Finance

How Safe Is Mobile Banking

Modified: December 30, 2023

Mobile banking is a safe and convenient way to manage your finances on the go. Find out more about the security measures in place to protect your sensitive information.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Mobile banking has revolutionized the way we manage our finances. With just a few taps on our smartphones, we can access our accounts, transfer funds, pay bills, and even apply for loans. The convenience and accessibility offered by mobile banking have made it increasingly popular among consumers.

However, with the convenience comes concerns about the safety and security of our financial information. As we entrust our sensitive data to mobile banking apps, it is essential to understand the security measures in place to protect our assets and mitigate potential risks.

In this article, we will explore the world of mobile banking and examine the safety of using these platforms. We will delve into the benefits of mobile banking, the security measures implemented by financial institutions, the risks and vulnerabilities associated with it, and practical tips to ensure secure mobile banking.

By understanding the landscape of mobile banking security, we can make informed decisions and take necessary precautions to safeguard our financial transactions.

Overview of Mobile Banking

Mobile banking refers to the use of mobile devices, such as smartphones and tablets, to perform financial transactions and access banking services. It provides customers with the flexibility to manage their accounts and conduct various financial activities on the go, without the need to visit a physical bank branch.

With the widespread adoption of mobile technology, financial institutions have embraced mobile banking as a way to enhance customer experience and streamline banking operations. Today, mobile banking apps offer a wide range of services, including checking account balances, transferring funds between accounts, paying bills, depositing checks using the device’s camera, and even applying for loans or credit cards.

One of the key advantages of mobile banking is its convenience. Gone are the days of waiting in long queues or rushing to the bank before closing time. With mobile banking, customers can access their accounts 24/7 and perform transactions at their convenience.

Moreover, mobile banking provides real-time access to account information, allowing users to monitor their financial activities closely. Push notifications and alerts can notify users about important updates, such as account deposits, withdrawals, or suspicious activity, ensuring that they stay informed about their finances.

Another significant benefit of mobile banking is its accessibility. It allows individuals who may have limited access to brick-and-mortar banking services, such as those in rural or remote areas, to conveniently manage their finances using their mobile devices.

Furthermore, mobile banking has proven to be a cost-effective solution for both financial institutions and customers. It reduces operational costs for banks by replacing traditional paper-based banking with digital processes. Customers, on the other hand, can save time and money by avoiding travel expenses and service charges associated with physical banking.

As mobile banking continues to evolve, financial institutions strive to enhance their offerings and provide more sophisticated features to their customers. From personal finance management tools to investment options, mobile banking is becoming a one-stop solution for all financial needs.

Benefits of Mobile Banking

Mobile banking offers numerous benefits to both individuals and businesses. Here are some of the key advantages:

- Convenience: Mobile banking provides unparalleled convenience. With just a few taps on your smartphone, you can access your accounts, transfer funds, pay bills, and perform various financial transactions from anywhere, at any time.

- Accessibility: Mobile banking allows individuals to manage their finances even when they are on the go. As long as you have internet connectivity, you can access your accounts and perform banking activities from the comfort of your home, office, or while traveling.

- Real-Time Account Monitoring: Mobile banking apps provide real-time access to your account information. You can easily check your account balances, view transaction history, and set up alerts to stay informed about any activity on your accounts.

- Quick and Easy Transfers: With mobile banking, you can transfer funds between your accounts or to other individuals almost instantly. Whether you need to pay a friend back for dinner or transfer money to a family member, it can be done with just a few taps on your smartphone.

- Bill Payment: Mobile banking apps allow you to conveniently pay your bills without the need for writing checks or visiting payment centers. You can set up recurring payments, schedule future payments, and even receive notifications for upcoming due dates.

- Mobile Deposits: Many mobile banking apps offer the ability to deposit checks by simply taking a photo of the check using your device’s camera. This saves time and eliminates the need to visit a bank branch or ATM.

