Finance

How To Get A First Time Credit Card

Modified: February 21, 2024

Learn how to get your first time credit card and build your credit history. Discover tips and strategies for managing your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit cards! As a first-time credit card holder, you’re about to embark on a journey that can significantly impact your financial life. Credit cards provide a convenient and flexible way to make purchases, but they also require responsible usage to avoid debt and maintain a healthy credit history.

Understanding how credit cards work and knowing the requirements to obtain one are crucial steps before diving into the world of plastic. This article aims to demystify the process and provide you with essential insights on how to get your first credit card.

Before we dive into the details, it’s important to note that having a credit card is not mandatory, but it can be beneficial in many ways. A credit card grants you financial flexibility, helps you establish credit history, and can even offer rewards and perks, such as cashback or travel benefits.

Now, let’s delve into the world of credit cards and discover how to navigate the process of obtaining your first one.

Understanding Credit Cards

Before applying for a credit card, it’s essential to grasp the basics of how they work. A credit card is a financial tool that allows you to borrow money up to a certain limit to make purchases. Unlike a debit card, which is directly linked to your bank account and uses your own funds, a credit card involves borrowing money from the card issuer.

When you use a credit card, you’re essentially taking out a short-term loan. This loan must be repaid within a specified period known as the grace period, usually ranging from 21 to 30 days. If you pay off the full balance within the grace period, you won’t incur any interest charges. However, if you carry a balance from month to month, interest will apply to the remaining amount owed.

Credit cards also come with additional features, such as cash advances, balance transfers, and rewards programs. Cash advances allow you to withdraw cash from an ATM using your credit card, but beware: they often come with high-interest rates and transaction fees. Balance transfers, on the other hand, enable you to move existing debt from one credit card to another, usually with a promotional interest rate for a limited period. Rewards programs can offer various benefits, including points, miles, or cashback on specific purchases.

