Home>Finance>What Happens When Dividends Are Brought Forward In A Simple Perfect Capital Market?

Finance

What Happens When Dividends Are Brought Forward In A Simple Perfect Capital Market?

Published: January 2, 2024

Discover the impact of bringing dividends forward in a perfect capital market. Learn how this financial strategy affects returns and investor decisions. Explore the finance implications now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Dividends

- Basics of a Simple Perfect Capital Market

- Concept of Bringing Dividends Forward

- Advantages of Bringing Dividends Forward

- Disadvantages of Bringing Dividends Forward

- Implications on Stock Prices

- Impact on Shareholders’ Wealth

- Examples of Companies Bringing Dividends Forward

- Conclusion

Introduction

Welcome to the world of dividends and the fascinating concept of bringing dividends forward. In the realm of finance, dividends play a crucial role in distributing profits to shareholders. They are a way for companies to reward their investors and provide them with a consistent stream of income. But what exactly does it mean to bring dividends forward? And how does it impact the stock market and shareholders?

To understand the concept of bringing dividends forward, we must first define what dividends are. In simple terms, dividends are a portion of a company’s earnings that are distributed to its shareholders. These earnings can come in different forms, such as cash, additional shares of stock, or even property.

Now, let’s dive into the basics of a simple perfect capital market. In a perfect capital market, there are no transaction costs, taxes, or restrictions on buying or selling securities. It is purely a theoretical concept that allows for easy and frictionless trading.

Bringing dividends forward refers to the practice of a company accelerating the payment of dividends to its shareholders. Instead of waiting for the regular distribution date, the company opts to pay the dividends earlier than scheduled. This decision can have significant implications for both the company and its shareholders.

There are advantages to bringing dividends forward. For companies, it can be a strategic move to attract more investors and boost shareholder confidence. By providing early access to dividends, companies can demonstrate their commitment to shareholder value and potentially attract new investors who prioritize regular income streams.

On the other hand, there are also disadvantages to bringing dividends forward. Companies need to carefully consider their cash flow situation and ensure that they have sufficient funds to meet the accelerated dividend payments without compromising their financial stability or future growth opportunities.

The impact of bringing dividends forward can be seen in the stock market. When a company announces that it will bring dividends forward, it often leads to an increase in the demand for its shares. Investors see this as a positive signal and may rush to buy the company’s stock, driving up its price. Consequently, the market value of the company may increase, resulting in higher shareholder wealth.

Overall, the concept of bringing dividends forward is a fascinating aspect of the financial world. It highlights the delicate balance companies must strike between maximizing shareholder value and maintaining financial stability. It is an intriguing strategy that can influence stock prices and impact the wealth of shareholders.

Now that we have a general understanding of what it means to bring dividends forward, let’s delve deeper into the advantages and disadvantages of this practice. Stay tuned!

Definition of Dividends

Before we explore the concept of bringing dividends forward, it’s essential to have a clear understanding of what dividends are. In the world of finance, dividends refer to a portion of a company’s profits that are distributed to its shareholders. They are a way for companies to reward investors for holding their stock and provide them with a share of the company’s success.

Dividends are typically paid in cash, but they can come in various forms, such as additional shares of stock or property. The amount of dividends distributed to shareholders is determined by the company’s board of directors, who assess the company’s financial performance, cash flow, and future prospects.

Dividends are a fundamental component of investing in stocks. They play a crucial role in generating passive income for shareholders, allowing them to earn regular cash flow from their investments. Dividends are particularly attractive to income-focused investors who prioritize stable and consistent returns.

One key aspect to note about dividends is their connection to a company’s profitability. In general, companies that generate healthy profits are more likely to pay dividends to their shareholders. However, the decision to pay dividends ultimately lies in the hands of the company’s management and board of directors, who must balance the interests of shareholders with the company’s long-term growth objectives.

Dividends can be classified into two main types: regular dividends and special dividends. Regular dividends are recurring payments made by companies to their shareholders on a predetermined schedule, such as quarterly or annually. These dividends are based on a set dividend rate or a certain percentage of the company’s earnings.

On the other hand, special dividends are one-time payments made by companies in addition to their regular dividends. These dividends are typically distributed when a company experiences exceptional financial performance, such as surpassing revenue or profit targets, selling assets, or receiving a windfall gain. Special dividends can be a pleasant surprise for shareholders, providing them with an extra boost of income beyond their regular dividend distributions.

