Finance

How To Send Credit Card Info Securely

Published: October 25, 2023

Learn how to securely send credit card info in the finance industry. Protect your sensitive data with these expert tips and best practices.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our guide on how to send credit card information securely. In today’s digital age, protecting sensitive financial information is of utmost importance. With the rise of online transactions and e-commerce, it is crucial to ensure that credit card details are transmitted safely and securely. In this article, we will explore the risks associated with transmitting credit card information, discuss secure methods for sending such data, and provide best practices to help you keep your financial information safe.

While the convenience of online shopping and digital payments has revolutionized the way we make purchases, it has also opened the door to potential risks and vulnerabilities. Cybercriminals are constantly on the lookout for opportunities to intercept and misuse credit card information. That’s why it is essential to understand the risks involved and take appropriate measures to protect your confidential data.

When it comes to transmitting credit card details, it is important to choose a method that offers a high level of security. This could include utilizing encryption techniques, secure file transfer methods, or even leveraging the security features of trusted payment gateways. By following these best practices, you can minimize the risk of data breaches and unauthorized access to your sensitive information.

In the following sections, we will delve deeper into the various methods and strategies you can employ to send credit card information securely. Remember, staying informed and implementing proactive security measures is key to safeguarding your financial well-being in the digital realm.

Understanding the Risks

Before diving into the methods of securely sending credit card information, it is crucial to understand the risks associated with its transmission. Whether you are a business owner collecting payments or an individual making online purchases, your credit card details are susceptible to various threats.

One of the primary risks is the interception of data during transmission. Traditional email services and standard file transfer methods are not encrypted, making them vulnerable to eavesdropping by malicious actors. Hackers can intercept unsecured credit card information and use it for fraudulent transactions or identity theft. Therefore, it is essential to choose secure methods that protect your data from prying eyes.

Data breaches are another major concern. Businesses that store customer payment information may become targets of cyberattacks. If a breach occurs and credit card information is compromised, it can have severe consequences for both the business and the affected individuals. This can lead to financial losses, damage to reputation, and potential legal repercussions.

Phishing attacks pose yet another risk to credit card security. Fraudsters often send deceptive emails or create fake websites designed to trick users into providing their credit card details. It is important to be vigilant and verify the authenticity of any communication or website before entering your sensitive information.

Moreover, mobile payment transactions have their own set of risks. If your mobile device is compromised or lost, unauthorized access to your credit card information becomes a potential threat. It is crucial to prioritize the security of your mobile payment apps and devices, keeping them updated and protected with strong passwords or biometric authentication.

By understanding these risks, you can make informed decisions about how to protect your credit card information during transmission. In the next section, we will explore secure methods for sending credit card information to minimize these risks and ensure the safety of your financial data.

Choosing a Secure Method

When it comes to transmitting credit card information securely, choosing the right method is crucial. Here are some options to consider:

- Secure Payment Gateways: Trusted online payment gateways, such as PayPal or Stripe, offer a secure and encrypted platform for processing credit card transactions. These services handle the transmission of information securely, reducing the risk of unauthorized access. When making online purchases, look for websites that utilize reputable payment gateways to ensure the safety of your credit card details.

- Encrypted Email: If you need to send credit card information via email, it is essential to use encryption. There are email services and plugins available that can encrypt your messages, such as ProtonMail or Virtru. Encrypting the email ensures that only the intended recipient can access the information, making it harder for hackers to intercept or read your credit card details.

- Secure File Transfer Protocol (SFTP): SFTP is a secure method for transferring files over the internet. It uses encryption to protect the data in transit, ensuring that credit card information remains confidential. If you need to send credit card details as a file attachment, consider using SFTP instead of traditional file transfer methods like FTP, which lack built-in security measures.

- Virtual Private Network (VPN): A VPN creates a secure, encrypted connection between your device and the internet. Using a VPN while transmitting credit card information adds an extra layer of protection by encrypting your data and masking your IP address. It ensures that your online activities, including credit card transactions, are shielded from potential hackers or eavesdroppers on public or unsecured networks.

- Secure Online Forms: Many websites offer secure online forms for collecting credit card information. These forms utilize encryption technology, usually indicated by the presence of an “https” URL and a padlock icon in the browser address bar. When submitting credit card details, always look for such secure forms to mitigate the risk of data interception.

By carefully considering these secure methods, you can reduce the risk of unauthorized access to your credit card information and ensure its safe transmission. In the next section, we will explore the importance of encrypting credit card information and how it adds an additional layer of security.

Encrypting Credit Card Information

Encrypting credit card information is a crucial step in enhancing the security of your sensitive financial data. Encryption is the process of encoding information in such a way that it can only be accessed or understood by authorized parties.

When it comes to credit card information, encryption ensures that even if the data is intercepted during transmission, it appears as a jumble of meaningless characters to anyone without the decryption key. This significantly reduces the risk of unauthorized access and protects your credit card details from prying eyes.

