Finance

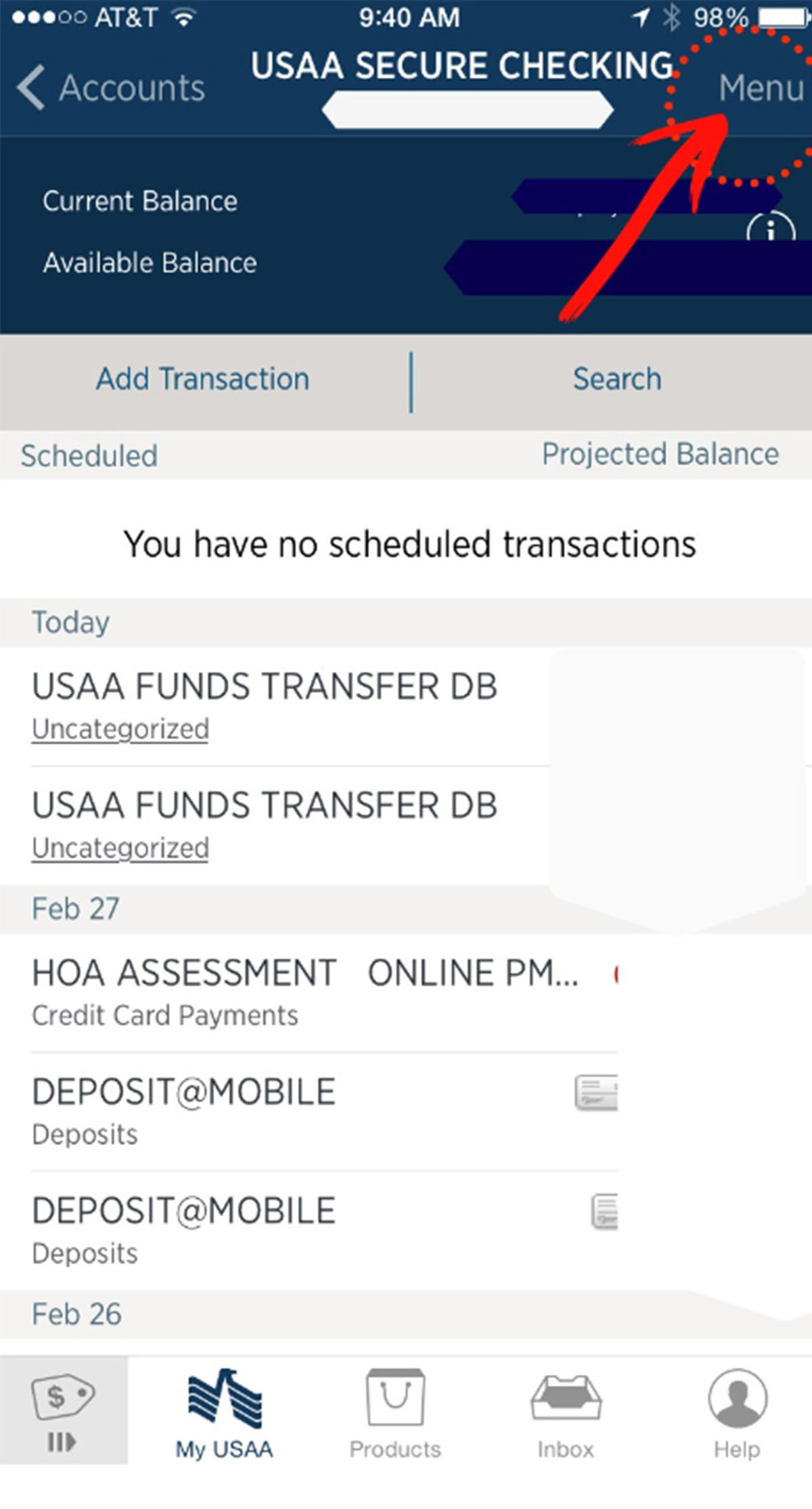

What Does Credit Adjustment FDES NNF Mean

Modified: February 21, 2024

Discover the meaning of Credit Adjustment FDES NNF in finance and how it affects your financial status. Gain insights on this crucial financial term.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance, understanding complex terms and concepts is vital to making informed decisions. One such term, which may sound like a jargon to many, is “credit adjustment FDES NNF.” This is an important aspect of the financial industry that plays a crucial role in determining the overall creditworthiness of individuals, companies, and even governments.

