Finance

What Is Amazon Credit Card Minimum Payment

Published: February 26, 2024

Learn about the minimum payment for Amazon credit cards and how it impacts your finances. Find out the importance of managing your credit card payments effectively. Discover tips for handling credit card minimum payments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Welcome to the world of Amazon credit cards! These financial tools offer a multitude of benefits, from cashback rewards to special financing options on Amazon purchases. However, it's crucial to grasp the concept of minimum payments to ensure responsible credit card management. In this comprehensive guide, we'll delve into the specifics of Amazon credit card minimum payments, shedding light on what they entail and how they can impact your financial well-being.

Understanding the dynamics of minimum payments is essential for every credit card holder. Whether you're new to credit cards or a seasoned user, comprehending the significance of minimum payments is pivotal for maintaining a healthy financial standing. By the end of this article, you'll have a clear understanding of Amazon credit card minimum payments, the factors influencing them, and valuable tips for managing these payments effectively.

Let's embark on this enlightening journey to unravel the intricacies of Amazon credit card minimum payments, empowering you to make informed financial decisions and leverage the benefits of your Amazon credit card responsibly.

Understanding Minimum Payments

Minimum payments represent the smallest amount that a credit card holder must pay by the due date to keep the account in good standing. This mandatory payment is typically calculated as a percentage of the total balance, often with a minimum dollar amount specified by the credit card issuer. While paying the minimum amount by the due date prevents late fees and negative marks on your credit report, it’s important to note that carrying a balance forward incurs interest charges, potentially leading to long-term debt if not managed prudently.

When you receive your credit card statement, the minimum payment due is clearly indicated. It’s crucial to recognize that while making the minimum payment on time is a fundamental obligation, it’s advisable to pay more than the minimum to reduce the overall interest accrued and expedite the repayment of the outstanding balance. By understanding the implications of minimum payments, cardholders can make informed decisions about managing their credit card debt effectively.

Moreover, comprehending the components of a credit card statement, including the minimum payment, empowers individuals to evaluate their financial obligations and devise a strategic repayment plan. This knowledge is particularly valuable for Amazon credit card holders, as it enables them to optimize their card usage, leverage rewards, and navigate the intricacies of minimum payments with confidence.

