Home>Finance>Level 2 Assets: Definition, Examples And Vs. Level 1 And 3 Assets

Finance

Level 2 Assets: Definition, Examples And Vs. Level 1 And 3 Assets

Published: December 17, 2023

Learn about level 2 assets in finance, including their definition, examples, and how they compare to level 1 and 3 assets.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Level 2 Assets: Definition, Examples, and Vs. Level 1 and 3 Assets

Welcome to the FINANCE category of our blog! Today, we’re diving into the world of Level 2 assets – what they are, how they differ from Level 1 and Level 3 assets, and some examples to help illustrate their importance in the financial world. So, if you’ve ever wondered about the different levels of assets and wanted to know more about Level 2 assets specifically, you’ve come to the right place!

Key Takeaways:

- Level 2 assets are financial instruments that have a value that is not as easily determinable as Level 1 assets but are still observable and have reliable market prices.

- Level 2 assets are classified based on the inputs used to determine their fair values and are an important part of the financial reporting process.

Now, let’s dive into the details. Level 2 assets are a classification of financial instruments that are marked-to-market using observable market data but are not as easily determinable as Level 1 assets. Unlike Level 1 assets, which have readily available and easily verifiable market prices, Level 2 assets require some degree of estimation or judgment in determining their fair values. However, they are still considered to have reliable market prices, making them stand out from Level 3 assets.

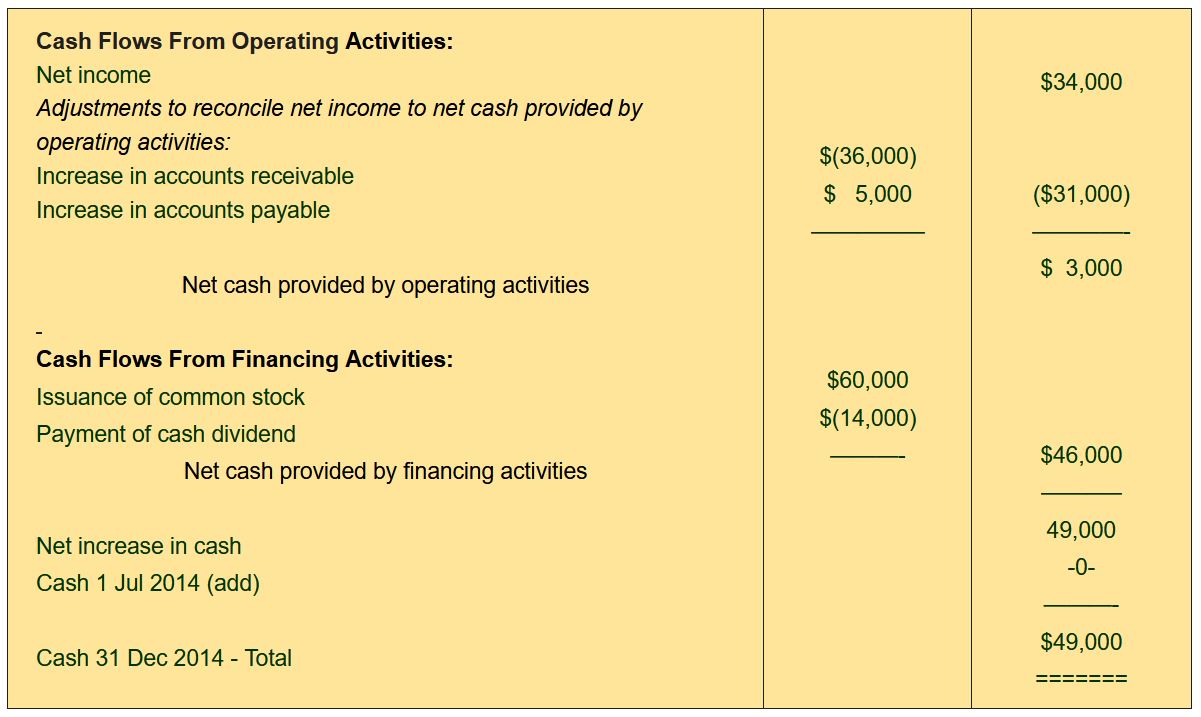

Level 2 assets fall under the fair value hierarchy established by the Financial Accounting Standards Board (FASB). The fair value hierarchy categorizes assets into three levels, based on the availability of inputs used to determine their fair value:

- Level 1 assets: These are assets with easily determinable market prices, such as listed stocks and exchange-traded funds. The prices for these assets are readily available and commonly used in determining their fair values.

- Level 2 assets: These assets have market prices that are derived from observable inputs, such as interest rates, prices of similar securities, or market indices. While some estimation is involved, Level 2 assets are still considered to have reliable market prices.

- Level 3 assets: These assets have prices that are typically not observable in the market and require significant estimation or judgment to determine their fair values. Examples include illiquid investments, certain derivatives, and privately held securities.

It’s important to note that the classification of an asset as Level 1, 2, or 3 depends on the availability and reliability of market data, not on the inherent quality or riskiness of the asset itself.

Now that we understand what Level 2 assets are and how they fit into the fair value hierarchy, let’s take a look at a few examples:

- Interest rate swaps

- Convertible bonds

- Options on listed securities

- Securities that have limited market activity or are illiquid

- Measured and reported through mark-to-market accounting

These are just a few examples of Level 2 assets, demonstrating the range of financial instruments that fall into this category.

In conclusion, Level 2 assets play a crucial role in the financial reporting process. While their fair values may require some estimation or judgment, they are still considered to have reliable market prices. Understanding the different levels of assets, including Level 2 assets, can provide valuable insights into the complexities of financial markets and reporting.

We hope this article provided a clear understanding of Level 2 assets and their significance. If you have any further questions or want to explore other finance-related topics, feel free to explore our blog for more informative articles. Happy learning!