Home>Finance>What Does Per Calendar Year Mean For Insurance?

Finance

What Does Per Calendar Year Mean For Insurance?

Published: November 19, 2023

Find out what "per calendar year" means in insurance and how it can impact your finances. Gain a clear understanding of this term and make informed choices for your coverage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of insurance, where numerous terms and concepts are thrown your way, often leaving you confused and overwhelmed. One such term that you may have come across is “Per Calendar Year.” But what does it actually mean in the realm of insurance? In this article, we will explore the definition of Per Calendar Year and delve into how it relates to insurance coverage.

Per Calendar Year, often abbreviated as PCY, is a term used by insurance companies to define the time period for which certain benefits or coverage limits apply. As the name suggests, it refers to a specific duration that spans from January 1st to December 31st of a given year. This time frame is important because it sets the boundaries within which insurance providers calculate coverage limits and benefits.

When it comes to insurance, understanding the limitations and benefits of your coverage is essential. Per Calendar Year plays a crucial role in this regard as it establishes a standardized timeframe for insurance policies. Whether it’s health insurance, car insurance, or any other form of coverage, Per Calendar Year helps determine when policy benefits reset and when coverage limits may be reached.

Now that we have a basic understanding of what Per Calendar Year means, let’s explore how it relates to insurance coverage in more detail.

Definition of Per Calendar Year

Per Calendar Year refers to a specific time period, typically spanning from January 1st to December 31st of a given year, during which certain benefits or coverage limits apply in the realm of insurance. This term is commonly used by insurance providers to define the duration for which policyholders can utilize their coverage before it resets or reaches its maximum limit.

Insurance policies often come with specific limits on benefits and coverage, such as annual deductibles, maximum out-of-pocket expenses, or a certain number of covered visits or procedures. Per Calendar Year is used to set the timeframe within which these limits apply. It helps both policyholders and insurance companies keep track of the utilization of coverage and the availability of benefits.

For example, if you have a health insurance policy with a Per Calendar Year deductible of $1,000, it means that you will be responsible for paying the first $1,000 of eligible medical expenses during that calendar year before your insurance coverage kicks in. Once you reach this deductible, your insurance will start covering a portion or all of the upcoming medical costs, subject to the specific terms and conditions of your policy.

In addition to deductibles, Per Calendar Year applies to other aspects of insurance coverage as well. For instance, if you have an annual maximum benefit limit of $10,000 on your dental insurance, this means that your insurance will only cover up to $10,000 worth of dental services within that calendar year. Once you exceed this limit, you will be responsible for paying any additional expenses out of pocket.

It’s important to note that the Per Calendar Year timeframe resets each year. This means that any benefits or coverage limits you may have utilized during the previous year will start anew at the beginning of the next calendar year. This allows insurance companies to evaluate and adjust their policies annually, and it gives policyholders a fresh opportunity to utilize their coverage to the fullest.

Now that we have a clear understanding of the definition of Per Calendar Year, let’s explore its significance in the context of insurance coverage.

How Per Calendar Year Relates to Insurance

Per Calendar Year plays a crucial role in the realm of insurance. It serves as a timeframe that determines the reset and utilization of benefits and coverage limits. Understanding how Per Calendar Year relates to insurance is essential for policyholders to make informed decisions and effectively manage their coverage.

One of the main ways Per Calendar Year relates to insurance is through the calculation of deductibles and out-of-pocket expenses. Insurance policies often require policyholders to meet a specific deductible amount before the coverage kicks in. This deductible is typically based on a Per Calendar Year timeframe. For example, if a health insurance policy has a $2,000 deductible per calendar year, the policyholder must pay $2,000 out of pocket in covered medical expenses before the insurance company starts covering the costs.

Similarly, Per Calendar Year is also used to determine the maximum out-of-pocket expenses policyholders are responsible for. Once the total out-of-pocket expenses reach a certain threshold, the insurance coverage typically covers 100% of the costs. This threshold is calculated on a Per Calendar Year basis, allowing policyholders to better plan and manage their healthcare expenses.

In addition to deductibles and out-of-pocket expenses, Per Calendar Year is relevant for tracking the utilization of benefits and coverage limits. Many insurance policies have a limited number of covered visits or procedures within a calendar year. For example, a dental insurance plan may cover two cleanings and one set of X-rays per calendar year. By resetting at the beginning of each year, policyholders can take advantage of their full benefits and ensure they receive necessary dental care.

