Finance

How To Generate Credit Repair Leads

Published: October 23, 2023

Learn effective strategies on how to generate credit repair leads in the finance industry. Get expert advice and tips to boost your business growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Repair Leads

- Tips for Generating Credit Repair Leads

- Utilizing Digital Marketing Strategies

- Building an Effective Online Presence

- Utilizing Social Media Platforms

- Offering Valuable Resources and Information

- Partnering with Local Businesses and Professionals

- Hosting Educational Webinars or Workshops

- Implementing Referral Programs

- Optimizing Website and Landing Pages

- Engaging in Email Marketing

- Utilizing Pay-Per-Click Advertising

- Conclusion

Introduction

Welcome to the world of credit repair leads! As a finance professional or a credit repair specialist, you understand the importance of generating quality leads to grow your business. But with the ever-evolving digital landscape and fierce competition, it can be a daunting task to navigate the waters of lead generation effectively.

But fear not! In this article, we will explore the various strategies and tips to help you generate credit repair leads and boost your business. Whether you are a seasoned pro or new to the industry, these insights will provide you with valuable information to attract potential clients and ultimately increase your chances of success.

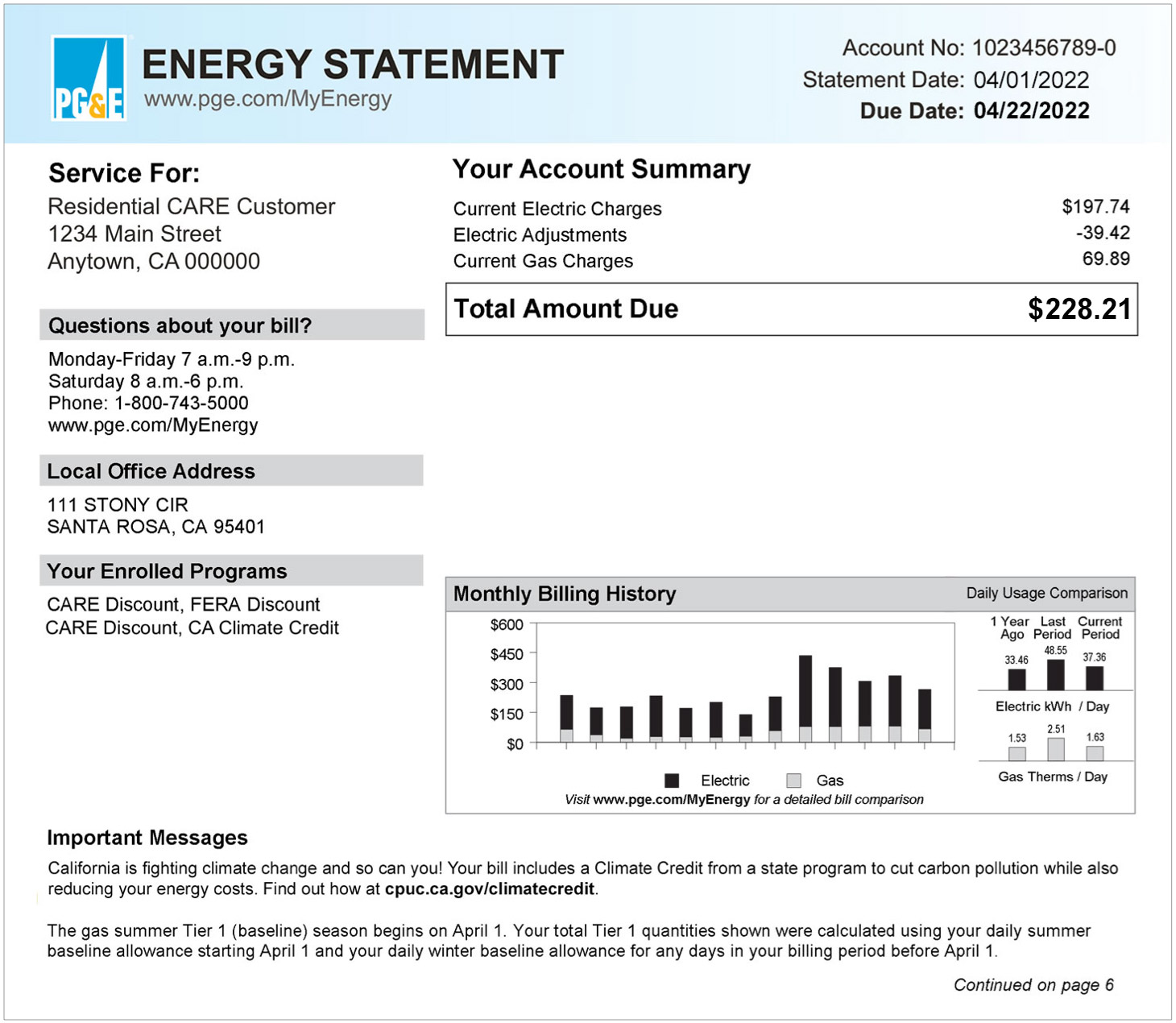

Understanding what credit repair leads are and why they are crucial is a fundamental step in your journey. Put simply, credit repair leads are individuals or businesses who have expressed an interest in improving their credit scores or repairing their credit history. These leads are a gold mine for credit repair specialists, as they represent potential customers who are actively seeking help to overcome financial challenges.

By tapping into the right strategies and channels, you can reach a wider audience and connect with those who need your services the most. With that in mind, let’s delve into the tips for generating credit repair leads and explore the various approaches you can take.

Understanding Credit Repair Leads

Before we dive into the strategies for generating credit repair leads, it’s important to have a clear understanding of who these leads are and why they are seeking assistance. Credit repair leads typically fall into two categories: individuals and businesses.

Individuals seeking credit repair assistance typically have lower credit scores due to missed payments, high credit card balances, or negative items on their credit reports. They may be struggling to qualify for loans, mortgages, or credit cards, and are actively looking for solutions to improve their creditworthiness.

On the other hand, businesses seeking credit repair are often small to medium-sized enterprises (SMEs) struggling with the impact of poor credit on their operations. These businesses may have difficulty obtaining financing, securing favorable terms with suppliers, or even attracting potential customers due to their credit history.

Understanding the motivations and pain points of these individuals and businesses is crucial for effectively targeting and converting credit repair leads. By addressing their specific concerns and offering tailored solutions, you can position yourself as a knowledgeable and trusted professional in the industry.

