Home>Finance>Real Economic Growth Rate (Real GDP Growth Rate): Definition

Finance

Real Economic Growth Rate (Real GDP Growth Rate): Definition

Published: January 16, 2024

Learn the definition of Real Economic Growth Rate and its connection to the Real GDP Growth Rate in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Real Economic Growth Rate (Real GDP Growth Rate)

When it comes to finance, understanding the factors that drive economic growth is crucial. One of the key indicators used to measure a country’s economic performance is the Real Economic Growth Rate, also known as Real GDP Growth Rate. But what does this term actually mean, and why is it important? In this blog post, we will delve into the definition of Real Economic Growth Rate and its significance in the world of finance.

Key Takeaways:

- The Real Economic Growth Rate measures the percentage increase in a country’s Gross Domestic Product (GDP) over a specific period, adjusted for inflation.

- It is an essential indicator of a country’s economic health, reflecting the rate at which the economy is growing or contracting.

Now, let’s dive deeper into Real Economic Growth Rate. Real GDP Growth Rate is a measurement of the change in a country’s economic output over time, accounting for the effects of inflation. By adjusting for inflation, this indicator provides a more accurate representation of economic growth by removing the impact of rising prices.

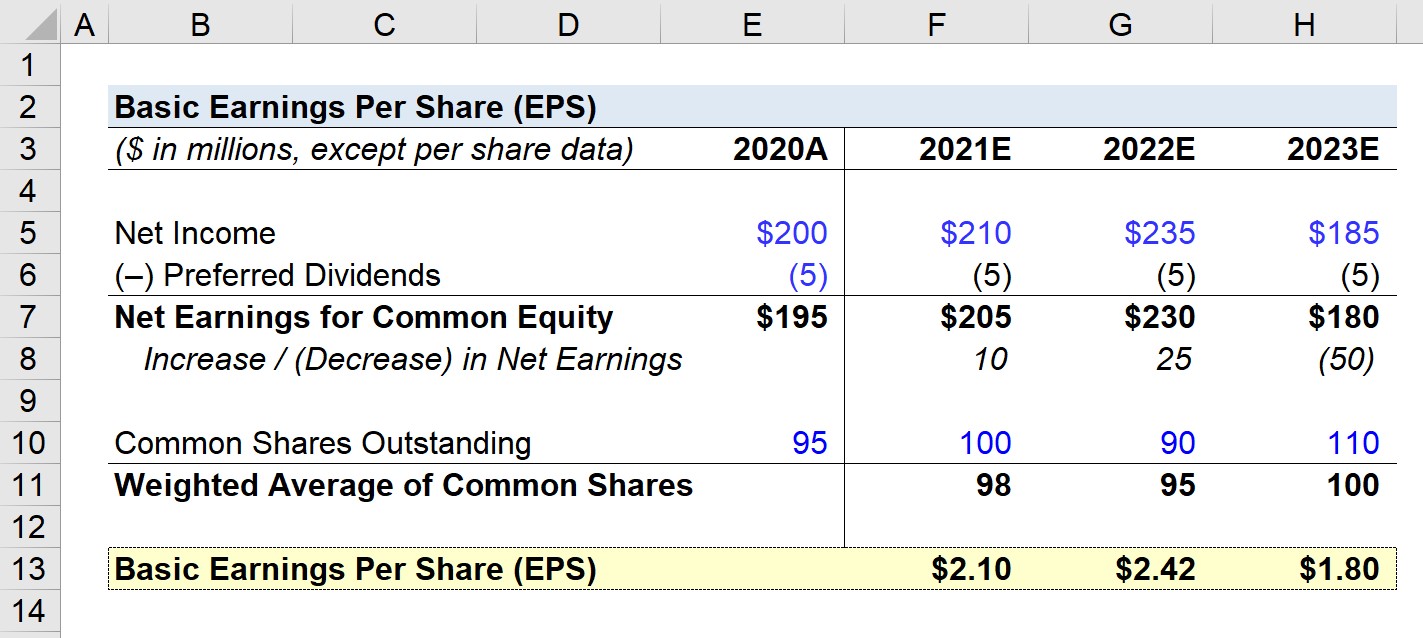

To calculate the Real Economic Growth Rate, economists compare nominal GDP, which is the unadjusted measure of economic output, to the GDP deflator, a price index that reflects inflation. By dividing the nominal GDP by the GDP deflator and multiplying the result by 100, economists can determine the Real GDP Growth Rate as a percentage.

Why is Real Economic Growth Rate important? Here are two key reasons:

- Indicator of Economic Health: The Real Economic Growth Rate provides valuable insights into a country’s economic health. A higher growth rate indicates a thriving economy, while a negative growth rate suggests an economic contraction. Policymakers, investors, and businesses rely on this indicator to gauge the overall economic performance and make informed financial decisions.

- Long-Term Planning: Real Economic Growth Rate is crucial for long-term planning. Governments and central banks use this data to formulate monetary and fiscal policies that can stimulate growth or counteract economic downturns. It also helps businesses identify growth opportunities and assess market conditions for investment purposes.

In conclusion, Real Economic Growth Rate is an important metric for assessing a country’s economic performance. By accounting for inflation, it provides a more accurate picture of economic growth, allowing policymakers, investors, and businesses to make informed decisions. Understanding this concept is essential for anyone interested in finance and the broader dynamics of national economies.

Stay tuned to our finance category for more in-depth articles on various aspects of the financial world.