Finance

How Often Does VTI Pay Dividends?

Published: January 3, 2024

Learn about the frequency of dividend payments for VTI in the world of finance. Discover how often VTI pays dividends and plan your investment strategy accordingly.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance! If you’re interested in investing or already have a portfolio, you’ve likely come across the abbreviation VTI. VTI refers to the Vanguard Total Stock Market Index Fund, which is a popular choice among investors looking for broad exposure to the U.S. stock market.

Investing in VTI can be a wise decision, given its low expense ratio, diversification benefits, and long-term growth potential. However, as a savvy investor, it’s important to understand how VTI generates returns and distributes them to shareholders.

One of the key ways for investors to earn returns through VTI is through dividends. Dividends are typically cash payments made by companies to their shareholders, representing a portion of the company’s profits. For VTI investors, understanding the frequency of dividend payments is crucial to effectively plan their investment strategy and manage cash flow.

In this article, we’ll delve into the world of VTI dividends and explore how often this fund pays dividends. We’ll also discuss the factors that influence dividend frequency and take a look at the historical dividend payments of VTI. So, let’s jump right in!

Note: It’s important to keep in mind that the information provided in this article is based on historical data and is subject to change. It’s always recommended to refer to the fund’s prospectus or consult with a financial advisor for the most up-to-date information regarding VTI dividends.

Understanding VTI

Before we dive into the specifics of dividend payments, it’s essential to have a clear understanding of VTI itself. VTI is an exchange-traded fund (ETF) offered by Vanguard, one of the largest investment management companies in the world.

The primary objective of VTI is to provide investors with exposure to the entire U.S. stock market. It achieves this by tracking the performance of the CRSP US Total Market Index, which represents approximately 100% of the investable U.S. stock market.

VTI holds a diversified portfolio of stocks across various sectors, including technology, healthcare, finance, and more. The fund provides broad market coverage and includes companies of various sizes, ranging from large-cap to small-cap. This diversification helps mitigate risk and allows investors to benefit from the overall growth of the U.S. stock market.

As an ETF, VTI offers several advantages. It provides investors with the ability to buy and sell shares throughout the trading day, just like individual stocks, making it highly liquid. Additionally, VTI has a low expense ratio, which means that a significant portion of the investment returns goes back to the shareholders. This makes VTI an attractive investment option for both long-term investors and those looking for a vehicle to park their cash.

Now that we have a basic understanding of VTI, let’s move on to discuss how dividends come into play and what you can expect as an investor.

Dividends and VTI

Dividends play a crucial role in the overall return potential of an investment. When it comes to VTI, dividends are an integral part of the fund’s strategy to distribute a portion of the income generated by the underlying stocks to its shareholders.

VTI collects dividends from the stocks it holds within its portfolio and passes them on to the investors. As an investor in VTI, you become entitled to receive a proportionate share of these dividend payments. The amount you receive will depend on the number of shares you own in the fund.

It’s important to note that the dividend payments from VTI may vary depending on several factors, including the dividend policies of the companies held within the fund and the overall performance of the stock market. Companies have the discretion to decide how much of their earnings they distribute as dividends, and this can impact the amount of dividends VTI receives.

Dividends can provide investors with a regular income stream, which can be especially beneficial for those who rely on their investments for cash flow or prefer periodic returns. Additionally, dividends can serve as a way to potentially compound your investment over time, as you can reinvest them to purchase additional shares of VTI or any other investment.

Now that we have a basic understanding of dividends and their importance in the context of VTI, let’s explore how frequently VTI pays dividends.

Frequency of VTI Dividend Payments

The frequency of dividend payments from VTI depends on the underlying stocks held within the fund. VTI aims to provide investors with a steady stream of income, and historically, it has paid dividends on a quarterly basis.

This means that VTI distributes dividends to its shareholders four times a year. The specific dates of these dividend payments can vary but are typically spaced out evenly throughout the year. Investors can expect to receive dividends from VTI in the months of March, June, September, and December.

It’s important to keep in mind that the amount of dividends you receive as an investor in VTI depends on several factors. These include the number of shares you own in the fund and the dividend amount per share, which can fluctuate based on the performance of the underlying stocks and the decisions made by the companies in terms of dividend distributions.

To get a better sense of the dividend payments from VTI, it can be helpful to track the dividend history of the fund. This will give you insights into the consistency and growth of dividend payments over time. By analyzing the historical data, you can make more informed decisions about your investment strategy and expectations for future dividends.

Now that we understand the frequency of dividend payments from VTI let’s explore the factors that can influence dividend frequency.

Factors Affecting Dividend Frequency

The frequency of dividend payments from VTI, like any other investment, can be influenced by various factors. Here are some key factors that can affect the dividend frequency of VTI:

- Company dividend policies: The dividend policies of the companies held within VTI can impact the frequency of dividend payments. Some companies may have a tradition of paying dividends on a quarterly basis, aligning with VTI’s current dividend schedule. Others may choose to pay dividends on a semi-annual or annual basis, which can affect the frequency of dividend payments from VTI.