- Enhanced Security Features: Mobile banking apps incorporate robust security measures to protect your financial information. These can include biometric authentication, such as fingerprint or facial recognition, as well as encrypted data transmission to keep your transactions secure.

- Personal Finance Management: Some mobile banking apps provide tools and features to help you track and manage your personal finances. You can set budgets, categorize expenses, and analyze your spending patterns to make informed financial decisions.

Overall, mobile banking offers unparalleled convenience, accessibility, and security, making it an essential tool for managing your finances in today’s digital age.

Security Measures in Mobile Banking

Ensuring the security of customer data and transactions is a top priority for financial institutions offering mobile banking services. To safeguard against unauthorized access and protect sensitive information, several security measures are implemented. Here are some of the key security measures in mobile banking:

- Encryption: Mobile banking apps use encryption technology to secure data transmission between the app and the bank’s servers. This ensures that information, such as login credentials and transaction details, is encrypted and cannot be intercepted by malicious actors.

- Authentication: Two-factor authentication (2FA) is commonly employed in mobile banking apps to provide an extra layer of security. Along with the username and password, users may be required to input a unique code sent via SMS or generated by an authentication app to verify their identity.

- Biometric Authentication: Many mobile banking apps support biometric authentication methods, such as fingerprint scanning or facial recognition. These biometric identifiers provide a secure and convenient way to authenticate users, as they are unique to each individual.

- Device Recognition: Mobile banking apps often use device recognition technology to identify and authenticate the device being used. This helps prevent unauthorized access from unfamiliar devices and provides an additional layer of security.

- Secure Socket Layer (SSL) Certificates: SSL certificates are used to establish secure connections between the mobile banking app and the bank’s servers. This ensures that data transmitted between the two endpoints is encrypted and cannot be intercepted or tampered with.

- Transaction Monitoring: Financial institutions employ advanced fraud detection systems to monitor customer transactions for any suspicious activity. Unusual patterns, large transfers, or transactions initiated from new or unrecognized devices may trigger alerts for further investigation.

- Secure Development Lifecycle: Mobile banking apps are developed using secure coding practices and undergo rigorous testing to identify and address any vulnerabilities. Regular security audits and updates ensure that the app remains secure and protected against emerging threats.

- Customer Education: Financial institutions educate their customers about mobile banking security best practices. This includes guidance on setting strong passwords, avoiding public Wi-Fi for banking transactions, and being cautious of phishing attempts or suspicious emails or messages.

By implementing these security measures, financial institutions strive to provide a safe and secure environment for customers to conduct their mobile banking transactions. However, it is also important for users to take personal responsibility for their mobile banking security by following recommended security practices and staying vigilant against potential threats.

Risks and Vulnerabilities in Mobile Banking

While mobile banking offers numerous benefits, it is not without its risks and vulnerabilities. It is crucial for users to be aware of these potential threats to protect their financial information and transactions. Here are some of the main risks and vulnerabilities in mobile banking:

- Malware and Phishing Attacks: Mobile devices are susceptible to malware and phishing attacks, where malicious software or fraudulent websites are designed to steal users’ sensitive information. Users should be cautious of downloading apps from untrusted sources and should always verify the authenticity of websites and messages before providing any personal or financial details.

- Lost or Stolen Devices: Mobile devices can be lost or stolen, potentially exposing sensitive banking information to unauthorized individuals. To mitigate this risk, users should employ device lock codes, biometric authentication, and consider remote device wiping capabilities in case their device falls into the wrong hands.

- Unsecured Wi-Fi Networks: Public Wi-Fi networks pose a significant risk as they are often unsecured. Hackers can intercept data transmitted over these networks, potentially compromising users’ login credentials or other sensitive information. It is advisable to avoid conducting mobile banking transactions on public Wi-Fi and instead use a secure and trusted network or a virtual private network (VPN).

- Social Engineering Attacks: Cybercriminals may employ social engineering techniques to trick users into revealing their sensitive information. This can include impersonating legitimate institutions or individuals through email, phone calls, or text messages. Users should exercise caution and never provide personal or banking information to unknown or suspicious sources.

