Home>Finance>How To Qualify For First-Time Homebuyer Tax Credit

Finance

How To Qualify For First-Time Homebuyer Tax Credit

Published: January 13, 2024

Learn how to qualify for the first-time homebuyer tax credit and save on your finance expenses as a new homeowner.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Buying a home is a milestone moment in many people’s lives, and it represents a significant financial commitment. To help alleviate the burden of purchasing a home, governments often offer incentives to first-time homebuyers, such as the First-Time Homebuyer Tax Credit. This tax credit is designed to provide financial relief and encourage individuals to take the leap into homeownership.

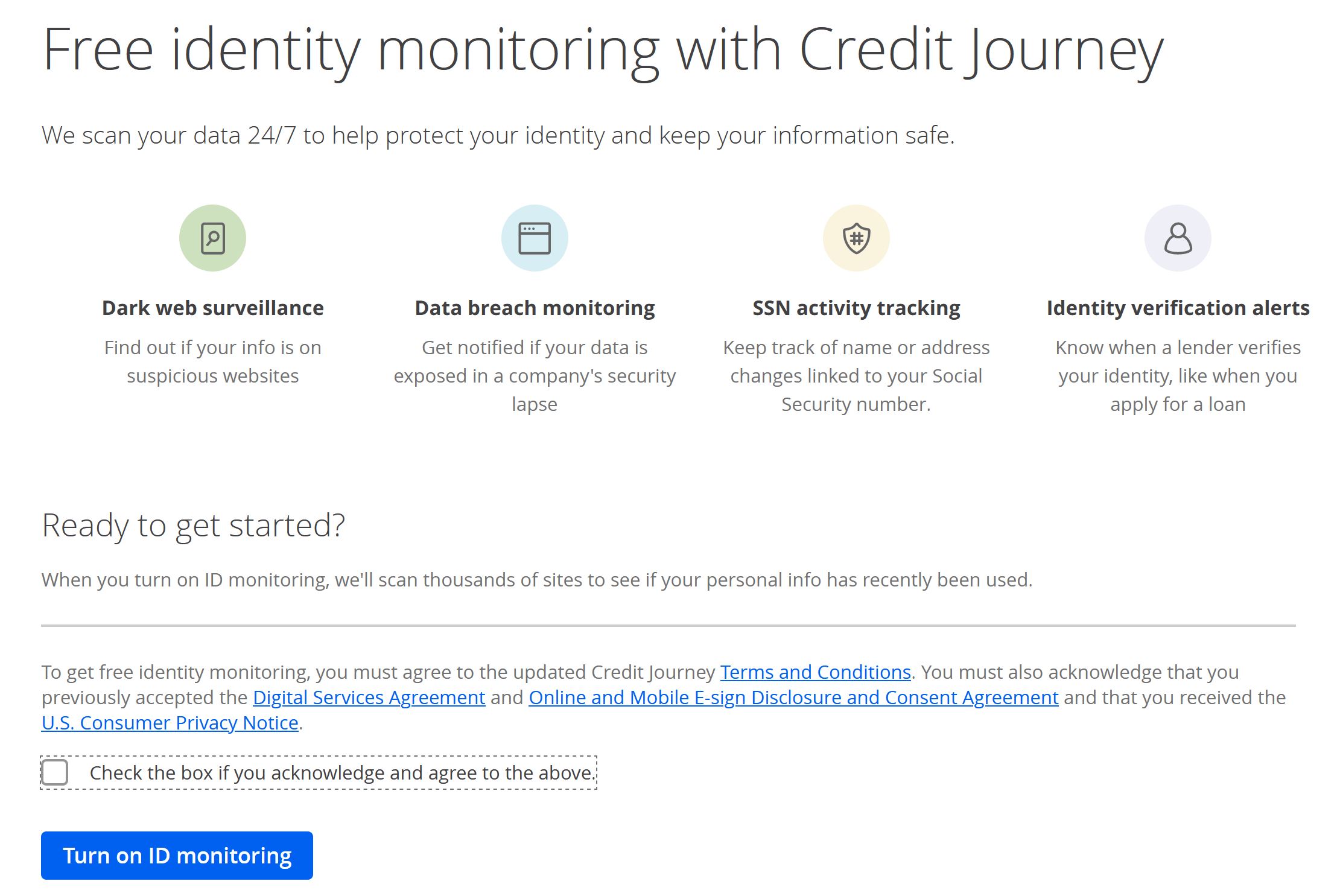

The First-Time Homebuyer Tax Credit is a tax incentive program offered by some countries or regions to eligible individuals who are purchasing their first home. It provides a financial benefit that can help offset the costs associated with buying a home, such as the down payment, closing costs, and other expenses.

