Finance

How To Improve Credit With Secured Card

Published: March 1, 2024

Learn how to boost your credit score with a secured card. Discover effective finance strategies to improve your financial standing. Unlock the power of secured cards today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit building, where financial empowerment begins with a strategic approach to managing your credit score. In this comprehensive guide, we will explore the transformative potential of secured credit cards in elevating your creditworthiness and opening doors to better financial opportunities. Whether you’re a young adult taking the first steps toward establishing credit or someone rebounding from past financial challenges, understanding the nuances of secured credit cards is a crucial aspect of your journey toward financial stability.

Many individuals find themselves in a Catch-22 situation when attempting to build or rebuild their credit. Without a solid credit history, it can be challenging to qualify for traditional credit cards or loans. However, without access to these financial tools, it becomes difficult to establish or improve one’s credit history. This is where secured credit cards enter the picture as a viable solution, providing a pathway to build or rebuild credit in a controlled and manageable manner.

Throughout this guide, we will delve into the intricacies of secured credit cards, exploring how they function, their role in credit improvement, and the best practices for utilizing them to maximize their benefits. By the end of this journey, you will be equipped with the knowledge and confidence to leverage secured credit cards as a powerful tool for enhancing your credit profile and achieving your long-term financial goals.

Understanding Secured Credit Cards

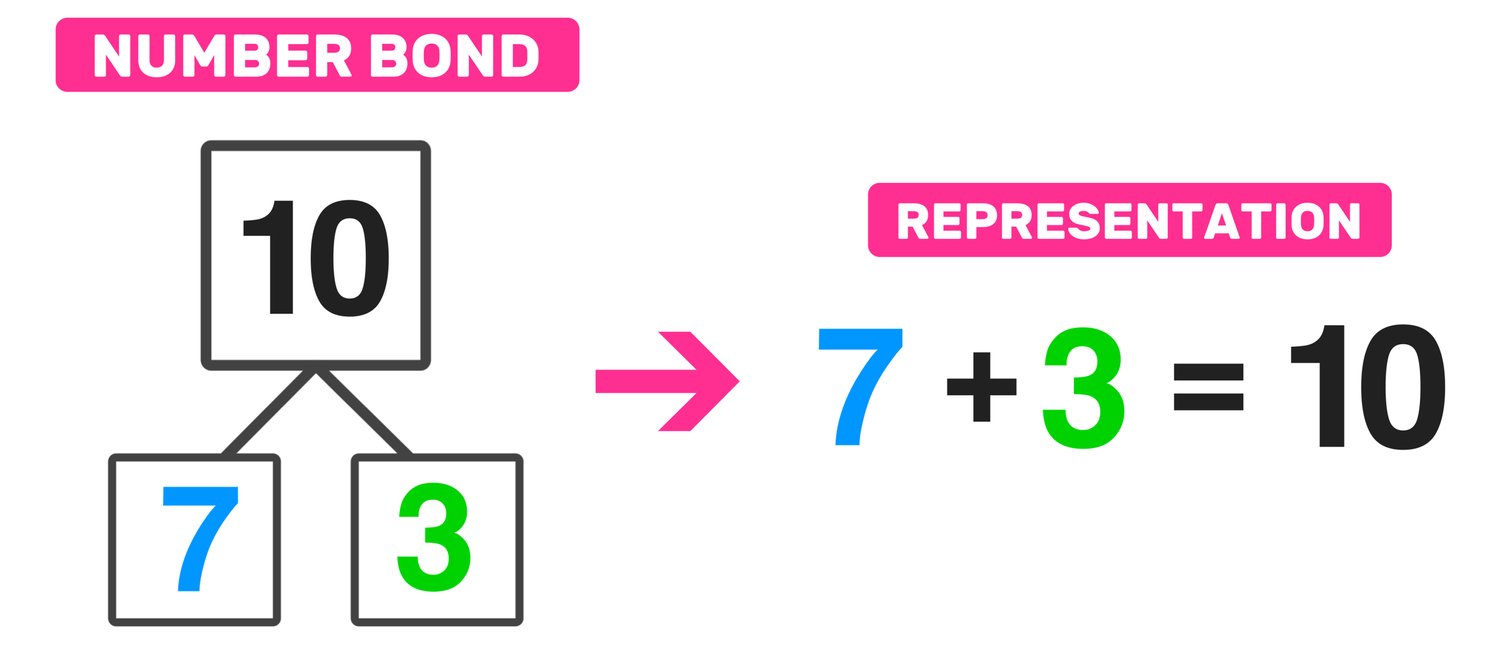

Secured credit cards are a unique financial product designed to provide individuals with limited or damaged credit histories an opportunity to access credit. Unlike traditional unsecured credit cards, secured cards require a security deposit, which serves as collateral and mitigates the risk for the card issuer. This deposit also determines the cardholder’s credit limit, typically matching the deposited amount. Essentially, secured credit cards offer a controlled means for individuals to demonstrate responsible credit usage and build a positive credit history.

It’s important to note that while secured credit cards function similarly to traditional credit cards, they are distinct in their underlying mechanics. The security deposit acts as a safety net for the card issuer, reducing the likelihood of default and allowing individuals with limited or poor credit to access credit on a secured basis. This unique structure provides a valuable entry point for those looking to establish or rehabilitate their credit standing.

Secured credit cards are not to be confused with prepaid debit cards, as the former directly impact the cardholder’s credit history and score. As the cardholder makes timely payments and exhibits responsible credit behavior, the positive activity is reported to the major credit bureaus, thereby contributing to the individual’s credit profile. This reporting aspect is a pivotal feature that distinguishes secured credit cards from other forms of payment cards.

Furthermore, secured credit cards are widely accepted by merchants and can be used for various transactions, just like traditional credit cards. This universality allows cardholders to experience the convenience and flexibility associated with credit card usage, while simultaneously working to improve their creditworthiness.