There are two main types of encryption commonly used to protect credit card information:

- Transport Layer Security (TLS): TLS is a cryptographic protocol that encrypts data during transmission over the internet. It creates a secure, encrypted connection between the user’s device and the receiving server, ensuring that any credit card information entered on a website is secure. Websites that utilize TLS will display a padlock icon in the browser’s address bar, indicating a secure connection.

- End-to-End Encryption: End-to-end encryption is a method where data is encrypted at the sender’s end and can only be decrypted by the intended recipient. This means that even the service provider facilitating the transmission does not have access to the decrypted data. Services like messaging apps, file transfer platforms, and secure email providers often employ end-to-end encryption to protect sensitive information, including credit card details.

When sending credit card information, it is essential to ensure that the chosen method incorporates encryption to safeguard the data. This provides an additional layer of security and protects against unauthorized access or interception by hackers.

It’s worth noting that encryption alone is not sufficient to guarantee the security of credit card information. It should be used in conjunction with other secure methods, such as the ones discussed earlier, for a comprehensive approach to protecting sensitive financial data.

In the next section, we will explore different secure file transfer methods that can be used to transmit credit card information securely.

Secure File Transfer Methods

When it comes to transmitting credit card information securely as a file attachment, utilizing secure file transfer methods is crucial. Here are some options to consider:

- SFTP (Secure File Transfer Protocol): SFTP is a secure method for transferring files over the internet. It uses encryption to protect the data in transit, ensuring that credit card information remains confidential. SFTP provides a higher level of security compared to traditional FTP (File Transfer Protocol), which lacks built-in encryption. To use SFTP, you will need an SFTP client and access to an SFTP server.

- Secure Cloud Storage: Cloud storage services such as Dropbox, Google Drive, or OneDrive offer secure file storage and sharing options. These platforms employ encryption to protect the files stored on their servers. By uploading your credit card information to a secure cloud storage account and sharing it with the intended recipient, you can ensure that the data remains protected during the transfer process.

- Encrypted File Compression: If you need to send multiple files or a folder containing credit card information, compressing them into an encrypted archive file can add an extra layer of security. Tools like WinZip or 7-Zip offer the ability to encrypt files and folders with a password. Make sure to choose a strong password and securely share it with the recipient separately.

- Virtual Data Rooms (VDRs): VDRs are secure online platforms designed for sharing and collaborating on sensitive documents. They provide advanced security features such as encryption, user access controls, and activity tracking. VDRs are commonly used in professional environments where the exchange of highly sensitive information, including credit card details, is required.

- Secure File Transfer Services: There are specialized secure file transfer services available that prioritize data security. These services offer end-to-end encryption, secure access controls, and features like automatic expiration of files after a specified period. Examples include Tresorit, ShareFile, and Egnyte. These services ensure that credit card information remains protected throughout the transfer process.

By utilizing these secure file transfer methods, you can significantly reduce the risk of unauthorized access to credit card information during transmission. Remember to choose the method that best suits your needs and aligns with your security requirements.

In the next section, we will discuss the use of secure payment gateways, which provide an additional layer of protection when transmitting credit card information for online transactions.

Using Secure Payment Gateways

Secure payment gateways play a critical role in ensuring the security of credit card information during online transactions. These gateways act as intermediaries between customers, merchants, and financial institutions, facilitating the secure transfer of payment data. Here’s why using secure payment gateways is essential:

Encryption: Secure payment gateways utilize encryption technology to protect credit card details. When a customer enters their credit card information on a website, the data is encrypted before being transmitted to the payment gateway for processing. This encryption ensures that the sensitive information remains secure and inaccessible to unauthorized parties.