It’s worth noting that credit repair leads are not limited to those with severely damaged credit. Many individuals and businesses with average or slightly below-average credit scores also seek credit repair services to optimize their financial standing and improve their borrowing options. Therefore, it’s essential to tailor your marketing efforts to appeal to a wide range of credit profiles.

Now that we have a solid understanding of credit repair leads and their motivations, let’s explore the strategies you can employ to generate qualified leads for your credit repair business.

Tips for Generating Credit Repair Leads

Generating credit repair leads requires a strategic and multi-faceted approach. Here are some tried-and-true tips to help you attract and convert high-quality leads:

- Utilizing Digital Marketing Strategies: Leverage the power of digital marketing to reach a wider audience. This includes search engine optimization (SEO), content marketing, and paid advertising campaigns.

- Building an Effective Online Presence: Create a professional website that showcases your expertise and offers valuable resources to visitors. Optimize your website for search engines and provide clear calls to action to encourage lead conversion.

- Utilizing Social Media Platforms: Establish a presence on social media platforms such as LinkedIn, Facebook, and Instagram. Engage with your target audience, share informative content, and build relationships that can turn into leads.

- Offering Valuable Resources and Information: Create and publish informative blog articles, e-books, or video content that educates and empowers your audience. This positions you as an authority and attracts leads who are actively seeking credit repair solutions.

- Partnering with Local Businesses and Professionals: Collaborate with local businesses such as mortgage brokers, real estate agents, or financial advisors who often encounter individuals in need of credit repair. Establish referral partnerships to exchange leads and expand your reach.

- Hosting Educational Webinars or Workshops: Organize virtual or in-person events where you can educate participants about credit repair strategies, credit score improvement, and debt management. These events help establish credibility and generate leads from attendees.

- Implementing Referral Programs: Encourage satisfied clients to refer friends, family, or colleagues to your credit repair services. Offer incentives, such as discounts or bonuses, to motivate referrals and boost your lead generation efforts.

- Optimizing Website and Landing Pages: Ensure that your website and landing pages are optimized for lead capture. Use compelling headlines, clear contact forms, and persuasive copy that drives visitors to take action and provide their contact information.

- Engaging in Email Marketing: Build an email list of interested prospects and develop targeted email campaigns. Regularly send informative and valuable content to nurture leads and move them closer to conversion.

- Utilizing Pay-Per-Click Advertising: Execute targeted pay-per-click (PPC) advertising campaigns on platforms like Google Ads or Facebook Ads. Use relevant keywords and compelling ad copy to attract leads actively searching for credit repair services.

