Finance

What APR Will I Get With A 700 Credit Score?

Published: March 3, 2024

Find out what APR you can expect with a 700 credit score. Learn how your finance options may be impacted and how to secure the best rates.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit scores and annual percentage rates (APR)! If you've ever wondered about the impact of your credit score on the APR you receive, you're in the right place. Understanding how credit scores influence APR can empower you to make informed financial decisions and potentially save a significant amount of money over time.

When you apply for a loan or a credit card, the APR plays a crucial role in determining the overall cost of borrowing. Essentially, APR represents the annual cost of borrowing money, including interest and additional fees. It directly affects the amount of interest you'll pay over the life of a loan or on a revolving balance, making it a key factor in managing your finances.

In this article, we'll delve into the intricacies of APR and credit scores, exploring how these two elements intersect and influence each other. By the end of this journey, you'll have a clearer understanding of the impact of a 700 credit score on the APR you're likely to receive. Additionally, we'll provide valuable insights on how you can improve your APR and take control of your financial future.

So, grab your favorite beverage, settle into a comfortable spot, and let's embark on this enlightening exploration of credit scores and APRs.

Understanding APR

Before delving into the specifics of how a 700 credit score impacts your APR, it’s essential to grasp the concept of APR itself. Annual Percentage Rate, commonly known as APR, represents the total cost of borrowing over a year, expressed as a percentage. It encompasses not only the interest charged on the principal amount but also any additional fees or charges associated with the loan or credit card.

Unlike the nominal interest rate, which only reflects the interest charged on the borrowed sum, APR provides a comprehensive view of the borrowing cost. It serves as a standardized metric that enables consumers to compare the true cost of different financial products, facilitating informed decision-making.

APR typically includes various components such as interest charges, origination fees, points, mortgage insurance, and certain closing costs. For credit cards, it encompasses annual fees, balance transfer fees, and other finance charges. By considering all these elements, APR offers a holistic understanding of the financial commitment associated with a particular borrowing arrangement.

Understanding the APR is crucial for borrowers as it directly impacts the total amount repaid over the life of a loan or the cost of carrying a balance on a credit card. A lower APR translates to reduced interest expenses, potentially saving borrowers a substantial sum of money. Therefore, being well-versed in the nuances of APR empowers individuals to make sound financial choices and optimize their borrowing costs.

Now that we’ve established a foundational understanding of APR, let’s explore the factors that influence this critical component of borrowing.

Factors Affecting APR

Several key factors influence the annual percentage rate (APR) offered by lenders. Understanding these determinants can shed light on the variability of APR across different borrowers and financial products. By comprehending the factors that affect APR, individuals can take proactive steps to potentially secure more favorable borrowing terms.

- Credit Score: One of the most influential factors impacting APR is the borrower’s credit score. Lenders utilize credit scores to assess the risk associated with extending credit. A higher credit score often correlates with lower perceived risk, leading to more favorable APR offers. On the other hand, individuals with lower credit scores may encounter higher APRs due to the heightened risk profile.

- Income and Debt-to-Income Ratio: Lenders consider an applicant’s income and debt-to-income ratio when determining the APR. A higher income and a lower ratio of debt relative to income may result in more competitive APR offers, reflecting the borrower’s financial stability and capacity to manage additional debt.

- Loan Term: The duration of the loan or credit agreement can impact the APR. Generally, longer loan terms may entail higher APRs, as they pose a greater risk to lenders. Shorter loan terms often come with lower APRs, as they are perceived as less risky and involve a shorter repayment period.

- Market Conditions: The prevailing economic environment and market interest rates can influence the APR. In a low-interest-rate environment, borrowers may encounter more favorable APRs, while higher market rates can lead to increased APRs on new credit offers.

- Type of Loan: The specific type of loan or credit product also plays a role in determining the APR. For example, mortgages, personal loans, and auto loans may have distinct APR structures based on the underlying collateral, the purpose of the loan, and the associated risk factors.

By considering these factors, borrowers can gain insight into the dynamics shaping APR offers. Additionally, being mindful of these determinants empowers individuals to make informed decisions and take proactive measures to enhance their financial standing, potentially leading to improved APR terms.