By understanding the fundamental principles of secured credit cards, individuals can make informed decisions about how to leverage this financial tool to their advantage. In the following sections, we will explore the specific ways in which secured cards can serve as a catalyst for credit improvement and financial empowerment.

How Secured Cards Can Improve Credit

Secured credit cards play a pivotal role in the journey toward credit improvement and financial stability. By utilizing a secured card responsibly, individuals can demonstrate their creditworthiness and establish a positive credit history. One of the primary mechanisms through which secured cards contribute to credit improvement is by providing a platform for responsible credit utilization.

When a cardholder consistently makes on-time payments and maintains a low credit utilization ratio— the amount of available credit used— they showcase financial discipline and reliability to potential lenders and creditors. This positive behavior is reported to the credit bureaus, contributing to the gradual enhancement of the individual’s credit score. Over time, this can lead to expanded access to more favorable credit products and terms.

Moreover, the responsible use of a secured credit card can aid in building a healthy credit mix, which is a key factor in determining one’s credit score. By responsibly managing a combination of installment loans, such as a car loan, and revolving credit, like a secured credit card, individuals can demonstrate their ability to handle different types of credit, thereby bolstering their creditworthiness.

Another critical aspect of secured cards in credit improvement is their potential to create a positive credit history for individuals with limited or damaged credit. As the cardholder continues to exhibit responsible credit behavior, the credit bureaus receive ongoing updates that reflect this positive activity. This gradual accumulation of positive data contributes to the overall strengthening of the individual’s credit profile, positioning them for future financial opportunities.

Furthermore, the disciplined use of a secured credit card can instill valuable financial habits, such as budgeting, tracking expenses, and managing cash flow. These skills are instrumental in fostering long-term financial wellness and can have a lasting impact on an individual’s overall financial health.

By understanding the mechanisms through which secured cards can bolster credit, individuals can harness the transformative power of these financial tools to pave the way for a brighter financial future. In the subsequent sections, we will delve into the considerations for choosing the right secured card and the best practices for using it responsibly to maximize its benefits.

Choosing the Right Secured Card

When embarking on the journey to improve credit with a secured card, selecting the right card is a crucial first step. With a myriad of secured card options available in the market, it’s essential to consider several key factors to ensure that the chosen card aligns with your financial goals and sets the stage for credit enhancement.

One of the primary considerations when choosing a secured card is the issuer’s reporting practices to the major credit bureaus. It’s imperative to select a card that consistently reports cardholder activity to all three bureaus—Equifax, Experian, and TransUnion. This comprehensive reporting ensures that your responsible credit usage is duly reflected across the spectrum of credit reports, maximizing the impact on your credit score.