It’s important to note that not all companies pay dividends. Some companies, especially newer or high-growth ones, may choose to reinvest their profits back into the business rather than distributing them to shareholders. Instead, these companies may focus on capital appreciation, aiming to increase the value of their stock over time.

Now that we have a solid understanding of what dividends are and their various forms, let’s explore the concept of bringing dividends forward and its implications on the financial landscape.

Basics of a Simple Perfect Capital Market

Before we delve deeper into the concept of bringing dividends forward, let’s establish a foundational understanding of a simple perfect capital market. In finance, a simple perfect capital market is a theoretical concept that serves as a benchmark for understanding how financial markets operate in an idealized setting.

In a simple perfect capital market, there are several key assumptions:

- No transaction costs: Buying or selling securities in the market does not incur any fees or transaction costs.

- No taxes: There are no taxes on capital gains, dividends, or any other financial transactions.

- No restrictions on buying and selling: Investors can freely buy and sell securities without any restrictions. There are no regulations or impediments that hinder the process.

- Perfect information: All investors have access to the same information. There are no information asymmetries, meaning everyone has equal and complete knowledge about the securities they are trading.

- Rational investors: All investors act rationally and make decisions solely based on maximizing their wealth. They do not have any emotional biases or irrational behavior.

- No impact on prices: The actions of individual investors or companies do not have any significant impact on security prices. This assumption assumes that the market is highly liquid and efficient.

These assumptions create an idealized framework where buying and selling securities is frictionless, information is readily available to all participants, and market prices reflect the true value of the securities. While a simple perfect capital market is a theoretical construct and may not fully correspond to real-world market conditions, it provides a useful baseline for understanding the workings of financial markets.

It’s important to note that real-world financial markets may deviate from these assumptions. Transaction costs, taxes, and regulations can impact market efficiency and investor behavior. Additionally, information asymmetries and behavioral biases can play a significant role in how securities are priced and traded. Nevertheless, the concept of a simple perfect capital market provides a starting point for analyzing financial phenomena such as bringing dividends forward.

Now that we have a clear understanding of the basics of a simple perfect capital market, let’s proceed to explore the concept of bringing dividends forward and its implications on businesses and investors.