Understanding the details of this tax credit is essential for those who are considering buying their first home. In this article, we will delve into the key aspects of the First-Time Homebuyer Tax Credit, including eligibility requirements, income limits, purchase requirements, application process, documentation needed, claiming the tax credit, and more.

Whether you’re a young professional looking to settle down or a family searching for a place to call home, the First-Time Homebuyer Tax Credit can make homeownership not only a dream come true but also a financially viable option. By taking advantage of this government incentive, you can receive significant tax benefits that can ease the financial strain of buying your first home.

Understanding the First-Time Homebuyer Tax Credit

The First-Time Homebuyer Tax Credit is a tax incentive program that aims to support individuals who are purchasing their first home. It is designed to provide financial assistance and encourage people to enter the real estate market. This tax credit can help reduce the overall cost of buying a home and make homeownership more attainable for first-time buyers.

The specific details and availability of the First-Time Homebuyer Tax Credit may vary depending on the country or region you reside in. It is crucial to research and understand the specific requirements and benefits offered in your location.

Typically, the First-Time Homebuyer Tax Credit is a non-refundable tax credit, meaning it can reduce the amount of tax you owe, but it will not provide a refund if the credit amount exceeds your tax liability. The maximum amount of the tax credit and the criteria for qualifying may differ depending on the jurisdiction.

In addition to reducing the overall tax liability, the First-Time Homebuyer Tax Credit can also help boost the economy by driving real estate activity. This program encourages individuals to invest in their local housing markets, stimulating economic growth and job creation within the construction and related industries.

It’s important to note that the First-Time Homebuyer Tax Credit is typically only available to individuals who meet specific eligibility requirements relating to income, purchase price, and property type. These requirements are put in place to ensure that the tax credit is targeted towards those who truly need assistance in purchasing their first home.

As prospective homebuyers, it is crucial to fully understand the details and qualifications surrounding the First-Time Homebuyer Tax Credit before embarking on the home buying process. By familiarizing yourself with the specifics of this tax credit, you can make informed decisions and take advantage of any available financial assistance to make your first home purchase a reality.

Eligibility Requirements

The eligibility requirements for the First-Time Homebuyer Tax Credit can vary depending on the country or region in which you reside. However, there are common criteria that are often considered when determining eligibility. It’s important to familiarize yourself with these requirements to ensure that you meet the necessary qualifications before applying for the tax credit.

1. First-Time Homebuyer Status: To be eligible for the tax credit, you must be a first-time homebuyer. This typically means that you have not owned a principal residence within the specified time frame, often ranging from three to five years prior to the purchase. Some jurisdictions may also consider individuals who have not owned a home in the country or region as first-time homebuyers.

2. Age and Citizenship: You must be of legal age and a citizen or legal resident of the country or region offering the tax credit. Proof of citizenship or residency may be required during the application process.

3. Purchase Date: The purchase of the home must occur within the specified timeframe set by the government. This timeline can vary, so it’s important to verify the specific dates applicable in your area.

4. Property Type: Typically, the First-Time Homebuyer Tax Credit applies to the purchase of a principal residence. This includes single-family homes, townhouses, condominiums, or cooperative apartments. It is important to note that the tax credit is not usually available for the purchase of investment properties or vacation homes.

5. Income Limits: Many jurisdictions impose income limits to ensure the tax credit is targeted towards individuals with lower to moderate income levels. These income limits may vary depending on the size of your household and the cost of living in your area. It’s crucial to verify the specific income thresholds applicable to your region.

6. Other Requirements: There may be additional requirements, such as completing a homebuyer education course or using an approved lender or real estate agent. These additional criteria are put in place to support responsible homeownership and ensure that individuals are well-informed throughout the process.

