Home>Finance>What Does Total Annual Income Mean On Credit Card Application

Finance

What Does Total Annual Income Mean On Credit Card Application

Modified: February 21, 2024

Learn the meaning of total annual income on credit card applications and how it impacts your finances. Discover why this information is important for getting approved.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction:

- Understanding Total Annual Income:

- Importance of Total Annual Income on Credit Card Applications:

- Factors Considered in Reporting Total Annual Income:

- How to Accurately Determine Total Annual Income:

- Mistakes to Avoid When Reporting Total Annual Income:

- Impact of Total Annual Income on Credit Card Approval:

- Conclusion:

Introduction:

Welcome to the world of credit cards! Applying for a credit card requires more than just filling out a basic form. One crucial piece of information that you will encounter on the application is your Total Annual Income. Understanding what this means and its significance in the application process is essential for any credit card applicant.

When you apply for a credit card, the issuer wants to assess your financial capability to handle credit. Your Total Annual Income plays a vital role in determining your creditworthiness and the credit limit you may be approved for. In this article, we will delve into the concept of Total Annual Income, its importance in credit card applications, factors considered in reporting it, how to accurately determine it, mistakes to avoid, and the overall impact it has on credit card approval.

Before we delve into the details, let’s clarify what Total Annual Income means. It refers to the sum of all the money you earn in a year, including your salary, wages, bonuses, commissions, rental income, interest income, and any other sources of earnings. This figure provides credit card issuers with an overview of your financial stability and your ability to repay any credit extended to you.

So, let’s dive into the depths of Total Annual Income and uncover everything you need to know to maximize your chances of credit card approval.

Understanding Total Annual Income:

When it comes to credit card applications, your Total Annual Income is a crucial factor that lenders use to evaluate your financial eligibility. It serves as a key indicator of your ability to manage credit responsibly. Understanding what constitutes Total Annual Income and how it is calculated is essential for accurately reporting this information on your credit card application.

Total Annual Income encompasses all the money you earn throughout the year. This includes your salary or wages from your job, any additional income from freelance work, bonuses, commissions, rental income, interest income from investments, and any other sources of earnings. Essentially, it represents your gross income before deductions such as taxes or other expenses.

It’s important to note that Total Annual Income is not limited to just one individual. If you have a spouse or partner who contributes to your household’s income, you may be required to include their income as well when reporting Total Annual Income on your credit card application.

The accuracy of reporting your Total Annual Income is vital, as it directly impacts the credit limit you may be approved for and the overall creditworthiness assessment. Lenders rely on this information to gauge your ability to handle credit responsibly and make timely payments.

