Finance

What Are Banking Hours

Published: November 2, 2023

Discover the banking hours of finance institutions, ensuring you have convenient access to your financial needs. Stay informed and plan your transactions accordingly.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Banking hours refer to the designated operating hours during which banks and financial institutions offer their services to customers. These hours are set by banks to ensure efficient and effective customer service while also complying with industry regulations and guidelines. Understanding banking hours is crucial for customers who wish to conduct various financial transactions, such as depositing or withdrawing funds, applying for loans, or seeking financial advice.

The specific banking hours can vary from one institution to another, and may be influenced by factors such as location, size, and the target market of the bank. Additionally, regional and international banking regulations may play a role in determining the standard operating hours for banks in different countries. It is important for customers to be aware of the general banking hours in order to plan their visits to the bank accordingly.

In this article, we will explore the different types of banking hours that customers may encounter, including standard hours, extended hours, weekend hours, lunchtime hours, and special holiday hours. By understanding these variations, customers can make the most of their banking experience and ensure that they can access the services they need within the designated operating times.

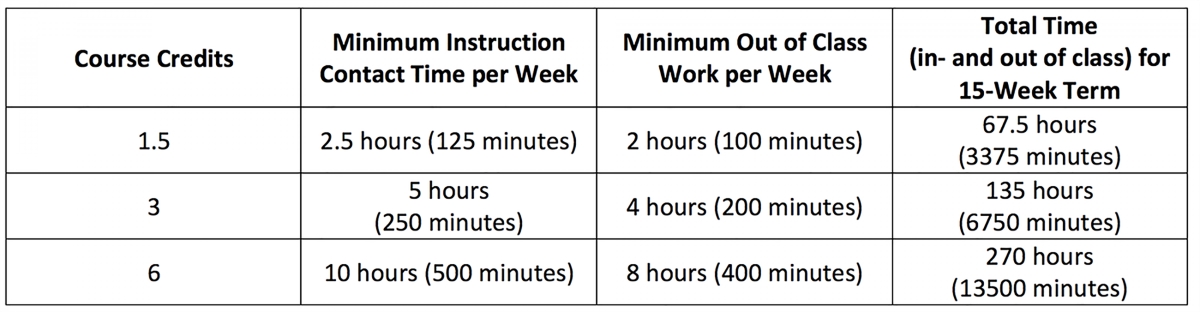

Standard Banking Hours

Standard banking hours are the regular operating hours that most banks adhere to on weekdays. These hours typically span from Monday to Friday and are generally consistent across different banks. The exact timing may vary slightly depending on the specific bank and branch, but the standard operating hours usually fall within a specific range to accommodate customers’ needs.

Most financial institutions open their doors to customers in the morning, typically around 9:00 or 10:00 AM, and continue to serve customers until the afternoon. The closing time for standard banking hours is usually around 4:00 or 5:00 PM. Some banks may extend their hours slightly, closing at 6:00 PM to accommodate customers who may need to visit after work.

It is important for customers to be aware of these standard hours to ensure that they plan their visits to the bank accordingly. Arriving too close to closing time may limit the services that can be provided, as certain transactions may require more time to process. Additionally, it is advisable to allow ample time for any queues or wait times that may be present during busy periods.

It is worth noting that certain banks may offer slightly shorter banking hours or have specific days when they close early. This can vary depending on factors such as the bank’s location, size, and the needs of its customer base. For instance, banks located in rural areas or smaller towns may have different operating hours compared to those in urban or metropolitan areas.

Furthermore, some banks may also have different operating hours for specific services. For example, the bank may allocate dedicated hours for business banking or wealth management services. It is recommended to check with the specific bank or branch or consult their website or customer service before planning a visit to ensure that the services required are available during the intended timeframe.

