Home>Finance>What Happens To My 401K If The Dollar Collapses

Finance

What Happens To My 401K If The Dollar Collapses

Published: October 18, 2023

Discover how the collapse of the dollar could impact your 401K and learn smart finance strategies to protect your retirement savings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding 401K

- What is the Dollar Collapse?

- Impact Of A Dollar Collapse on 401K

- Options for Protecting Your 401K

- Diversifying Your Investments

- The Role of Precious Metals in Protecting Your 401K

- Evaluating the Safety of Different Investments

- Strategies for Preserving Your 401K in a Dollar Collapse

- Conclusion

Introduction

Planning for retirement is an essential aspect of securing a comfortable financial future. One popular retirement savings option that many individuals take advantage of is the 401K. A 401K is a tax-advantaged retirement account offered by employers to their employees, allowing them to contribute a portion of their pre-tax income towards their retirement.

However, as with any investment, it is important to consider potential risks and uncertainties that could impact the value of your 401K. One of these risks is the possibility of a dollar collapse.

The dollar collapse refers to a scenario in which the value of the US dollar significantly depreciates, leading to a decline in purchasing power and economic instability. This can be caused by various factors such as economic downturns, excessive borrowing, inflation, or geopolitical events.

So, what happens to your hard-earned 401K if the dollar collapses? In this article, we will explore the potential impact of a dollar collapse on your 401K and discuss strategies to protect and preserve your retirement savings in such a scenario.

Understanding 401K

Before diving into the potential impact of a dollar collapse on your 401K, it’s important to have a clear understanding of what a 401K is and how it functions.

A 401K is a retirement savings plan offered by employers to their employees. It allows individuals to contribute a portion of their salary to the account on a pre-tax basis, meaning that the contributions are deducted from their paycheck before taxes are applied. This provides an immediate tax benefit, as the contributions are not subject to income tax at the time of contribution.

One of the key advantages of a 401K is the ability for the investments to grow tax-free until retirement. This means that any capital gains, dividends, or interest earned within the 401K are not taxed as long as the funds remain in the account.

In addition to the tax advantages, many employers offer a matching contribution to incentivize employees to participate in the 401K plan. This means that the employer will match a certain percentage of the employee’s contributions, further boosting the growth of the retirement savings.

It’s important to note that a 401K is subject to certain restrictions and limitations. There are annual contribution limits set by the IRS, which may change from year to year. Additionally, there are penalties for withdrawing funds from the 401K before reaching the age of 59 ½, unless certain exceptions apply.

Overall, a 401K is a powerful tool for retirement savings, offering tax advantages and the potential for long-term growth. However, it is not immune to external economic factors such as a dollar collapse, which can have a significant impact on the value of the investments held within the account.

What is the Dollar Collapse?

The term “dollar collapse” refers to a significant decrease in the value of the US dollar relative to other currencies. It is a scenario where the purchasing power of the dollar diminishes, leading to economic instability and financial uncertainty.

The value of a currency, including the US dollar, is influenced by various factors such as supply and demand, interest rates, economic indicators, and geopolitical events. A dollar collapse can occur due to a combination of these factors, often triggered by a loss in confidence in the currency.

One of the primary causes of a dollar collapse is excessive national debt. When a country accumulates a large amount of debt, it can lead to concerns about its ability to repay or service that debt. As a result, investors may lose confidence in the country’s currency, causing its value to decline.

Inflation is another contributing factor to a potential dollar collapse. When the value of money decreases due to rising prices of goods and services, it erodes the purchasing power of the currency. If inflation becomes rampant, it can undermine confidence in the dollar, leading to a collapse.

Geopolitical events and global economic trends also play a role in the stability of the dollar. Factors such as trade disputes, political uncertainties, or shifts in global economic power can impact the value of the dollar in relation to other currencies.

In a dollar collapse scenario, the impact on the economy can be far-reaching. Purchasing imported goods would become more expensive, leading to higher prices for consumers. Investments denominated in dollars would lose value, affecting both individuals and businesses. Additionally, a dollar collapse can lead to economic recession, as borrowing costs rise and consumer spending slows down.

Given the potential consequences of a dollar collapse, it is crucial for individuals to consider its impact on their retirement savings, including their 401K.

Impact Of A Dollar Collapse on 401K

A dollar collapse can have a significant impact on the value of your 401K and the overall performance of your retirement savings. Here are some key ways in which a dollar collapse can affect your 401K:

- Stock Market Volatility: A dollar collapse often brings increased volatility to the stock market. Stock prices can be highly sensitive to changes in the value of the currency, which may result in sharp declines or fluctuations in the value of your 401K investments.

