Finance

Non-Spouse Beneficiary Rollover Definition

Published: January 1, 2024

The non-spouse beneficiary rollover in finance refers to transferring inherited retirement funds to an individual retirement account (IRA) or another qualified plan. Understand this definition and its implications for financial planning.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Non-Spouse Beneficiary Rollover: A Key Tax Strategy for Your Finances

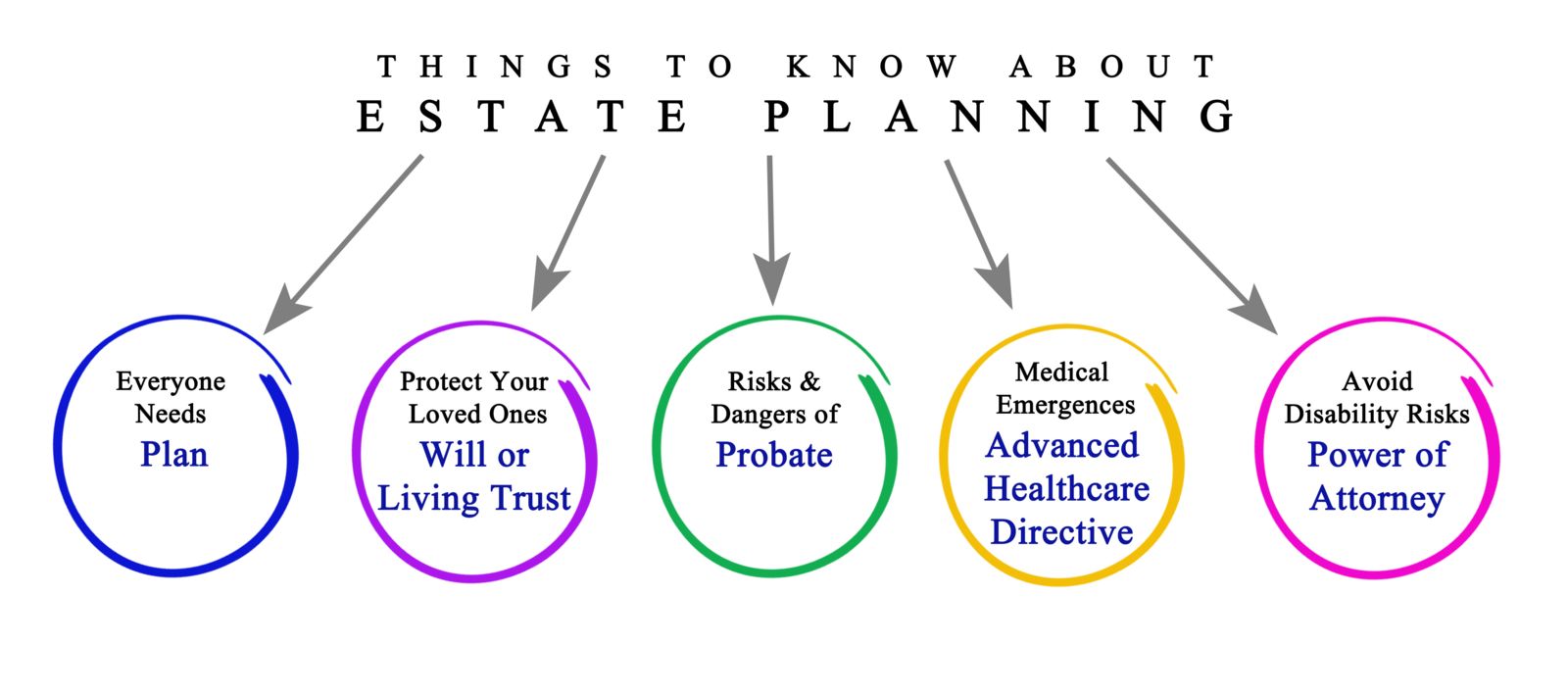

When it comes to planning for the future, financial strategies can play a critical role in ensuring that you and your loved ones are well taken care of. One important aspect of financial planning is understanding the concept of a Non-Spouse Beneficiary Rollover. In this article, we will dive deep into the definition of this tax strategy and explore how it can benefit you and your beneficiaries in the long run.

Key Takeaways:

- A Non-Spouse Beneficiary Rollover allows non-spouse beneficiaries to transfer inherited retirement accounts into their own Individual Retirement Accounts (IRAs).

- This strategy helps beneficiaries retain the tax-deferred status of the inherited retirement accounts and provides flexibility in managing future withdrawals.

A Non-Spouse Beneficiary Rollover is an effective tax planning tool that offers financial flexibility and control, allowing non-spouse beneficiaries to maximize their inheritance. To fully comprehend the significance of this strategy, let’s break it down a bit further.

What is a Non-Spouse Beneficiary Rollover?

A Non-Spouse Beneficiary Rollover refers to the ability of non-spouse beneficiaries to transfer the assets from an inherited retirement account, such as a 401(k) or an IRA, into their own Individual Retirement Account. This rollover option is available when an individual inherits a retirement account from someone other than their spouse, such as a parent, sibling, or extended family member.

By utilizing this tax strategy, non-spouse beneficiaries can maintain the tax-deferred status of the inherited retirement account and potentially defer the payment of income tax until withdrawals are made. This offers a considerable advantage, as the tax liability is spread out over a longer period, allowing beneficiaries to potentially minimize their tax liability.

The Benefits of a Non-Spouse Beneficiary Rollover

The Non-Spouse Beneficiary Rollover strategy offers several advantages for both the non-spouse beneficiaries and the original account owner:

- Tax-deferred growth: By rolling over the inherited retirement account into their own IRA, non-spouse beneficiaries can continue to benefit from tax-deferred growth. This means that the investments within the IRA can grow without being subject to immediate taxation.

- Control and flexibility: Non-spouse beneficiaries who opt for a rollover gain greater control over the inherited retirement account. They can manage the investments according to their own financial goals, and they have the flexibility to withdraw funds on their own timeline, potentially minimizing their tax liability.

It’s important to note that timing plays a crucial role in executing a Non-Spouse Beneficiary Rollover, as there are specific rules and deadlines that must be followed to ensure compliance with the IRS regulations. Consulting with a financial advisor or tax professional experienced in estate planning and retirement accounts can help you navigate these complexities and make informed decisions.

In Conclusion

Understanding the intricacies of financial planning is crucial in maximizing the benefits of your investments and ensuring that your beneficiaries are well-positioned for the future. The Non-Spouse Beneficiary Rollover is just one example of a tax strategy that can help you preserve and grow your wealth while providing flexibility to your loved ones. By working with professionals and staying informed about the latest tax and retirement planning techniques, you can make the most of your financial journey and build a solid foundation for the future.