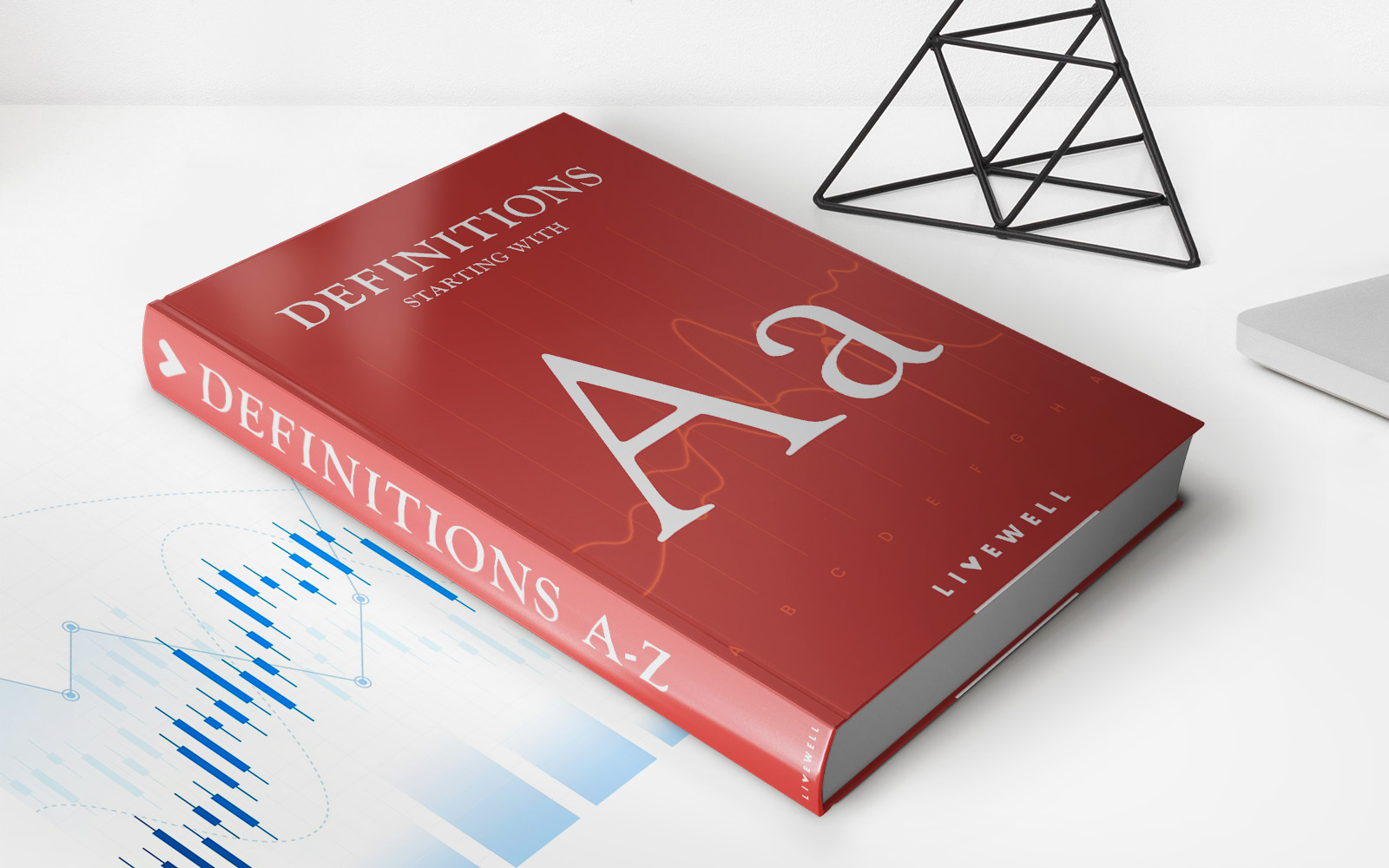

Extended Banking Hours

In response to the evolving needs of customers, many banks have introduced extended banking hours to provide greater convenience and flexibility. Extended hours are designed to cater to customers who are unable to visit during standard banking hours due to work, personal commitments, or other reasons.