By incorporating these tips into your lead generation strategy, you can enhance your online presence, establish credibility, and attract a steady stream of qualified credit repair leads. Remember, consistency, adaptability, and continuous improvement are key to achieving sustainable results in lead generation.

Utilizing Digital Marketing Strategies

In today’s digital age, leveraging digital marketing strategies is essential for generating credit repair leads. Here are some key digital marketing techniques to implement:

Search Engine Optimization (SEO): Optimize your website and content to rank higher in search engine results. Conduct keyword research to identify relevant keywords and incorporate them naturally into your website copy, blog articles, and other content.

Content Marketing: Create high-quality, informative content that addresses the pain points of your target audience. Publish blog articles, videos, infographics, and guides that provide valuable insights into credit repair and credit score improvement.

Paid Advertising: Consider running pay-per-click (PPC) advertising campaigns on search engines and social media platforms. Set up targeted ads that appear when users search for credit repair or related topics, and direct them to dedicated landing pages to capture their information.

Video Marketing: Capitalize on the rise of video content by creating engaging videos that educate and inform viewers. Share tips on credit repair, demystify common misconceptions, and showcase success stories to build credibility and attract leads.

Social Media Marketing: Establish a strong presence on social media platforms where your target audience hangs out. Engage with users, share valuable content, and actively participate in relevant communities and groups to build brand awareness and generate leads.

Online Directories: List your credit repair business on reputable online directories and review websites. This increases your visibility and helps potential leads find your services when searching for credit repair solutions in their area.

Customer Reviews and Testimonials: Encourage satisfied clients to leave positive reviews and testimonials on your website and third-party review platforms. Potential leads often rely on reviews to make informed decisions, so displaying positive feedback builds trust and credibility.

Email Marketing: Build an email list by offering valuable resources or exclusive promotions in exchange for visitors’ email addresses. Send out regular newsletters and targeted email campaigns to nurture leads and guide them towards becoming paying customers.

Analytics and Tracking: Use web analytics tools to track the performance of your digital marketing efforts. Monitor website traffic, conversion rates, and engagement metrics to identify areas of improvement and optimize campaign performance.

Mobile Optimization: Ensure that your website and landing pages are mobile-friendly to cater to the increasing number of users accessing the internet through mobile devices. A seamless mobile experience enhances user engagement and improves the chances of generating leads.

By implementing these digital marketing strategies, you can effectively position your credit repair business in front of your target audience, increase brand visibility, and generate a steady stream of credit repair leads.

Building an Effective Online Presence

Building a strong online presence is crucial for generating credit repair leads. Here are some key strategies to help you establish an effective online presence:

Create a Professional Website: Your website serves as the foundation of your online presence. Ensure that it is visually appealing, user-friendly, and optimized for lead generation. Include clear calls to action and contact forms to capture visitor information.

Optimize for Search Engines: Implement search engine optimization (SEO) techniques to improve your website’s visibility in search engine results. Research relevant keywords and incorporate them naturally into your website content, meta tags, and headings.

Showcase Your Expertise: Highlight your experience, credentials, and success stories on your website. Position yourself as a trusted authority in the credit repair industry to build credibility and attract leads.

Offer Valuable Content: Create informative blog articles, guides, and resources that address common credit repair challenges. This not only positions you as an expert but also attracts potential leads who are searching for solutions to their credit problems.

Engage with Visitors: Provide opportunities for visitors to engage with your content, such as commenting on blog posts or participating in forums. Respond promptly to inquiries and engage in meaningful conversations to build relationships and establish trust.

Utilize Live Chat: Implement a live chat feature on your website to offer real-time assistance and support. This allows you to engage with visitors and address their questions or concerns directly, increasing the chances of converting them into leads.

Optimize for Mobile Devices: Ensure that your website is optimized for mobile devices, as an increasing number of users browse the internet on their smartphones and tablets. A mobile-friendly website provides a seamless user experience and improves lead conversion.

Build a Blogging Strategy: Regularly publish informative and valuable blog articles related to credit repair. This helps attract organic traffic to your website and positions you as a go-to resource for credit repair information.

Show Social Proof: Display testimonials, case studies, and client success stories on your website. Social proof establishes trust and demonstrates your ability to deliver results, making it more likely for potential leads to reach out to you.

Engage on Social Media: Establish a presence on social media platforms where your target audience is active. Share your blog articles, videos, and other content to foster engagement, attract leads, and drive traffic to your website.