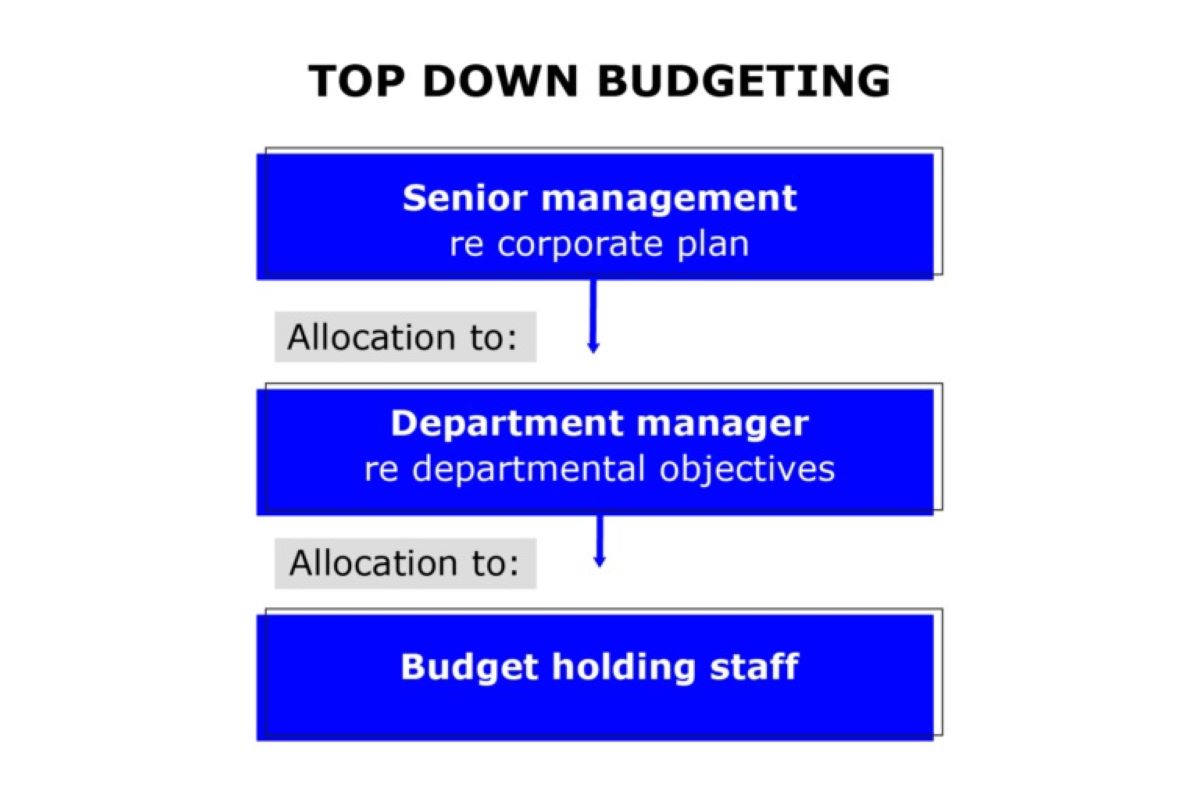

Moreover, your Total Annual Income serves as a benchmark for determining your debt-to-income ratio (DTI). This ratio compares your monthly debt payments to your monthly income and helps lenders assess your ability to take on additional debt.

In summary, understanding Total Annual Income is crucial when applying for a credit card. It encompasses the sum of all the money you earn in a year and serves as a key indicator of your financial stability and creditworthiness.

Importance of Total Annual Income on Credit Card Applications:

The Total Annual Income you report on your credit card application holds significant importance in the eyes of the credit card issuer. It serves as a crucial determinant of your creditworthiness and plays a key role in shaping the terms and conditions of your credit card approval. Let’s explore why Total Annual Income is of such great importance in the credit card application process.

1. Creditworthiness Assessment: By examining your Total Annual Income, credit card issuers can assess your ability to manage credit responsibly. A higher income generally indicates a greater capacity to make timely credit card payments and handle higher credit limits. This, in turn, increases your chances of receiving a favorable credit card approval.

2. Determining Credit Limit: Your reported Total Annual Income helps credit card issuers determine the appropriate credit limit they can extend to you. The higher your income, the higher the credit limit you may be approved for. This allows you to have greater purchasing power and flexibility when using your credit card.

3. Affordability and Repayment Ability: Credit card issuers want to ensure that you can comfortably afford the credit card payments. By analyzing your Total Annual Income, they can determine if your income is sufficient to cover your living expenses, existing debts, and potential credit card payments. This assessment helps mitigate the risk of default and increases the likelihood of timely payments.

4. Offer Customization: Your Total Annual Income provides credit card issuers with valuable information to tailor credit card offers that suit your financial profile. Based on your income level, issuers can offer different card types, rewards programs, interest rates, and additional benefits. This allows you to choose a credit card that aligns with your financial needs and goals.

5. Monitoring Financial Stability: Total Annual Income serves as an indicator of your financial stability. Consistently reporting a stable income over time showcases your ability to maintain a steady flow of income, which is essential in the eyes of credit card issuers. It instills confidence in them that you are less likely to encounter financial difficulties and makes you a more reliable candidate for credit.

Overall, Total Annual Income holds significant importance in the credit card application process. It is a key factor in assessing your creditworthiness, determining your credit limit, ensuring affordability, customization of offers, and monitoring your financial stability. Therefore, providing accurate and transparent information about your Total Annual Income is crucial for a successful credit card application.

Factors Considered in Reporting Total Annual Income:

When reporting your Total Annual Income on a credit card application, it’s important to provide accurate and comprehensive information. Credit card issuers take several factors into consideration when evaluating your reported income. Let’s explore the key factors that are considered when reporting Total Annual Income.

1. Employment Income: The primary source of income for most individuals is their employment. This includes your salary or wages from your job. Credit card issuers typically require documentation, such as pay stubs or employment contracts, to verify your employment income.

2. Additional Income: In addition to your employment income, credit card issuers also consider other sources of income. This can include income from freelance work, part-time jobs, self-employment, or any other supplementary sources of earnings. Providing documentation or proof of these additional income sources can strengthen your application.

3. Rental Income: If you own rental properties, any income generated from them should be included in your Total Annual Income. This can include rental income from residential or commercial properties. You may need to provide rental agreements or lease contracts as supporting documentation.

