Finance

What Does Day Only Mean In Stocks

Published: January 18, 2024

Discover the meaning of "day only" in stocks and how it relates to finance. Gain insights into the significance of this term for traders and investors.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to the world of stocks and investing, there are various terms and concepts that can seem overwhelming for beginners. One such term is “day only” trading. If you’re new to the world of stocks, you may be wondering, “What does day only mean in stocks?”

Day only trading refers to a specific trading strategy where an investor buys and sells securities within the same trading day. In other words, any positions opened during the day are closed before the market closes, and no trades are held overnight. This approach is also known as “intraday trading” or “day trading,” and it differs from other strategies where positions are held for a longer duration.

The purpose of day only trading is to take advantage of short-term price fluctuations and capitalize on intraday market movements. Traders who adopt this strategy aim to make profits from small price changes that occur during the day, rather than relying on long-term trends or overnight developments.

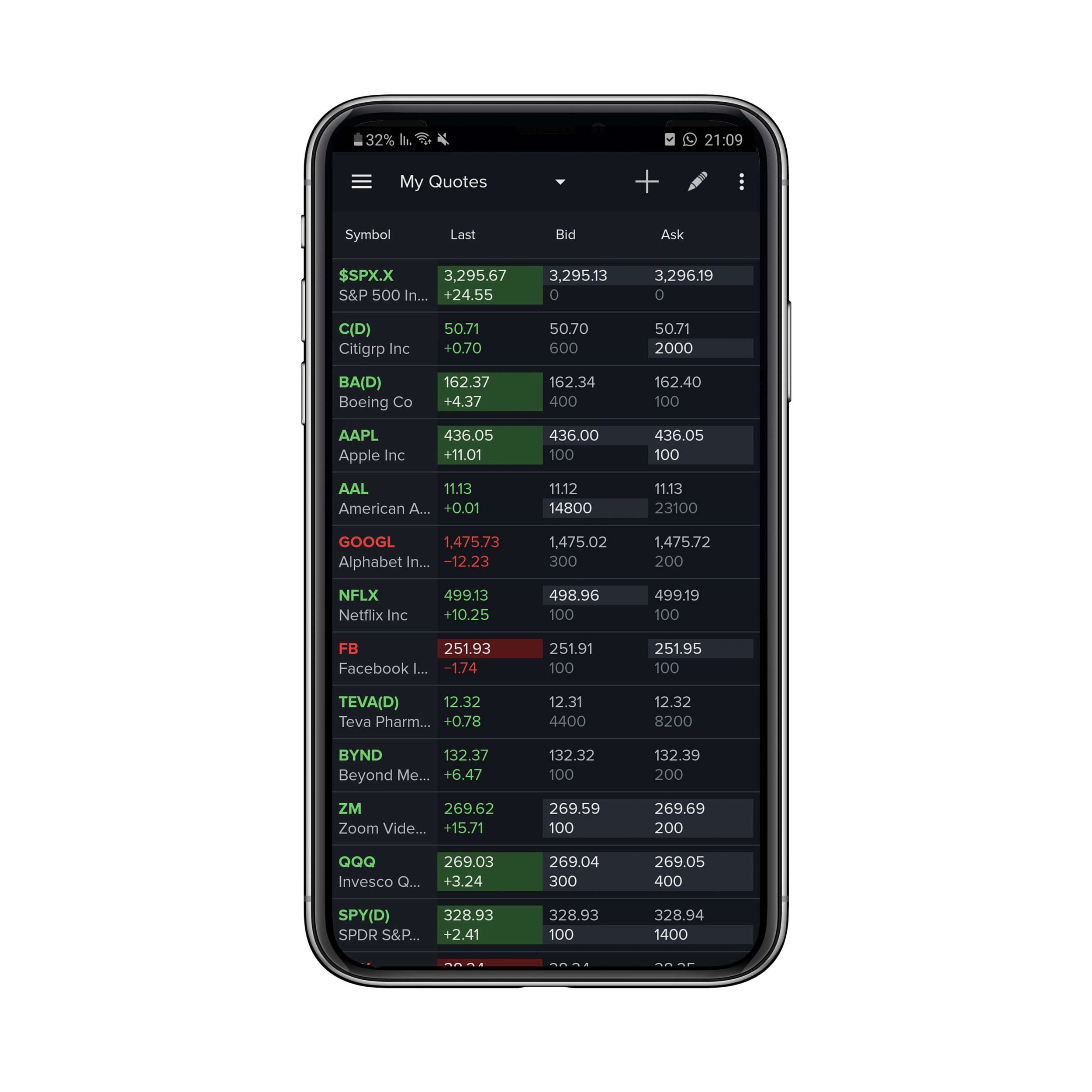

In day only trading, investors heavily rely on technical analysis, chart patterns, and indicators to make quick decisions and execute trades. Timing is crucial, as positions are typically held for only a few minutes or hours. Traders closely monitor stock prices, volume, and market trends to identify potential trading opportunities and execute trades swiftly.

Day only trading requires a high level of focus, discipline, and risk management. It is a fast-paced and highly volatile strategy that requires traders to stay updated with market news and developments. While it can offer potential high returns, it also carries significant risks, which we will explore further in this article.

In the following sections, we will delve deeper into the understanding of day only trading and why it is significant. We will also discuss the risks and limitations associated with this approach, as well as popular day only trading strategies and some tips for aspiring day only traders.

Understanding Day Only in Stocks

Day only trading is a trading strategy that focuses on short-term market movements. It involves buying and selling securities within the same trading day, with no positions held overnight. To better understand the concept, let’s take a closer look at the key elements of day only trading:

- Timeframe: Day only trading operates on an intraday timeframe. Traders open and close positions within the span of a few minutes to a few hours, aiming to capitalize on short-term price fluctuations.

- Market Volatility: Day only trading thrives in volatile market conditions. Traders look for stocks that exhibit significant price movements and high trading volumes, as these present opportunities for potential profits.

- Technical Analysis: Technical analysis plays a vital role in day only trading. Traders use various chart patterns, technical indicators, and price action analysis to spot potential entry and exit points for their trades.

