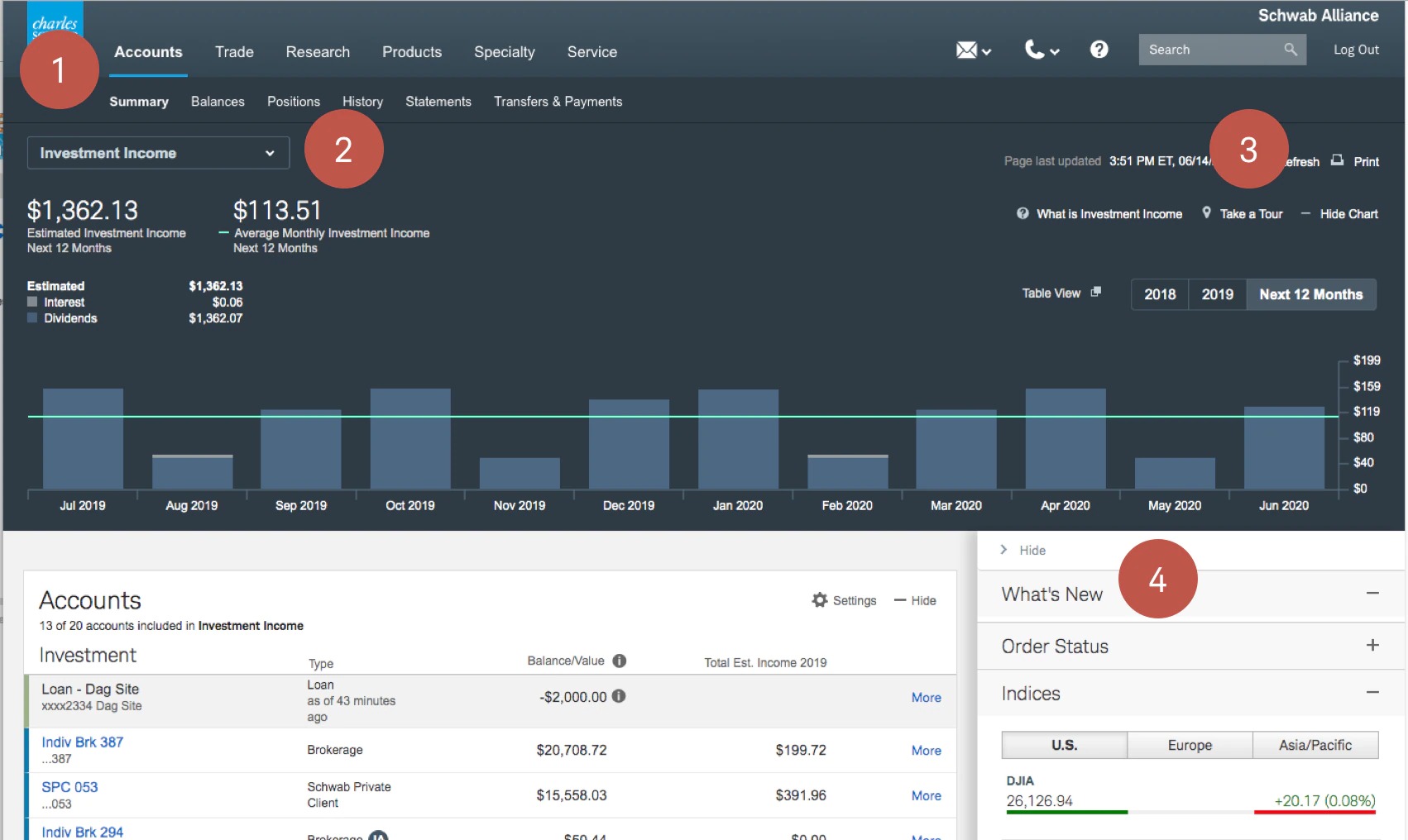

Home>Finance>Leptokurtic Distributions: Definition, Example, Vs. Platykurtic

Finance

Leptokurtic Distributions: Definition, Example, Vs. Platykurtic

Published: December 17, 2023

Learn about leptokurtic distributions in finance, including their definition, example, and comparison to platykurtic distributions. Enhance your understanding of statistical analysis in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Leptokurtic Distributions: Definition, Example, Vs. Platykurtic

Gaining a comprehensive understanding of statistics is essential when it comes to making informed financial decisions. One statistical concept that is often overlooked but still holds great significance is that of leptokurtic distributions. In this blog post, we will define leptokurtic distributions, provide an example to illustrate their behavior, and compare them to platykurtic distributions. By the end of this article, you will have a deeper understanding of this statistical phenomenon and its implications in finance.

Key Takeaways:

- Leptokurtic distributions have a higher peak and heavier tails compared to a normal distribution.

- Platykurtic distributions have a flatter peak and lighter tails compared to a normal distribution.

What are Leptokurtic Distributions?

Leptokurtic distributions, also known as “fat-tailed” distributions, are statistical distributions that exhibit higher peaks and heavier tails compared to a normal distribution. In simpler terms, these distributions indicate that data points tend to cluster around the mean (peak) more tightly and have a higher probability of extreme values (heavier tails) compared to what would be expected under a normal (or Gaussian) distribution.

Leptokurtic distributions can be visualized as a bell-shaped curve that is narrower with a elevated central peak. This indicates that the dataset has more values closer to the mean, making it less spread out than a normal distribution. However, the tails of a leptokurtic distribution are fatter, meaning there is a greater likelihood of observing extreme values.

Example of a Leptokurtic Distribution

Let’s consider the example of stock market returns to better understand leptokurtic distributions. In an efficient market, stock returns are often assumed to follow a normal distribution. However, in reality, stock market returns can be leptokurtic.

Suppose we analyze the daily returns of a particular stock over a long period of time. If these returns follow a leptokurtic distribution, we would observe the following characteristics:

- A greater concentration of returns around the mean value (higher peak): This indicates that the stock returns have a higher probability of being close to the average return.

- A higher probability of experiencing extreme returns (heavier tails): This means that there is a greater chance of observing unusually large gains or losses in comparison to a normal distribution.

By understanding the characteristics of a leptokurtic distribution, investors can better comprehend the potential risks and rewards associated with their investment choices.

Leptokurtic Distributions vs. Platykurtic Distributions

Now that we have discussed leptokurtic distributions, it’s important to distinguish them from platykurtic distributions. While leptokurtic distributions have heavier tails, platykurtic distributions have lighter tails compared to a normal distribution. This means that data points in a platykurtic distribution are more spread out, resulting in a flatter peak.

Platykurtic distributions are often associated with lower volatility and a more stable range of values, indicating that extreme events are less likely to occur. On the other hand, leptokurtic distributions suggest higher volatility and a greater chance of observing extreme values.

Conclusion

By understanding the concept of leptokurtic distributions, investors can make more informed decisions and be better prepared for potential risks. Remember, leptokurtic distributions have higher peaks and heavier tails, indicating a greater probability of extreme values. It’s important to compare these distributions to platykurtic distributions, which have flatter peaks and lighter tails. Consider these statistical insights when analyzing financial data and always consult with a professional for personalized financial advice.