Extended banking hours typically include opening earlier and closing later than the standard operating hours. This allows customers to visit the bank outside of regular business hours and have access to a variety of banking services.

For example, some banks may open their doors as early as 7:00 or 8:00 AM to accommodate individuals who need to conduct their banking before heading to work. Similarly, the closing time for extended hours may be extended until 6:00, 7:00, or even 8:00 PM, depending on the bank.

Extended banking hours are often implemented by larger banks or those located in areas with high customer demand. These extended hours enable customers with busy schedules to manage their finances more conveniently, without having to take time off during the workweek.

It is important for customers to note that extended banking hours may not be available at all branches of a bank. In some cases, only select branches or specific locations within a bank’s network may offer extended hours. Therefore, it is advisable to check with the bank or their website for the nearest branch that provides extended hours before planning a visit.

Additionally, customers should be aware that while extended hours allow for greater flexibility, there may be limitations on certain services during these times. For example, complex transactions or specialized services may only be available during standard banking hours. It is recommended to verify the availability of specific services with the bank or their customer service beforehand to avoid any inconvenience.

Overall, extended banking hours offer customers the convenience to visit the bank outside of standard operating hours, making it easier to manage their financial affairs without conflicting with their daily schedules. It is a valuable service tailored to meet the needs of modern customers.