- Market conditions: The performance of the stock market can also influence the frequency of dividend payments. During periods of economic uncertainty or market volatility, some companies may choose to reduce or suspend dividend payments. This can have a trickle-down effect on VTI’s dividend frequency, as the fund relies on the dividend payments received from the underlying companies.

- Corporate earnings: The financial health and profitability of the companies held in VTI can impact dividend payments. If a company experiences a decrease in earnings, it may choose to reduce or cut dividends altogether. Conversely, companies with strong earnings growth may increase dividend payments, potentially leading to more frequent distributions from VTI.

- Regulatory requirements: VTI, as an exchange-traded fund, must comply with regulatory guidelines regarding dividend distribution. These requirements can impact the frequency at which dividends are paid to shareholders.

It’s important to remember that dividend frequency can change over time and may not always remain constant. As an investor in VTI, it’s advisable to stay informed about market conditions, company earnings, and any updates from Vanguard regarding dividend payments.

Understanding these factors can help you manage your expectations regarding the frequency of dividends from VTI and make informed decisions about your investment strategy.

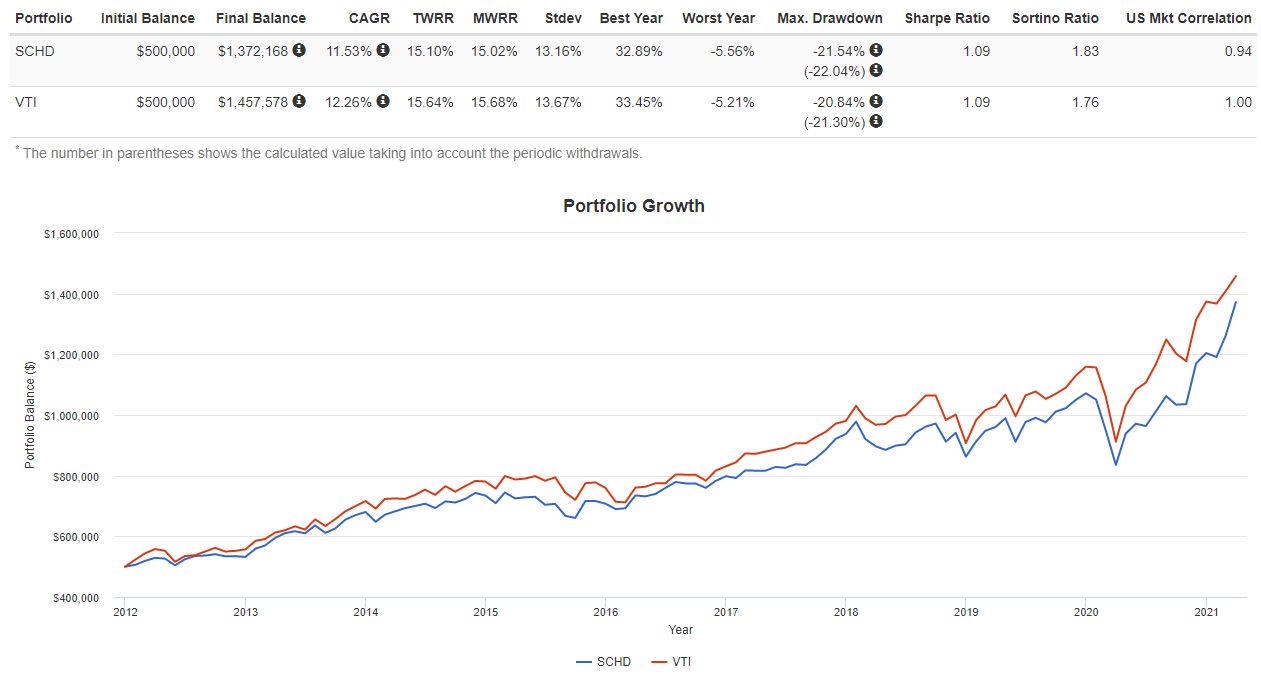

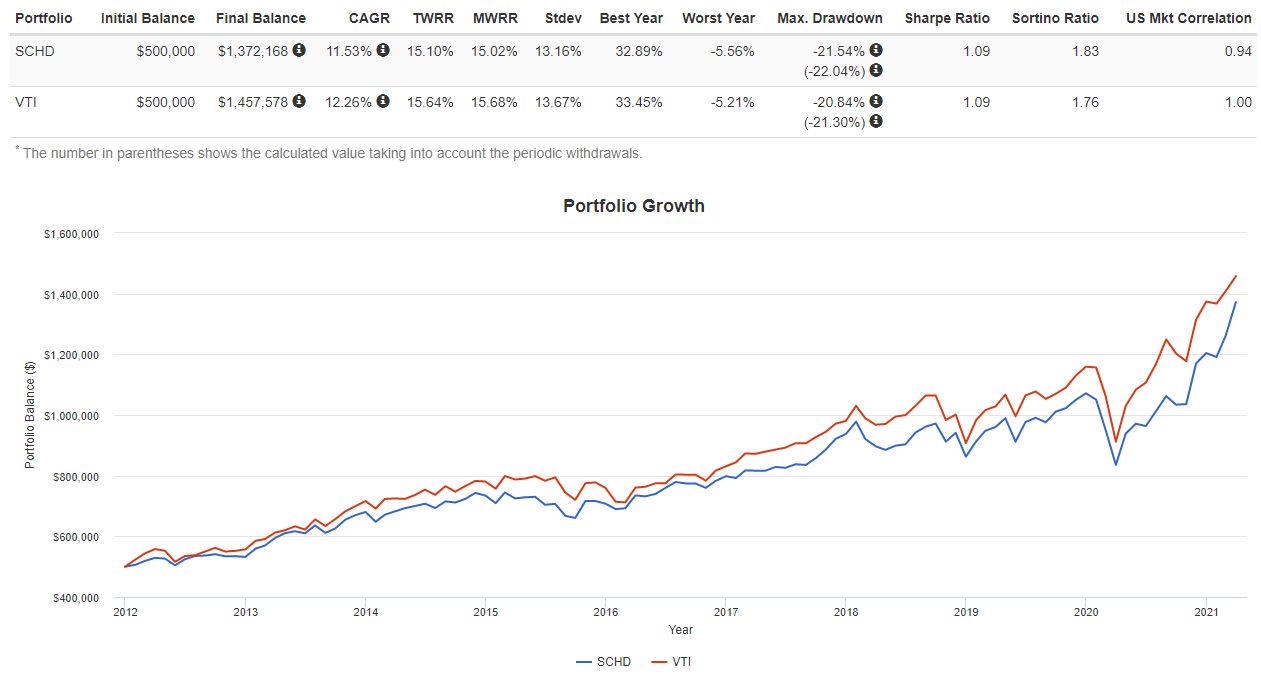

Historical Dividend Payments of VTI

Examining the historical dividend payments of VTI can provide valuable insights into the fund’s dividend distribution pattern and growth over time. While past performance is not indicative of future results, it can give investors a sense of the fund’s track record and how dividends have been impacted by various market conditions.

Since its inception, VTI has consistently paid dividends on a quarterly basis. The amount of these dividends can fluctuate based on factors such as the overall performance of the stock market, the dividend policies of the underlying companies, and changes in corporate earnings.

It’s important to note that the per-share dividend amount of VTI has shown growth over the years, reflecting the potential for increased dividend income for long-term holders of the fund. However, it’s important to remember that dividend growth is not guaranteed and can vary depending on market conditions and the performance of the underlying stocks.

For example, let’s examine the historical dividend payments of VTI over the past few years:

- In 2019, the quarterly dividends ranged from approximately $0.84 to $0.95 per share.