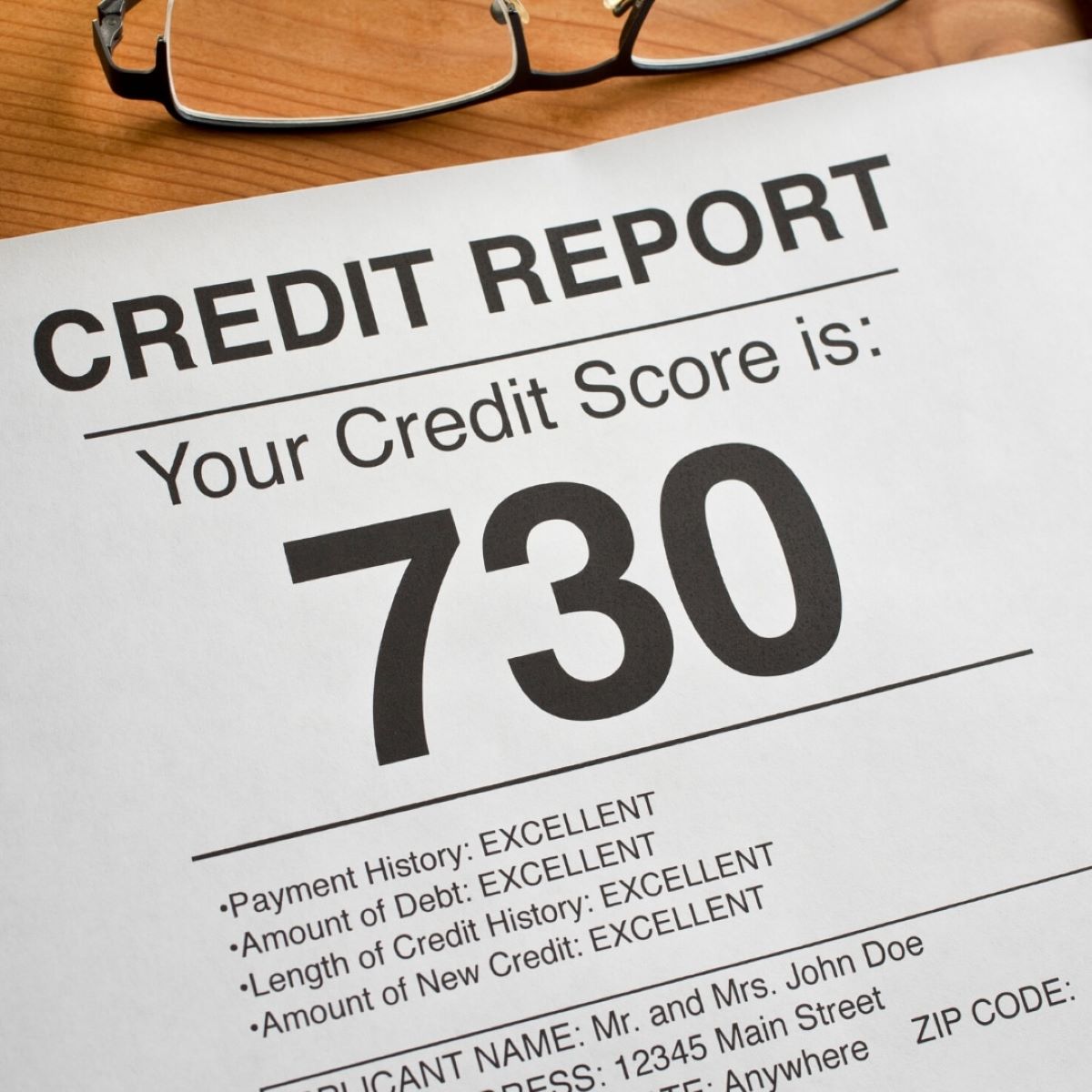

It’s important to note that responsible credit card usage involves keeping your credit utilization ratio low. This ratio is the percentage of your available credit that you’re using. Keeping it below 30% can positively impact your credit score. Additionally, always aim to make at least the minimum payment on time each month to avoid late fees and potential damage to your credit history.

Now that you have a basic understanding of credit cards, let’s explore the minimum requirements to obtain your first one.

Minimum Requirements for Getting a First Time Credit Card

When applying for your first credit card, certain criteria must be met to increase your chances of approval. While requirements may vary between card issuers, here are the common factors considered:

- Age: You must be at least 18 years old to apply for a credit card independently. Some issuers may require you to be older.

- Income: Demonstrating a stable source of income is crucial. It reassures the card issuer that you can repay any charges you make on the card.

- Credit History: As a first-time credit card applicant, you may not have an extensive credit history. In such cases, issuers often consider alternative criteria such as your employment history or academic record.

- Proof of Identity: You’ll need to provide documents that verify your identity, such as a valid ID card, passport, or driver’s license.

- Social Security Number (SSN) or Individual Tax Identification Number (ITIN): In the United States, most credit card issuers require applicants to have an SSN or ITIN to apply for a credit card. Without one of these numbers, it may be more challenging to get approved.

It’s worth mentioning that having a co-signer or applying for a secured credit card can also help if you don’t meet all the criteria. A co-signer is someone with an established credit history who agrees to take responsibility for the debt if you default on payments. With a secured credit card, you provide a cash deposit that serves as collateral for the credit limit, reducing risk for the issuer.

Remember, meeting the minimum requirements doesn’t guarantee approval, but it’s a necessary starting point. It’s important to choose a credit card that matches your financial situation and goals. Next, we’ll explore how to build credit history to improve your chances of getting approved for your first credit card.

Building Credit History

Building a solid credit history is essential when it comes to obtaining your first credit card. Without a credit history, lenders have no information to assess your creditworthiness, making it challenging to get approved. Here are some steps you can take to start building credit:

- Open a Bank Account: Start by opening a checking or savings account in your name. This establishes a relationship with a financial institution and shows responsibility in managing your finances.

- Apply for a Secured Credit Card: If you’re having difficulty getting approved for a traditional credit card, a secured credit card can be a good option. With a secured card, you provide a deposit that serves as collateral for your credit limit. By making timely payments, you can demonstrate responsible credit management.

- Become an Authorized User: Another way to start building credit is by becoming an authorized user on someone else’s credit card. This could be a family member or a close friend who is willing to add you to their account. Just make sure the primary cardholder has a positive credit history and pays their bills on time.

- Apply for a Student Credit Card: If you’re a student, you may be eligible for a credit card designed specifically for students. These cards often have lower credit requirements and provide opportunities to build credit while pursuing your education.

- Pay Bills on Time: Consistently paying your bills, such as rent, utilities, and student loans, on time can help establish a positive payment history. Late or missed payments can have a negative impact on your credit score.

It’s crucial to remember that building credit takes time. Make sure to monitor your credit report regularly and address any errors or discrepancies that may negatively affect your creditworthiness. With consistent responsible credit behavior, you’ll be on your way to establishing a solid credit history and increasing your chances of getting approved for your first credit card.

