Finance

What Can You Buy With A Credit Card

Published: November 4, 2023

Discover the power of finance with a credit card. Explore the endless possibilities of what you can buy and enjoy the convenience and rewards.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

A credit card is not just a small piece of plastic. It holds immense power and flexibility in your financial life. With a credit card, you have the ability to make purchases, both big and small, without physically having the cash in hand. From everyday expenses to bigger investments, a credit card can be your trusted companion.

In this article, we will explore the various benefits and possibilities that come with owning a credit card. We will delve into the different things you can buy using a credit card, taking advantage of the convenience and security it offers. Whether it’s making online purchases, booking travel arrangements, enjoying dining experiences, or even getting cash advances, a credit card opens up a world of possibilities.

However, it’s important to remember that a credit card should be used responsibly. It is not free money and must be managed with care. When used wisely, a credit card can provide numerous advantages and perks that can greatly enhance your financial life.

So, let’s dive into the exciting world of credit card purchases and discover what you can buy with this powerful financial tool.

Benefits of Using a Credit Card

Using a credit card comes with a wide range of benefits that can significantly enhance your financial life. Here are some key advantages:

- Rewards and Cash Back: Many credit cards offer rewards programs, allowing you to earn points or cash back on your purchases. These rewards can be redeemed for travel, merchandise, or even statement credits, providing you with additional value for your spending.

- Convenience: With a credit card, you don’t need to carry around large amounts of cash or worry about finding an ATM. You can simply swipe or tap your card to make purchases, saving you time and effort.

- Security: Credit cards come with built-in security features such as fraud protection and zero liability for unauthorized transactions. If your card is lost or stolen, you can report it immediately, limiting your liability and providing peace of mind.

- Build Credit History: Responsible credit card usage can help you build a positive credit history. By making timely payments and keeping your credit utilization low, you can improve your credit score and gain access to better loan and credit options in the future.

- Emergency Fund: Having a credit card can serve as an emergency fund in case of unexpected expenses. It provides a safety net that can be used when needed, allowing you to cover essential costs without depleting your savings.

- Record of Expenses: Credit card statements provide a detailed record of your expenses, making it easier to track and manage your spending. This can be especially helpful when it comes to budgeting and financial planning.

These benefits make credit cards a valuable financial tool when used responsibly. However, it’s important to remember that credit card debt can quickly accumulate if not managed carefully. Always make sure to make timely payments and avoid overspending to fully reap the benefits of using a credit card.

Purchasing Goods and Services

One of the most common uses of a credit card is for purchasing goods and services. Whether you’re shopping at a local store or making online purchases, a credit card provides a convenient and secure payment method. Here are some benefits of using a credit card for this purpose:

- Wide Acceptance: Credit cards are universally accepted, making them a convenient option for making purchases almost anywhere in the world. Whether you’re buying groceries, clothing, electronics, or even paying for services like healthcare or home repairs, a credit card is readily accepted.

- Consumer Protections: When you make a purchase using a credit card, you may receive additional consumer protections. Many credit cards offer extended warranties, purchase protection, and price protection, which can provide peace of mind and added value for your purchases.

- Returns and Disputes: If you need to return a product or dispute a charge, using a credit card can simplify the process. Credit card companies often have dispute resolution processes in place to help resolve any issues that may arise with a purchase.

- Budgeting and Expense Tracking: Credit card statements provide a detailed record of your purchases, making it easier to track your expenses and manage your budget. This enables you to have a clear overview of your spending habits and make adjustments where necessary.

Additionally, some credit cards offer special discounts, cashback, or rewards for specific categories of purchases, such as groceries, gas, or travel. Taking advantage of these rewards programs can help you save money and get additional value from your spending.

However, it’s important to note that using a credit card for purchasing goods and services requires responsible spending habits. It’s crucial to only spend within your means and pay off your credit card balance in full each month to avoid interest charges and accumulating debt. With proper financial management, a credit card can be a valuable tool for making everyday purchases and enjoying the benefits it offers.