Before applying for the First-Time Homebuyer Tax Credit, carefully review the eligibility requirements of your country or region. It is advisable to consult with a tax professional or visit the official government website for accurate and up-to-date information. By meeting the eligibility requirements, you can maximize your chances of receiving the tax credit and enjoy the financial benefits it offers.

Income Limits

Income limits are an important factor in determining eligibility for the First-Time Homebuyer Tax Credit. These limits are established to ensure that the tax credit is targeted towards individuals with lower to moderate income levels who may require financial assistance in purchasing their first home.

The income limits for the tax credit can vary depending on the country or region in which you reside. The limits are typically based on your household size and the median income of your area. It’s important to consult the official government website or speak with a tax professional to determine the specific income limits applicable to your location.

Generally, income limits are set to ensure that the tax credit benefits those who may face financial challenges when entering the real estate market. They are designed to prevent individuals with higher incomes from taking advantage of the tax credit, as it is primarily intended to assist first-time homebuyers who may need additional support.

Keep in mind that income limits may be subject to change each year or based on government policy updates. It’s essential to stay informed about any changes to the income limits to determine your eligibility accurately.

If your income exceeds the limits set for the First-Time Homebuyer Tax Credit, you may not be eligible to receive the credit. However, other government programs or incentives may be available to assist individuals with higher incomes in achieving homeownership, so it’s worthwhile to explore other avenues that may be available in your area.

When applying for the First-Time Homebuyer Tax Credit, you will likely be required to provide proof of your income, such as tax returns or pay stubs. It’s important to maintain accurate records and be prepared to present this documentation during the application process.

By understanding and adhering to the income limits established for the First-Time Homebuyer Tax Credit, you can ensure that you meet the necessary eligibility criteria. This will enable you to make the most of this financial incentive and receive the assistance you need to facilitate your journey towards homeownership.

Purchase Requirements

When it comes to the First-Time Homebuyer Tax Credit, there are specific purchase requirements that must be met to qualify for the tax credit. These requirements are put in place to ensure that the credit is utilized for the purchase of a primary residence and to prevent abuse of the program. Understanding these purchase requirements is crucial before embarking on your homebuying journey.

1. Primary Residence: The First-Time Homebuyer Tax Credit is generally only available for the purchase of a primary residence. This means that the home must be intended for your own occupancy and not used as an investment property or vacation home. Certain jurisdictions may have additional guidelines on what qualifies as a primary residence, so it’s essential to review the specific requirements in your area.

2. Purchase Date: The purchase of the home must usually take place within a specified period set by the government. This timeframe can vary depending on your country or region. It’s crucial to understand the purchase dates that are eligible for the First-Time Homebuyer Tax Credit to ensure that your transaction falls within the designated timeframe.

3. Purchase Price Limits: Some jurisdictions impose limits on the purchase price of the home to qualify for the tax credit. These limits help ensure that the tax credit is directed towards individuals purchasing homes within certain price ranges. It’s important to verify the purchase price limits applicable in your area to determine if your intended home falls within the eligible range.

4. Financing: Generally, the home purchase must be financed through a qualified lender. Financing through a reputable lender ensures that the transaction is conducted in a legitimate manner and helps uphold the integrity of the tax credit program. Using an approved lender may be a requirement in order to claim the First-Time Homebuyer Tax Credit.

It’s crucial to familiarize yourself with the specific purchase requirements set forth by your country or region. Failure to meet these requirements may result in ineligibility for the First-Time Homebuyer Tax Credit. Make sure to consult with a tax professional or visit the official government website for accurate and up-to-date information on the purchase requirements applicable to your area.

By understanding and adhering to the purchase requirements, you can ensure that you meet the necessary criteria to qualify for the First-Time Homebuyer Tax Credit. This will enable you to take advantage of the tax credit and make homeownership more affordable and attainable.