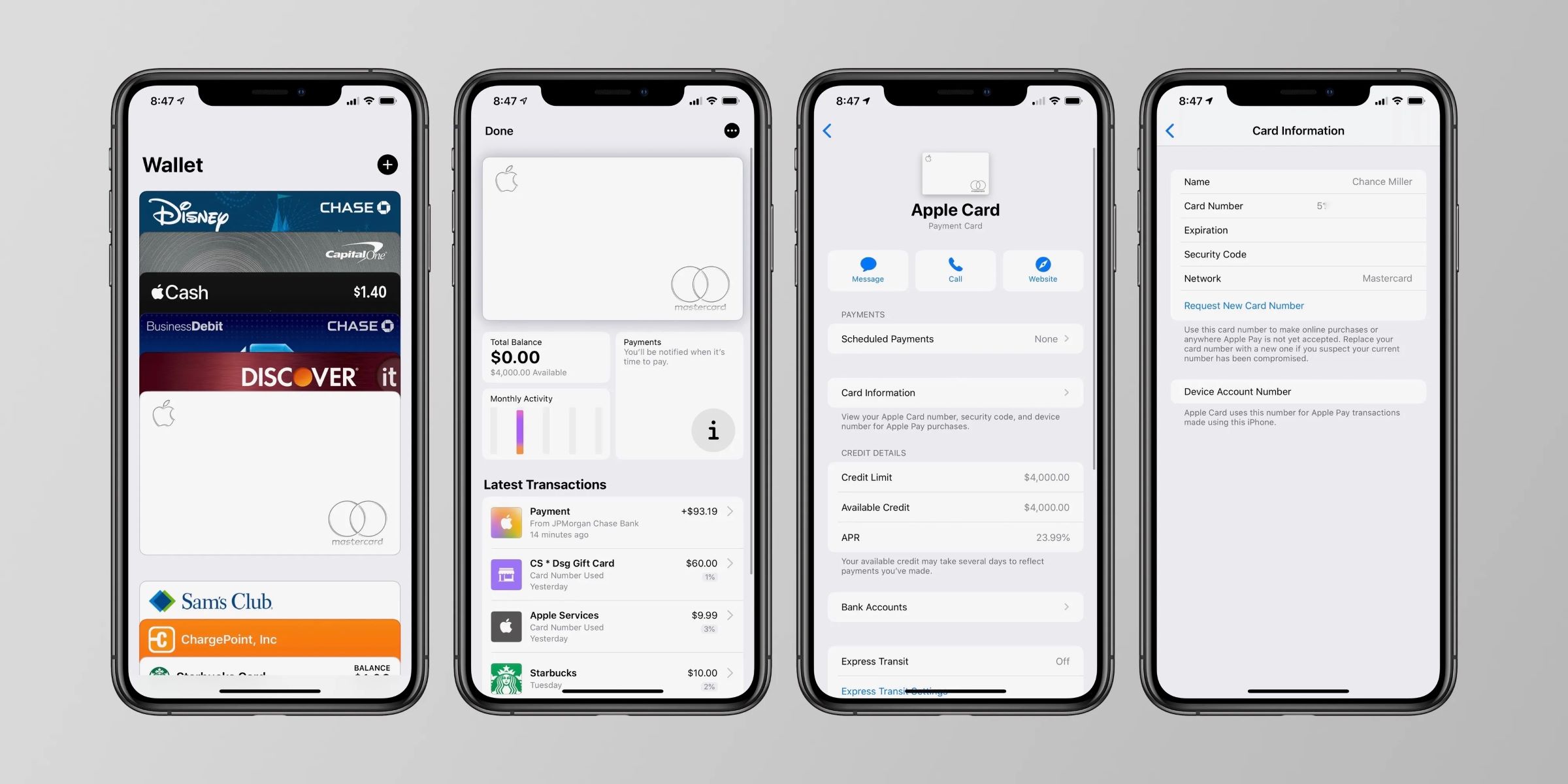

Tokenization: Many secure payment gateways employ tokenization to enhance security. Instead of storing actual credit card information, the payment gateway generates a unique token that represents the card details. This token is used for future transactions, reducing the risk of data breaches as sensitive card information is not stored on the merchant’s servers.

PCI DSS Compliance: Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to protect credit card information. Secure payment gateways adhere to these industry best practices to ensure the highest level of security. Compliance with PCI DSS standards helps mitigate the risk of data breaches and ensures the secure handling of credit card data.

Fraud Detection and Prevention: Secure payment gateways have built-in fraud detection and prevention measures to identify and block suspicious transactions. They employ advanced algorithms and machine learning techniques to analyze patterns and detect potential fraudulent activities, providing an added layer of protection for both the merchant and the customer.

When making online purchases, look for websites that offer secure payment gateways. These can be recognized by logos or badges displaying the names of trusted payment gateway providers, such as PayPal, Stripe, or Braintree. Verifying the authenticity of the payment gateway and ensuring that it is PCI DSS compliant are important factors in safeguarding credit card information.

By utilizing secure payment gateways, you can have peace of mind knowing that your credit card information is being handled with the utmost care and security during online transactions.

In the next section, we will explore the importance of mobile payment security and the measures you can take to protect your credit card information while using mobile payment apps.

Mobile Payment Security

In recent years, mobile payment methods have gained immense popularity, offering convenience and flexibility for making payments. However, it is crucial to prioritize mobile payment security to protect your credit card information. Here are some important considerations:

Secure Apps: Ensure that the mobile payment app you use is from a trusted source, such as an official app store. Stick to well-established payment apps with a strong reputation for security. These apps often incorporate encryption technology and other security measures to protect your credit card information.

Device Security: Keep your mobile device secure by enabling a passcode, fingerprint or facial recognition, and regular software updates. These measures help prevent unauthorized access to your device and the sensitive information stored on it, including credit card details.