- Reduced Purchasing Power: When the value of the dollar declines, the purchasing power of your retirement savings decreases. This means that the amount of goods and services you can afford with your 401K may be significantly reduced, leading to a lower standard of living in retirement.

- Impact on Bond Investments: Bonds are another common investment option within 401K portfolios. In the event of a dollar collapse, bond values may be affected by inflation and rising interest rates. This can lead to a decrease in the value of bond investments, negatively impacting your 401K.

- International Investments: If your 401K includes international investments, a dollar collapse can have varying effects. On one hand, a weaker dollar may benefit companies that generate a significant portion of their revenues from overseas markets. On the other hand, it can also result in decreased returns for investments denominated in foreign currencies.

- Inflation Risk: A dollar collapse is often accompanied by higher inflation rates. Inflation erodes the value of money over time, reducing the purchasing power of your retirement savings. This means that even if the nominal value of your 401K remains the same, it may not be enough to cover rising costs of living.

It’s important to recognize that the impact of a dollar collapse on your 401K will depend on various factors, such as the composition of your investment portfolio and the actions you take to protect and diversify your retirement savings. Implementing a strategy to safeguard your 401K against a potential dollar collapse is crucial to minimize its impact and ensure the long-term stability of your retirement funds.

Options for Protecting Your 401K

While the potential impact of a dollar collapse on your 401K may seem daunting, there are several options available to help protect and preserve your retirement savings. Here are some strategies you can consider:

- Stay Informed: Keep yourself updated on economic trends, geopolitical events, and market conditions that may impact the value of the dollar. Being aware of potential risks allows you to make more informed decisions regarding your 401K investments.