Additionally, evaluating the fees associated with the secured card is essential. While it’s common for secured cards to carry annual fees and processing fees, opting for a card with reasonable fees is prudent. Some secured cards offer the possibility of transitioning to an unsecured card after a period of responsible card usage, presenting an opportunity to recoup the initial deposit and potentially upgrade to a card with more favorable terms in the future.

The deposit requirement and credit limit offered by the secured card issuer are also pivotal factors to consider. Different issuers may have varying minimum and maximum deposit requirements, and the credit limit extended is typically equivalent to the deposited amount. It’s important to assess these parameters in relation to your budget and credit utilization needs, ensuring that the secured card aligns with your financial circumstances.

Furthermore, some secured cards may feature additional perks, such as cashback rewards or credit education resources, which can augment the overall value proposition of the card. While these perks should not be the sole basis for selecting a secured card, they can certainly influence the decision when comparing similar options.

Lastly, reviewing the terms and conditions of the secured card, including the annual percentage rate (APR) and any potential penalty fees, is crucial in making an informed decision. Understanding the cost of carrying a balance and the consequences of late payments or exceeding the credit limit empowers individuals to use the secured card judiciously and avoid unnecessary financial strain.

By carefully evaluating these factors and conducting thorough research, individuals can identify a secured card that not only facilitates credit improvement but also aligns with their financial objectives and sets the stage for long-term financial success.

Using a Secured Card Responsibly

Responsibly managing a secured credit card is instrumental in leveraging its potential to improve credit and foster financial stability. By adhering to best practices and exercising discipline in card usage, individuals can maximize the positive impact of their secured card on their credit profile.

One of the fundamental principles of responsible secured card usage is making timely payments. Ensuring that the monthly payments are made in full and by the due date demonstrates reliability and financial discipline to creditors and is a key factor in building a positive credit history. Setting up automatic payments or calendar reminders can be effective strategies to avoid missed payments.

It’s also crucial to maintain a low credit utilization ratio, ideally below 30% of the available credit limit. Keeping credit utilization in check showcases prudent financial management and can contribute to a positive credit score. Individuals can achieve this by strategically using the secured card for essential purchases and promptly paying off the balances to avoid carrying debt from month to month.

Regularly reviewing the account activity and monitoring spending patterns is another aspect of responsible secured card usage. By staying vigilant for any unauthorized charges and proactively managing expenses, individuals can maintain control over their financial obligations and prevent potential issues that could impact their credit standing.

Additionally, refraining from applying for multiple credit products simultaneously and exercising restraint in acquiring new debt is essential. Each credit inquiry generates a hard inquiry on the credit report, which can temporarily lower the credit score. By being selective and deliberate in pursuing new credit, individuals can mitigate the potential negative impact on their credit profile.

Furthermore, individuals should aim to keep their secured card account open for an extended period, as the length of credit history is a significant factor in determining creditworthiness. Closing the account prematurely can diminish the positive history associated with the card and may affect the average age of credit accounts, potentially impacting the credit score.

By embracing these principles of responsible secured card usage, individuals can harness the full potential of this financial tool in fortifying their creditworthiness and setting the stage for broader financial opportunities. In the subsequent section, we will explore the importance of monitoring one’s credit score and the strategies for achieving success in the credit improvement journey.

Monitoring Your Credit Score

Regularly monitoring your credit score is a crucial aspect of managing your financial health and maximizing the benefits of utilizing a secured credit card. By staying informed about your credit standing, you can track the impact of your financial decisions, identify areas for improvement, and detect any inaccuracies or potential signs of identity theft.

There are several avenues through which individuals can access their credit scores and reports. Many financial institutions offer complimentary access to credit scores, enabling cardholders to stay updated on their credit standing. Additionally, numerous online platforms provide free credit score monitoring services, empowering individuals to track their credit progress and receive alerts about significant changes.

Regularly reviewing your credit report allows you to identify any errors or discrepancies that could be negatively impacting your credit score. Addressing inaccuracies promptly with the credit bureaus can help rectify these issues and prevent unwarranted damage to your credit standing.

Monitoring your credit score also provides insight into the effectiveness of your credit improvement efforts. As you utilize your secured card responsibly and exhibit positive credit behavior, you can observe the gradual impact on your credit score. This visibility can serve as a motivating factor and reinforce the value of prudent financial management.