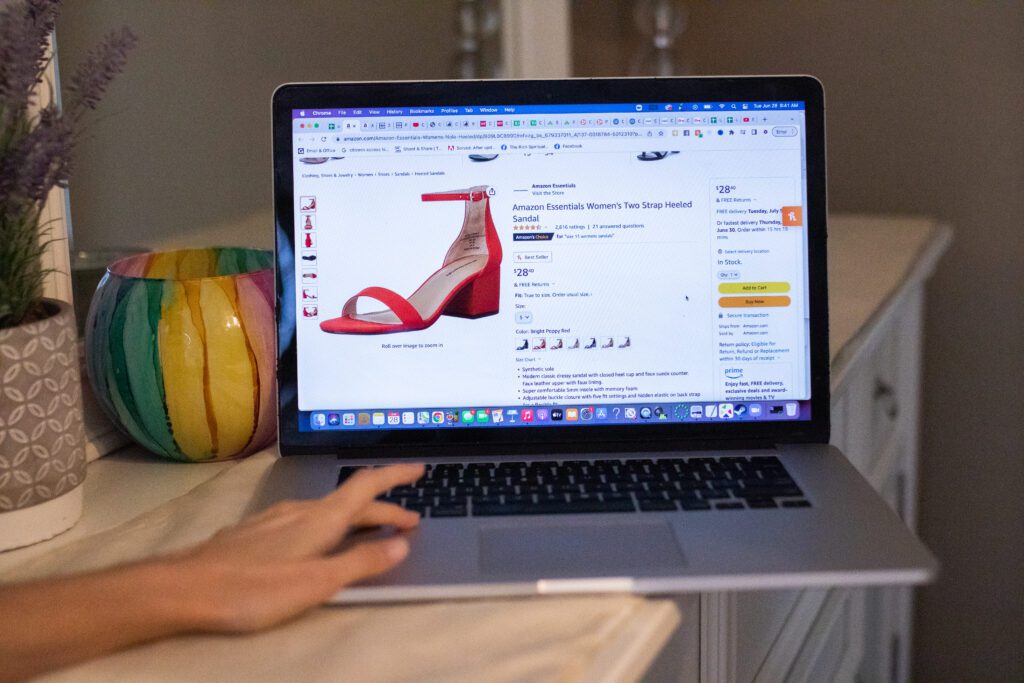

Online Shopping

The advent of e-commerce has revolutionized the way we shop, and credit cards have played a significant role in this transformation. Online shopping has become increasingly popular due to its convenience and accessibility. Credit cards are the preferred payment method for online purchases, and here’s why:

- Security: Credit cards provide a layer of security when shopping online. They offer protection against fraud, and most credit card companies have robust systems in place to detect and prevent unauthorized transactions. Additionally, if you encounter any issues with your purchase, such as an item not being delivered or a fraudulent merchant, you have the opportunity to dispute the charge and potentially receive a refund.

- Convenience and Speed: Using a credit card allows for quick and seamless transactions when shopping online. You can simply enter your card details, verify your identity, and complete your purchase within minutes. This eliminates the need to go through lengthy payment processes or wait for other payment methods to be processed.

- Wide Variety of Options: Credit cards provide access to a vast selection of online retailers and marketplaces. Whether you’re shopping for clothing, electronics, home goods, or even booking travel accommodations, a credit card gives you the flexibility to shop from numerous online platforms.

- Online Rewards and Discounts: Many credit cards offer exclusive rewards and discounts for online purchases. These can include cashback, loyalty points, or special promotions with partner merchants. Taking advantage of these offers can help you save money and get more value from your online shopping.

When shopping online with a credit card, it’s important to practice good security measures. Ensure that you’re shopping from reputable websites, look for secure payment gateways, and be cautious when entering your card details on unfamiliar platforms. Regularly monitor your credit card statements for any unauthorized transactions and report any suspicious activity immediately.

Overall, credit cards provide a safe, convenient, and reliable payment method for online shopping. By using them responsibly, you can enjoy the benefits of a seamless shopping experience and have the flexibility to explore a vast array of online retailers and services.