Monitor Online Reputation: Regularly monitor and manage your online reputation. Respond to reviews and address customer feedback promptly and professionally. A positive online reputation builds trust and encourages leads to choose your services.

By focusing on building a strong and effective online presence, you can establish credibility, attract quality leads, and position your credit repair business for success in the digital landscape.

Utilizing Social Media Platforms

Social media platforms have become powerful tools for generating credit repair leads. Here are some strategies to effectively utilize social media for lead generation:

Choose the Right Platforms: Identify the social media platforms that your target audience frequents the most. Focus your efforts on those platforms to maximize reach and engagement.

Create Compelling Profiles: Optimize your social media profiles by providing complete and accurate information about your credit repair services. Use eye-catching visuals and a compelling bio that communicates the value you offer.

Share Valuable Content: Craft and share informative and engaging content related to credit repair. Provide tips, insights, and valuable resources that your target audience will find useful.

Engage with Your Audience: Actively engage with your followers by responding to comments, messages, and inquiries in a timely and professional manner. Establishing a meaningful dialogue helps build trust and fosters a sense of community.

Participate in Relevant Discussions: Join relevant groups, communities, or forums where your target audience participates. Contribute to discussions, answer questions, and provide valuable insights to establish yourself as an authority in credit repair.

Run Social Media Ads: Utilize the targeting options available on social media platforms to run paid advertising campaigns. Create compelling ad campaigns that resonate with your target audience and drive them to your website or landing page.

Host Contests or Giveaways: Organize contests or giveaways on social media to encourage engagement and attract new followers. Offer a free credit consultation or a valuable resource in exchange for likes, comments, or shares.

Collaborate with Influencers: Partner with influencers in the personal finance or credit repair space to expand your reach and tap into their followers. This can include guest posting on their blogs, participating in collaboration videos, or sponsoring their content.

Utilize Social Listening: Monitor social media conversations and keywords related to credit repair. Participate in discussions and offer relevant advice or solutions to those seeking help, positioning yourself as a valuable resource.

Track Performance and Adjust: Utilize social media analytics to track the performance of your posts and campaigns. Identify what is resonating with your audience and adjust your strategy accordingly.

Be Consistent and Authentic: Consistency is key when utilizing social media platforms for lead generation. Regularly post valuable content, engage with your audience, and showcase your expertise. Additionally, be authentic in your messaging and interactions to build trust and credibility.

By harnessing the power of social media, you can amplify your credit repair business’s visibility, engage with your target audience, and attract high-quality leads that convert into customers.

Offering Valuable Resources and Information

One effective approach to generate credit repair leads is by offering valuable resources and information. By providing helpful and informative content, you can establish yourself as a trusted authority in the field and attract leads who are actively seeking credit repair solutions. Here are some strategies to offer valuable resources and information:

Create Informative Blog Content: Develop a blog on your website where you can regularly publish articles related to credit repair. Address common credit repair challenges, provide tips and advice, and share relevant industry news and updates. This helps build credibility and attracts organic traffic to your website.

Produce Educational Videos: Consider creating videos that educate your audience about credit repair topics. Discuss common credit mistakes, explain the impacts of credit utilization, or provide step-by-step guides on improving credit scores. Share these videos on your website, social media platforms, and YouTube to reach a wider audience.

Offer Free Guides and E-books: Develop comprehensive guides or e-books that provide in-depth information on credit repair strategies. Offer these resources as free downloads on your website in exchange for visitors’ contact information. This allows you to capture leads and nurture them through the sales funnel.

Host Webinars or Online Workshops: Organize virtual events where you can share your expertise through webinars or online workshops. Topics can include credit repair basics, debt management strategies, or how to dispute errors on credit reports. These events not only educate attendees but also position you as a knowledgeable professional and generate leads.

Provide Credit Score Assessments: Offer free credit score assessments or consultations as lead magnets. Visitors can input their information on a dedicated form to receive a personalized credit score assessment from you. This exchange allows you to gather leads and follow up with tailored recommendations to improve their credit.

Curate Relevant Industry News: Stay up-to-date with industry news and changes in credit regulations. Share this information on your website or through social media platforms to keep your audience informed. Position yourself as an industry expert who is knowledgeable about the latest trends and developments.

Answer Frequently Asked Questions: Anticipate the common questions and concerns that individuals may have about credit repair. Create a frequently asked questions (FAQ) section on your website or address these questions through blog posts or videos. By providing clear and helpful answers, you establish yourself as a resource and build trust with potential leads.