Now that you’re familiar with the steps to build credit history, let’s move on to researching and comparing credit card options.

Researching and Comparing Credit Card Options

With a better understanding of credit cards and a foundation of credit history, it’s time to explore the plethora of credit card options available to you. Researching and comparing different credit cards allows you to find one that aligns with your financial needs and goals. Here are some factors to consider:

- Interest Rates: The interest rate, also known as the Annual Percentage Rate (APR), is an important factor to consider. Lower interest rates can save you money if you carry a balance from month to month.

- Credit Limit: The credit limit is the maximum amount you can borrow on the card. Consider your spending habits and ensure the credit limit is sufficient for your needs.

- Fees: Take note of any annual fees, late payment fees, foreign transaction fees, or other charges associated with the card. These fees can vary widely, so it’s important to compare them to find a card with reasonable fees.

- Rewards and Perks: Many credit cards offer rewards programs and perks. Consider whether you prefer cashback, airline miles, hotel rewards, or other benefits. Pick a card that aligns with your spending habits and offers rewards that are valuable to you.

- Introductory Offers: Some credit cards come with introductory offers, such as 0% APR for a specified period or bonus rewards for spending a certain amount within the first few months. These offers can provide additional value, but be aware of any terms and conditions.

- Customer Reviews and Feedback: Reading customer reviews and feedback can give you insights into the card issuer’s customer service, ease of use, and overall satisfaction.

Visit the websites of different card issuers, carefully review the terms and conditions, and compare the features and benefits of each card. Use comparison websites and online resources to help simplify the process.

Remember, there is no one-size-fits-all credit card. The right card for you depends on your financial situation, spending habits, and goals. Take your time to compare and research, ensuring you make an informed decision.

Once you’ve narrowed down your options, it’s time to proceed with the application process for your first credit card.

Applying for a First Time Credit Card

After conducting thorough research and comparing different credit card options, you’re ready to apply for your first credit card. Follow these steps to ensure a smooth application process:

- Gather Required Documents: Before starting the application, gather all the necessary documents, such as proof of identification, proof of income, and any other required information specific to the card issuer.

- Fill Out the Application Form: Complete the credit card application form accurately and honestly. Provide all the requested information, including your personal details, employment history, and financial information.

- Review the Terms and Conditions: Carefully review the terms and conditions of the credit card, ensuring you understand the interest rates, fees, rewards program, and any other important information. Take note of the grace period, minimum payment requirements, and any promotional offers.

- Submit the Application: Once you have reviewed and filled out the application form, submit it to the card issuer through their preferred method, which may be online, by mail, or in-person at a branch or store.

- Wait for Approval: After submitting your application, be patient and wait for a response. The card issuer will review your application, considering factors such as your credit history, income, and other qualifications.

- Activate and Start Using Your Card: If your application is approved, you will typically receive the credit card by mail. Activate your card as per the instructions provided and start using it responsibly for your purchases.

It’s important to mention that during the application process, it’s advisable to apply for only one credit card at a time. Applying for multiple cards simultaneously can negatively impact your credit score and make you appear desperate for credit.

If your application is declined, don’t be disheartened. Take the time to understand the reasons behind the rejection and work on improving the factors that led to it. You can consider applying for a secured credit card or seeking a co-signer to strengthen your chances of approval.

Now that you’ve successfully obtained your first credit card, it’s crucial to understand how to use it responsibly and avoid falling into credit card debt.

Responsible Credit Card Usage

Having a credit card comes with the responsibility of using it wisely to maintain a healthy financial life. Here are some tips to help you use your first credit card responsibly:

- Create a Budget: Before making any credit card purchases, set a budget and track your expenses. This will help you avoid overspending and ensure you can comfortably pay off your monthly balance.

- Pay Your Bill on Time: Paying your credit card bill on time is crucial to maintaining a good credit history. Late payments can result in late fees and negatively impact your credit score. Consider setting up automatic payments or reminders to ensure you never miss a payment.

- Pay More Than the Minimum Due: While it’s important to make at least the minimum payment each month, aim to pay off more than the minimum whenever possible. By doing so, you’ll reduce the amount of interest that accumulates on your balance.

- Avoid Maxing Out Your Credit Limit: Keeping your credit utilization ratio low is key to maintaining a healthy credit score. Aim to use no more than 30% of your available credit. Maxing out your credit limit can negatively impact your creditworthiness.

- Avoid Cash Advances: Cash advances on credit cards often come with high fees and steep interest rates. Only use them as a last resort and be sure to repay the cash advance as quickly as possible.