In simple terms, credit adjustment refers to the assessment made by financial institutions or credit agencies to evaluate the credit risk associated with a particular borrower or entity. It is a means of adjusting the credit rating or score based on various factors to determine the likelihood of a borrower defaulting on their financial obligations.

The abbreviation “FDES” stands for Financial Definition and Evaluation System, which is a sophisticated algorithm used by credit agencies to evaluate the creditworthiness of individuals and entities. On the other hand, “NNF” refers to the Non-Normalized Factor, which is the adjustment factor applied to the credit rating.

Understanding the intricacies of credit adjustment FDES NNF is essential for anyone seeking a loan, applying for credit, or evaluating the creditworthiness of their business partners. By diving deeper into this concept and exploring the factors that influence credit adjustment, individuals can make more informed financial decisions and mitigate potential risks.

This article aims to provide a comprehensive overview of credit adjustment FDES NNF, its definition, explanation, and the factors that influence it. By the end of this article, readers will have a better understanding of the importance of this concept and its implications in the financial world.

Definition of Credit Adjustment

Credit adjustment is a process used by financial institutions and credit agencies to assess the credit risk associated with a borrower or entity. It involves adjusting the credit rating or score based on various factors to determine the likelihood of default. This adjustment is crucial in determining the interest rates, loan terms, and overall creditworthiness of individuals, businesses, and even governments.

When applying for a loan or seeking credit, lenders rely on credit ratings provided by credit agencies to evaluate the borrower’s ability to repay the debt. However, a standard credit rating might not capture the complete picture of a borrower’s financial situation. That’s where credit adjustment comes into play.

The credit adjustment process takes into account several factors that can impact a borrower’s creditworthiness. These factors may include the borrower’s financial history, income stability, debt-to-income ratio, employment status, and other relevant information. The credit agencies analyze these factors to determine the risk associated with lending money to a particular borrower.

The primary purpose of credit adjustment is to provide a more accurate assessment of a borrower’s creditworthiness. By considering the unique circumstances and risk factors associated with each borrower, credit adjustment ensures a more personalized evaluation. This process allows lenders to make informed decisions and offer appropriate loan terms and interest rates that reflect the actual risk involved.

It is important to note that credit adjustment can work in two directions – upward and downward. An upward adjustment indicates an increased credit risk and could result in a lower credit rating, making it more challenging to obtain credit or secure favorable loan terms. Conversely, a downward adjustment indicates a reduced credit risk and may lead to a higher credit rating, making it easier to access credit and potentially securing better loan terms.

In summary, credit adjustment is a critical process that ensures a more accurate evaluation of a borrower’s creditworthiness. By considering various factors, lenders can make informed decisions and tailor credit offers to reflect the actual risk involved. Understanding credit adjustment is essential for borrowers and entities looking to access credit or evaluate their creditworthiness.

Overview of FDES and NNF

In the realm of credit adjustment, two key elements come into play: FDES and NNF. Understanding these concepts is essential to comprehend the intricacies of credit adjustment FDES NNF.

FDES (Financial Definition and Evaluation System) is a sophisticated algorithm used by credit agencies to evaluate the creditworthiness of individuals, businesses, and governments. It takes into account various factors, such as payment history, credit utilization, length of credit history, and more, to generate a credit rating or score. The FDES algorithm uses a complex mathematical formula to assess the risk profile of the borrower and determine an initial credit rating.

NNF (Non-Normalized Factor) is the adjustment factor applied to the credit rating generated by the FDES algorithm. It takes into consideration additional factors that may impact creditworthiness but are not accounted for in the initial credit rating. The NNF is a crucial component of credit adjustment, as it allows for a more accurate evaluation of a borrower’s credit risk.

The NNF can be influenced by various factors, including but not limited to:

- Current economic conditions: The overall economic climate, such as recession or inflation, can affect an individual’s or business’s ability to repay their debts. This factor is taken into account during the credit adjustment process.

- Industry-specific considerations: Certain industries may carry more risk than others due to market volatility, regulatory changes, or other industry-specific factors. The NNF considers these factors to adjust the credit rating accordingly.

- Geo-specific factors: The location of the borrower can influence their credit risk. Factors such as political stability, economic conditions, and legal environment can impact the NNF and, consequently, the credit rating.

- Special circumstances: Unforeseen events like natural disasters, pandemics, or legal issues can have a significant impact on an individual’s or business’s financial stability. These circumstances are taken into consideration during the credit adjustment process.

Overall, the FDES and NNF work together to provide a more holistic evaluation of a borrower’s creditworthiness. The FDES sets the initial credit rating based on various factors, while the NNF adjusts the credit rating to account for additional risk factors that may not be captured in the initial assessment.