- Weak Authentication: Inadequate or weak authentication methods can increase the risk of unauthorized access to mobile banking accounts. It is crucial to enable strong authentication features, such as two-factor authentication, to enhance the security of mobile banking transactions.

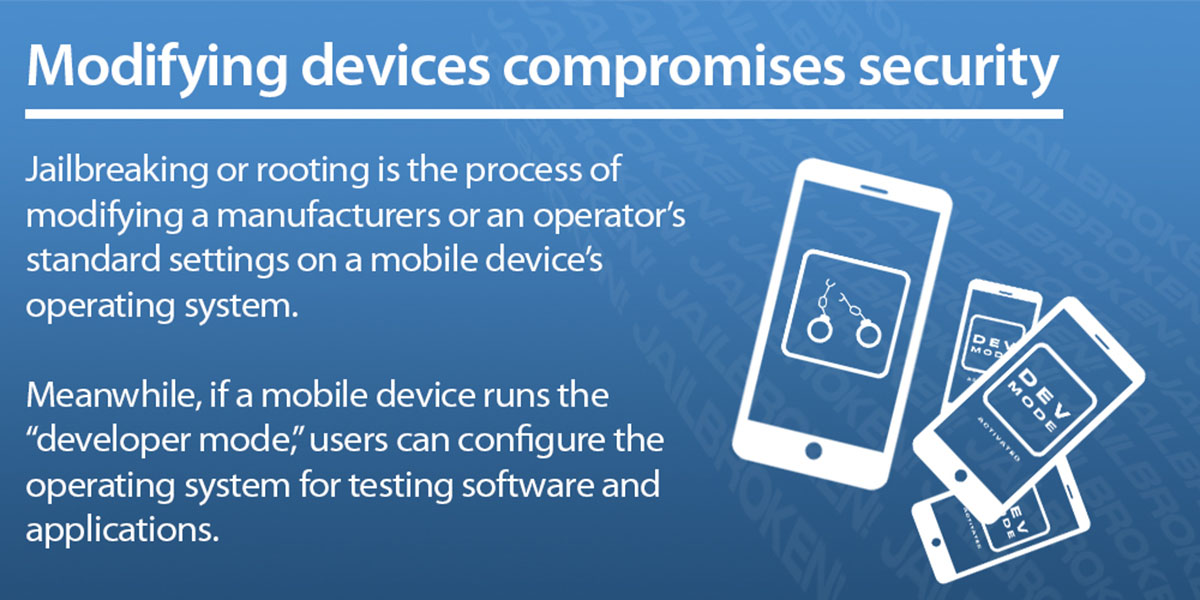

- Mobile Banking App Vulnerabilities: Mobile banking apps themselves may have vulnerabilities that can be exploited by attackers. It is vital for financial institutions to regularly update and patch their mobile banking apps to address these vulnerabilities and protect against potential security breaches.

- Insider Threats: Internal employees of financial institutions may pose a risk to the security of mobile banking. It is essential for organizations to have strong access controls, monitoring systems, and employee training programs to mitigate the risk of insider threats.

While financial institutions take various security measures to protect mobile banking transactions, it is critical for users to also take proactive steps, such as keeping their devices and apps updated, using strong passwords, and practicing caution while accessing their mobile banking accounts.

By understanding the risks and vulnerabilities associated with mobile banking, users can make informed decisions and take appropriate measures to protect their financial information and ensure the security of their mobile banking transactions.

Authentication Methods in Mobile Banking

Authentication is a critical aspect of mobile banking security, ensuring that only authorized users can access their accounts and perform transactions. To enhance the security of mobile banking, financial institutions employ various authentication methods. Here are some commonly used authentication methods in mobile banking:

- Username and Password: This is the most basic form of authentication used in mobile banking. Users enter their unique username or customer ID along with a strong password to access their accounts. It is essential to choose a strong and unique password to prevent unauthorized access.