Application Process

The application process for the First-Time Homebuyer Tax Credit may vary depending on the country or region in which you reside. It’s important to familiarize yourself with the specific steps and requirements outlined by your local government to ensure a smooth application process. Here are some common steps involved in applying for the tax credit:

1. Research and Gather Information: Start by researching the First-Time Homebuyer Tax Credit program offered in your area. Understand the eligibility criteria, income limits, purchase requirements, and any other relevant information. This will help you determine if you meet the necessary qualifications and are eligible to apply.

2. Fill Out the Application: Obtain the official application form from the appropriate government agency or download it from the official website. Carefully complete the application, ensuring that all required information is accurate and provided in the specified format. Review the form thoroughly to check for any errors or omissions.

3. Prepare Supporting Documentation: Gather the necessary documentation to support your application. This may include proof of identity, proof of citizenship or residency, income verification, purchase contract or agreement, and any other documents specified by the government. Ensure that all documents are valid, up-to-date, and meet the requirements specified by the government agency.

4. Submit the Application: Submit your completed application form and supporting documents to the designated government agency. Follow the instructions provided on the application form and ensure that you meet any applicable deadlines for submission. Consider sending the application via certified mail or using secure online submission methods if available.

5. Await Confirmation and Processing: After submitting your application, it may take some time for the government agency to process your application and verify your eligibility. Be patient and wait for their confirmation. If needed, you may follow up with the agency to inquire about the status of your application.

6. Seek Professional Advice: If you have any questions or concerns during the application process, consider seeking advice from a tax professional or contacting the government agency directly. They can provide guidance and address any inquiries you may have related to the First-Time Homebuyer Tax Credit.

7. Maintain Documentation: It’s important to keep copies of your application form, supporting documents, and any communication with the government agency. This will serve as a record of your application and provide proof of your eligibility if needed in the future.

By following these steps and ensuring that you meet all the requirements, you can navigate the application process for the First-Time Homebuyer Tax Credit smoothly. Remember to stay informed and seek assistance when needed to maximize your chances of receiving the tax credit and enjoying the financial benefits it provides.

Documentation Needed

When applying for the First-Time Homebuyer Tax Credit, you will be required to provide various documents to support your eligibility and verify your qualifications. These documents are essential in ensuring that you meet the necessary requirements and that your application is processed smoothly. Here are some common documents that may be needed:

1. Proof of Identity: You will likely need to provide a valid government-issued identification document, such as a driver’s license, passport, or social security card. This helps establish your identity and confirm that you are eligible for the tax credit.

2. Proof of Citizenship or Residency: Depending on the requirements of your country or region, you may need to provide documentation to prove your citizenship or legal residency status. This could include a birth certificate, naturalization certificate, or residency permit.

3. Income Verification: To determine your eligibility based on income limits, you will typically need to provide documentation of your income. This could include recent pay stubs, tax returns, W-2 forms, or other income-related documents. Make sure the documents accurately reflect your current income status.

4. Purchase Agreement or Contract: A copy of the purchase agreement or contract for the home you are buying will likely be required. This document verifies the details of the transaction, such as the purchase price and terms of the agreement.

5. Proof of First-Time Homebuyer Status: You may need to provide evidence of your first-time homebuyer status. This could include a statement or affidavit confirming that you have not owned a home within the specified timeframe, or any other documents requested by the government agency to prove your eligibility.

6. Other Supporting Documents: Depending on the specific requirements of the First-Time Homebuyer Tax Credit program in your area, additional documents may be needed. These could include bank statements, proof of funds for the down payment, homeowners insurance information, or any other documents relevant to your application.

It is essential to carefully review the documentation requirements provided by the government agency and ensure that you gather all the necessary documents. Keep in mind that the documents requested may vary based on your country or region, so it’s crucial to consult the official government website or seek advice from a tax professional for accurate and up-to-date information.

Organize your documents in a clear and orderly manner, keeping copies of everything for your records. This will help streamline the application process and ensure that you can provide all the necessary information to support your eligibility for the First-Time Homebuyer Tax Credit.

Claiming the Tax Credit

Once you have met all the eligibility requirements for the First-Time Homebuyer Tax Credit and have completed the application process, it is time to claim the tax credit. The steps to claim the tax credit may vary depending on the country or region you reside in. Here are some common considerations when claiming the tax credit:

1. Complete the Tax Forms: Typically, you will need to include the relevant tax forms to claim the First-Time Homebuyer Tax Credit when filing your annual tax return. The specific forms required may vary, but they often include Form 5405 or any other forms specified by the government agency.