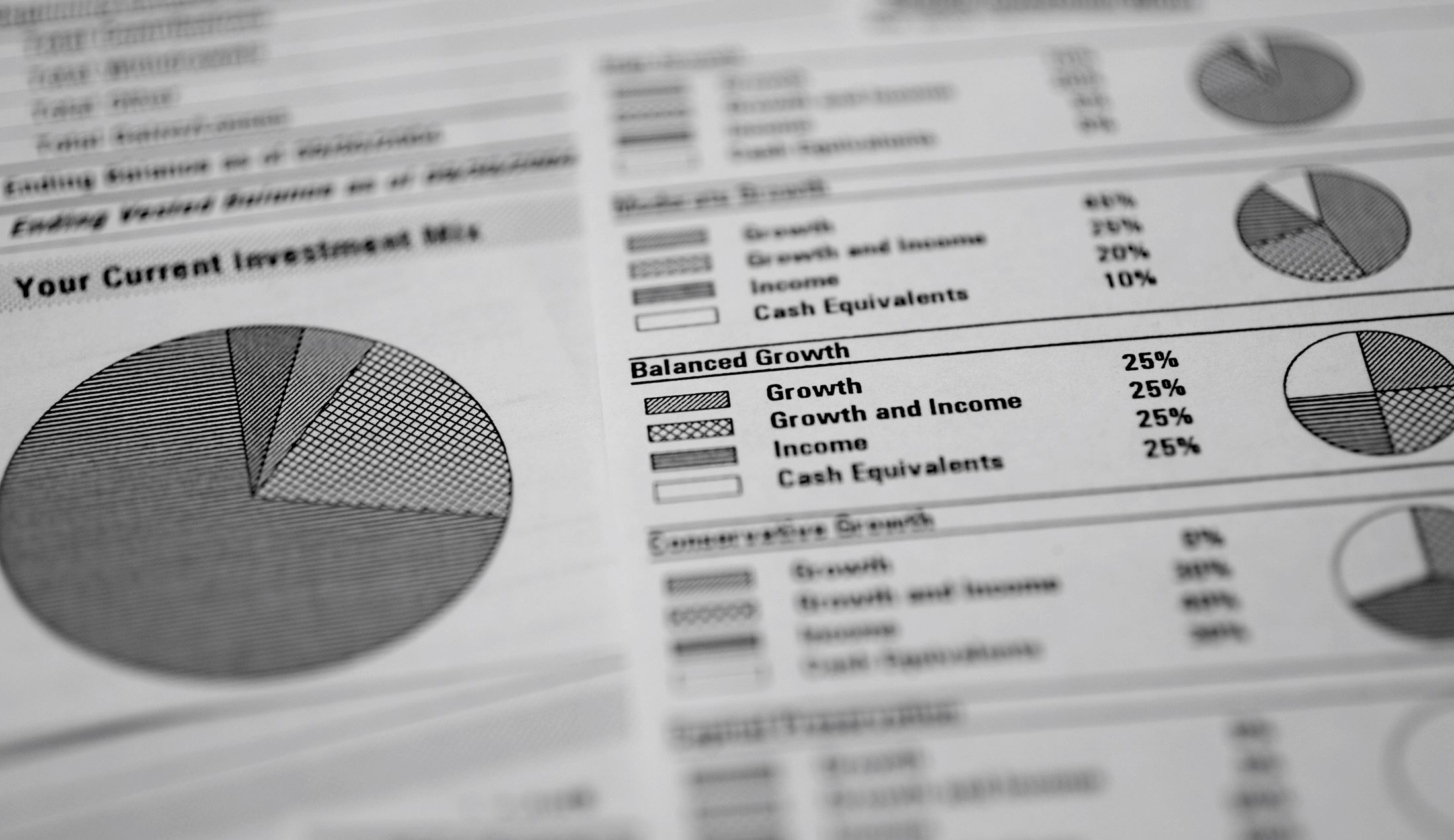

- Diversify Your Investments: One of the key principles of investment risk management is diversification. By spreading your 401K investments across different asset classes, industries, and regions, you can reduce the impact of a potential dollar collapse on your overall portfolio. Consider including a mix of stocks, bonds, mutual funds, real estate investment trusts (REITs), and other asset classes in your 401K portfolio.

- Consider Alternative Investments: In addition to traditional stocks and bonds, explore alternative investment options such as real estate, commodities, or even cryptocurrencies. These alternative investments can provide additional diversification and potential protection against a dollar collapse.

- Review Your Asset Allocation: Regularly review and adjust the asset allocation of your 401K portfolio to ensure it aligns with your risk tolerance and long-term goals. As economic conditions change, you may need to rebalance your portfolio to maintain an optimal mix of assets.

- Seek Professional Advice: Consulting with a financial advisor who specializes in retirement planning can provide valuable insight and guidance. An experienced advisor can help you navigate the complexities of a potential dollar collapse and tailor an investment strategy that aligns with your specific needs and goals.

- Consider a Self-Directed IRA: If your employer allows it, you may have the option to roll over your 401K into a self-directed IRA. This gives you greater control over your investments and the flexibility to include alternative assets such as precious metals or real estate, which are often considered as hedges against economic downturns.

Remember, there is no one-size-fits-all approach to protecting your 401K from a dollar collapse. It’s important to evaluate your own risk tolerance, investment goals, and preferences when implementing a strategy to safeguard your retirement savings. Regularly monitoring and adjusting your portfolio, staying informed, and seeking professional advice will go a long way in mitigating potential risks and ensuring the long-term stability of your 401K.

Diversifying Your Investments

When it comes to protecting your 401K from potential risks, diversification is a key strategy to consider. Diversifying your investments means spreading your money across different asset classes and investment types, which can help reduce your overall risk exposure and potentially enhance returns. Here are some reasons why diversification is important and how you can achieve it:

Minimize Risk: By diversifying your investments, you can spread your risk across different sectors, industries, and asset classes. This is important because different investments perform differently in various economic conditions. By having a mix of stocks, bonds, real estate, and other assets, you are less vulnerable to a single investment negatively impacting your overall portfolio in the event of a dollar collapse or other economic downturn.

Capture Growth Opportunities: Diversification allows you to participate in different areas of the market that may experience growth. While some sectors may be negatively impacted by a dollar collapse, others may thrive. By diversifying your investments, you increase your chances of capturing growth opportunities and potentially mitigating losses from underperforming investments.

Stability in Volatile Markets: Diversification can add stability to your portfolio during periods of market volatility. If one investment is experiencing a downturn, other investments may be performing well, helping to offset potential losses. This helps to smooth out the overall performance of your portfolio and reduce the impact of market fluctuations.

Asset Allocation: One way to diversify your investments is through asset allocation. Asset allocation refers to the distribution of your investments across different asset classes, such as stocks, bonds, and cash. The allocation should be based on your risk tolerance, time horizon, and investment goals. A well-diversified portfolio typically includes a mix of investments that balance risk and potential returns.

Consider Different Sectors: Diversifying within each asset class or sector is also important. For example, within stocks, you can diversify across various industries like technology, healthcare, finance, and consumer goods. By investing in different sectors, you lower your exposure to any individual industry’s performance, reducing the impact of industry-specific risks.

Invest in International Markets: Another way to diversify your 401K is by including international investments. Investing in foreign markets provides exposure to different economies and currencies. This can help mitigate the impact of a dollar collapse as the value of international currencies may fluctuate differently than the US dollar.