4. Investment Income: Income from investments such as dividends, interest, or capital gains should also be reported. This can include income from stocks, bonds, mutual funds, or real estate investments. Statements or proof of these investment incomes should be included when reporting Total Annual Income.

5. Spousal or Partner’s Income: If you have a spouse or partner who contributes to your household income, their income may need to be included in your Total Annual Income. Credit card issuers may request proof of their income, such as pay stubs or tax returns.

It’s important to note that credit card issuers require documented evidence to verify the reported Total Annual Income. This ensures the accuracy of the information provided and helps prevent fraud or misrepresentation.

When reporting your Total Annual Income, it’s crucial to be transparent and provide supporting documentation for all sources of income. Failing to do so may lead to delays in the application process or even rejection of your application. Accuracy and honesty are key when reporting your Total Annual Income on a credit card application.

How to Accurately Determine Total Annual Income:

Determining your Total Annual Income is a crucial step in accurately reporting it on a credit card application. To ensure accuracy and completeness, follow these steps to calculate your Total Annual Income:

1. Gather Income Documents: Start by gathering all relevant income documents, including pay stubs, tax returns, and any other financial statements that reflect your income. These documents provide a comprehensive overview of your earnings throughout the year.

2. Calculate Employment Income: Begin with your primary source of income, which is typically your salary or wages from your job. Add up the income from each pay period to calculate your annual employment income. If you receive a regular paycheck, multiply your gross monthly income by 12 to determine your annual employment income.

3. Include Additional Income Sources: If you have additional sources of income, such as freelance work or part-time jobs, calculate the earnings from each source separately. Add up all the additional income amounts to determine the total additional income for the year.

4. Account for Rental Income: If you earn rental income from properties you own, calculate the total rental income for the year. This can be done by adding up all rental payments received throughout the year. Make sure to deduct any expenses related to managing the rental property before calculating the net rental income.

5. Consider Investment Income: If you receive income from investments, such as dividends, interest, or capital gains, gather the necessary financial statements or tax documents that reflect these earnings. Sum up the investment income received during the year to determine the total investment income.

6. Include Spousal or Partner’s Income: If you are married or have a partner who contributes to your household income, include their income in the calculation. Gather their income documents and follow the same steps to determine their annual income. Add their income to your own to arrive at the Total Annual Income for your household.

7. Double-Check for Accuracy: Once you have calculated the income from all sources, double-check your calculations to ensure accuracy. Take note of any deductions, such as taxes or other expenses, that should be deducted from your total income to arrive at your net annual income.

Remember, accuracy and honesty are paramount when determining and reporting your Total Annual Income. Double-check all calculations and ensure that you have included income from all applicable sources. Providing an accurate representation of your Total Annual Income will not only help you present a credible financial profile to credit card issuers but also avoid potential issues or concerns during the application process.

Mistakes to Avoid When Reporting Total Annual Income:

Accurately reporting your Total Annual Income is critical when applying for a credit card. Any discrepancies or inaccuracies can have significant consequences on the outcome of your application. To ensure a smooth application process and avoid potential issues, it’s important to be aware of common mistakes to avoid when reporting your Total Annual Income:

1. Underreporting Income: One common mistake is underreporting or failing to include certain sources of income. Whether it’s additional income from freelance work, rental income, or investment earnings, make sure to include all applicable sources. Underreporting your income may result in a lower credit limit or even rejection of your application.

2. Inflating Income: While it’s crucial to provide an accurate representation of your income, inflating your income is equally problematic. Lying about your income to secure a higher credit limit or better credit card terms is considered fraud and can lead to serious legal consequences. It’s best to be honest and transparent about your income to maintain integrity throughout the application process.

3. Not Including Spousal or Partner’s Income: If you are married or have a partner who contributes to your household income, it’s important to include their income on the application if required. Failing to do so may result in an incomplete representation of your financial situation, leading to potential complications or misunderstandings with the credit card issuer.

4. Unrealistic Income Projections: Projecting future income or inflating your current income based on expected raises or bonuses is not advised. Stick to reporting your current stable income rather than relying on potential future earnings. Credit card issuers assess your creditworthiness based on your present financial situation, not on projections.

5. Misinterpreting Gross and Net Income: Be aware of the difference between gross and net income. Gross income is your total earnings before any deductions, while net income reflects the amount you take home after taxes and other deductions. Ensure you report your total gross income accurately, as this is what credit card issuers typically consider when evaluating your application.