Importance of Credit Score

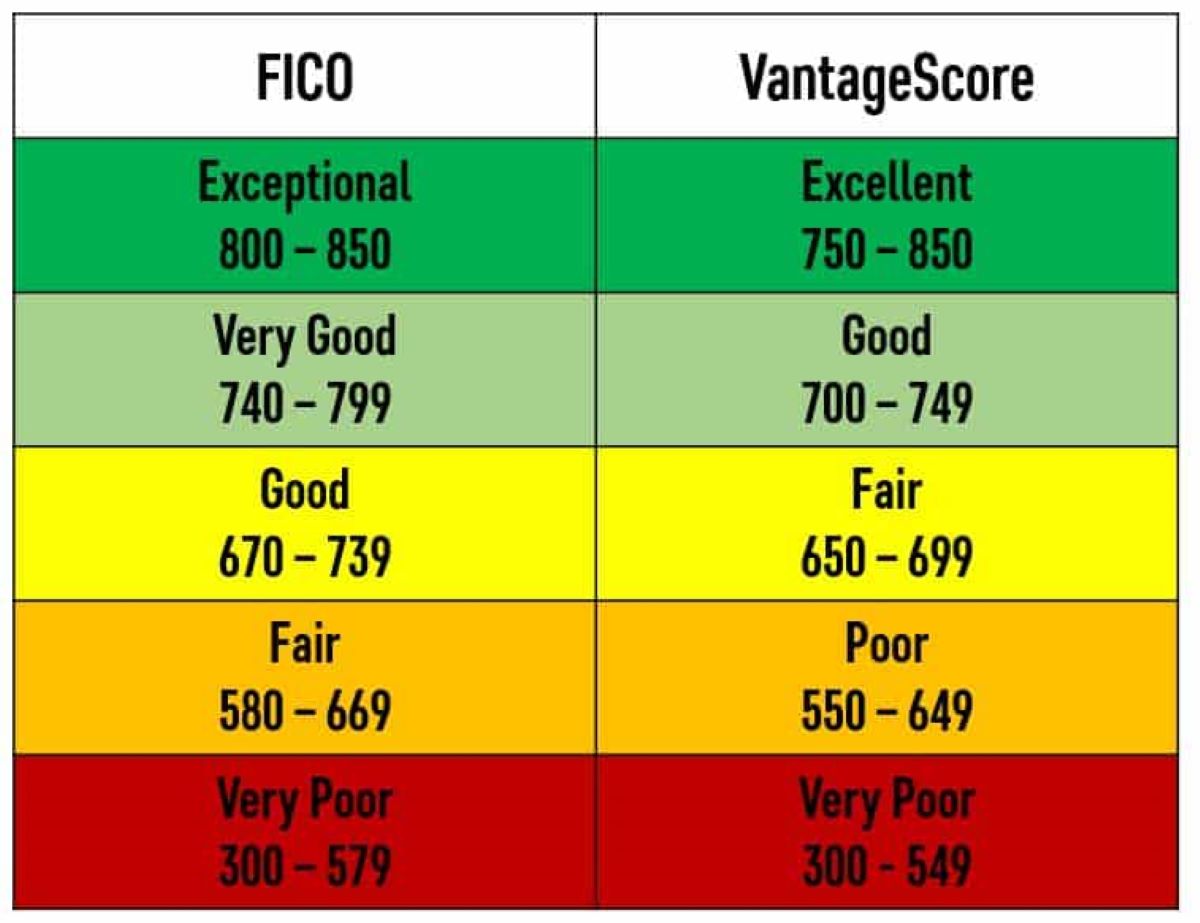

Your credit score is a pivotal factor in the realm of personal finance, wielding significant influence over various aspects of your financial life. This three-digit number, typically ranging from 300 to 850, serves as a barometer of your creditworthiness in the eyes of lenders and financial institutions. Understanding the importance of your credit score is crucial, as it directly impacts your ability to secure favorable borrowing terms, access competitive financial products, and even influence certain non-financial aspects of your life.

Access to Credit: A robust credit score opens doors to a spectrum of credit options, including mortgages, auto loans, personal loans, and credit cards. Lenders use credit scores to evaluate the risk associated with extending credit, and a higher score often translates to more accessible credit and more favorable terms.

Impact on APR: As explored earlier, credit scores significantly influence the annual percentage rate (APR) offered by lenders. Individuals with higher credit scores are typically eligible for lower APRs, resulting in reduced interest expenses over the life of a loan or credit card balance.

Employment Opportunities: In some cases, employers may review credit reports as part of the hiring process, especially for roles that involve financial responsibilities. A positive credit history, reflected in a strong credit score, can bolster your candidacy for certain positions.

Insurance Premiums: Insurance companies often consider credit scores when determining premiums for auto and homeowner’s insurance. A higher credit score may lead to lower insurance costs, potentially yielding substantial savings over time.

Utility Deposits: When establishing utility services, such as electricity, water, or cable, a good credit score can mitigate the need for hefty security deposits, contributing to more seamless and cost-effective utility setup.

Given the multifaceted impact of credit scores, nurturing a healthy credit profile is instrumental in securing favorable financial opportunities and minimizing the cost of credit. By maintaining responsible credit habits, such as making timely payments, managing credit utilization, and monitoring your credit report, you can cultivate a robust credit score that serves as a valuable asset in your financial journey.

APR with a 700 Credit Score

With a credit score of 700, individuals typically occupy a solid position within the credit score spectrum. This score reflects a history of responsible credit management and may qualify you for a variety of credit products with competitive terms. When it comes to APR, a 700 credit score can yield favorable outcomes, positioning you as a relatively low-risk borrower in the eyes of lenders.

