Home>Finance>Open-Ended Fund: Definition, Example, Pros And Cons

Finance

Open-Ended Fund: Definition, Example, Pros And Cons

Published: January 3, 2024

Looking for an open-ended fund? Discover the definition, examples, pros, and cons in the world of finance. Find out if this investment option is right for you.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is an Open-Ended Fund?

When it comes to investing in the stock market, there are several options available to individuals looking to grow their wealth. One such option is an open-ended fund. But what exactly is an open-ended fund and how does it work?

An open-ended fund is a type of mutual fund that allows investors to buy and sell shares at any time. Unlike closed-ended funds, which have a fixed number of shares, open-ended funds can continuously issue new shares as investors buy in and redeem shares as investors sell out. This structure gives investors the flexibility to enter and exit the fund as per their convenience.

It’s important to note that open-ended funds are typically managed by professional fund managers who make investment decisions on behalf of the investors. By pooling funds from multiple investors, the fund manager can invest in a diversified portfolio of securities, such as stocks, bonds, or a combination of both.

Key Takeaways:

- An open-ended fund is a type of mutual fund that allows investors to buy and sell shares at any time.

- Open-ended funds are managed by professional fund managers who make investment decisions on behalf of the investors.

Example of an Open-Ended Fund

To better understand how an open-ended fund works, let’s take a look at an example. Imagine you want to invest in a technology sector mutual fund. You decide to invest $10,000 in an open-ended technology fund. The fund manager will use your investment, along with investments from other investors, to buy a diversified portfolio of technology-related stocks, such as Apple, Microsoft, and Google.

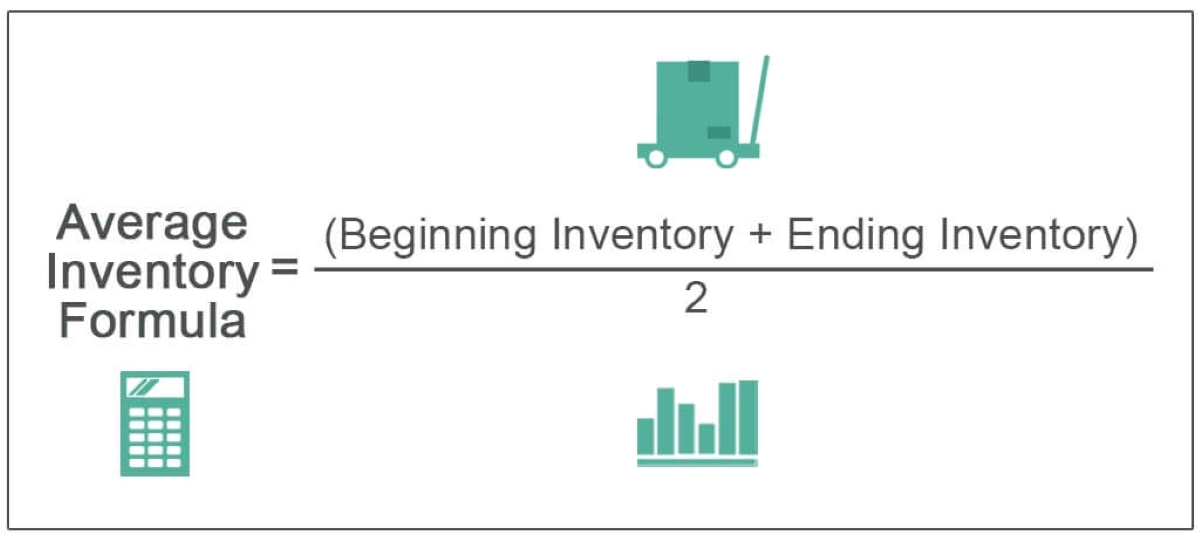

Over time, the value of the technology stocks in the fund may increase or decrease. If you decide to sell your shares, the fund manager will redeem them at the current net asset value (NAV) per share, which is calculated by dividing the total value of the fund’s assets by the number of outstanding shares. This allows you to exit the fund and receive the current value of your investment.

The Pros and Cons of Open-Ended Funds

Like any investment option, open-ended funds have their own set of advantages and disadvantages. Here are a few pros and cons:

Pros:

- Easy accessibility: Open-ended funds offer the convenience of buying and selling shares at any time, giving investors liquidity when they need it.

- Professional management: With open-ended funds, your investment is managed by professionals who have experience in analyzing and selecting suitable investment opportunities.

- Diversification: Open-ended funds typically hold a diversified portfolio of assets, which helps to spread out risk.

Cons:

- Expense ratio: Open-ended funds often come with an expense ratio, which represents the fund’s operating expenses. These expenses can eat into the overall returns of the investment.

- Market risk: As with any investment in the stock market, open-ended funds are subject to market fluctuations, and the value of your investment can go up or down.

- Redemption fees: Some open-ended funds may have redemption fees if shares are sold within a certain timeframe. These fees can reduce the investor’s overall return.

Overall, open-ended funds can be a great option for investors looking for flexibility, professional management, and diversification. However, it’s important to carefully consider the fees and risks associated with these funds before making any investment decisions.

In Conclusion

An open-ended fund is a type of mutual fund that offers investors the ability to buy and sell shares at any time. These funds are managed by professionals and can provide easy accessibility, professional management, and diversification. However, investors should be aware of the expense ratio, market risk, and redemption fees associated with open-ended funds. By carefully considering these factors, investors can make informed decisions and potentially benefit from the advantages offered by open-ended funds.