Home>Finance>How To Read Stocks: A Complete Guide For Beginners

Finance

How To Read Stocks: A Complete Guide For Beginners

Modified: September 6, 2023

If you ever had a problem on how to read stocks, we’ll help you understand what numbers and lines mean, so you can decide what to buy and what to sell.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

When trying to read stocks, anyone who has tried to look at stock charts may get overwhelmed by the myriad of lines that shoot up or down. Not to mention the varying numbers and labels that do not seem to make sense.

But just as it’s crucial to invest to achieve financial freedom, it is also important to learn how to read stocks to make informed decisions in investing in the market.

It’s so much easier to just read a list of stocks that are best to buy and invest in, like this article we’ve put together. But what counts as the best stocks will be different for each investor and will be determined by each one’s goals. So it will do you good to learn how to read stocks.

Once you know how to read stocks, you will learn that there’s a story behind charts and one of them is a glimpse of what’s happening in the broader market. You can minimize loss and maximize profit just by looking at how it’s projected to perform.

Understanding Stock Quotes

The best way to approach a stock chart is by looking at numbers and lines individually, understand what they represent, and study how they are connected to each other.

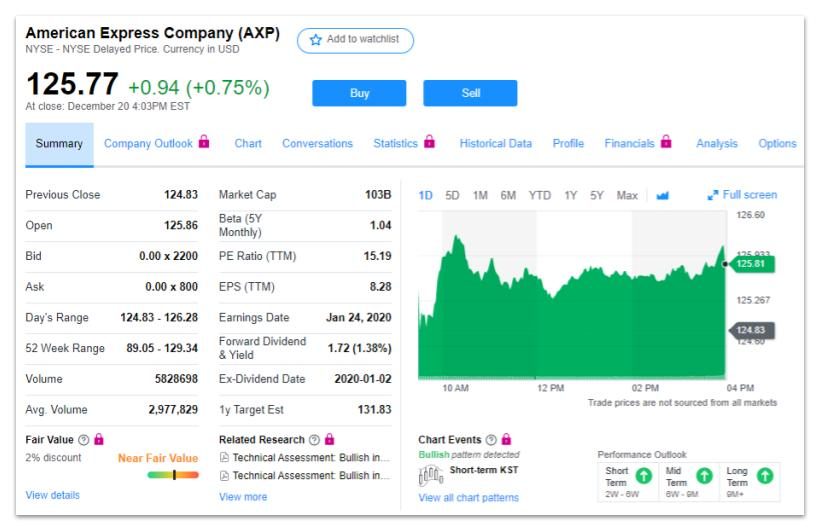

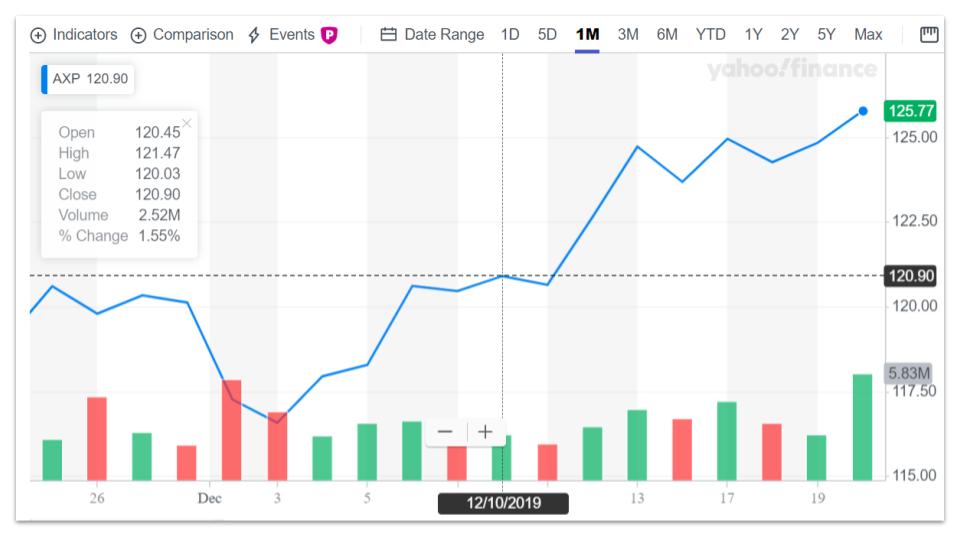

Let’s start by looking at this chart from Yahoo Finance. We assure you, you are well on your way to understanding how to read stocks and understand them!

Screenshot from Yahoo Finance

Stock Quote, as represented by this chart, is the price of a stock. It is generally supplemented with other information such as the price changes, current trading price, highs and lows, and volume

Screenshot from Yahoo Finance

Company Name & Ticker Symbol

At the very top portion, you will see the company name American Express Company with a ticker symbol of AXP. The ticker symbol is the shortform of each stock.

Stock Exchange

Right below the company name is the Stock Exchange facility at which the company stocks are traded. As a beginning investor, you may be just learning that there is an endless list of Stock Exchange facilities.