Offer Credit Repair Tools and Templates: Develop useful tools and templates that individuals can utilize to track their credit score, create a budget, or dispute errors on their credit report. These resources provide value and incentivize visitors to provide their contact information in exchange.

Participate in Online Communities: Engage with online communities and forums where individuals discuss credit repair topics. Offer valuable advice and solutions to their credit-related questions, and include a link to your website or blog for more information. This positions you as an authority and can drive traffic to your site, generating leads.

Remember, the key to offering valuable resources and information is to demonstrate your expertise, solve problems for your target audience, and showcase the value you can provide. By doing so, you attract leads who are actively seeking credit repair solutions and are more likely to convert into paying customers.

Partnering with Local Businesses and Professionals

Partnering with local businesses and professionals can be an effective strategy for generating credit repair leads. By collaborating with individuals or organizations that have complementary services or target similar audiences, you can expand your reach and tap into new sources of leads. Here are some tips for successful partnerships:

Identify Potential Partners: Research and identify local businesses and professionals that have a client base that aligns with your target audience. This can include mortgage brokers, real estate agents, financial advisors, or tax consultants.

Establish Trust and Build Relationships: Reach out to potential partners and initiate conversations to build rapport. Attend networking events, join industry associations, and participate in local business forums to connect with potential partners and establish trust.

Create Win-Win Partnerships: When approaching potential partners, focus on the mutual benefits of collaboration. Highlight how partnering with you can add value to their clients and vice versa. This can include reciprocal referrals or offering joint services or incentives.

Provide Educational Resources: Offer to conduct educational seminars or workshops for your partner’s clients. Share your expertise in credit repair and provide valuable insights that address their clients’ financial needs. This positions you as a trusted resource and generates leads from their client base.

Exchange Leads: Establish a referral system with your partners where you exchange leads. When your partner encounters a client in need of credit repair services, they can refer them to you, and you can reciprocate by referring clients who may require their services.

Collaborate on Marketing Efforts: Pool your resources with your partners to execute joint marketing campaigns. This can include co-hosting webinars, creating co-branded content, or promoting each other’s services on your respective websites and social media platforms.

Create Co-Branded Materials: Develop co-branded marketing materials such as brochures, flyers, or handouts that highlight the collaboration between you and your partner. Distribute these materials at trade shows, local events, or through your partner’s office to reach potential leads.

Attend Partner’s Events: Participate in your partner’s networking events, seminars, or workshops. Networking with their clients allows you to personally connect with individuals who may be in need of credit repair services and generate leads through face-to-face interactions.

Stay in Touch: Maintain regular communication with your partners to nurture the relationship. Provide updates on your services, share industry insights, and discuss potential collaborative opportunities. This helps strengthen the partnership and keeps you top of mind when they come across credit repair leads.

Measure and Evaluate: Continuously assess the effectiveness of your partnerships. Monitor the number of leads generated, conversion rates, and overall impact on your business. Make adjustments and refine your partnership strategy based on the results.

Remember, successful partnerships rely on trust, mutual benefits, and shared goals. By collaborating with local businesses and professionals, you can tap into their network and attract leads who are already in need of credit repair services, enhancing the growth of your business.

Hosting Educational Webinars or Workshops

Hosting educational webinars or workshops is a powerful strategy for generating credit repair leads. By providing valuable information and insights through interactive online events, you can position yourself as an expert in the field and attract individuals who are actively seeking credit repair solutions. Here are some key tips for hosting successful educational webinars or workshops:

Identify Relevant Topics: Choose topics that are relevant to your target audience and address common credit repair challenges. Focus on subjects such as credit score improvement, debt management, disputing errors on credit reports, or building healthy financial habits.

Create Engaging Content: Develop a well-structured presentation or workshop curriculum that delivers valuable insights and actionable steps. Use visual aids, case studies, and real-life examples to engage your audience and reinforce key concepts.

Promote Your Event: Utilize your website, social media platforms, and email marketing to promote your webinar or workshop. Create compelling landing pages and registration forms to capture participant information. Leverage your network and partnerships to expand your reach.

Choose the Right Webinar Platform: Select a reliable webinar platform that offers interactive features such as live chat, polls, and Q&A sessions. This allows participants to engage with you and each other, fostering a sense of community and improving the overall experience.

Deliver Valuable Insights: Share practical tips, strategies, and best practices during your presentation. Provide actionable steps that participants can implement to improve their credit situation. By offering valuable information, you demonstrate your expertise and build trust with potential leads.