- Risk Management: Effective risk management is crucial in day only trading. Traders implement stop-loss orders to limit potential losses and set profit targets to secure gains. They also carefully manage their position sizes to control risk exposure.

Day only trading is often associated with high trading volumes, as frequent buying and selling occur throughout the trading day. Traders use trading platforms that provide real-time market data, level II quotes, and advanced charting tools to execute trades quickly and take advantage of short-lived opportunities.

It’s important to note that day only trading is distinct from other trading approaches, such as swing trading or long-term investing. While swing traders hold positions for multiple days or weeks, day only traders focus on short-term movements and aim to close all their positions by the end of the trading day.

Day only trading requires traders to make quick decisions based on technical analysis and market trends. They need to stay updated with relevant news, economic releases, and corporate announcements that may impact the price movements of the stocks they are trading.

This strategy appeals to active traders who seek immediate gratification through frequent trading and enjoy the fast-paced nature of the market. However, it’s important to recognize that day only trading comes with its own set of risks and limitations, which we will explore in the next section.

Importance of Day Only Trading

Day only trading holds significant importance in the world of stock market investing. Here are a few reasons why this trading strategy is considered important:

- Leveraging Intraday Opportunities: Day only trading allows investors to capitalize on short-term price fluctuations that occur within a single trading day. By actively participating in the market and making quick trading decisions, traders can potentially profit from the intraday market movements.

- Flexibility and Adaptability: Day only trading offers a high degree of flexibility and adaptability. Traders have the freedom to choose which stocks they want to trade and can adjust their strategies quickly based on market conditions. This flexibility allows them to take advantage of various market situations and adapt to changing trends.

- Enhancing Trading Skills: Day only trading requires constant practice and analysis. As traders frequently execute trades and monitor charts, they develop a better understanding of market dynamics, technical indicators, and trading patterns. This constant engagement helps to sharpen their trading skills over time.

- Efficient Use of Capital: Day only trading allows investors to generate returns on their capital within a short period. Instead of tying up their funds in long-term investments, traders can use their capital efficiently by actively engaging in intraday trading and potentially earn profits through multiple trades throughout the day.

- Adapting to High Volatility: Day only trading thrives in volatile market conditions. While volatility is often seen as a risk, for day traders, it offers an opportunity to profit from rapid price movements. By staying focused and being adept at analyzing market trends, day traders can navigate the ups and downs of the market and exploit volatility to their advantage.