- Review Your Statements: Regularly review your credit card statements to check for any unauthorized or fraudulent charges. If you notice any discrepancies, contact your card issuer immediately.

- Keep Your Card Information Secure: Protect your credit card information to prevent unauthorized use. Avoid sharing your card details with anyone unnecessarily, and be cautious when making online purchases.

- Monitor Your Credit Score: Keep an eye on your credit score to track your progress and identify any areas for improvement. Many credit card issuers provide free access to your credit score through their online banking portals.

By following these responsible credit card usage tips, you can build a positive credit history, improve your credit score, and pave the way for future financial success.

However, it’s important to remember that credit cards are not free money. It’s essential to develop disciplined spending habits and avoid the temptation of overspending. Use your credit card as a financial tool to make convenient purchases and build credit, but always do so within your means.

Now that you’re equipped with knowledge on responsible credit card usage, let’s move on to some tips for managing credit card debt.

Tips for Managing Credit Card Debt

While responsible credit card usage is important, it’s equally crucial to manage your credit card debt effectively. Here are some tips to help you avoid and manage credit card debt:

- Create a Repayment Plan: If you carry a balance on your credit card, develop a repayment plan to pay it off as quickly as possible. Consider using strategies like the debt avalanche or debt snowball method to prioritize high-interest debts or smaller balances first.

- Avoid Minimum Payments: Paying only the minimum payment each month can keep you trapped in debt for a long time due to accumulating interest. Aim to pay more than the minimum to make substantial progress in reducing your debt.

- Consolidate High-Interest Debt: If you have multiple credit card debts with high-interest rates, consider consolidating them into a single loan or transferring balances to a credit card with a lower interest rate. This can make your debt more manageable and potentially save you money on interest.

- Seek Professional Assistance: If your debt becomes overwhelming and you are struggling to make payments, consider seeking guidance from a credit counseling agency or a financial advisor. They can offer advice and assistance in developing a repayment plan that suits your situation.

- Avoid Using Credit Cards for Everyday Expenses: While credit cards can be convenient for purchases, relying on them for daily expenses can quickly lead to accumulating debt. Stick to using cash or debit cards for everyday expenses and use your credit card sparingly and responsibly.

- Negotiate with Credit Card Companies: In some cases, you may be able to negotiate with your credit card companies for lower interest rates, waived fees, or extended payment plans. Contact your card issuer to explore possible options.

- Avoid New Credit Card Debt: While paying off your existing credit card debt, avoid adding new debt to your cards. This can further complicate your financial situation and delay your progress in becoming debt-free.

- Practice Financial Discipline: Develop healthy financial habits such as budgeting, tracking expenses, and distinguishing needs from wants. By practicing discipline in your spending, you can prevent unnecessary debt from accumulating.

Remember, managing credit card debt requires patience and consistency. It’s important to stay committed to your repayment plan and make responsible financial decisions to avoid falling back into debt.

By following these tips and maintaining a proactive approach to managing your credit card debt, you can make significant strides in improving your financial stability and achieving your long-term financial goals.

Now, let’s conclude our journey on how to get your first credit card and summarize the key points discussed.

Conclusion

Obtaining your first credit card is an exciting step towards financial independence and building a positive credit history. However, it’s essential to approach the process with knowledge and responsibility. By understanding credit cards, meeting the minimum requirements, building credit history, researching and comparing options, and using your credit card responsibly, you set yourself up for success.

Remember, responsible credit card usage involves paying your bills on time, keeping your credit utilization ratio low, and avoiding unnecessary debt. Stick to a budget, track your expenses, and prioritize timely payments to maintain a healthy credit history and improve your credit score.

When researching credit card options, consider interest rates, credit limits, fees, rewards programs, and any introductory offers. Choose a credit card that aligns with your financial goals and spending habits.

Managing credit card debt requires discipline and a strategic approach. Create a repayment plan, aim to pay more than the minimum balance, and explore options like consolidation or negotiation with your card issuer. Seek professional assistance if needed and practice financial discipline to avoid falling into further debt.

By following these steps and tips, you can navigate the credit card world effectively, avoid common pitfalls, and make the most of your first credit card experience. Remember, responsible credit card usage is a lifelong skill that will benefit you in managing your finances and achieving your financial goals.

Take this knowledge and apply it wisely. Use your first credit card as a tool to build credit, enjoy the convenience it brings, and make responsible financial decisions. Your credit card journey starts now, and with the right mindset and approach, you’re on your way to a secure financial future.