Encourage Participation: Engage with your audience by encouraging participation and interaction throughout the session. Conduct live polls, allow for Q&A sessions, and address participant questions and concerns. This creates a dynamic and interactive experience, enhancing engagement and retention.

Offer Exclusive Incentives: Provide attendees with exclusive incentives such as special discounts on your credit repair services, access to additional resources, or a free credit consultation. This encourages attendees to take the next step and become potential leads.

Record and Repurpose Your Content: Record your live webinar or workshop and make it available as on-demand content. This allows individuals who couldn’t attend the live event to access the valuable information and helps generate leads even after the event has ended.

Follow Up with Attendees: After the event, follow up with the attendees to thank them for their participation and provide any additional resources or offers discussed during the webinar or workshop. Personalized follow-ups demonstrate your commitment and can nudge attendees to take further action.

Evaluate and Learn: Measure the success of your webinar or workshop by monitoring attendance rates, engagement levels, and lead conversion. Gather feedback from participants to understand how to improve future events. Continuously refine your content and delivery based on these insights.

The hosting of educational webinars or workshops allows you to showcase your expertise, build credibility, and generate credit repair leads from an engaged and targeted audience. By providing valuable insights and actionable steps, you establish yourself as a trusted resource, increasing the likelihood of conversion.

Implementing Referral Programs

Implementing referral programs can be a highly effective strategy for generating credit repair leads. By leveraging the power of word-of-mouth marketing, you can tap into the networks of your satisfied clients and business partners to expand your reach. Here are some key steps to implement a successful referral program:

Define Incentives: Determine the incentives you will offer to those who refer new leads to your credit repair services. These can include discounts on your services, cash rewards, gift cards, or exclusive access to resources.

Identify Potential Referrers: Identify individuals or businesses who are likely to refer leads to you. This can include your current clients, colleagues in related industries, friends, family, or professionals such as real estate agents or mortgage brokers who frequently encounter individuals in need of credit repair services.

Communicate Your Referral Program: Clearly communicate your referral program to your existing clients and potential referrers. Explain how the program works, the incentives they can earn, and the process for submitting referrals.

Simplify the Referral Process: Make it easy for referrers to submit leads to you. Create a dedicated referral form on your website, provide a referral tracking system, or offer a unique referral code that can be easily shared.

Nurture Relationships: Build strong relationships with your existing clients and potential referrers. Provide exceptional service, go above and beyond to meet their needs, and establish trust. Happy clients and partners are more likely to refer others to your credit repair services.

Reward Referrals: Promptly reward individuals or businesses that refer leads to you. Express your gratitude, provide the agreed-upon incentives, and acknowledge their role in helping grow your business. This encourages future referrals and strengthens the relationship with referrers.

Monitor and Track Referrals: Keep track of the leads referred by each individual or business. Implement a system to track the source of each lead to accurately attribute referrals. This allows you to assess the effectiveness of your referral program and identify your top referrers.

Offer Incentives to Referred Leads: Consider offering incentives to the leads who are referred to your credit repair services. This can be a discount on their initial consultation fee or a bonus resource to encourage them to take the next steps in working with you.

Promote Your Referral Program: Actively promote your referral program through various channels. Utilize your website, social media platforms, email newsletters, and in-person interactions to remind clients and potential referrers about the program’s benefits and how they can participate.

Regularly Follow Up: Follow up with referred leads and keep them informed of your services and how you can help them. Personalize your communication to demonstrate that you value their referral and are committed to providing the best solutions for their credit repair needs.

Implementing a referral program taps into the power of personal recommendations and leverages the trust and credibility of your satisfied clients and business partners. By incentivizing referrals and nurturing relationships, you can generate a consistent stream of high-quality credit repair leads that are more likely to convert into customers.

Optimizing Website and Landing Pages

Optimizing your website and landing pages is crucial for generating credit repair leads. By ensuring that your online presence is user-friendly, visually appealing, and optimized for conversion, you can attract and capture the attention of potential clients. Here are key steps to optimize your website and landing pages:

Create a Clear Call-to-Action: Clearly define the action you want visitors to take on your website, whether it’s signing up for a newsletter, scheduling a consultation, or downloading a free resource. Place compelling call-to-action buttons prominently on your website and landing pages.

Simplify Navigation: Make it easy for visitors to explore your website and find the information they need. Streamline your navigation menu, use clear and descriptive labels, and ensure that your website structure is intuitive.

Design with a Mobile-First Approach: Optimize your website and landing pages for mobile devices. With a significant number of users browsing on smartphones and tablets, responsive design ensures a seamless user experience and increases the chances of lead conversion.