Understanding the FDES and NNF is crucial for borrowers, lenders, and credit agencies. It allows lenders to make more informed decisions, borrowers to take proactive steps to improve their creditworthiness, and credit agencies to provide a more accurate representation of credit risk.

Explanation of Credit Adjustment FDES NNF

Credit adjustment FDES NNF refers to the process of modifying a borrower’s credit rating generated by the Financial Definition and Evaluation System (FDES) through the application of the Non-Normalized Factor (NNF). This adjustment is made to ensure that the credit rating accurately reflects the borrower’s creditworthiness by considering additional risk factors that may not be accounted for in the initial assessment.

The FDES algorithm takes into account various factors, such as payment history, credit utilization, length of credit history, and more, to generate an initial credit rating. This rating serves as a starting point and provides a baseline understanding of the borrower’s creditworthiness. However, it may not fully capture the unique circumstances and risk factors associated with each borrower.

The NNF comes into play to address this limitation. It considers additional factors that can impact the borrower’s credit risk and adjusts the credit rating accordingly. This adjustment ensures a more accurate evaluation of the borrower’s overall creditworthiness. The specific factors taken into consideration for the NNF adjustment can vary depending on the credit agency and the lending institution.

For example, if the FDES algorithm generates a credit rating of “A” for a borrower, the NNF adjustment could result in an upward or downward modification of the credit rating. If the borrower is involved in an industry that is experiencing significant volatility, the NNF adjustment could potentially decrease the credit rating to “A-,” reflecting increased risk. On the other hand, if the borrower has a strong credit history and stable income, the NNF adjustment could lead to an upward modification, resulting in an “A+” credit rating.

It’s important to note that the NNF adjustment is not a fixed formula or a standardized process. Credit agencies and lending institutions have their own proprietary methods for determining the NNF adjustment, based on their assessment of additional risk factors. These factors may include current economic conditions, industry-specific considerations, geo-specific factors, and special circumstances.

Overall, credit adjustment FDES NNF is a mechanism that allows for a more accurate evaluation of a borrower’s creditworthiness. By incorporating additional risk factors and adjusting the credit rating generated by the FDES algorithm, lenders can make more informed decisions regarding loan approvals, interest rates, and loan terms, while borrowers can better understand their credit standing and take steps to improve it, if needed.

Factors Influencing Credit Adjustment FDES NNF

Credit adjustment FDES NNF takes into account a variety of factors that can influence a borrower’s creditworthiness and risk profile. These factors help credit agencies and lenders make more accurate adjustments to the initial credit rating generated by the Financial Definition and Evaluation System (FDES). Understanding the factors that influence credit adjustment FDES NNF is crucial for borrowers, as it can impact their ability to obtain credit and the terms they are offered.

Here are some key factors that can influence credit adjustment:

- Payment History: A borrower’s track record of making timely payments is one of the most critical factors considered in credit adjustment. Consistently missed or late payments can negatively affect the credit rating and increase the NNF adjustment.

- Credit Utilization: The ratio of the borrower’s credit card balances to their credit limits plays a significant role in credit adjustment. Higher credit utilization suggests a higher risk of default and may result in a downward NNF adjustment.

- Length of Credit History: The length of time a borrower has held credit accounts influences credit adjustment. A longer credit history provides more data points for evaluation and may lead to a more favorable NNF adjustment.

- Debt-to-Income Ratio: The ratio of a borrower’s total debt to their income is an important measure of their ability to manage debt. Higher debt-to-income ratios may lead to a higher NNF adjustment, indicating increased credit risk.

- Employment Status and Stability: The stability of a borrower’s employment can impact credit adjustment. Lenders prefer borrowers with steady employment as it demonstrates an ability to meet financial obligations. Unemployment or frequent job changes may result in a higher NNF adjustment.

- Current Economic Conditions: The overall economic climate, such as recession or inflation, can impact credit adjustment. Unfavorable economic conditions may lead to a higher NNF adjustment, reflecting increased credit risk.

- Industry-Specific Considerations: Different industries have varying levels of risk and volatility. Credit agencies may consider industry-specific factors, such as market trends or regulatory changes, in determining the NNF adjustment.

- Geo-Specific Factors: The location of the borrower can also influence credit adjustment. Factors such as political stability, economic conditions, and legal environment can impact the NNF adjustment, particularly for borrowers operating in international markets.