Amazon Credit Card Minimum Payment

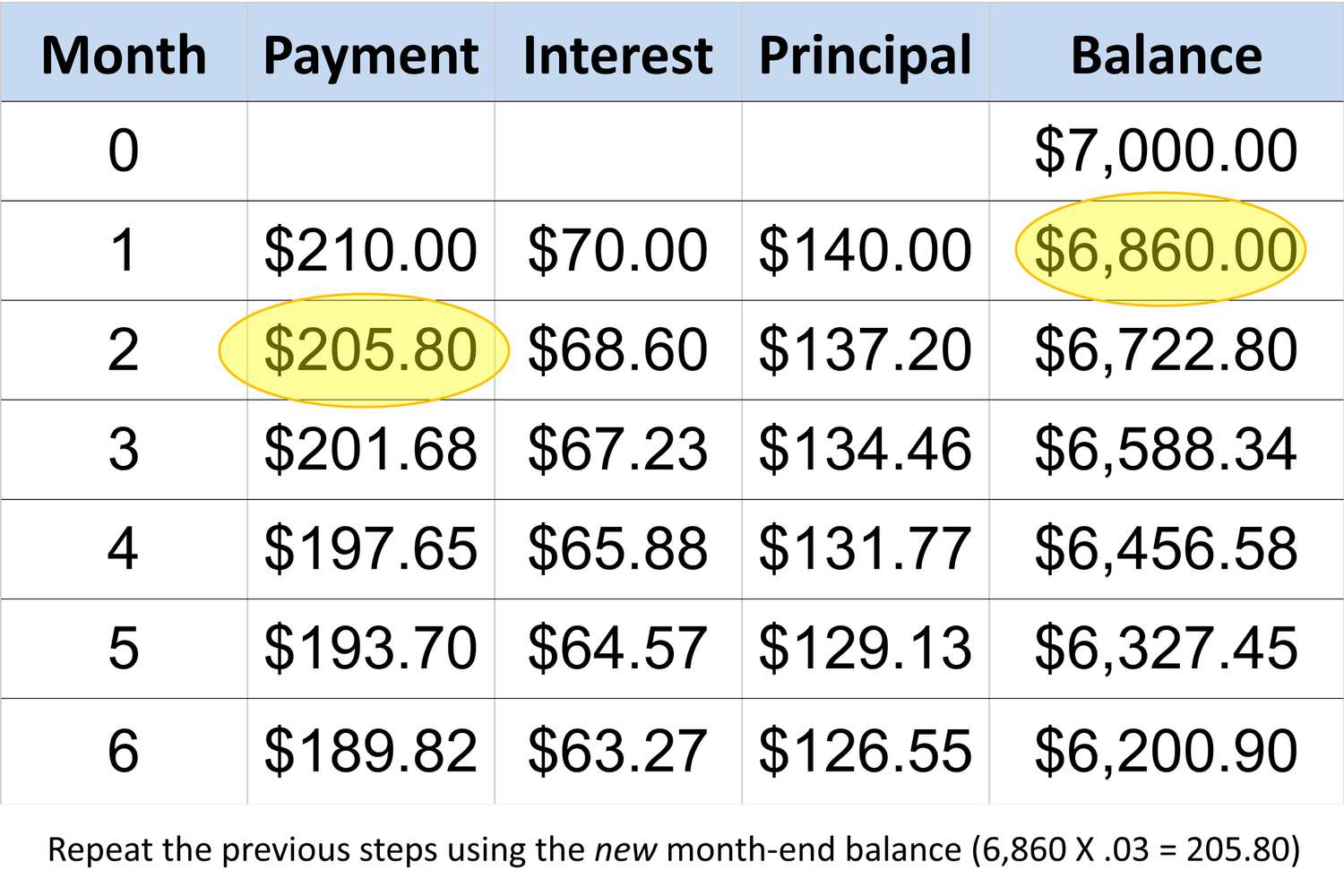

As an Amazon credit card holder, understanding the specifics of the minimum payment requirement is essential for effective financial management. The minimum payment for an Amazon credit card is determined based on various factors, including the outstanding balance, interest charges, and any fees incurred during the billing cycle. It’s important to note that the minimum payment amount may fluctuate from month to month, depending on these variables.

Amazon credit card minimum payments are typically calculated as a percentage of the total balance, with a minimum dollar amount specified by the issuer. This percentage is commonly around 1% to 3% of the outstanding balance, ensuring that cardholders fulfill their minimum payment obligation while considering the impact of interest charges on the remaining balance.

When managing an Amazon credit card, staying informed about the minimum payment due is crucial to avoid potential penalties and maintain a positive credit standing. By proactively monitoring the minimum payment requirement and understanding how it’s calculated, cardholders can plan their finances effectively and strive to pay more than the minimum to minimize interest costs and expedite debt repayment.

Furthermore, Amazon credit card minimum payments are integral to the overall credit utilization ratio, a key factor in credit scoring. By managing minimum payments responsibly and keeping the credit utilization ratio within optimal limits, cardholders can positively impact their credit score, paving the way for future financial opportunities.

Factors Affecting Amazon Credit Card Minimum Payment

Several factors influence the minimum payment requirement for an Amazon credit card, each playing a pivotal role in determining the amount due on the monthly statement. Understanding these factors is instrumental in managing the minimum payment effectively and optimizing your financial strategy.

1. Outstanding Balance: The total amount owed on the Amazon credit card directly impacts the minimum payment. As the outstanding balance increases, the minimum payment also rises proportionally, reflecting the ongoing financial obligation.

2. Interest Charges: Accumulated interest on the outstanding balance contributes to the minimum payment calculation. Higher interest charges result in an increased minimum payment, emphasizing the importance of managing interest costs through timely repayments.