Optimize Load Times: Improve the loading speed of your website to prevent visitors from getting frustrated and leaving. Compress images, minify code, and utilize caching to reduce page load times and provide a smoother browsing experience.

Use Clear and Compelling Headlines: Capture visitors’ attention with clear and compelling headlines that communicate the value of your credit repair services. Highlight the benefits of working with you and address their pain points to engage them further.

Create a Benefit-Focused Landing Page: Design dedicated landing pages that focus on the benefits and unique selling points of your credit repair services. Clearly communicate how your services can help solve the visitors’ credit challenges and guide them towards taking action.

Include Testimonials and Social Proof: Display testimonials, reviews, and case studies from satisfied clients on your website and landing pages. Social proof helps build trust and credibility, giving potential clients confidence in your ability to deliver results.

Optimize Forms for Lead Capture: Place contact forms strategically on your website and landing pages to capture visitor information. Keep forms brief, ask for essential details, and assure visitors of their data’s privacy and security.

Utilize Trust Symbols and Security Badges: Display trust symbols, security badges, and certifications to reassure visitors that their personal and financial information is secure. This helps build trust and reduces any concerns they may have about sharing their details.

Use Visual Elements Strategically: Incorporate relevant and engaging visuals throughout your website and landing pages. Use high-quality images, infographics, and videos to break up text and make your content more visually appealing and memorable.

Implement A/B Testing: Continuously test and optimize your website and landing pages. Experiment with different layouts, colors, copy, and call-to-action placements to determine what resonates best with your target audience and improves conversion rates.

Analyze User Behavior: Use analytics tools to track user behavior on your website and landing pages. Understand how visitors navigate through your site, which pages they spend the most time on, and where they drop off. Use these insights to make data-driven improvements.

Optimizing your website and landing pages ensures a seamless user experience, captures leads effectively, and increases the chances of conversion. By focusing on creating a user-friendly and visually appealing online presence, you can maximize the potential of your credit repair lead generation efforts.

Engaging in Email Marketing

Email marketing is a powerful tool for generating credit repair leads and nurturing relationships with potential clients. By utilizing targeted email campaigns, you can provide valuable content, stay top-of-mind, and guide leads through the customer journey. Here are key steps to engage in effective email marketing:

Build an Opt-In Email List: Start by building an opt-in email list comprised of individuals who have explicitly expressed interest in receiving communications from you. Offer valuable resources or exclusive promotions in exchange for their email addresses.

Create Compelling and Personalized Content: Craft engaging and personalized email content that resonates with your audience. Segment your email list based on interests, demographics, or where they are in the customer journey, and tailor your content accordingly.

Deliver Valuable Resources: Provide valuable resources, such as educational blog articles, e-books, or videos, through your email campaigns. Offer tips and insights on credit repair, debt management, or credit score improvement to establish yourself as a trusted expert.

Nurture Leads with Drip Campaigns: Develop automated drip campaigns that deliver a series of targeted emails over a predetermined period. Use drip campaigns to provide additional information, address common questions, and build trust as leads progress towards becoming customers.

Personalize Email Subject Lines and Content: Personalization is key to capturing attention and increasing open rates. Address recipients by name in the subject line and tailor the content to their specific needs or interests whenever possible.

Include Clear Call-to-Actions: Include a clear and compelling call-to-action in your emails, directing recipients towards the desired action. This can be scheduling a consultation, downloading a resource, or signing up for a webinar. Make the call-to-action prominent and visually appealing.

Optimize for Mobile Devices: Ensure that your emails are optimized for mobile devices. Use responsive design so that your emails are visually appealing and easy to read on smartphones and tablets.

A/B Test Your Emails: Conduct A/B testing to determine which email subject lines, content, layouts, or call-to-action buttons perform better. Test different variables in your emails to optimize open rates, click-through rates, and conversion rates.

Automate Follow-Ups and Reminders: Set up automated follow-up emails and reminders based on specific triggers or actions taken by recipients. For example, if someone downloads a resource, automate a follow-up email asking if they have any questions or would like to schedule a consultation.

Analyze Email Campaign Performance: Monitor key email metrics such as open rates, click-through rates, and conversion rates. Analyze which campaigns and content resonate most with your audience and make data-driven adjustments to improve performance.

Comply with Email Marketing Regulations: Ensure that your email marketing practices align with applicable regulations, such as GDPR or CAN-SPAM. Obtain proper consent from recipients, provide easy unsubscribe options, and respect their privacy rights.