- Special Circumstances: Unforeseen events, such as natural disasters or legal issues, can have a significant impact on a borrower’s creditworthiness. These special circumstances are taken into account during credit adjustment and may result in varying NNF adjustments.

It’s important to remember that the specific factors and weightage assigned may vary between credit agencies and lenders. Understanding these factors can help borrowers take proactive steps to improve their creditworthiness and mitigate potential risks.

Importance of Understanding Credit Adjustment FDES NNF

Understanding credit adjustment FDES NNF is of utmost importance for individuals, businesses, and lenders alike. It plays a significant role in determining creditworthiness, loan approvals, interest rates, and overall financial stability. Here are some reasons why understanding credit adjustment is crucial:

- Accurate Credit Evaluation: Credit adjustment ensures a more accurate evaluation of a borrower’s creditworthiness by considering additional risk factors. This helps lenders make informed decisions and offer loan terms and interest rates that reflect the true level of risk associated with a borrower.

- Better Loan Terms: A thorough understanding of credit adjustment FDES NNF allows borrowers to proactively improve their financial standing. By addressing factors that may negatively impact their credit rating, borrowers can potentially secure better loan terms, including lower interest rates and more favorable repayment terms.

- Risk Mitigation: Credit adjustment helps lenders and credit agencies mitigate the risks associated with lending. By adjusting the credit rating to reflect additional risk factors, lenders can make more informed decisions and reduce the likelihood of defaults or financial losses.

- Opportunity for Improvement: Understanding credit adjustment enables borrowers to identify areas for improvement in their credit profile. By addressing factors that contribute to a higher NNF adjustment, borrowers can take steps to enhance their creditworthiness and increase their chances of obtaining credit in the future.

- Access to Credit: For individuals and businesses, access to credit is often essential for growth, investments, and financial stability. Understanding credit adjustment FDES NNF helps borrowers position themselves as attractive candidates for credit, increasing their chances of loan approvals.

- Business Partner Evaluation: When evaluating potential business partners, understanding credit adjustment FDES NNF empowers individuals and businesses to assess their partner’s creditworthiness accurately. This knowledge helps in making informed decisions and mitigating financial risks associated with partnering or extending credit to other entities.

- Financial Planning: Understanding credit adjustment allows individuals and businesses to incorporate their creditworthiness into their financial planning. By comprehending the factors that influence credit adjustment, borrowers can make informed decisions regarding their financial goals, such as budgeting, savings, and debt management.

In summary, understanding credit adjustment FDES NNF is crucial for borrowers and lenders alike. It provides a more accurate evaluation of creditworthiness, facilitates better loan terms, mitigates risks, allows for opportunities for improvement, and enables informed decisions in financial planning and business partnerships. By grasping the intricacies of credit adjustment, individuals and businesses can navigate the financial landscape more effectively and enhance their overall financial well-being.

Conclusion

In the complex world of finance, understanding credit adjustment FDES NNF holds great significance. It allows individuals, businesses, and lenders to navigate the realm of credit with greater accuracy, making informed decisions and mitigating risks effectively.

Credit adjustment serves as a vital mechanism that ensures the credit rating reflects the borrower’s true creditworthiness. By considering additional risk factors through the Non-Normalized Factor (NNF) after the initial assessment by the Financial Definition and Evaluation System (FDES), lenders can offer appropriate loan terms and interest rates that align with the borrower’s risk profile.

The factors influencing credit adjustment FDES NNF encompass a wide range of variables, such as payment history, credit utilization, employment stability, industry-specific considerations, and more. Each factor plays a role in shaping the borrower’s creditworthiness and the subsequent NNF adjustment made to their credit rating.

Understanding credit adjustment is crucial for borrowers as it presents the opportunity to take proactive steps to improve creditworthiness, secure better loan terms, and access credit when needed. For lenders and credit agencies, credit adjustment helps in mitigating risks associated with lending by providing a more accurate assessment of borrower’s creditworthiness.

Moreover, comprehending credit adjustment FDES NNF aids in evaluating the creditworthiness of potential business partners and incorporating credit-related factors into financial planning. It empowers individuals and businesses to make informed decisions and mitigate financial risks associated with partnerships and extending credit to other entities.

To sum up, understanding credit adjustment FDES NNF is vital for all parties involved in the financial industry. It enables borrowers to enhance their creditworthiness, access credit, and secure better loan terms. For lenders and credit agencies, it allows for accurate risk assessment and better decision-making. By grasping the intricacies of credit adjustment, individuals, businesses, and lenders can navigate the world of credit with confidence and pave the way for a sound financial future.