Regularly Review and Rebalance: Diversification is not a one-time task. It requires regular monitoring and rebalancing to ensure that your portfolio remains aligned with your investment objectives and risk tolerance. Market conditions and economic factors change over time, and your investment mix should reflect those changes.

Keep in mind that diversification does not guarantee profits or protect against losses, but it can help reduce risk and increase the potential for long-term growth. As always, consult with a financial advisor to determine the appropriate diversification strategy based on your unique financial situation, goals, and risk tolerance.

The Role of Precious Metals in Protecting Your 401K

When it comes to protecting your 401K from potential economic uncertainties, incorporating precious metals into your investment strategy can offer a number of advantages. Precious metals, such as gold, silver, platinum, and palladium, have historically been recognized as a store of value and a hedge against inflation. Here’s why they can play a valuable role in safeguarding your retirement savings:

Protection Against Currency Devaluation: Precious metals are tangible assets that are not reliant on any specific currency. As a result, they can provide a hedge against a potential dollar collapse or devaluation. Over time, the value of precious metals has tended to rise in response to currency fluctuations and economic uncertainties, making them a valuable asset to help protect your 401K’s purchasing power.

Safe-Haven Asset: During times of economic turmoil and market volatility, investors often flock to safe-haven assets like gold and silver. Precious metals are considered a reliable store of value that can act as a “safe harbor” for your 401K investments. The demand for precious metals tends to rise when other asset classes, such as stocks or bonds, experience significant declines, providing stability and potential capital preservation for your portfolio.

Diversification Benefits: Including precious metals in your 401K portfolio can enhance diversification. Precious metals have historically exhibited low correlation with other asset classes, such as stocks and bonds. This means that they may behave differently in response to market conditions, helping to reduce the overall volatility of your portfolio. By diversifying your investments with precious metals, you can potentially mitigate risk and enhance the long-term stability of your 401K.

Inflation Hedge: Precious metals have long been considered a hedge against inflation. When inflation rises, the value of paper currency tends to decline, while the value of precious metals typically increases. By holding a portion of your 401K in precious metals, you can help protect against the erosion of purchasing power caused by inflation, preserving the value of your retirement savings over time.

Liquidity and Accessibility: Investing in precious metals can provide liquidity and accessibility to your 401K portfolio. Precious metals are traded globally, and there are well-established markets for buying and selling gold, silver, and other metals. This ensures that you can easily convert your precious metal investments into cash if needed.

It’s important to note that while precious metals offer distinct advantages, they should be considered as part of a diversified investment strategy rather than the sole focus of your portfolio. The optimal allocation to precious metals within your 401K will depend on factors such as your risk tolerance, investment goals, and market conditions.

Consulting with a financial advisor who specializes in retirement planning and understands the intricacies of precious metals can help you determine the appropriate allocation for your 401K. They can guide you in selecting the right types of precious metals, such as physical bullion, exchange-traded funds (ETFs), or mining stocks, to suit your investment objectives and risk profile.

Evaluating the Safety of Different Investments

When it comes to protecting your 401K, it is essential to carefully evaluate the safety of different investment options. While all investments carry some level of risk, there are certain factors to consider to assess the safety and stability of your investments. Here are key factors to evaluate:

Historical Performance: Review the historical performance of the investment options available in your 401K. Look for investments that have demonstrated consistent returns over time, as this indicates their ability to weather market volatility and economic downturns.

Risk and Volatility: Assess the level of risk and volatility associated with each investment option. Higher-risk investments may yield higher returns, but they also come with a greater potential for loss. Consider your risk tolerance and investment goals when selecting investments that align with your comfort level.

Industry and Sector Analysis: Evaluate the stability and growth potential of the industries and sectors in which your investment options operate. Diversify your investments across multiple industries to mitigate the risk of being heavily concentrated in a specific sector that may be prone to volatility.

Company Financials: Research the financial health and stability of the companies in which you are investing. Evaluate key financial indicators such as revenue growth, profitability, debt levels, and cash flow. Strong financial fundamentals indicate a company’s ability to withstand economic challenges and generate long-term value.

Market Capitalization: Consider the market capitalization of the companies you are investing in. Large-cap companies with established track records often offer more stability and liquidity than small or mid-cap companies. However, smaller companies may present growth opportunities if willing to accept a higher level of risk.

Management and Leadership: Evaluate the management team and leadership of the companies in which you are investing. Look for experienced and competent management with a strong track record of making prudent business decisions. A skilled management team can navigate economic uncertainties and position the company for long-term success.