The New York Stock Exchange (which you see in this chart) and the Nasdaq Stock Exchange are first on the list of the 1 Trillion Club, referring to securities exchange with a market capitalization of over 1 trillion.

Previous Price

The Previous Close is the price at which the stock closed on the previous day.

Open Price

Open Price is the price at which stock opened trading on a given day.

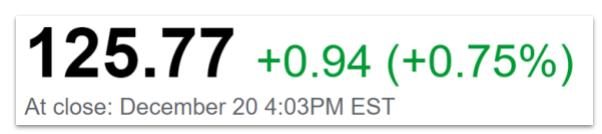

Closing Price

The Closing Price is the price at which the stock stopped trading during the normal hours. At this point, it is important to know that the regular NYSE Trading is open Monday to Friday between 9 am to 4 pm EST.

On December 20, 4:03 PM EST, AXP stopped trading at the closing price of USD 125.77. The green numbers show you the price increase as of the day you are viewing the chart. Total these numbers and you get the current price.

Now, the close price is significant information to look at. If the stock closes above the previous close, you can expect an upward movement for the stock. On the other hand, if the close price is below the previous close, you can expect a downward movement in the stock price.

Looking at AXP, we can predict that there will be an upward movement in the chart since the close price of 125.77 is higher than the previous close of 124.83.

Bid & Ask Price

The Bid Price is the highest price a buyer is currently willing to pay for a stock. While Ask Price is the lowest price at which a seller is currently willing to sell the stock. When placing a market order, you are buying or selling a stock at the best available price.

Bid and Ask Price will be constantly changing at any time of day. It tells you how much people are willing to buy and sell stocks.

Day’s Range

Day’s Range indicates the highest and lowest price at which the stock is traded throughout the day beginning from market open to market close.

52 Week Range

52 Week Range is the same as the Day’s Range, only it shows the trajectory of the stocks in a span of a year.

Volume

Screenshot from Yahoo Finance

Volume refers to the stocks traded for today while the Average Volume refers to traded stocks usually about three months.

The volume can tell you a lot about the stock’s liquidity. When we say liquidity, it means that the stock can easily be bought and sold in the market without a change in price. Liquid stocks are what you need to look for as you can sell them anytime when you need there will be a drop in price.

There’s a good chance that when a stock is trading at a certain price, you will get a close price should you decide to dump your shares. An illiquid stock will be difficult to sell.

Any stock with a volume of 10,000 shares per day is considered a low volume stocks. If you’re lucky, a low volume stock can be a diamond in the rough. But in most cases, there’s a reason people are not trading these stocks and you would want to stay away from it.

Looking at stocks more closely, you can see also see the changes in the volume in the lower part of the chart. We’ll get to the importance of trending volume later.

Market Capitalization

Photo by Mark Finn on Unsplash

The Market Cap is the total value of all the company’s shares. You can calculate this by multiplying the company’s total number of shares by the price of a stock.

Large-cap companies have a market cap of $10 billion or more. Investing in companies with a large market cap will mean huge returns because of a consistent increase in share value.

Mid-cap companies have $2 billion to $10 billion market cap. These are companies that have been around for only a couple of years and have promising growth.

Companies that are just starting out, or are serving a niche market can have anything between $300 million to $2 billion market cap. Small-cap companies are risky investments among the three categories.

Market Cap can change significantly if the values of shares go up or down, or when the company increases the number of outstanding shares.

Beta

Beta is used to measure the volatility of a stock. A beta of 1 or greater means the stock moves up or down more quickly than the market overall. The security’s price is more volatile than the market.

A beta between 0 and 1 means the stock doesn’t move as much as the market. While a negative beta means the stock moves in the opposite direction of the market.

A beta of 1.04 means that AXP is 4% more volatile than the market. When you add AXP to your stock portfolio, it will mean that it will increase your portfolio’s risk, but at the same time, it will also increase its expected return as in the case of choosing any high volatile stocks.

P/E Ratio

Every dollar a company made, they are paying the indicated dollars per stock, price to earnings ratio, divide the current stock price by the earnings per share for the past year.

Earnings Date

If you want to look at the company’s financial report, the earnings date will tell you when. This date is the official announcement about the company’s profitability for a given time period.

Earnings Per Share

EPS is a good indicator of how well the company is doing. This is the number of net profits a company has earned per share of its stock. EPS is updated every quarter after the company reports earnings.

Dividend Per Share

For dividend stocks, companies offer small payouts to shareholders when it makes profits.

Ex-dividend share

This is important info when you have invested in dividend stocks. In order to get a stock’s upcoming dividend, the investor must purchase shares of the stock prior to the ex-dividend date.

1-year Target EST

This is an analyst’s estimate of what one share of stock will be worth in a span of a year.

How To Read Stocks

So far, identifying the labels in the stock quote might have been a little easy. Now we’re onto the hard part on how to read stocks chart.