6. Failing to Provide Documentation: Inaccurate or incomplete documentation can lead to delays or denial of your credit card application. Ensure you have proper documentation and supporting evidence for all sources of income reported on your application. This includes pay stubs, tax returns, bank statements, rental agreements, or any other relevant documentation.

7. Neglecting to Update Income Information: If your income has significantly changed since your last credit card application, it’s important to update the information accordingly. Failure to provide updated and accurate income details may result in a mismatch between reported income and your current financial situation.

By avoiding these common mistakes, you can ensure that your reported Total Annual Income is accurate, transparent, and in line with the requirements of the credit card issuer. This will not only increase your chances of credit card approval but also help establish a foundation of trust with the lender.

Impact of Total Annual Income on Credit Card Approval:

Your Total Annual Income plays a significant role in determining whether your credit card application will be approved or denied. The income you report provides credit card issuers with valuable insights into your financial capacity and ability to manage credit responsibly. Let’s explore the various ways in which Total Annual Income impacts the approval process:

1. Credit Limit: The Total Annual Income reported on your credit card application has a direct influence on the credit limit you will be approved for. A higher income signifies a greater ability to handle higher credit limits, as it indicates a stronger financial standing. Thus, a higher Total Annual Income can result in a more favorable credit limit being extended to you.

2. Creditworthiness Assessment: Credit card issuers use Total Annual Income as one of the key factors in assessing your creditworthiness. A higher income level suggests a lower risk for the issuer, as it implies a greater ability to make timely payments. Therefore, a higher Total Annual Income may enhance your overall creditworthiness in the eyes of the issuer, increasing your chances of approval.

3. Debt-to-Income Ratio (DTI): Total Annual Income is crucial in determining your Debt-to-Income Ratio (DTI), which is the ratio of your monthly debt payments to your monthly income. A lower DTI indicates a lesser burden of debt on your income, signifying increased financial stability. A higher Total Annual Income provides a favorable DTI and can improve your likelihood of credit card approval.

4. Card Type and Rewards Programs: Depending on your Total Annual Income, credit card issuers may offer different card types and rewards programs. Higher-income individuals may have access to premium credit cards with enhanced benefits, such as travel rewards, cashback programs, or exclusive perks. These offers are often tailored to match the spending power and lifestyle of individuals with higher reported incomes.

5. Additional Benefits and Perks: Some credit cards offer additional benefits and features based on the reported income. These may include higher cash withdrawal limits, waived annual fees, or priority customer service. A higher Total Annual Income can make you eligible for such additional perks and privileges.

It is essential to note that while Total Annual Income is an influential factor, it is not the sole determinant of credit card approval. Credit card issuers also consider other factors such as credit history, credit score, employment stability, and existing debts. These factors, along with your Total Annual Income, collectively contribute to the evaluation of your credit card application.

Ultimately, reporting an accurate and realistic Total Annual Income is crucial for a successful credit card approval. It demonstrates your financial capability and provides the credit card issuer with the necessary information to assess your creditworthiness. By accurately reporting your Total Annual Income, you enhance your chances of obtaining the credit card that best suits your financial needs and aspirations.

Conclusion:

Understanding the concept of Total Annual Income and its significance in credit card applications is essential for anyone looking to obtain a credit card. Your Total Annual Income serves as a vital indicator of your financial stability, creditworthiness, and ability to manage credit responsibly. Accurately reporting your income on your credit card application is crucial to secure favorable terms and increase your chances of approval.

By accurately reporting your Total Annual Income, you provide credit card issuers with a clear picture of your financial capacity. This information enables them to assess your eligibility for different credit card types, determine your credit limit, and offer customized benefits and perks based on your reported income.

Avoiding common mistakes, such as underreporting or inflating your income, and providing supporting documentation for all income sources, is essential to maintain transparency and credibility throughout the application process.

Furthermore, it’s important to regularly review and update your reported Total Annual Income if there are significant changes in your financial situation. This ensures that your application reflects your current income accurately, helping credit card issuers make an informed decision.

Remember, Total Annual Income is just one of the factors considered in the credit card approval process. Credit history, credit score, employment stability, and existing debts also play a role in the decision-making process. Therefore, maintaining a good credit history and managing your finances responsibly are equally important when applying for a credit card.

In conclusion, understanding the importance of Total Annual Income and accurately reporting it on your credit card application can greatly enhance your chances of approval. By providing a complete and honest representation of your income, you position yourself as a reliable and creditworthy candidate. So, gather your income documentation, carefully calculate your Total Annual Income, and confidently apply for a credit card that aligns with your financial needs and goals.