- Two-Factor Authentication (2FA): Two-factor authentication adds an extra layer of security by requiring users to provide an additional piece of information to verify their identity. This can be a one-time code sent via SMS, a generated code from an authentication app, or a biometric factor like a fingerprint scan or facial recognition.

- Biometric Authentication: Many mobile banking apps support biometric authentication, leveraging unique physical characteristics of individuals such as fingerprints, facial recognition, or iris scans. This provides a convenient and secure way to authenticate users and is difficult to replicate or forge.

- Device Recognition: Device recognition is used to identify and authenticate the mobile device being used to access the mobile banking app. This can involve identifying the device’s unique identifiers, such as the International Mobile Equipment Identity (IMEI) number or device fingerprinting, to ensure that the device is authorized to access the account.

- Secure Key or Token: Some financial institutions provide customers with a physical device or token that generates one-time passwords (OTP) for authentication. Users enter the OTP along with their username and password to access their mobile banking accounts.

- Geolocation Authentication: Geolocation authentication uses the device’s GPS or IP address to verify the user’s physical location. If the user’s location does not match the authorized locations configured by the user or financial institution, access to the mobile banking app may be restricted.

- Out-of-Band Authentication: Out-of-band authentication involves independently verifying the user’s identity through a separate communication channel. For example, when initiating a transaction, the user may receive a verification code through a phone call or separate messaging app to confirm the authenticity of the transaction.

Implementing multiple authentication methods provides an additional layer of security, making it harder for attackers to gain unauthorized access to mobile banking accounts. Financial institutions often allow users to customize their authentication preferences and enable the methods they feel most comfortable with.

It is crucial for users to understand and use the available authentication methods in mobile banking to ensure the security of their accounts. By using strong passwords, enabling two-factor authentication, and incorporating biometric authentication if available, users can significantly enhance the security of their mobile banking experience.

Secure Mobile Banking Apps and Platforms

Ensuring the security of mobile banking apps and platforms is vital to protect users’ financial information and transactions. Financial institutions deploy various security measures to develop secure mobile banking apps and platforms. Here are some key components of secure mobile banking apps and platforms:

- Encryption: Mobile banking apps implement encryption technology to secure data transmission between the app and the bank’s servers. This ensures that sensitive information, such as login credentials and transaction details, is securely transmitted and protected from interception.

- Secure Development Lifecycle: Mobile banking apps undergo a secure development lifecycle where security is integrated into every stage of the app’s development. This includes following secure coding practices, conducting regular security testing and code reviews to identify and address any vulnerabilities.

- Regular Updates and Patches: Financial institutions release regular updates and patches for their mobile banking apps to address any vulnerabilities and ensure the app remains secure against emerging threats. It is essential for users to keep their mobile banking apps up to date to benefit from these security enhancements.

- Secure Storage of Data: Mobile banking apps store sensitive user data securely on the user’s device by utilizing technologies such as secure containers or encrypted storage. This protects data in the event of device theft or unauthorized access.

- Robust Authentication: Secure mobile banking apps enforce strong authentication requirements, such as strong password policies, two-factor authentication, and biometric authentication where available. This helps prevent unauthorized access to user accounts.

- Fraud Detection and Monitoring: Mobile banking apps incorporate advanced fraud detection and monitoring systems to identify and mitigate suspicious activities. This includes monitoring for unusual transaction patterns, analyzing user behavior, and triggering alerts for potential fraudulent activities.

- User Education and Awareness: Financial institutions provide user education and awareness campaigns to educate users about mobile banking security best practices. This includes guidance on creating strong passwords, avoiding phishing attempts, and practicing caution while accessing mobile banking apps.

- Secure Communication Channels: Mobile banking apps ensure the use of secure communication channels, such as Secure Socket Layer (SSL) or Transport Layer Security (TLS), to establish a secure connection between the app and the bank’s servers. This prevents unauthorized interception and tampering of data during transmission.