Travel Expenses

When it comes to travel, credit cards offer a multitude of benefits and perks that can enhance your experience and provide valuable savings. Here’s how credit cards can help with your travel expenses:

- Rewards and Points: Many credit cards offer travel rewards programs that allow you to earn points or miles for every dollar spent. These rewards can be redeemed for flights, hotel stays, car rentals, and more, helping offset the cost of your travel expenses.

- Travel Insurance Coverage: Certain credit cards offer travel insurance coverage when you book your trip using the card. This can include coverage for trip cancellation or interruption, lost baggage, rental car insurance, and even emergency medical expenses. Checking with your credit card provider to understand the extent of travel insurance coverage can potentially save you from purchasing additional insurance policies.

- Airline and Hotel Benefits: Some credit cards provide exclusive benefits when booking flights or hotel stays. This can include access to airport lounges, complimentary upgrades, early check-in, late check-out, and more. These perks can enhance your travel experience and make it more comfortable and enjoyable.

- Foreign Transaction Fees: If you’re traveling internationally, using a credit card can help you avoid expensive foreign transaction fees. Certain credit cards are specifically designed for international travelers and do not charge additional fees for purchases made in foreign currencies.

- Emergency Assistance: In case of emergency while traveling, credit cards often provide emergency assistance services. This can include access to worldwide emergency assistance hotlines, concierge services, and even emergency cash replacement if your card is lost or stolen.

It’s important to choose a credit card that aligns with your travel needs and preferences. Research different travel credit cards and compare their benefits, annual fees, and rewards programs to find the best fit for you.

When using a credit card for travel expenses, make sure to create a budget and plan your spending accordingly. Avoid carrying a balance on your card whenever possible to minimize interest charges. Keeping track of your travel expenses and payments will help you manage your finances effectively.

Whether you’re booking flights, accommodations, or on-the-go purchases, using a credit card for travel expenses can provide significant advantages and make your travel experiences more rewarding.

Dining and Entertainment

Credit cards offer a range of benefits and rewards that can enhance your dining and entertainment experiences. Whether you’re enjoying a meal at a restaurant, grabbing a drink at a bar, or experiencing a night of entertainment, using a credit card can provide added convenience and rewards. Here’s how credit cards can enhance your dining and entertainment experiences:

- Rewards and Cash Back: Many credit cards offer cash back or rewards programs specifically tailored to dining and entertainment expenses. This means that every time you dine out, catch a movie, or attend a concert, you can earn points or cash back that can be redeemed for future purchases or even statement credits.

- Exclusive Discounts: Some credit cards partner with restaurants, theaters, and entertainment venues to offer exclusive discounts and promotions. These discounts can help you save money on dining experiences or ticket purchases, allowing you to enjoy more for less.

- Dining Benefits: Certain credit cards provide additional dining benefits such as access to exclusive restaurant reservation services, priority seating, or even complimentary dining experiences at select partner establishments.

- Convenient Splitting of Bills: Splitting the bill and calculating individual shares can be a hassle, especially in large groups. Credit cards offer the convenience of splitting the bill among multiple individuals, allowing each person to pay their share directly using their own credit card.

- Concierge Services: Some premium credit cards provide concierge services that can assist in booking reservations, securing tickets to popular events, or providing personalized recommendations for dining and entertainment options based on your preferences.

Using a credit card for dining and entertainment expenses not only offers added convenience and rewards but also provides a layer of security. Credit cards typically come with fraud protection and zero liability for unauthorized transactions, ensuring that your transactions are secure.

However, it’s important to use your credit card responsibly and within your budget. It’s easy to overspend when dining out or indulging in entertainment activities, so make sure to set a limit and stick to it. Paying off your credit card balance in full each month will ensure that you do not accumulate unnecessary interest charges.

By leveraging the benefits and rewards that credit cards offer, you can enhance your dining and entertainment experiences while also enjoying the financial advantages they provide.

Subscription Services

Subscription services have become increasingly popular in recent years, offering a convenient and cost-effective way to access a wide range of products and services. Credit cards play a significant role in managing these recurring payments, providing numerous benefits for subscribers. Here are some advantages of using a credit card for subscription services:

- Convenience: Using a credit card for subscription services simplifies the payment process. You can set up automatic payments, ensuring that your subscription is renewed seamlessly without the need for manual intervention each month.