Email marketing allows you to maintain regular communication with leads, provide valuable information, and nurture relationships over time. By consistently delivering engaging and relevant content, you can build trust, establish credibility, and convert leads into loyal customers.

Utilizing Pay-Per-Click Advertising

Pay-Per-Click (PPC) advertising is a powerful tool for generating credit repair leads by placing targeted ads in front of your ideal audience. By utilizing platforms like Google Ads or social media advertising, you can reach individuals who are actively searching for credit repair solutions or fall within your target demographic. Here are key steps to effectively utilize PPC advertising:

Set Clear Goals: Define your PPC advertising goals, whether it’s increasing website traffic, generating leads, or driving conversions. This helps you tailor your campaigns for maximum effectiveness.

Identify Relevant Keywords: Conduct keyword research to identify relevant keywords and phrases that potential clients may search for when seeking credit repair services. Include these keywords in your ad copy and landing page content for better ad visibility.

Create Compelling Ad Copy: Develop compelling and concise ad copy that grabs attention and entices users to click. Highlight the unique value you offer, address pain points, and include a clear call-to-action to drive clicks.

Utilize Ad Extensions: Take advantage of ad extensions like site links, call extensions, or structured snippets to provide additional information and encourage engagement. These extensions increase the visibility and effectiveness of your ads.

Optimize Landing Pages: Direct clicks from your ads to dedicated landing pages that are optimized for conversion. Ensure landing pages align with the ad copy, provide clear information, and have a strong call-to-action to prompt lead generation.

Set a Realistic Budget: Determine your PPC advertising budget based on your goals and revenue targets. Start with a manageable budget and gradually increase it as you optimize your campaigns and generate positive returns.

Monitor and Refine: Regularly monitor the performance of your PPC campaigns. Assess key metrics like click-through rates, conversion rates, and cost per conversion. Make data-driven optimizations to improve the effectiveness of your ads.

Target Specific Audiences: Utilize audience targeting options available in PPC platforms to define your target audience based on demographics, interests, or behaviors. This ensures your ads reach individuals who are most likely to be interested in your credit repair services.

Optimize for Mobile: With a significant number of users accessing the internet through mobile devices, ensure that your ads and landing pages are optimized for mobile screens. Mobile-friendly experiences improve user engagement and drive better results.

Test and Experiment: Test different ad variations, headlines, call-to-action buttons, and landing page layouts to identify what resonates best with your target audience. Experiment with different messaging and design elements to optimize your campaigns.

Remarketing: Implement remarketing campaigns to target individuals who have previously visited your website or engaged with your ads. Deliver tailored ads with compelling offers or reminders to nurture leads and drive conversions.

Track Conversions and ROI: Implement conversion tracking on your website to measure the results of your PPC campaigns. Track lead conversions and calculate the return on investment (ROI) to assess the overall performance and profitability of your advertising efforts.

Utilizing PPC advertising allows you to reach a highly targeted audience actively seeking credit repair services, increasing your chances of generating high-quality leads. By carefully crafting ad campaigns, optimizing landing pages, and monitoring performance, you can maximize the effectiveness of your PPC campaigns and drive results for your credit repair business.

Conclusion

Generating credit repair leads requires a combination of effective strategies and a keen understanding of your target audience. By implementing the tips covered in this article, you can create a comprehensive lead generation strategy that maximizes your reach and converts potential clients into satisfied customers.

Understanding credit repair leads and their motivations is the first step in attracting the right audience. Tailor your marketing efforts to address their specific pain points and position yourself as a knowledgeable and trustworthy expert in the field.

Utilizing digital marketing strategies, such as SEO, content marketing, and social media, allows you to expand your online presence and attract a wider audience. Offering valuable resources and information, hosting webinars or workshops, and implementing referral programs help establish your credibility and encourage leads to take the next step.

Optimizing your website and landing pages ensures a seamless user experience, captivates visitors, and increases the likelihood of lead conversion. Engaging in email marketing and utilizing pay-per-click advertising further enhance your lead generation efforts by nurturing relationships and targeting specific audiences.

Consistency, adaptability, and continuous improvement are essential in lead generation. Regularly analyze and refine your strategies based on data and feedback. By focusing on providing value, building relationships, and delivering exceptional service, you can generate a steady stream of high-quality credit repair leads.

Remember, lead generation is an ongoing process. Stay up-to-date with industry trends, continuously optimize your strategies, and remain committed to providing exceptional value to your leads. With a well-rounded approach, your credit repair business can thrive and help individuals and businesses overcome their credit challenges.