

Exploring financial assistance options, negotiating payment plans, and comparing costs of different surgeons and facilities can also help manage the financial aspect of the procedure. Taking advantage of healthcare-specific accounts, such as HSAs or FSAs, and considering alternative financing options can provide additional flexibility in managing the costs.

It is important to remember that the cost of spinal fusion surgery should not be the sole determining factor when deciding on the procedure. The potential benefits and improved quality of life should also be considered. Discussing your financial concerns with your healthcare provider and exploring all available options can help you make an informed decision.

By taking proactive measures, being informed about insurance coverage, seeking second opinions, and utilizing available resources, patients can navigate the financial challenges associated with spinal fusion surgery. This will help ensure a smoother and more manageable experience, allowing patients to focus on their recovery and regain their quality of life.