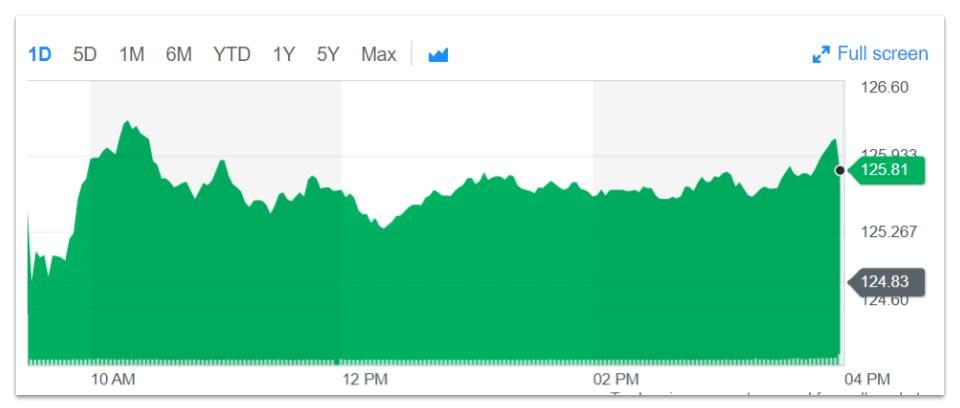

1. Study The Trend Lines

Screenshot from Yahoo Finance

Stock charts include charting, plot lines, and price movement of a given stock.

To start, if you look at the chart, you will see there are two axes: price in the vertical axis, and time in the horizontal axis. An interactive or customizable chart like Yahoo or Google Finance will let you change the time frame either in a span of a day, month, or year. The chart below shows you the stock trend for the day.

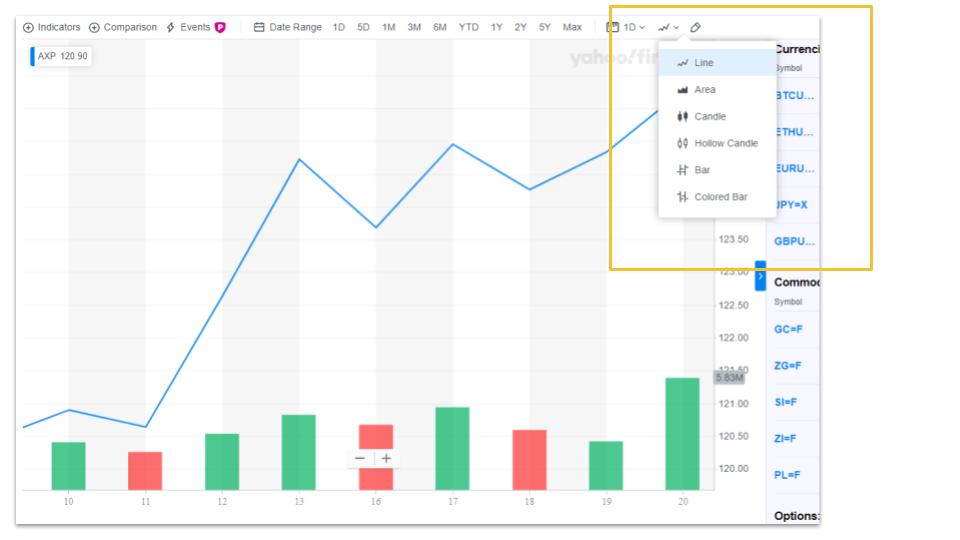

If you click on the chart to look at the graphs in a full screen, set it in a month’s time frame, this is what you will see:

Screenshot from Yahoo Finance

Chart Styles – There are different chart styles to choose from, including traditional line, mountain/area, candlesticks, or bars. Some investors also find Heiken Ashi easier to understand than candlesticks.

The blue line is called a traditional line. But this can be changed depending on which chart style investors are comfortable with and which data they are trying to look at.

Line Charts track the movements of a stock. Bar charts show the high and low prices with the closing price to chart its trend. The candlestick chart, on the other hand, uses green and red boxes to indicate periods of bullish and bearish.

You can experiment which is easier for you to understand by changing it up.

Screenshot from Yahoo Finance

2. Look For Lines of Support & Resistance

Photo by Ishant Mishra on Unsplash

Support and Resistance are levels at which stocks stay within a given period of time. Wing at these lines, the goal is to identify when to buy and when to sell. While there is no correct way to use these lines to know when to buy, and that every investor has different ways of interpreting these lines, it’s important to understand the process.

If you have a long investment horizon, you may not draw as many lines of support and resistance, as you don’t read too much from each up and downs

If you are focusing on investing in the short term, you may want to draw more lines to be able to analyze trends in a shorter period.

3. Look At Historic Trading Volumes

Small vertical lines at the bottom of the chart represent the trading volumes. Spikes in trading volume can indicate the strength of a trend. Meaning, the higher the volume, the more liquid the stock is.

Sometimes, there will be a correlation between the stock price and trading volume. A low stock price usually will have a high trading volume as, in many cases, people will be trading after hearing good or bad news about the company. In which, they will either sell or buy stocks.

With high volumes comes greater ease when buying or selling. If a lot of people are trading the stock that day, you should be able to buy or sell it quickly.

With a little bit of practice, you’ll soon be able to find winning stocks and learn the best time to buy or sell them. We hope you now know how to read stocks and are a little more familiar with what you’re doing.