Finance

Uniform Distribution Definition

Published: February 13, 2024

Discover the meaning of uniform distribution in finance and how it plays a crucial role in analyzing data patterns and making informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the Power of Finance: A Guide to Strengthening Your Financial Health

Finance is a vital aspect of our lives, as it impacts every decision we make, from paying bills to planning for retirement. It can be complex and overwhelming, but with the right knowledge and strategies, you can take control of your financial health. In this blog post, we will explore the world of finance, providing you with essential insights and tips to navigate the intricacies of personal finance successfully.

Key Takeaways:

- Finance plays a crucial role in our everyday lives.

- With the right knowledge and strategies, anyone can improve their financial health.

What is Finance?

Finance encompasses the management of money and investments, including budgeting, saving, spending, and investing. It revolves around making informed decisions to maximize the value of your financial resources. Understanding the principles of finance empowers individuals to make wise financial choices and achieve their short-term and long-term goals.

Whether you are a recent college graduate, a young professional, or someone planning for retirement, developing a strong understanding of finance is crucial. It can help you achieve financial stability, minimize debt, and build wealth to secure your future.

2 Key Takeaways:

- Understanding finance enables individuals to make informed decisions and take control of their financial health.

- Maintaining financial stability requires diligent budgeting, saving, spending, and investing.

Building Blocks of Personal Finance

When it comes to personal finance, there are several fundamental concepts and strategies you need to grasp:

- Budgeting: Creating a budget helps you track your income and expenses, enabling you to make prudent spending decisions and save for future goals.

- Saving: Saving money is essential for emergencies, financial goals, and retirement. By adopting smart saving strategies, such as automating your savings or setting aside a percentage of each paycheck, you can build a strong financial foundation.

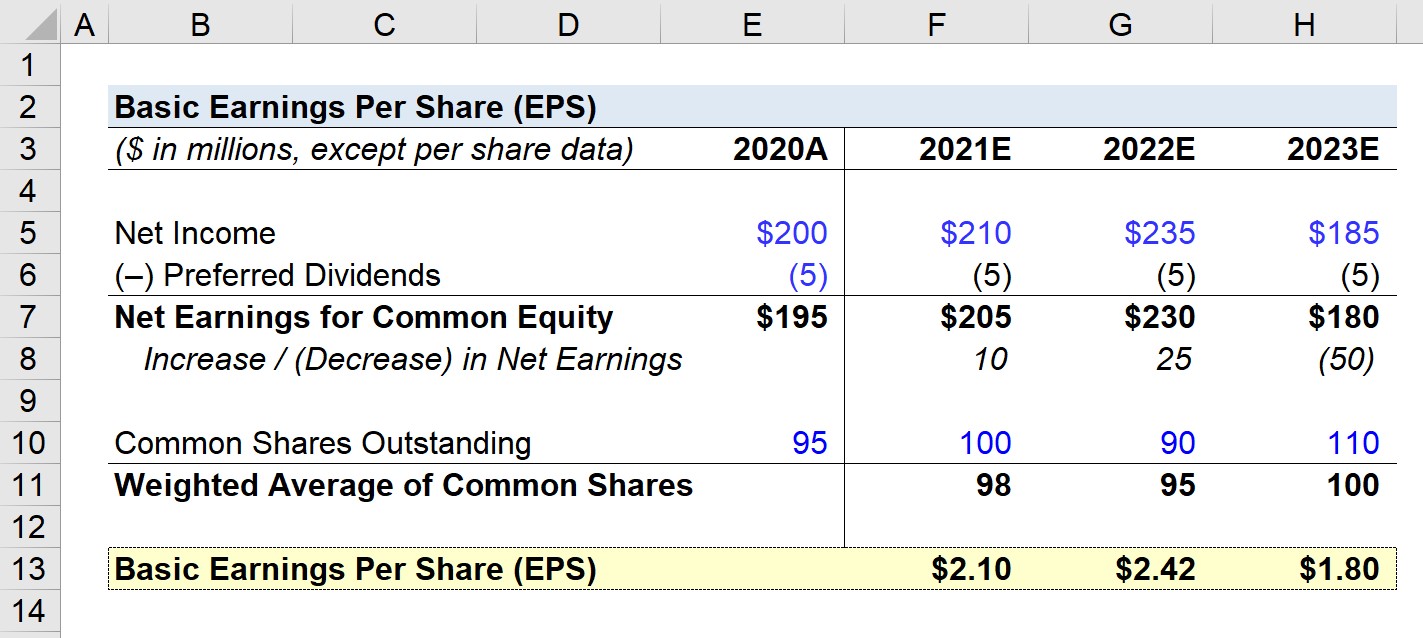

- Investing: Investing your money can generate additional income and help grow your wealth over time. Understanding the different investment options, such as stocks, bonds, and real estate, can assist you in making informed investment decisions.

- Debt Management: Managing debt is crucial to maintaining strong financial health. It involves understanding interest rates, paying off high-interest debt first, and avoiding unnecessary debt.

- Retirement Planning: Planning for retirement ensures that you have enough financial resources to support yourself after leaving the workforce. Consider investing in retirement accounts, such as 401(k)s and IRAs, to secure your financial future.

By focusing on these building blocks of personal finance, you can strengthen your financial health and build a solid foundation for a prosperous future.

Conclusion

Finance plays a pivotal role in our lives, and by understanding its principles, we can take control of our financial well-being. Budgeting, saving, investing, debt management, and retirement planning are all essential components of personal finance that can help us navigate life’s financial challenges and secure a prosperous future.

So, why is finance important? Well, with a solid foundation in finance, you can make informed decisions, achieve your financial goals, and lead a financially stress-free life. Take the first step towards strengthening your financial health today!