- Rewards and Discounts: Many credit cards offer rewards or cashback on select categories, including subscription services. This means that you can earn rewards or cash back on your regular subscriptions, effectively getting additional value for your payments.

- Expense Tracking: Credit card statements provide a detailed record of your subscription payments, making it easier to track your expenses. This allows you to have a clear overview of the total amount spent on subscription services and can aid in managing your budget.

- Fraud Protection: Credit cards offer fraud protection, providing an added layer of security for your subscription payments. If there are any unauthorized charges or if the service provider fails to deliver as promised, you have the ability to dispute the charge and potentially receive a refund.

When using a credit card for subscription services, it’s important to review the terms and conditions of each subscription carefully. Understand the cancellation policy and any potential renewal fees to avoid any surprises or unwanted charges on your credit card statement. Additionally, regularly review your subscriptions to ensure that you are still getting value from each service and cancel any that are no longer necessary.

By utilizing a credit card for subscription services, you can enjoy the convenience of automatic payments, take advantage of rewards and discounts, and effectively manage your expenses. Just remember to use your credit card responsibly and stay within your budget to fully reap the benefits.

Gasoline and Transportation

Using a credit card for gasoline and transportation expenses can provide various benefits and savings opportunities. Whether you’re fueling up your car, purchasing public transportation passes, or booking rideshare services, here’s how credit cards can enhance your experience:

- Rewards and Cash Back: Many credit cards offer rewards or cash back on gas station purchases and transportation expenses. This means that every time you fill up your gas tank or pay for transportation-related expenses, you can earn points, miles, or cash back that can be redeemed for future purchases or statement credits.

- Discounts on Gasoline: Some credit cards have partnerships with specific gas station chains and offer discounts on gasoline purchases. These discounts can help you save money every time you fuel up your vehicle.

- Travel Benefits: Certain credit cards provide travel benefits that can be utilized for transportation expenses. These benefits can include airline statement credits, access to airport lounge programs, or even discounts on rental cars or rideshare services.

- Increased Security: Paying for gasoline and transportation expenses with a credit card offers a higher level of security compared to using cash. Credit cards come with fraud protection and zero liability for unauthorized transactions, providing peace of mind when making these payments.

By utilizing a credit card for your gasoline and transportation expenses, you can earn rewards or cash back, access discounts, and enjoy added security. However, it’s important to use your credit card responsibly and avoid overspending. Make sure to pay off your balance in full each month to avoid accumulating unnecessary interest charges.

Additionally, some credit cards may offer specific benefits or rewards for certain types of transportation, such as commuter benefits for public transportation or rewards for rideshare services like Uber or Lyft. Researching and choosing a credit card that best aligns with your transportation needs can help you maximize your savings and rewards.

Overall, credit cards can enhance your experience when it comes to gasoline and transportation expenses, allowing you to earn rewards, access discounts, and enjoy the convenience and security that they provide.

Insurance Premiums

Using a credit card to pay for your insurance premiums can offer several advantages and benefits. From auto insurance to health insurance and everything in between, here’s how credit cards can enhance your experience when it comes to paying insurance premiums:

- Rewards and Cash Back: Many credit cards offer rewards or cash back on insurance payments. This means that every time you pay your insurance premiums with your credit card, you can earn points, miles, or cash back that can be redeemed for future purchases or statement credits.

- Convenient Payment Option: Paying insurance premiums with a credit card offers convenience and flexibility. You can set up automatic payments, ensuring that your premiums are paid on time without the need for manual intervention each month or quarter.

- Expense Tracking: Credit card statements provide a detailed record of your insurance payments, making it easier to track your expenses. This enables you to have a clear overview of your insurance costs and can help you manage your budget effectively.

- Utilizing Credit Card Benefits: Some credit cards offer specific insurance-related benefits. For example, certain premium credit cards may provide travel insurance, rental car insurance, or extended warranty coverage. Paying your insurance premiums with these credit cards can offer added protection and benefits that may not be available with other payment methods.