- In 2020, the dividends experienced a dip in the midst of market volatility due to the COVID-19 pandemic. The quarterly dividends ranged from about $0.49 to $0.60 per share.

- In 2021, as the market recovered, the quarterly dividends increased and ranged from approximately $0.82 to $0.97 per share.

It’s important to keep in mind that these figures are for illustrative purposes only and are subject to change. The actual dividend payments can vary from quarter to quarter and may be influenced by various factors, as mentioned earlier.

By analyzing the historical dividend payments of VTI, investors can gain insights into how dividends have evolved over time and make more informed decisions about their investment strategy. It’s crucial, however, to conduct proper research and ensure that the information you reference is up-to-date before making any investment decisions.

Conclusion

Understanding the frequency of dividend payments from VTI is essential for investors looking to generate income and manage their investment strategy effectively. VTI, as an ETF that aims to provide broad exposure to the U.S. stock market, pays dividends on a quarterly basis. These dividends represent a portion of the income generated by the underlying companies held within the fund.

The frequency of dividend payments can be influenced by multiple factors, including the dividend policies of the companies, market conditions, corporate earnings, and regulatory requirements. Monitoring these factors and staying informed about changes in dividend payments is crucial for investors seeking consistent income from their VTI investment.

Examining the historical dividend payments of VTI can provide insights into the fund’s track record and potential for dividend growth. However, it’s important to note that past performance is not indicative of future results, and dividend payments can vary based on market conditions and other factors.

As an investor, it’s advisable to consult with a financial advisor and review the latest information from Vanguard to stay up-to-date on VTI dividend payments. This will help you make informed decisions about your investment strategy and manage your expectations regarding dividend income.

In conclusion, VTI offers investors an opportunity to participate in the growth of the U.S. stock market while providing potential income through quarterly dividend payments. By understanding the frequency of dividend payments from VTI and the factors that can influence them, investors can make informed decisions about their investment goals and maximize the benefits of holding this popular ETF.