Per Calendar Year also affects policy renewal and changes. When a policy comes up for renewal, insurance companies assess the utilization of benefits and coverage limits during the previous calendar year. This helps them determine the risk and adjust premiums accordingly. Additionally, policyholders have the opportunity to review and modify their coverage during this time to align with their evolving needs and circumstances.

Understanding how Per Calendar Year relates to insurance is crucial for making informed decisions and optimizing the benefits and coverage of your insurance policies. By keeping track of your deductible, out-of-pocket expenses, and utilization of coverage limits within the defined calendar year, you can effectively manage your insurance and make the most of the benefits it provides.

Next, let’s explore the benefits and limitations of Per Calendar Year coverage.

Benefits and Limitations of Per Calendar Year Coverage

Per Calendar Year coverage has both benefits and limitations that policyholders should be aware of. Understanding these aspects can help individuals make informed decisions about their insurance and effectively manage their healthcare expenses.

One of the key benefits of Per Calendar Year coverage is that it provides a clear reset point for benefits and coverage limits. At the start of each calendar year, policyholders have a fresh opportunity to utilize their coverage to the fullest. This allows individuals to plan their healthcare needs accordingly and take advantage of any necessary treatments or procedures without being limited by the previous year’s utilization.

Another benefit is the ability to manage out-of-pocket expenses. With Per Calendar Year coverage, policyholders can track their expenses and plan accordingly to meet deductibles and out-of-pocket maximums. This helps individuals budget for healthcare expenses and ensures they are not caught off guard by unexpected medical costs.

Per Calendar Year coverage also offers transparency and predictability. Policyholders know exactly when their coverage resets and when any changes to their benefits or coverage limits may occur. This allows for better planning and decision-making when it comes to choosing healthcare providers or scheduling medical procedures.

However, Per Calendar Year coverage does have its limitations. One limitation is that it may not align with a policyholder’s specific healthcare needs. Certain medical conditions may require ongoing treatment or frequent visits to healthcare providers, which can surpass the coverage limits within a calendar year. In such cases, individuals may need to consider additional coverage or options that aren’t limited to the Per Calendar Year timeframe.

Additionally, Per Calendar Year coverage may not provide flexibility for unexpected medical expenses. If a policyholder exhausts their coverage limits early in the year, they may be responsible for paying out-of-pocket for any additional medical expenses until the coverage resets in the next calendar year. It’s important to consider this limitation and have a financial plan in place to cover any unforeseen healthcare costs.

Furthermore, it’s essential to note that Per Calendar Year coverage may vary depending on the type of insurance and the specific policy. Different insurance plans may have different deductible amounts, coverage limits, and renewal dates. It’s important for policyholders to thoroughly review their insurance policies and consult with their insurance provider to fully understand the details of their Per Calendar Year coverage.

Understanding the benefits and limitations of Per Calendar Year coverage allows policyholders to make informed decisions about their insurance and effectively manage their healthcare expenses. By planning and budgeting accordingly, individuals can maximize the benefits of their insurance coverage while ensuring they are prepared for any potential limitations.

Now, let’s take a look at some examples of Per Calendar Year coverage in different insurance contexts.

Examples of Per Calendar Year Coverage

Per Calendar Year coverage can be found in various types of insurance policies, each with its own specific benefits and limitations. Let’s explore a few examples of how Per Calendar Year coverage applies in different insurance contexts:

Health Insurance

In health insurance, Per Calendar Year coverage is commonly seen in terms of deductibles, out-of-pocket expenses, and coverage limits. For example, let’s say you have a health insurance policy with a $2,500 deductible per calendar year. This means you would need to pay $2,500 out of pocket for eligible medical expenses before your insurance coverage kicks in. Additionally, your policy might have an out-of-pocket maximum of $5,000 per calendar year. Once you reach this limit, your insurance company covers 100% of eligible expenses for the remainder of the calendar year.

Dental Insurance

In dental insurance, Per Calendar Year coverage often includes services such as cleanings, X-rays, and other dental procedures. For instance, your dental insurance plan may cover two cleanings and one set of X-rays per calendar year. If you use one cleaning and the X-rays during the first half of the year, you would need to wait until the next calendar year to utilize the remaining coverage. Understanding the specific coverage limits for dental procedures within a calendar year allows you to plan your dental appointments accordingly.