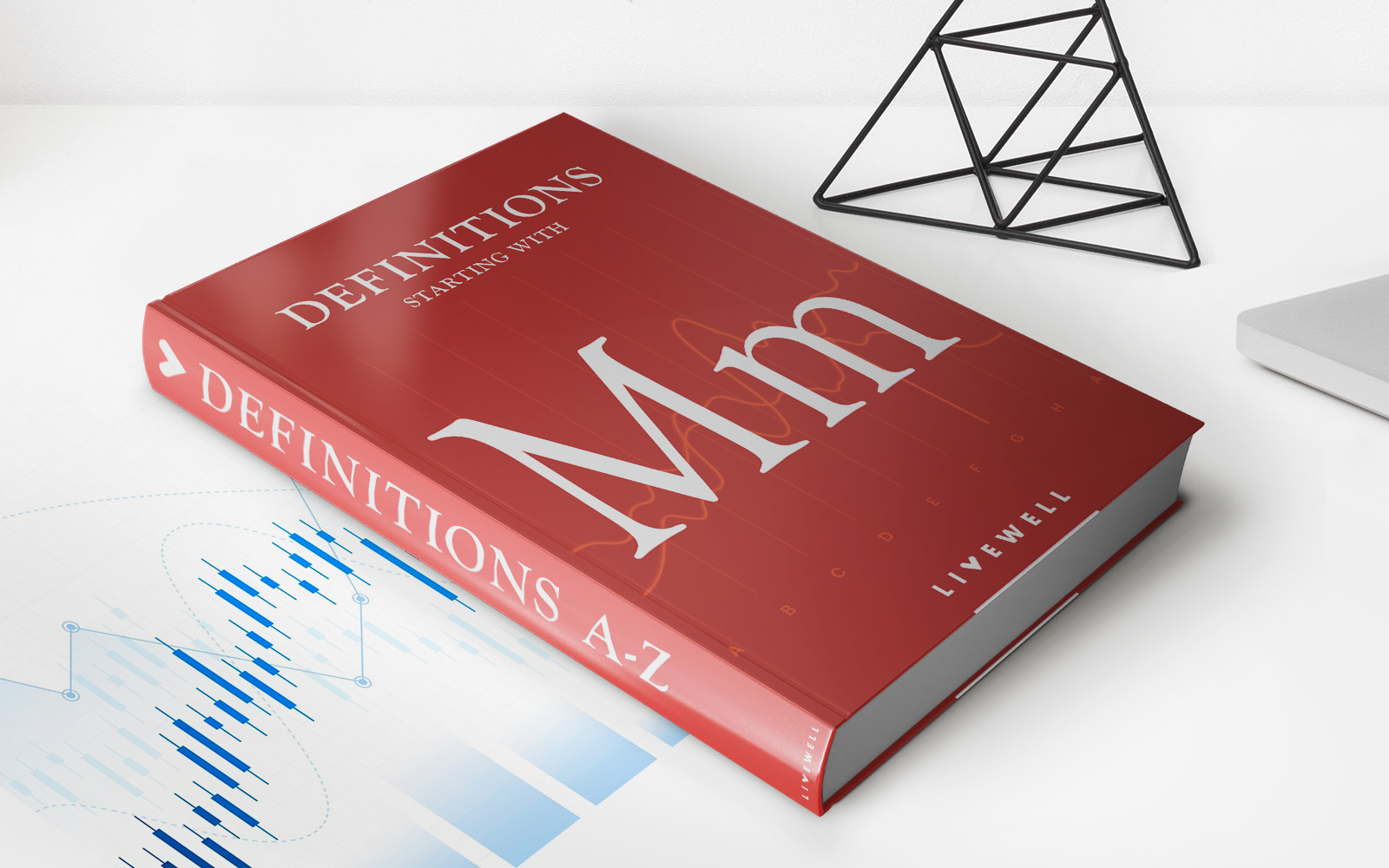

Weekend Banking Hours

Traditionally, banks used to only operate during weekdays, leaving customers with limited opportunities to conduct their banking transactions on weekends. However, as customer demands and expectations have evolved, many banks now offer weekend banking hours to cater to individuals who are unable to visit the bank during the workweek.

Weekend banking hours typically include Saturday and sometimes Sunday. This extension of operating hours provides greater convenience and accessibility for customers who may have demanding work schedules or other commitments during weekdays.

The specific timings for weekend banking hours can vary from one bank to another. Some banks may operate for a full day on Saturdays, while others may have limited hours, such as half-day operations in the morning or afternoon. In some cases, banks may be closed on Sundays or operate with significantly reduced hours.

Weekend banking hours are particularly beneficial for individuals who may need to carry out certain time-sensitive transactions, such as cash withdrawals, check deposits, or obtaining cashier’s checks for upcoming financial obligations. It also allows individuals to seek assistance with their banking needs, such as opening accounts or obtaining financial advice.

Although weekend banking hours offer extended accessibility, it is important for customers to note that not all branch locations of a bank may offer these hours. Banks often have designated branches that are open on weekends, while others may remain closed. It is recommended to check with the specific bank or consult their website or customer service to determine the nearest branch that operates on weekends.

Customers should also be aware that certain services, such as wire transfers or more complex financial transactions, may have limitations or may not be available during weekend banking hours. It is advisable to contact the bank or review their website for details regarding the availability of specific services during weekends to avoid any inconvenience.

Weekend banking hours have significantly improved accessibility and convenience for individuals who have limited availability during weekdays. By providing these extended operating hours, banks are able to cater to the needs of a broader range of customers, enhancing their overall banking experience.

Lunchtime Banking Hours

Lunchtime banking hours refer to a specific time window during weekdays when banks accommodate customers who wish to visit during their lunch breaks. These hours are designed to cater to those individuals who are unable to go to the bank during regular working hours.

Recognizing that many people have limited time during their lunch breaks, banks have adjusted their operating hours to provide a convenient window for customers to conduct their banking activities. Lunchtime banking hours typically fall around midday, between 12:00 PM and 2:00 PM, although the specific timings may vary among different banks and branches.

During lunchtime banking hours, customers can avail themselves of various services, such as cash withdrawals, check deposits, account inquiries, or making loan payments. Banks strive to ensure that these services are efficiently provided within the shorter time frame to accommodate customers’ tight schedules.

It is important to note that lunchtime banking hours may vary depending on the branch location and the size of the bank. Some banks may offer extended lunchtime hours or staggered lunch breaks for their staff to ensure continuous service during this busy period. Others may have designated staff members specifically assigned to handle the increased customer traffic during lunchtime.