Dividend Payments: Dividend-paying stocks can offer a level of stability and income generation for your 401K. Evaluate the track record of companies in terms of their history of dividend payments and dividend growth. Look for companies with a consistent dividend payout and a healthy dividend yield.

Regulatory Environment: Consider the regulatory environment in which the investments operate. Changes in regulations or government policies can have a significant impact on certain industries, so it is important to assess the potential regulatory risks and how they may affect your investments.

Professional Analysis: Consult with financial advisors or investment professionals who can provide expert analysis and insights on the safety and stability of different investment options. They can help evaluate the risks and potential returns to guide your investment decisions within your 401K.

Remember, no investment is completely without risk, and past performance does not guarantee future results. It is important to regularly review and reassess your investment choices, taking into account changes in the economic landscape and your own financial goals. By carefully evaluating the safety of different investments, you can make informed decisions to protect and grow your 401K in the face of potential challenges.

Strategies for Preserving Your 401K in a Dollar Collapse

In the event of a potential dollar collapse, it is crucial to have strategies in place to preserve the value of your 401K and protect your retirement savings. Here are some effective strategies to consider:

- Monitor and Diversify: Regularly monitor the performance of your investments within your 401K. Keep a diverse portfolio that includes a mix of asset classes such as stocks, bonds, real estate, and alternative investments. Diversification can help spread your risk and minimize the impact of a dollar collapse on your overall portfolio.

- Consider Inflation Hedges: Inflation erodes the purchasing power of your retirement savings. Invest in assets that historically act as inflation hedges, such as commodities, real estate, and inflation-protected securities. These types of investments tend to hold their value or even increase in price during periods of inflation, helping to preserve the real value of your 401K.

- Allocate to Precious Metals: As previously mentioned, adding precious metals to your portfolio can provide a hedge against a devaluing dollar. Consider allocating a portion of your 401K to investments like gold and silver, which have historically maintained their value during economic uncertainties.

- Review and Adjust Investment Strategy: Stay informed about economic trends and adjust your investment strategy accordingly. In a dollar collapse scenario, it may be prudent to shift investments towards more defensive sectors or assets that are less susceptible to currency fluctuations.

- Protect Against Market Volatility: Market volatility is often intensified during times of a currency crisis. Protect your 401K by implementing risk management techniques such as stop-loss orders, diversifying across different market sectors, and avoiding excessive exposure to high-risk investments.

- Consider International Investments: Diversifying your portfolio with international investments can provide exposure to different currencies and economies. This diversification can help cushion the impact of a dollar collapse and provide opportunities for growth in other markets that may be performing well.

- Revisit Your Asset Allocation: Regularly review your asset allocation and adjust it based on changing market conditions and your investment goals. In times of economic uncertainty, you may want to consider a more conservative asset allocation to minimize potential losses.

- Seek Professional Guidance: Consulting with a financial advisor who specializes in retirement planning can provide valuable guidance and support in navigating a potential dollar collapse. They can help you analyze the risks and opportunities and tailor a strategy specific to your financial objectives.

- Maintain a Long-Term Perspective: It’s important to remember that market fluctuations, including a potential dollar collapse, are part of the natural economic cycle. Stay focused on your long-term retirement goals and avoid making impulsive investment decisions based on short-term market movements.

Implementing these strategies can help you protect your 401K and navigate the potential impact of a dollar collapse. However, it is essential to personalize your approach based on your individual financial situation, risk tolerance, and investment goals. Regularly reassess your portfolio and stay informed about market conditions to make informed decisions about preserving and growing your retirement savings.

Conclusion

Preparing for a potential dollar collapse and safeguarding your 401K is an essential aspect of retirement planning. While it’s impossible to predict the future with certainty, there are strategies you can implement to protect your retirement savings and mitigate the impact of a dollar collapse.

Evaluating the safety of different investments, diversifying your portfolio, and considering assets like precious metals can help provide stability and preserve the value of your 401K. Regularly monitoring your investments, adjusting your asset allocation, and seeking professional advice can ensure that your retirement savings remain aligned with your long-term goals.

Remember that your unique financial situation, risk tolerance, and investment objectives should guide your decision-making process. As you navigate potential economic uncertainties, maintaining a long-term perspective will help you weather market fluctuations and make sound investment decisions based on your retirement goals.

Ultimately, the key is to stay informed, be proactive, and regularly review and reassess your investment strategy. By taking these steps, you can protect and preserve your 401K, helping to secure a comfortable retirement even in the face of a potential dollar collapse.