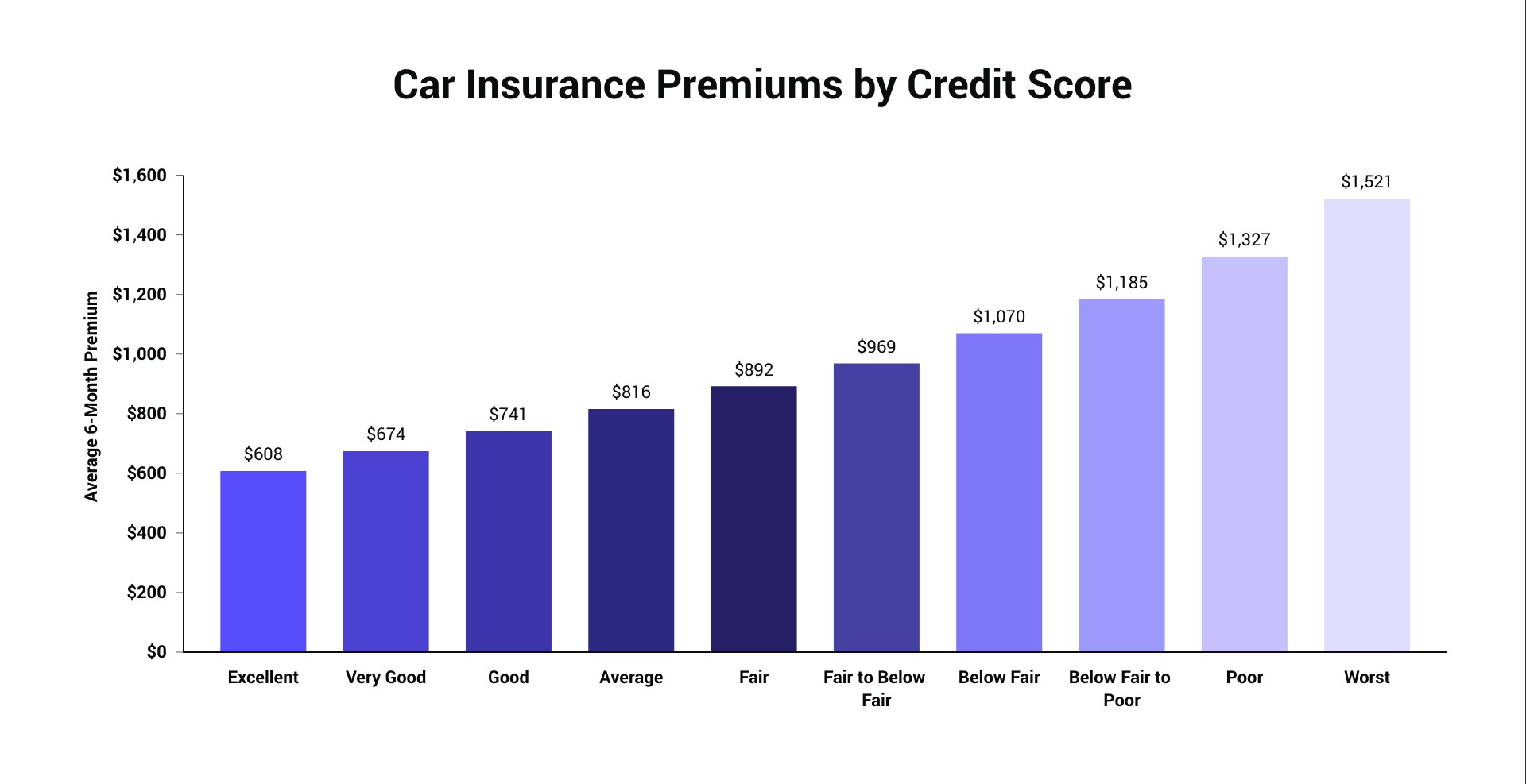

Vehicle Insurance

In vehicle insurance, Per Calendar Year coverage can be related to auto accidents and claims. For example, let’s say you have an auto insurance policy that allows up to two accident claims per calendar year. If you submit two claims within a calendar year, any additional claims would not be covered until the next calendar year. Understanding the specific limits and the timing of Per Calendar Year coverage is crucial when managing your vehicle insurance and making claims.