3. Fees and Penalties: Incurred fees, such as late payment fees or over-limit charges, are factored into the minimum payment. Avoiding these fees is essential to maintain a manageable minimum payment and mitigate unnecessary financial burdens.

4. Credit Utilization Ratio: The ratio of the outstanding balance to the credit limit, known as the credit utilization ratio, influences the minimum payment. Managing this ratio responsibly can positively impact the minimum payment and overall credit health.

5. Promotional Financing: If the Amazon credit card includes promotional financing offers, the utilization of these financing options can affect the minimum payment calculation. Understanding the terms of promotional financing is crucial for accurate financial planning.

By comprehending these factors and their impact on the minimum payment, Amazon credit card holders can proactively manage their financial responsibilities, optimize their repayment strategy, and maintain a healthy credit profile. It's essential to stay informed about these variables to make informed decisions and ensure responsible credit card usage.

Tips for Managing Amazon Credit Card Minimum Payment

Effectively managing the minimum payment for your Amazon credit card is essential for maintaining financial stability and optimizing your credit card usage. By implementing strategic approaches and prudent financial habits, you can navigate the minimum payment requirements with confidence and mitigate potential challenges. Here are valuable tips to help you manage your Amazon credit card minimum payment effectively:

- Regular Monitoring: Stay vigilant about your credit card statements and monitor the minimum payment due each month. By proactively tracking this essential figure, you can plan your finances accordingly and avoid any surprises.

- Timely Payments: Ensure that you make your credit card payments on time to avoid late fees and negative impacts on your credit score. Setting up automatic payments or reminders can be instrumental in maintaining timely payments.

- Pay More Than the Minimum: While the minimum payment is mandatory, strive to pay more than the minimum whenever possible. By reducing the outstanding balance, you can minimize interest charges and expedite your journey toward debt freedom.

- Strategic Budgeting: Incorporate your minimum payment obligations into your budgeting strategy. Allocate sufficient funds to cover the minimum payment while prioritizing additional payments to reduce the overall balance.

- Avoid Additional Fees: Steer clear of unnecessary fees, such as late payment fees and over-limit charges, by adhering to the terms of your Amazon credit card and maintaining responsible financial practices.

- Utilize Rewards Wisely: If your Amazon credit card offers rewards or cashback benefits, consider utilizing these rewards to offset your balance or make additional payments, effectively reducing the minimum payment obligation.

- Communicate with the Issuer: In cases of financial hardship or unexpected challenges, don’t hesitate to communicate with the credit card issuer. They may offer assistance or alternative payment arrangements to help you manage your minimum payment effectively.

By integrating these tips into your financial approach, you can navigate the minimum payment requirements of your Amazon credit card adeptly, optimize your credit card management, and work toward a stronger financial foundation.

Conclusion

Congratulations! You’ve embarked on a journey to unravel the intricacies of Amazon credit card minimum payments, gaining valuable insights into their significance and the factors influencing their calculation. By understanding the dynamics of minimum payments and implementing effective management strategies, you’re well-equipped to navigate your Amazon credit card obligations with confidence and prudence.

As you continue your financial endeavors, remember that responsible credit card usage, including managing minimum payments, is fundamental to your long-term financial well-being. By staying informed, monitoring your statements diligently, and implementing prudent financial habits, you can harness the benefits of your Amazon credit card while mitigating potential challenges associated with minimum payments.

Always strive to pay more than the minimum, allocate funds strategically, and leverage rewards wisely to optimize your credit card management. By doing so, you can minimize interest costs, reduce your outstanding balance, and pave the way for a healthier financial future.

Keep in mind that open communication with your credit card issuer and proactive financial planning are invaluable tools in managing your Amazon credit card minimum payment effectively. By adhering to these principles and integrating the tips provided, you can navigate the world of credit cards with confidence and prudence, fostering a positive financial trajectory.

Armed with this knowledge, you’re empowered to make informed decisions, optimize your financial strategy, and leverage the benefits of your Amazon credit card responsibly. As you continue your financial journey, may these insights serve as a guiding light, illuminating the path toward financial prosperity and well-being.