2. Provide Documentation: Along with the tax forms, you may need to provide supporting documents that confirm your eligibility and verify the details of your home purchase. This could include copies of the purchase agreement, proof of first-time homebuyer status, and any other documents requested by the government agency.

3. Calculate the Tax Credit: Determine the amount of the tax credit you are eligible to claim. The tax credit is typically a percentage of the qualified home purchase price or a fixed amount specified by the government. Refer to the guidelines provided by the government agency or consult with a tax professional to accurately calculate the tax credit amount.

4. Follow Filing Instructions: Carefully follow the filing instructions provided by the government agency when completing your tax return. Include the relevant tax forms, attach any required documentation, and double-check for accuracy before submitting your tax return.

5. Review Deadlines: Be mindful of the deadlines for filing your tax return and claiming the First-Time Homebuyer Tax Credit. Missing the deadline may result in the loss of the opportunity to claim the tax credit for the given tax year. Stay informed about the specific deadlines applicable to your country or region.

6. Seek Professional Advice: If you are unsure about how to claim the tax credit or need assistance with the filing process, it is advisable to seek advice from a tax professional or consult with the government agency. They can provide guidance, answer any questions you may have, and ensure that you properly claim the tax credit.

Once you have followed these steps and successfully claimed the First-Time Homebuyer Tax Credit, you can expect to receive the tax credit as a reduction in your overall tax liability. The method of receiving the tax credit may vary depending on your country or region, such as a direct credit against your tax owed or a refund if the credit amount exceeds your tax liability.

Remember to keep copies of your tax return, supporting documentation, and any communication with the government agency as part of your records. This will help you maintain proper documentation and provide evidence of your claim if required in the future.

By understanding the process of claiming the tax credit and taking the necessary steps, you can maximize the benefit of the First-Time Homebuyer Tax Credit and alleviate some of the financial burden associated with purchasing your first home.

Deadline and Timeframe

Understanding the deadline and timeframe associated with the First-Time Homebuyer Tax Credit is crucial to ensure that you don’t miss out on this valuable opportunity. The specific dates and timelines may vary depending on the country or region, so it’s important to check the guidelines provided by the government agency. Here are some key considerations regarding the deadline and timeframe:

1. Application Deadline: The application deadline refers to the last date by which you must submit your application for the First-Time Homebuyer Tax Credit. This deadline is typically set by the government and may vary each year. It’s important to be aware of the application deadline to ensure that you submit your application on time.

2. Purchase Date Requirement: The purchase date requirement refers to the timeframe within which the home purchase must occur to be eligible for the tax credit. This time period is usually specified by the government agency and may vary depending on the country or region. It is important to confirm the specific purchase date requirement applicable to your area to ensure that your transaction falls within the eligible timeframe.

3. Tax Filing Deadline: In some cases, the deadline to claim the First-Time Homebuyer Tax Credit may coincide with the tax filing deadline for the given tax year. This means that you must include the relevant tax forms and claim the tax credit by the tax filing deadline. It’s crucial to stay informed about the specific tax filing deadline and adhere to it to avoid missing out on the tax credit.

4. Timeframe for Processing: Once you have submitted your application and claimed the tax credit, there may be a timeframe for the government agency to process your application. This time frame can vary, and it’s important to be patient and allow sufficient time for processing. If needed, you can follow up with the agency to inquire about the status of your application and any estimated timelines for processing.

To ensure that you meet the deadlines and timeframes associated with the First-Time Homebuyer Tax Credit, it is advisable to start the application process well in advance. Research and gather the required documentation early, complete the necessary paperwork accurately, and submit your application in a timely manner. Being mindful of the deadlines and timeframes will help ensure that you maximize your chances of receiving the tax credit and enjoy the financial benefits it offers.

Remember that missing the deadlines or failing to meet the specified timeframes may result in the loss of the opportunity to claim the tax credit for the given tax year. Stay informed, be proactive, and consult with the government agency or a tax professional to clarify any uncertainties and ensure that you meet all the necessary requirements within the designated timeframe.

