Home>Finance>Indirect Rollover Definition, Rules, Requirements

Finance

Indirect Rollover Definition, Rules, Requirements

Published: December 8, 2023

Learn the definition, rules, and requirements of indirect rollovers in finance. Understand how to manage your retirement funds effectively and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Indirect Rollover Definition, Rules, Requirements

When it comes to managing your finances, it’s important to have a clear understanding of different financial terms and options available to you. One such option is an indirect rollover, which can be a useful tool for managing your retirement savings. In this blog post, we’ll explore the definition, rules, and requirements of an indirect rollover, helping you make informed decisions about your finances.

Key Takeaways:

- An indirect rollover allows you to move funds from one retirement account to another without incurring immediate tax consequences.

- To complete an indirect rollover, you must deposit the distributed funds into another eligible retirement account within a specified time frame.

Before we dive into the details of an indirect rollover, let’s answer a commonly asked question: What exactly is an indirect rollover? An indirect rollover is a process that allows you to transfer funds from one retirement account, such as a 401(k), to another qualified retirement account, like an Individual Retirement Account (IRA), without triggering a taxable event immediately.

Understanding the Rules

Now that we have a better understanding of the definition of an indirect rollover, let’s explore the rules associated with this financial option:

- The first rule to note is the 60-day timeline. To complete an indirect rollover, you must deposit the distributed funds into another eligible retirement account within 60 days of receiving the funds from the original account.

- It’s crucial to adhere to the one rollover per 12-month period rule. The Internal Revenue Service (IRS) limits individuals to one indirect rollover per year, regardless of the number of retirement accounts they have.

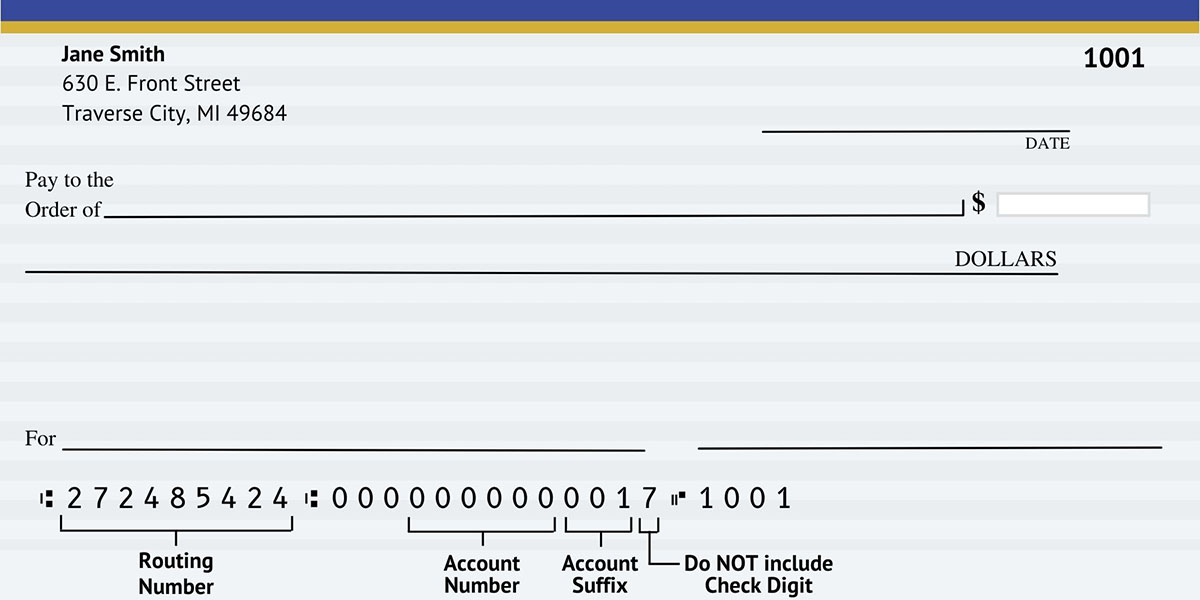

- Another key rule is the 20% withholding. If you receive a distribution from your retirement account but fail to deposit the full amount into another eligible account within the specified time frame, the IRS requires a mandatory 20% withholding for tax purposes.

Meeting the Requirements of an Indirect Rollover

While understanding the rules is important, it’s equally crucial to meet the requirements set forth by the IRS for an indirect rollover. Here are a few requirements to keep in mind:

- The funds you receive must be eligible for a rollover. Examples of eligible funds include distributions from your 401(k) plan or a traditional IRA.

- You must deposit the funds from the original account into a new eligible retirement account within the 60-day time frame to avoid tax implications.

- Ensure that the receiving retirement account allows indirect rollovers. Contact your financial institution or custodian to confirm their policies.

- Maintain accurate records of your indirect rollover transactions to provide documentation in case of an audit.

Conclusion

An indirect rollover can be a valuable tool for managing and consolidating your retirement savings. By understanding the definition, rules, and requirements associated with an indirect rollover, you can make informed decisions and navigate the process without running into unnecessary tax complications. Remember to consult with a financial advisor or tax professional to ensure your specific situation aligns with the regulations and to receive personalized guidance.