Employee Benefits

Many employee benefit programs, such as healthcare flexible spending accounts (FSAs) and health savings accounts (HSAs), also operate on a Per Calendar Year basis. These accounts allow employees to set aside pre-tax funds for eligible healthcare expenses for the calendar year. Any unused funds typically do not roll over to the next calendar year, so it’s important to plan and utilize the funds before the end of the year to maximize the benefits.

These examples highlight how Per Calendar Year coverage is utilized in different types of insurance. It’s important to review your specific insurance policies and understand the terms and limitations of your Per Calendar Year coverage to make the most of your benefits and effectively manage your coverage.

Now that we have explored examples of Per Calendar Year coverage, let’s move on to understanding your insurance options in relation to Per Calendar Year.

Understanding Your Insurance Options

When it comes to insurance, it’s essential to understand your options and make informed decisions that align with your specific needs and circumstances. Here are some key factors to consider when evaluating your insurance options in relation to Per Calendar Year coverage:

Policy Coverage

Take the time to review the coverage offered by different insurance policies. Consider factors such as deductibles, out-of-pocket expenses, coverage limits, and any exclusions or limitations. Look for policies that provide comprehensive coverage and align with your specific healthcare or insurance needs.

Per Calendar Year Deductibles

Understand the deductible requirements and how they apply on a Per Calendar Year basis. Determine if the deductible is reasonable and manageable for your budget, and consider how it may affect your healthcare expenses throughout the calendar year.

Coverage Limits

Be aware of the coverage limits set for different types of services or procedures within a calendar year. Consider your healthcare needs and ensure that the coverage limits provided by the policy are sufficient. If certain procedures or services are essential for your health, ensure that the policy offers adequate coverage for those specific needs.

Renewal Dates

Take note of the renewal dates for your insurance policies. This is an opportunity to review your coverage, make any necessary changes, and ensure that it aligns with your current needs. Use this time to reassess your coverage options and explore alternatives if needed.

Additional Coverage Options

Consider if additional coverage options are necessary for your specific circumstances. If you have medical conditions or anticipate higher healthcare needs, explore supplemental coverage options that go beyond the limits imposed by Per Calendar Year policies. This may include purchasing additional policies or adding riders to your existing coverage.

Financial Planning

As with any insurance policy, it’s crucial to have a financial plan in place. Per Calendar Year coverage helps manage the timing of expenses, but it’s important to budget for potential out-of-pocket costs. Consider setting aside funds or exploring savings accounts such as health savings accounts (HSAs) or flexible spending accounts (FSAs) to cover any potential healthcare expenses that may arise.

By understanding your insurance options and considering factors such as policy coverage, deductibles, coverage limits, renewal dates, additional coverage options, and financial planning, you can make informed decisions and choose the insurance policies that best suit your needs and provide the optimal coverage within the Per Calendar Year timeframe.

Now, let’s wrap up our discussion.

Conclusion

Understanding the concept of Per Calendar Year is crucial for navigating the world of insurance. It establishes a defined timeframe within which benefits and coverage limits apply, allowing policyholders to plan and utilize their coverage effectively. Whether it’s health insurance, dental insurance, vehicle insurance, or employee benefit programs, Per Calendar Year coverage serves as a guideline for deductibles, out-of-pocket expenses, and coverage limits.

By truly comprehending the benefits and limitations of Per Calendar Year coverage, policyholders can make informed decisions about their insurance options and effectively manage their healthcare expenses. It’s important to review policy details, such as coverage limitations, deductibles, and renewal dates, to ensure that the chosen insurance aligns with specific healthcare needs and offers maximum benefit within the designated calendar year.

Additionally, considering additional coverage options and engaging in financial planning can help policyholders cover any potential out-of-pocket expenses that may arise beyond the coverage limits of a Per Calendar Year policy.

Having a clear understanding of your insurance options and utilizing Per Calendar Year coverage to its fullest potential not only helps in managing costs but also provides peace of mind, knowing that you are protected in times of unexpected situations or healthcare needs.

In conclusion, embrace the knowledge and make the most of Per Calendar Year coverage by understanding how it applies to different insurance contexts, reviewing policy details, exploring supplemental coverage options, and planning your finances accordingly. By doing so, you can navigate the world of insurance with confidence and ensure that you maximize the benefits and coverage available to you within each calendar year.