The importance of day only trading is also evident in the larger financial ecosystem. The liquidity provided by day traders contributes to overall market efficiency and ensures that there are always buyers and sellers in the market. This liquidity is essential for attracting institutional investors and maintaining a healthy trading environment.

It’s worth noting that day only trading may not be suitable for all investors. It requires a certain level of expertise, time commitment, and diligent risk management. Traders must have the ability to make quick decisions, control their emotions, and adapt to the fast-paced nature of the market.

In the next section, we will explore the risks and limitations associated with day only trading, as it’s important to have a comprehensive understanding of the potential challenges before diving into this trading strategy.

Risks and Limitations of Day Only Trading

While day only trading can offer potential rewards, it also comes with its fair share of risks and limitations. Traders need to be aware of these factors before engaging in this trading strategy. Here are some of the key risks and limitations associated with day only trading:

- Market Volatility: While volatility can present lucrative trading opportunities, it also amplifies the risks. Intraday price movements can be swift and unpredictable, leading to potential losses if trades are not executed with precision. Traders must have the experience and skill to navigate highly volatile markets.

- Emotional Impact: Day only trading can be emotionally challenging. The fast-paced nature of intraday trading can induce stress and anxiety, leading to impulsive decision-making. Traders must develop strong emotional discipline and manage their emotions effectively to make rational trading decisions.

- Execution Risks: The timing of execution plays a crucial role in day only trading. Slippage, where the actual execution price differs from the expected price, can occur, especially when trading highly volatile stocks with large spreads. Traders need to consider execution risks and factor them into their trading strategies.

- Margin Requirements: Day only trading often involves using leverage through margin accounts. While leverage can amplify profits, it also increases the potential for losses. Traders must carefully manage their margin requirements and be aware of the risks of trading on borrowed funds.

- Limited Trading Opportunities: Day only traders are limited to trading hours, typically between the opening and closing hours of the stock exchange. This limits the number of trading opportunities available, especially for traders located in different time zones. Traders must be selective in choosing the right stocks and identify the most opportune times to enter and exit trades.

Additionally, it’s important to consider the costs associated with day only trading, such as transaction fees, commissions, and market data subscriptions. These expenses can significantly impact overall profitability, especially for frequent traders who execute numerous trades each day.

It’s crucial for day only traders to have a solid risk management plan in place. Setting strict stop-loss orders and profit targets can help mitigate potential losses and protect capital. Traders should also focus on managing their position sizes to control their risk exposure and avoid overtrading.

Overall, day only trading requires a comprehensive understanding of the risks involved and a disciplined approach to trading. Traders should be prepared to invest time in continuous learning, observing market trends, and refining their trading strategies.

Next, let’s explore some popular day only trading strategies that traders employ to navigate the market.

Day Only Trading Strategies

Day only trading involves employing various strategies to identify potential trading opportunities and execute trades within the same trading day. Here are some popular day only trading strategies that traders often use:

- Breakout Trading: This strategy involves identifying stocks that are experiencing a significant price breakout above a key resistance level or below a key support level. Traders aim to enter the trade as the price breaks out and ride the momentum for potential profits.

- Reversal Trading: Reversal trading focuses on stocks that have experienced a significant price move in one direction and are expected to reverse course. Traders watch for signs of trend exhaustion, such as overbought or oversold conditions, and look for potential entry points to profit from the reversal.

- Momentum Trading: Momentum trading involves capitalizing on stocks that are exhibiting strong upward or downward momentum. Traders look for stocks with high trading volume and significant price movement, aiming to ride the momentum and profit from the continuation of the trend.

- Scalping: Scalping is a strategy that involves making multiple quick trades throughout the day to capture small price movements. Traders aim to profit from small, incremental gains by entering and exiting trades within seconds or minutes. Scalping requires a high level of focus and quick decision-making skills.

- News Trading: News trading involves taking advantage of significant market-moving news events. Traders monitor news releases, corporate announcements, economic indicators, and other relevant news sources to identify stocks that are likely to experience volatility and make trading decisions based on the news.

These strategies are not exhaustive, and many traders develop their own personalized approaches based on their risk tolerance, trading style, and market analysis. It’s crucial for day only traders to thoroughly backtest and validate their chosen strategies before implementing them in live trading.

Successful day only traders also emphasize the importance of having a well-defined trading plan. This plan includes specific entry and exit criteria, risk management techniques, and rules for capital allocation. By sticking to a consistent and disciplined trading plan, day only traders can increase their likelihood of success in the market.