Potential Tax Credit Amount

The potential tax credit amount for the First-Time Homebuyer Tax Credit can vary depending on the country or region in which you reside. The specific calculation method and maximum amount of the tax credit may differ, so it’s crucial to review the guidelines provided by the government agency. Here are some key factors to consider when determining the potential tax credit amount:

1. Percentage or Fixed Amount: The tax credit may be calculated as a percentage of the qualified home purchase price or as a fixed amount determined by the government. The percentage or fixed amount can vary depending on the country or region. Check with the government agency to understand the specific calculation method used in your area.

2. Maximum Tax Credit: There is often a maximum limit on the tax credit amount that can be claimed. This maximum cap is set by the government and can vary based on factors such as the cost of living, regional housing market conditions, and government policies. It’s important to check the guidelines to determine the maximum tax credit amount applicable to you.

3. Purchase Price Limit: Some jurisdictions impose purchase price limits on homes eligible for the tax credit. These limits ensure that the tax credit is primarily directed towards individuals purchasing homes within a certain price range. Verify the purchase price limits applicable to your area to determine if your home qualifies for the tax credit.

4. Income-Related Adjustments: In certain instances, the tax credit amount may be adjusted based on your income level. Higher income individuals may receive a lower tax credit amount or may not qualify for the tax credit at all. It’s important to understand the income-related adjustments to accurately estimate your potential tax credit amount.

5. Regional Variances: Keep in mind that the potential tax credit amount can vary between different regions within the same country. Factors such as local government policies, regional housing market conditions, and cost of living can influence the tax credit amount. Check the guidelines specific to your region for accurate information.

Consult with a tax professional or visit the official government website to calculate the potential tax credit amount you may be eligible for. They can assist you in understanding the specific calculations and provide accurate estimates based on your individual circumstances.

Remember that the potential tax credit amount is subject to change each year or based on government policy updates. Stay informed about any changes to the tax credit program to ensure that you have the most accurate information when estimating your potential tax credit amount.

By understanding the factors that influence the potential tax credit amount, you can make informed decisions and take advantage of the financial benefits offered by the First-Time Homebuyer Tax Credit.

Repaying the Tax Credit

Repaying the First-Time Homebuyer Tax Credit is a crucial consideration to understand when taking advantage of this incentive. While the specific repayment requirements can vary based on the country or region you reside in, it’s important to review the guidelines provided by the government agency. Here are some key points to know about repaying the tax credit:

1. Repayment Terms: In some cases, the First-Time Homebuyer Tax Credit may need to be repaid over a certain period of time. This repayment requirement is typically triggered if you sell the home or no longer use it as your primary residence within a specified timeframe after purchasing it. Consult the guidelines or speak with a tax professional to understand the specific repayment terms applicable to your situation.

2. Repayment Schedule: If you are required to repay the tax credit, you will typically need to do so according to a specified repayment schedule. The repayment schedule may vary depending on the rules set by the government agency. It’s crucial to adhere to the repayment schedule to avoid any penalties or interest charges.

3. Exceptions and Reliefs: Depending on the circumstances, there may be exceptions or relief provisions that can reduce or eliminate the repayment requirement. For example, if you sell the home to a qualified buyer, experience financial hardship, or face other qualifying circumstances, you may be eligible for relief from repayment. It’s important to review the guidelines or consult with a tax professional to determine if any exceptions or reliefs apply to your situation.

4. Reporting Repayments: If you are required to repay the tax credit, you will need to report the repayments when filing your annual tax return. The specific forms and reporting instructions may differ based on the government agency’s requirements. Ensure that you accurately report the repayments and follow the guidelines provided for reporting purposes.

5. Seek Professional Advice: Repaying the First-Time Homebuyer Tax Credit can be complex, with different rules and scenarios depending on your situation. If you have questions or concerns about the repayment requirements, it is advisable to consult with a tax professional or reach out to the government agency for guidance. They can provide tailored advice based on your specific circumstances.

Understanding the repayment terms and requirements is crucial to avoid any unforeseen financial obligations in the future. By familiarizing yourself with the guidelines and seeking professional advice, you can ensure that you fulfill the repayment obligations and remain in compliance with the tax credit program.