It’s important to note that while credit cards offer these advantages, you should only use them if you can pay off the balance in full each month. Otherwise, you may incur interest and fees that can outweigh the benefits gained from using the credit card.

Before opting to pay your insurance premiums with a credit card, check with your insurance provider to ensure that they accept credit card payments. Also, be aware of any associated transaction fees that may be charged for using a credit card as a payment method.

By utilizing a credit card for your insurance premiums, you can earn rewards or cash back, enjoy the convenience of automatic payments, and have a record of your expenses. Just ensure that you are using your credit card responsibly and within your budget to maximize the benefits and rewards it offers.

Cash Advances

While credit cards are primarily used for making purchases, they also offer a feature called cash advances, which allows you to withdraw cash from your credit card. Cash advances can be useful in certain situations, but it’s important to understand the potential implications and use them wisely. Here’s what you need to know:

- Convenience: Cash advances can be a convenient option when you need immediate access to cash. Whether you’re in a location where credit cards are not accepted or simply require physical currency, a cash advance provides a solution.

- Emergency Situations: Cash advances can come in handy during emergencies when you need funds quickly. It can help cover unexpected expenses or bridge a temporary financial gap.

- Higher Interest Rates: Cash advances typically carry higher interest rates compared to regular credit card purchases. Interest is usually charged from the day the cash advance is taken, making it important to pay off the balance as soon as possible to minimize interest charges.

- Cash Advance Fees: In addition to higher interest rates, cash advances often come with upfront fees. These fees can be either a percentage of the cash advance amount or a fixed fee, and they contribute to the cost of obtaining cash from your credit card.

- Impact on Credit Score: Similar to any credit card usage, taking cash advances can impact your credit score. Failing to pay off the cash advance balance or carrying a high balance can negatively affect your credit utilization ratio, which accounts for a significant part of your credit score.

- Alternative Options: Before considering a cash advance, explore alternative options such as personal loans, lines of credit, or borrowing from friends or family. These options may offer more favorable terms and save you from the high interest rates and fees associated with cash advances.

It’s important to carefully evaluate whether a cash advance is the right choice for your situation. Consider the associated costs, interest rates, and available alternatives before proceeding with a cash advance from your credit card. If you do decide to proceed, make sure to pay off the balance as quickly as possible to minimize interest charges and avoid any negative impact on your credit.

Remember, responsible credit card usage is crucial to maintaining a healthy financial standing. While cash advances can provide immediate access to funds, they should be used sparingly and with caution to avoid falling into a cycle of debt.

Conclusion

Credit cards offer numerous benefits and advantages when it comes to making purchases and managing our finances. From the convenience of online shopping to the rewards and cash back on everyday expenses, credit cards have become an essential tool in our financial lives. However, it’s important to use credit cards responsibly and within our means to fully enjoy their benefits.

By using credit cards for purchasing goods and services, we gain access to a wide range of products and experiences. Online shopping has become effortless and secure, while dining and entertainment experiences are enhanced through rewards, discounts, and added conveniences. For travel expenses, credit cards provide travel rewards, insurance coverage, and exclusive benefits that make our journeys more enjoyable.

Subscription services can be effortlessly managed through automatic payments, and credit cards offer convenience, reward points, and additional security in the process. Even for gasoline and transportation expenses, credit cards provide rewards and discounts, making our everyday commuting more rewarding.

When it comes to insurance premiums, credit cards offer rewards, cash back, and convenient payment options. Lastly, while cash advances can provide quick access to cash, it’s important to use them judiciously and understand the associated fees and risks.

Ultimately, the key to making the most out of credit cards is responsible usage. Paying off the balance in full each month, staying within our budget, and avoiding unnecessary interest charges are essential practices to maintain a healthy financial status.

As you explore the possibilities of what you can buy with a credit card, make sure to choose a credit card that aligns with your lifestyle and financial goals. Consider the rewards, benefits, and fees associated with each card to find the best fit for your needs.

By utilizing your credit card wisely and leveraging its benefits, you can enjoy a seamless and rewarding financial experience while making your purchases, managing expenses, and securing your financial future. So, go ahead and unlock the potential of your credit card to improve your financial journey!