While lunchtime banking hours offer convenience for those on their lunch breaks, customers should be aware that these hours may also result in higher customer volumes and longer wait times. It is advisable to plan ahead and allow for extra time during lunchtime banking hours to ensure sufficient time to complete transactions without feeling rushed.

To maximize the efficiency of their visit during lunchtime banking hours, customers can also take advantage of online banking services. Many banks offer digital platforms that allow customers to carry out various transactions, such as transfers, bill payments, or account management, without the need to visit a physical branch. This can save valuable time and provide greater convenience, especially during busy lunch breaks.

Lunchtime banking hours have become a valuable feature for customers who are unable to visit the bank during regular working hours. By offering this specific time window, banks demonstrate their commitment to meeting customer needs and providing convenient banking solutions for individuals with busy schedules.

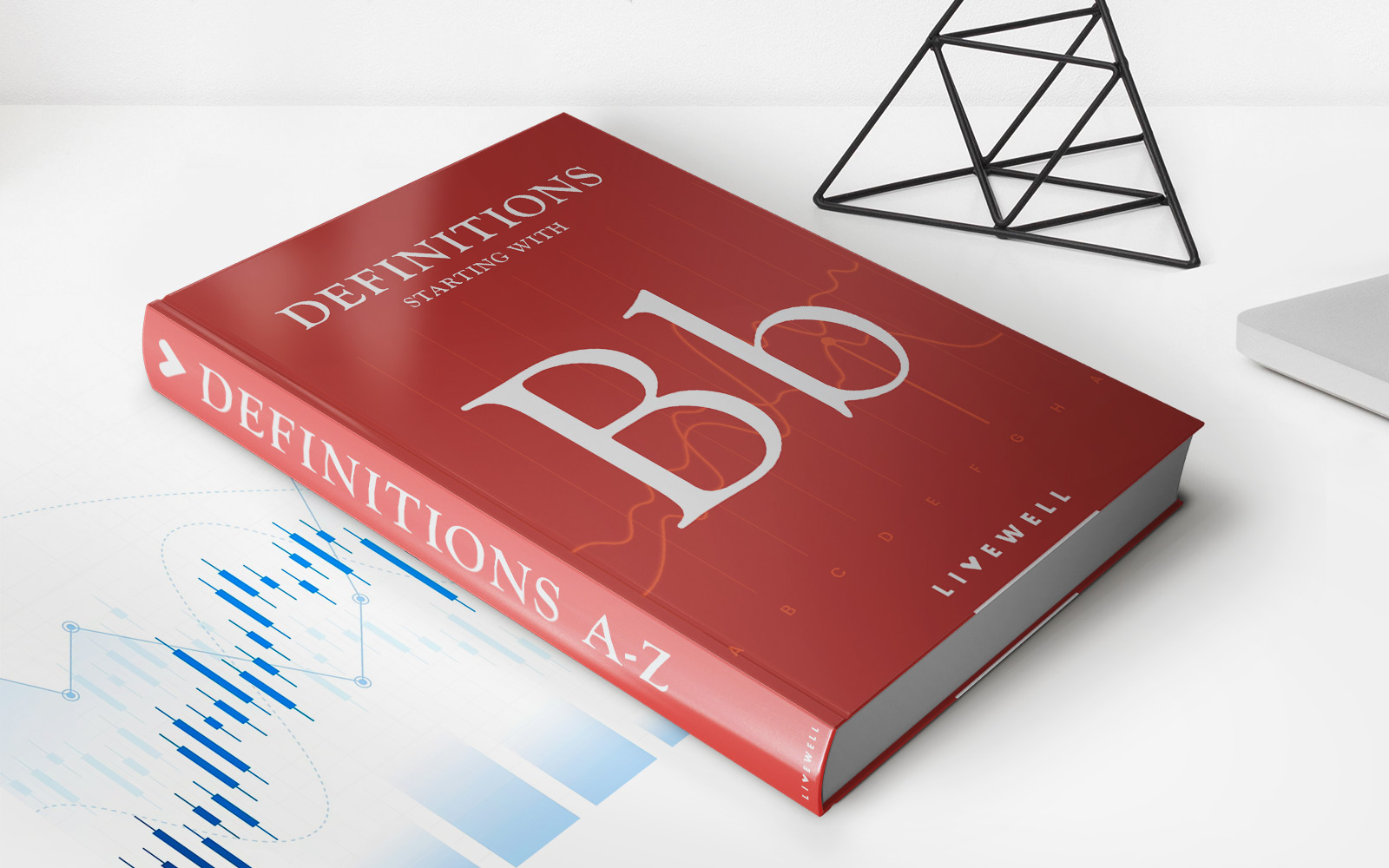

Holiday Banking Hours

Holiday banking hours refer to the operating hours of banks and financial institutions during public holidays and special occasions. These hours may differ from the standard operating hours and are put in place to accommodate customers’ banking needs during these festive or important periods.

The specific holiday banking hours can vary depending on the country, region, and bank. Banks typically provide advance notice to customers regarding any changes to their operating hours during holidays. This information is usually communicated through the bank’s website, social media channels, or in-branch notices.

During holidays, banks may have shortened operating hours or even close for the day, especially on major public holidays such as Christmas, New Year’s Day, and Thanksgiving. In some cases, banks may have limited staff or specific branches open to handle only essential banking services during these times.

It is essential for customers to plan ahead and be aware of the holiday banking hours to avoid any inconvenience. When planning financial transactions or store visits during public holidays, customers should factor in the possibility of limited banking services and adjust their plans accordingly.

Online banking and mobile banking services can be particularly helpful during holidays when physical branches are closed or have limited hours. These digital platforms allow customers to access their accounts, transfer funds, pay bills, and perform other basic banking activities, regardless of the bank’s operating hours.