Furthermore, staying attuned to your credit score facilitates proactive identification of areas for enhancement. Whether it’s reducing credit card balances, diversifying credit types, or addressing any past delinquencies, the visibility into your credit profile empowers you to take targeted actions to fortify your creditworthiness.

Additionally, regular credit monitoring enables individuals to detect any unauthorized activity or signs of identity theft. By promptly identifying and addressing any irregularities, individuals can prevent potential damage to their credit standing and mitigate the impact of fraudulent activity.

By integrating credit score monitoring into your financial routine, you can maintain a clear understanding of your credit standing, track the progress of your credit improvement journey, and proactively address any issues that may arise. In the following section, we will explore actionable tips for success in leveraging a secured credit card to enhance your credit profile and achieve financial empowerment.

Tips for Success

Embarking on the path to credit improvement with a secured credit card requires a strategic approach and commitment to sound financial practices. By incorporating the following tips into your credit-building journey, you can maximize the effectiveness of your secured card and pave the way for long-term financial success.

- Utilize the Secured Card Sparingly: While it’s important to use your secured card regularly to demonstrate responsible credit usage, it’s equally crucial to avoid excessive spending. Focus on essential purchases and aim to keep your credit utilization low to showcase prudent financial management.

- Make Timely Payments: Consistently making on-time payments is a cornerstone of credit improvement. Setting up automatic payments or reminders can help ensure that you fulfill your financial obligations punctually, reinforcing your reliability to creditors.

- Monitor Your Credit Score: Regularly tracking your credit score and reviewing your credit report allows you to stay informed about your credit standing, identify areas for improvement, and address any inaccuracies that may arise.

- Strategically Manage Credit Inquiries: Avoid applying for multiple credit products within a short timeframe, as each application generates a hard inquiry on your credit report. Be selective and deliberate in pursuing new credit to minimize the impact on your credit score.

- Exercise Patience and Persistence: Building or rebuilding credit is a gradual process that requires patience and perseverance. By consistently exhibiting responsible credit behavior, you can steadily enhance your creditworthiness over time.

- Explore Transition Opportunities: Some secured card issuers offer the possibility of transitioning to an unsecured card after a period of responsible card usage. Investigate the prospects for upgrading to a card with more favorable terms and potential rewards.

- Embrace Financial Education: Take advantage of resources and tools offered by the secured card issuer to enhance your financial literacy. Understanding key concepts such as credit utilization, credit scores, and budgeting can empower you to make informed financial decisions.

- Practice Discipline and Budgeting: Cultivate disciplined financial habits, such as budgeting, tracking expenses, and living within your means. These fundamental skills are instrumental in sustaining long-term financial wellness.

By integrating these tips into your approach to utilizing a secured credit card, you can navigate the path to credit improvement with confidence and purpose. These strategies lay the groundwork for not only enhancing your credit profile but also fostering enduring financial empowerment and stability.

Conclusion

In the realm of credit building and financial empowerment, secured credit cards serve as a valuable tool for individuals seeking to establish or rehabilitate their credit histories. By understanding the fundamental principles of secured cards and embracing best practices for their responsible usage, individuals can embark on a transformative journey toward enhanced creditworthiness and broader financial opportunities.

Throughout this guide, we’ve explored the intricate dynamics of secured credit cards, delving into their role in credit improvement and the strategies for leveraging them effectively. From the foundational understanding of secured cards to the actionable tips for success, we’ve navigated the landscape of credit enhancement with a focus on informed decision-making and prudent financial management.

It’s essential to recognize that the journey to credit improvement with a secured card requires patience, discipline, and a commitment to sound financial practices. By utilizing the secured card responsibly, monitoring your credit score, and embracing financial education, you can position yourself for enduring financial success and stability.

As you embark on this journey, remember that credit improvement is a gradual process that rewards perseverance and responsible financial behavior. Each step taken toward prudent credit management contributes to the strengthening of your credit profile and opens doors to a brighter financial future.

Ultimately, the utilization of a secured credit card as a catalyst for credit improvement represents a proactive investment in your financial well-being. By integrating the insights and strategies presented in this guide, you can navigate the path to credit enhancement with confidence and purpose, setting the stage for lasting financial empowerment and security.

Armed with knowledge, perseverance, and a commitment to financial wellness, you are poised to harness the transformative potential of secured credit cards and chart a course toward a robust and resilient credit profile.