It is crucial for users to download mobile banking apps directly from reliable sources, such as official app stores, to avoid downloading counterfeit or malicious apps. Users should also verify the legitimacy of the app by checking the developer’s information and reading reviews or ratings before installation.

By utilizing secure mobile banking apps and platforms, users can have confidence in the security of their financial transactions and protect their sensitive information from unauthorized access.

Tips for Safe Mobile Banking

While mobile banking offers convenience and flexibility, it is important to take certain precautions to ensure the security of your financial information. Here are some tips for safe mobile banking:

- Download Apps from Official Sources: Only download mobile banking apps from official app stores, such as the Apple App Store or Google Play Store. This ensures that you are downloading legitimate and secure apps.

- Use Strong Authentication: Enable strong authentication methods, such as two-factor authentication or biometric authentication, if available. This adds an extra layer of security to your mobile banking accounts.

- Keep Your Device Updated: Regularly update your mobile device’s operating system and mobile banking apps with the latest security patches. These updates often address vulnerabilities and enhance the overall security of your device.

- Secure Your Device: Use a strong and unique passcode, PIN, or pattern lock to secure your device. Enable automatic device locking after a period of inactivity to prevent unauthorized access.

- Be Wary of Public Wi-Fi: Avoid using public Wi-Fi networks for mobile banking transactions, as they are often unsecured and can expose your sensitive information. Use a trusted and secure network or a virtual private network (VPN) for mobile banking.

- Beware of Phishing Attempts: Be cautious of suspicious emails, text messages, or calls requesting personal or financial information. Financial institutions will never ask for such information through unsolicited communication.

- Monitor Your Accounts Regularly: Regularly review your mobile banking transaction history and account statements for any unauthorized or suspicious activity. Report any discrepancies to your financial institution immediately.

- Set Account Alerts: Enable transaction alerts and notifications on your mobile banking app. These alerts can inform you of any unusual activity or large transactions on your accounts.

- Use Secure Networks for Updates: When updating your mobile banking app, ensure you are using a secure and trusted network to download and install the updates. Avoid using open or unsecured Wi-Fi networks for app updates.

- Log Out and Clear Cache: Always log out of your mobile banking app after each session. Additionally, regularly clear your app cache to remove any temporary files that may contain sensitive information.

By following these tips, you can significantly enhance the security of your mobile banking experience and protect your financial information from unauthorized access. It is crucial to stay vigilant and practice good security habits to safeguard your mobile banking transactions.

Conclusion

Mobile banking has transformed the way we manage our finances, offering unparalleled convenience and accessibility. However, as we embrace the convenience of mobile banking, it is crucial to prioritize the security of our financial information and transactions.

In this article, we explored the world of mobile banking, understanding its benefits, security measures, risks, and vulnerabilities. We discussed the various authentication methods used in mobile banking, as well as the importance of secure mobile banking apps and platforms.

By implementing encryption, two-factor authentication, biometric authentication, and other security measures, financial institutions strive to protect user data and ensure secure mobile banking experiences. However, it is equally important for users to practice safe mobile banking habits, such as downloading apps from official sources, using strong authentication methods, and being cautious of phishing attempts and unsecured Wi-Fi networks.

Mobile banking offers the flexibility to manage our finances on the go, but it is essential to remain vigilant and stay informed about best practices for secure mobile banking. Regularly monitoring our accounts, keeping devices and apps updated, and practicing strong password hygiene are just a few steps we can take to strengthen our mobile banking security.

As mobile banking continues to evolve, it is expected that financial institutions will continue to enhance the security measures in place and provide users with even more secure and seamless mobile banking experiences. However, users must remain proactive and educated about potential risks to protect their financial well-being.

With a combination of advanced security measures implemented by financial institutions and responsible user practices, we can enjoy the benefits of mobile banking while minimizing the risks associated with it. By prioritizing security, we can confidently manage our finances from the convenience of our mobile devices.