Customers should also be aware that some holidays may have more significant impacts on banking services than others. For instance, national holidays or major cultural celebrations may result in extended closures or limited services. It is advisable to consult the bank’s official channels or contact customer service for specific information regarding holiday hours.

It is worth noting that while physical branches may be closed during holidays, ATMs are often available for basic banking services such as cash withdrawals and account balance inquiries. This allows customers to access their funds and perform simple transactions even when the bank is closed.

By providing holiday banking hours and alternative banking options, banks strive to ensure that customers can manage their finances and access essential services even during public holidays. It is essential for customers to stay informed about these operating hours and plan their banking activities accordingly during holiday periods.

Conclusion

Understanding banking hours is essential for customers who want to efficiently carry out their financial transactions and access banking services. Whether it’s standard operating hours, extended hours, weekend hours, lunchtime hours, or holiday hours, being aware of these variations allows customers to plan their visits to the bank effectively and make the most of their banking experience.

Standard banking hours form the backbone of a bank’s service availability, providing consistent operating hours from Monday to Friday. Extended banking hours offer greater convenience for customers who have busy schedules or find it challenging to visit during the regular workweek.

Weekend banking hours have proven to be invaluable for those who are unable to visit the bank during weekdays. By providing accessibility on Saturdays and sometimes Sundays, banks ensure that customers can carry out their financial transactions and address their banking needs on weekends.

Lunchtime banking hours are designed to cater to individuals who wish to visit the bank during their lunch breaks, providing a convenient window to conduct banking activities within a shorter time frame.

Holiday banking hours are adjusted to accommodate public holidays and special occasions. While banks may have shortened operating hours or close on major holidays, online banking services and ATMs provide alternative options for customers to manage their finances.

In conclusion, banks strive to offer a range of operating hours to meet the diverse needs of their customers. By understanding the different types of banking hours, individuals can plan their visits accordingly, take advantage of online banking options, and ensure efficient and convenient access to essential banking services.