It’s important to note that the repayment provisions may change over time, so it’s advisable to stay updated with any updates or amendments to the First-Time Homebuyer Tax Credit program to ensure you have the most accurate information regarding repayment requirements.

By being aware of the repayment obligations associated with the tax credit, you can make informed decisions and plan your financial obligations accordingly when utilizing this incentive to purchase your first home.

Frequently Asked Questions

Here are some common questions and answers related to the First-Time Homebuyer Tax Credit:

1. Can I qualify for the tax credit if I am not a first-time homebuyer?

No, the First-Time Homebuyer Tax Credit is specifically designed for individuals purchasing their first home. If you have previously owned a home within the defined time frame, you may not be eligible for the tax credit.

2. What is the difference between a tax credit and a tax deduction?

A tax credit directly reduces the amount of tax you owe, while a tax deduction reduces your taxable income. The First-Time Homebuyer Tax Credit is a tax credit that can provide more substantial financial benefits compared to a tax deduction.

3. Are there income limits to qualify for the tax credit?

Yes, many jurisdictions impose income limits to ensure that the tax credit is primarily available to individuals with lower to moderate income levels. These income limits may vary depending on your household size and the cost of living in your area. It’s important to check the specific income limits applicable to your region.

4. Can I claim the tax credit for any type of home?

The tax credit is typically available for the purchase of a primary residence. This includes single-family homes, townhouses, condominiums, or cooperative apartments. However, it is generally not available for investment properties or vacation homes. Verify the requirements for your specific region.

5. Is the tax credit refundable?

The First-Time Homebuyer Tax Credit is typically a non-refundable tax credit, which means that it can reduce the amount of tax you owe but will not provide a refund if the credit amount exceeds your tax liability.

6. What happens if I sell the home before the repayment period ends?

If you sell the home or no longer use it as your primary residence within the specified timeframe after purchasing it, you may be required to repay the tax credit. The specific repayment terms and exceptions differ based on the rules set by the government agency. Review the guidelines or consult with a tax professional for accurate information.

7. How do I claim the tax credit on my tax return?

To claim the First-Time Homebuyer Tax Credit, you will typically need to include the relevant tax forms, such as Form 5405, when filing your annual tax return. Attach any required documentation and accurately report the details of your home purchase to claim the tax credit.

8. Can I receive other government incentives along with the First-Time Homebuyer Tax Credit?

Yes, it is possible to combine the First-Time Homebuyer Tax Credit with other government incentives or programs, such as down payment assistance or homebuyer assistance programs. However, eligibility requirements for each program may vary, so it’s important to understand the specific guidelines of each incentive you plan to utilize.

Remember, these are general answers to frequently asked questions. The specific details and requirements may vary depending on your country or region. It is advisable to consult with a tax professional or visit the official government website for accurate and up-to-date information related to the First-Time Homebuyer Tax Credit in your area.

Conclusion

The First-Time Homebuyer Tax Credit is a valuable incentive designed to support individuals in purchasing their first home. By understanding the eligibility requirements, income limits, purchase requirements, and application process, you can take advantage of this tax credit and make homeownership more affordable and attainable.

Research the specific guidelines and requirements set by your country or region to ensure that you meet all the necessary qualifications. Familiarize yourself with the potential tax credit amount and any repayment obligations that may apply in the future. Seek advice from a tax professional or government agency to address any questions or concerns you have during the process.

By utilizing the First-Time Homebuyer Tax Credit, you can significantly reduce the financial burden associated with buying a home. This tax credit can ease your financial journey toward homeownership and provide a valuable opportunity to invest in your own property.

Remember to stay informed about any updates or changes to the tax credit program and its requirements. Adhering to the deadlines, maintaining accurate documentation, and complying with the repayment terms, if applicable, will help ensure a smooth and successful experience in claiming the tax credit.

The path to homeownership can be both exciting and challenging. The First-Time Homebuyer Tax Credit aims to alleviate some of the financial stress and make your dream of owning a home a reality. Seize this opportunity, take the necessary steps, and leverage the benefits offered by this tax incentive to embark on your journey to homeownership with confidence.