Two-Factor Authentication: Enable two-factor authentication (2FA) for your mobile payment apps whenever possible. 2FA adds an extra layer of security by requiring a secondary form of verification, such as a one-time password sent to your mobile device, in addition to your usual login credentials.

Secure Wi-Fi Networks: Avoid making mobile payments over public, unsecured Wi-Fi networks, as these are often prone to interception by hackers. Stick to using trusted networks that require passwords and are encrypted. If you must use public Wi-Fi, consider using a virtual private network (VPN) to encrypt your connection and protect your data.

Enable Remote Lock and Wipe: In case your mobile device is lost or stolen, enable features like remote lock and wipe. This allows you to remotely lock or erase the data from your device to prevent unauthorized access to your credit card information.

Regularly Monitor Transactions: Keep a close eye on your transaction history and credit card statements. If you notice any suspicious activity, notify your card issuer immediately. Promptly reporting any unauthorized transactions can help mitigate any potential financial losses.

By following these mobile payment security practices, you can ensure that your credit card information remains protected while using mobile payment apps. It is crucial to strike a balance between convenience and security to safeguard your financial well-being.

Now that we have explored mobile payment security, let’s move on to discussing best practices for sending credit card information securely in any context.

Best Practices for Sending Credit Card Information

When it comes to sending credit card information securely, following best practices is essential to protect your sensitive financial data. Here are some key practices to keep in mind:

- Minimize Data Collection: Only collect and share the credit card information that is absolutely necessary. Avoid storing credit card details for longer than needed, and securely dispose of any unnecessary information.

- Utilize Encryption: Always use encryption when transmitting credit card information. Whether it’s through secure payment gateways, encrypted email, or secure file transfer methods, encryption ensures that the data remains secure and inaccessible to unauthorized parties.

- Keep Software and Systems Updated: Regularly update your operating systems, web browsers, antivirus software, and other applications to ensure they are equipped with the latest security features and patches. Outdated software may have vulnerabilities that could be exploited by hackers.

- Secure Passwords: Use strong, unique passwords for all your accounts, including those associated with credit card transactions. Incorporate a mix of uppercase and lowercase letters, numbers, and special characters. Avoid using easily guessable passwords or reusing passwords across multiple platforms.

- Use Multi-Factor Authentication: Enable multi-factor authentication whenever possible. This adds an extra layer of security by requiring multiple forms of verification, such as a password and a unique code sent to your mobile device, to access your accounts containing credit card information.

- Be Wary of Phishing Attempts: Be vigilant and cautious of phishing emails, messages, or phone calls that attempt to trick you into providing your credit card information. Beware of any suspicious or unexpected requests for such information and verify the legitimacy of the communication before sharing any sensitive data.

- Regularly Monitor Credit Card Statements: Keep a close eye on your credit card statements and transaction history. If you identify any unauthorized charges, report them immediately to your card issuer. Prompt action can help mitigate the impact of fraudulent activities.

- Educate Yourself and Stay Informed: Stay updated on the latest security practices and emerging threats related to credit card transactions. Regularly educate yourself about new security measures, technologies, and potential risks to ensure you are taking appropriate measures to protect your sensitive information.

By following these best practices, you can significantly reduce the risk of unauthorized access to your credit card information and ensure its secure transmission. Prioritizing security and implementing these practices will provide peace of mind during online transactions.

Before we conclude, let’s summarize the key points covered in this guide on sending credit card information securely.

Conclusion

Safely sending credit card information is of utmost importance in today’s digital world. With the increasing prevalence of online transactions, it is crucial to adopt secure methods and practices to protect your sensitive financial data.

In this guide, we have explored various aspects of sending credit card information securely. We discussed the risks associated with transmitting this data and the importance of choosing secure methods and encryption techniques to mitigate those risks. We also covered secure file transfer methods, the use of trusted payment gateways, mobile payment security, and best practices to follow when sending credit card information.

Remember to prioritize the use of secure payment gateways that offer encryption and tokenization to protect your credit card information during online transactions. Utilize secure file transfer methods such as SFTP, secure cloud storage, and encryption for file attachments. When using mobile payment apps, ensure device security, use secure networks, and enable additional security measures like two-factor authentication.

Follow best practices, including minimizing data collection, keeping software updated, using strong passwords, being cautious of phishing attempts, and regularly monitoring credit card statements. Staying informed and educated about the latest security practices is essential in the ongoing fight against fraud and data breaches.

By implementing these strategies and practices, you can mitigate the risks associated with sending credit card information and have confidence in the security of your financial transactions.

However, it is important to note that security is a constantly evolving field, and new threats may arise. It is your responsibility to stay informed about the latest security measures and adapt accordingly to ensure the continued protection of your credit card information.

By taking the necessary precautions and being vigilant, you can confidently send credit card information securely, protecting your financial well-being in the digital world.