Mortgages: For individuals with a credit score of 700, mortgage APRs can range from around 3% to 4%, depending on prevailing market conditions and other financial factors. This favorable APR range can make homeownership more accessible and affordable, enabling you to secure a mortgage with reasonable interest expenses.

Auto Loans: With a credit score of 700, you may qualify for auto loan APRs in the range of 4% to 6%. This can translate to manageable monthly payments and reduced interest costs over the life of the loan, enhancing the overall affordability of purchasing a vehicle.

Personal Loans: When seeking personal loans, individuals with a 700 credit score may encounter APRs in the vicinity of 10% to 15%, offering relatively competitive terms compared to borrowers with lower credit scores. This can make personal financing more accessible and cost-effective for various needs, such as debt consolidation or home improvements.

Credit Cards: With a credit score of 700, you may qualify for credit cards with APRs in the range of 15% to 20%, depending on the specific card and issuer. While these rates may be higher than those offered to individuals with higher credit scores, they still present manageable terms for responsible credit card usage.

It’s important to note that APRs can vary based on individual financial circumstances, lender policies, and market conditions. Additionally, lenders may consider factors beyond credit scores when determining APR offers. Nevertheless, a 700 credit score generally positions individuals favorably, opening the door to a range of credit options with competitive APRs.

By maintaining and further improving a 700 credit score, you can continue to access attractive APRs and enhance your overall financial well-being. This underscores the significance of nurturing a positive credit profile and engaging in prudent credit management practices.

Tips to Improve Your APR

Enhancing your credit profile and financial standing can pave the way for more favorable annual percentage rates (APR) on loans and credit products. By implementing strategic measures and cultivating responsible credit habits, you can potentially secure improved APR terms, saving money and bolstering your financial well-being. Here are valuable tips to elevate your creditworthiness and enhance your prospects of obtaining more favorable APR offers:

- Maintain Timely Payments: Consistently making on-time payments across all your credit accounts is paramount. Payment history significantly influences your credit score and is a key consideration for lenders when assessing creditworthiness.

- Manage Credit Utilization: Strive to keep your credit utilization ratio—the amount of credit used relative to your total available credit—below 30%. Responsible utilization demonstrates prudent credit management and can positively impact your credit score.

- Monitor Your Credit Report: Regularly review your credit report to identify and address any inaccuracies or discrepancies. Ensuring the accuracy of your credit report is crucial, as it directly influences your credit score and the APR offers you receive.

- Limit New Credit Applications: Minimize the frequency of new credit applications, as multiple inquiries within a short period can temporarily lower your credit score. Strategic and intentional credit applications can help maintain a stable credit profile.

- Establish a Diverse Credit Mix: Having a diverse array of credit accounts, such as credit cards, installment loans, and a mortgage, can contribute to a well-rounded credit profile. This diversity can enhance your creditworthiness and potentially lead to more favorable APR offers.

- Consider Credit-Building Products: If you’re in the process of rebuilding or establishing credit, exploring secured credit cards or credit-builder loans can provide avenues for enhancing your credit history and, consequently, your APR prospects.

- Engage in Financial Education: Continuously expand your financial knowledge and literacy. Understanding the nuances of credit management, budgeting, and personal finance empowers you to make informed decisions that positively impact your creditworthiness.

By integrating these tips into your financial practices, you can fortify your credit position and potentially unlock more attractive APR offers. Remember that credit improvement is a gradual process, and consistent dedication to prudent financial management can yield significant dividends in the form of improved APR terms and enhanced financial opportunities.

Conclusion

As we conclude this exploration of credit scores and annual percentage rates (APR), it’s evident that these elements wield substantial influence over the cost and accessibility of credit. Your credit score serves as a pivotal determinant in the APR offers you receive, impacting the affordability of loans, credit cards, and other financial products. With a 700 credit score, individuals are positioned to access a range of credit options with competitive APRs, reflecting a history of responsible credit management and financial stability.

Understanding the intricacies of APR and the factors that influence it empowers you to make informed financial decisions, potentially saving significant sums of money over time. By implementing prudent credit management practices and nurturing a positive credit profile, you can enhance your creditworthiness and unlock more favorable APR terms.

It’s essential to recognize that credit improvement is an ongoing journey, and consistent efforts to maintain responsible credit habits can yield tangible benefits. As you strive to elevate your credit standing, remember that each positive step contributes to a stronger financial foundation and improved access to cost-effective credit options.

Ultimately, the interplay between credit scores and APR underscores the importance of financial literacy, responsible credit management, and proactive credit enhancement. By embracing these principles, you can navigate the realm of credit with confidence, leveraging your credit score to secure favorable APRs and embark on a path of sustained financial well-being.

So, as you continue your financial journey, remember that your credit score is not merely a number—it’s a reflection of your financial prudence and a catalyst for unlocking a world of promising financial opportunities.