However, it’s important to remember that no strategy guarantees profits, and losses are an inherent part of trading. Traders should always exercise caution, practice proper risk management, and continuously adapt their strategies based on market conditions.

In the next section, we will provide some valuable tips for those considering day only trading as a career or a part-time endeavor.

Tips for Day Only Traders

Day only trading can be a challenging endeavor, but with the right approach and mindset, traders can increase their chances of success. Here are some valuable tips to consider for aspiring day only traders:

- Educate Yourself: Start by building a strong foundation of knowledge about the stock market, technical analysis, and various day only trading strategies. Take advantage of educational resources such as books, online courses, webinars, and reputable trading platforms that offer educational materials.

- Practice with a Demo Account: Before diving into live trading, utilize a demo account to practice and hone your trading skills. This allows you to get hands-on experience and test different strategies without risking real money.

- Choose the Right Trading Platform: Select a reliable and user-friendly trading platform that provides real-time data, advanced charting tools, and order execution capabilities. Additionally, ensure that the platform offers competitive commission rates and supports the stocks you are interested in trading.

- Develop and Stick to a Trading Plan: Create a well-defined trading plan that incorporates specific entry and exit criteria, risk management techniques, and profit targets. A trading plan helps you stay disciplined during market fluctuations and reduces the likelihood of impulsive decision-making.

- Manage Risk: Implement effective risk management strategies to protect your capital. Set stop-loss orders for every trade to limit potential losses and avoid emotional decision-making. Additionally, do not risk more than a set percentage of your trading account on any single trade.

- Focus on a Few Select Stocks: Instead of trying to trade every stock that comes across your radar, focus on a small number of stocks that you have thoroughly analyzed and understand well. This allows you to closely monitor their price movements, spot patterns, and develop a better understanding of their behavior.

- Stay Informed: Stay updated with relevant market news, economic releases, and corporate announcements that may impact your trading positions. Use reliable news sources and economic calendars to stay informed about potential market-moving events.

- Control Your Emotions: Emotions can cloud judgment and lead to impulsive decisions. Avoid chasing trades or emotionally reacting to market fluctuations. Instead, stick to your trading plan, trust your analysis, and remain disciplined throughout the trading day.

- Review and Evaluate: Regularly review your trades and evaluate your performance. Identify areas for improvement, learn from your mistakes, and make necessary adjustments to your trading strategies. Continuous learning and self-reflection are key to evolving as a day only trader.

Remember, day only trading is a skill that takes time and practice to develop. It’s important to start small, be patient, and focus on improving your skills gradually. The journey to becoming a successful day only trader may have its ups and downs, but with perseverance and dedication, you can increase your chances of achieving your trading goals.

Finally, let’s conclude our discussion on day only trading and summarize the key points we have covered.

Conclusion

In conclusion, day only trading is a trading strategy focused on capitalizing on short-term price movements within the same trading day. It offers traders the opportunity to take advantage of intraday market fluctuations and potentially generate profits through frequent and well-timed trades.

Understanding the concept, risks, and limitations of day only trading is crucial for traders considering this approach. Market volatility, emotional impact, execution risks, margin requirements, and limited trading opportunities are factors that traders must carefully evaluate and manage.

Despite the challenges, day only trading holds importance in the world of stock market investing. It offers flexibility, the ability to leverage intraday opportunities, and the potential to enhance trading skills through active participation in the market.

To increase the likelihood of success, aspiring day only traders should educate themselves, practice with a demo account, choose the right trading platform, develop a trading plan, manage risk effectively, focus on a select group of stocks, stay informed with market news, and maintain emotional discipline.

It’s essential to recognize that day only trading is a skill that requires continuous learning, practical experience, and ongoing evaluation of performance. Traders must adapt their strategies based on market conditions and have a well-defined risk management plan in place.

Ultimately, day only trading can be a rewarding endeavor for those who approach it with dedication, discipline, and a willingness to learn and adapt. By understanding the dynamics of day only trading and implementing effective strategies, traders can navigate the market with confidence and aim for consistent profitable trades.

Remember, each trading day is a learning opportunity, and growth as a trader comes from experience and the willingness to constantly improve. So, whether you’re a part-time day trader or pursuing it as a full-time career, embrace the journey and strive for continuous growth in your day only trading endeavors.