Concept of Bringing Dividends Forward

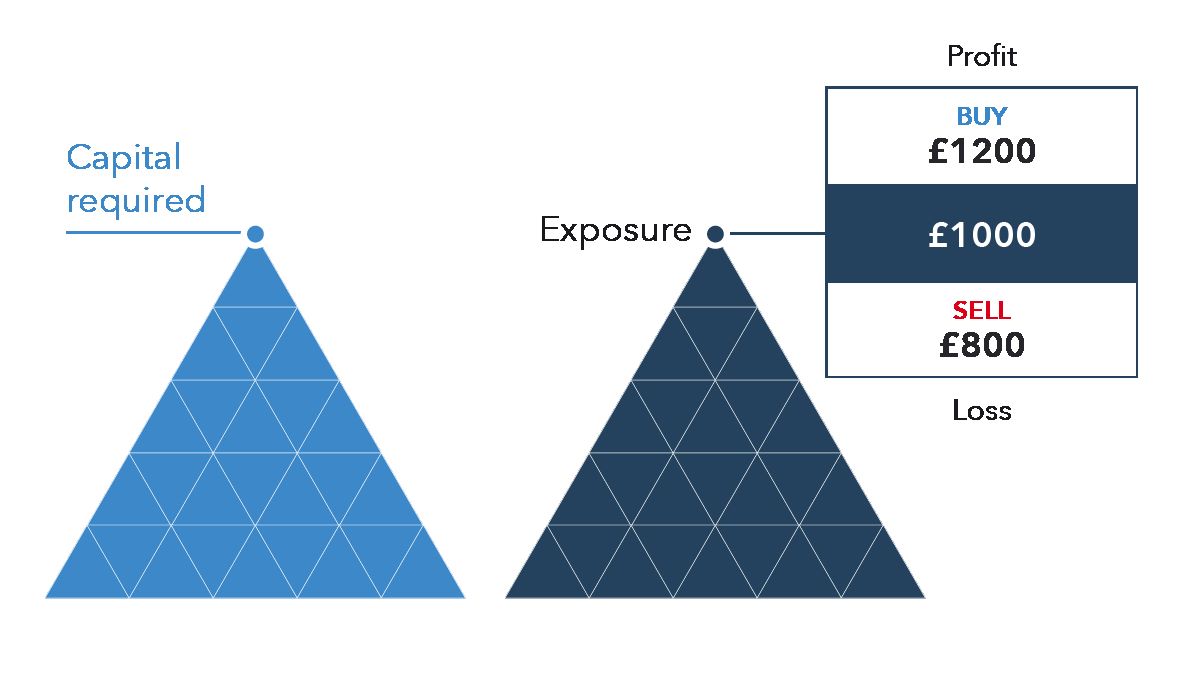

In the world of finance, bringing dividends forward refers to the practice of a company accelerating the payment of dividends to its shareholders. Instead of waiting for the regular distribution date, the company chooses to pay the dividends earlier than scheduled.

When a company brings dividends forward, it essentially moves the payment date closer to the present, allowing shareholders to receive their dividend payments sooner than expected. This can have several implications for both the company and its shareholders.

The decision to bring dividends forward is typically made by the company’s management and board of directors. They consider various factors, including the company’s financial position, cash flow requirements, and shareholder expectations, before making the decision. It is a strategic move that can have both advantages and disadvantages.

One of the advantages of bringing dividends forward is the ability to attract more investors. By offering early access to dividends, companies can demonstrate their commitment to providing regular income streams to their shareholders. This can be particularly appealing to income-focused investors who prioritize stable and consistent returns. It can also help attract new investors who are seeking companies that prioritize shareholder value.

Another advantage of bringing dividends forward is the potential to boost shareholder confidence and loyalty. When a company announces that it will bring dividends forward, it signals financial strength and stability. Shareholders may view this as a positive indicator of the company’s performance and its ability to generate consistent profits. This can lead to increased trust and loyalty among existing shareholders, potentially resulting in a lower likelihood of selling their shares.

However, bringing dividends forward also has its disadvantages. Companies need to carefully consider their cash flow situation before deciding to accelerate dividend payments. It is important to ensure that there are sufficient funds available to meet the accelerated dividend obligations without compromising the company’s financial stability or hindering its growth prospects. If a company faces cash flow constraints, accelerating dividends may not be a viable option.

Furthermore, bringing dividends forward may have tax implications for both the company and its shareholders. Depending on the jurisdiction and tax laws, there may be different tax rates or regulations governing the early payment of dividends. Companies and shareholders should consult with tax professionals to understand the potential tax consequences of bringing dividends forward.

By bringing dividends forward, a company can have an impact on the stock market as well. The announcement of accelerated dividend payments often leads to increased demand for the company’s shares. Investors interpret this move as a positive signal and may rush to buy the stock, driving up its price in the market. This can result in increased market value for the company and potentially benefit shareholders who hold its shares.

Overall, bringing dividends forward is a strategic decision that companies make to enhance investor appeal and demonstrate commitment to shareholder value. While it can have advantages in terms of attracting investors and boosting shareholder confidence, companies must carefully consider their financial position and tax implications before implementing such a move.

Now that we have explored the concept of bringing dividends forward, let’s delve deeper into the specific advantages and disadvantages associated with this practice.

Advantages of Bringing Dividends Forward

Bringing dividends forward, or accelerating the payment of dividends, can offer several advantages for both companies and their shareholders. Let’s explore some of the key benefits associated with this practice:

- Enhanced investor appeal: By offering early access to dividends, companies can significantly enhance their investor appeal. Investors, particularly those seeking regular income streams, are attracted to companies that prioritize consistent and timely dividend payments. Bringing dividends forward can help companies differentiate themselves from competitors and attract a broader investor base.

- Increased shareholder confidence: Accelerated dividend payments can instill greater confidence among shareholders. When a company announces that it will bring dividends forward, it signals financial strength and stability. Shareholders view this as a positive indicator of the company’s performance and its ability to generate consistent profits. Increased confidence can lead to greater loyalty among existing shareholders, reducing the likelihood of them selling their shares.

- Improved shareholder retention: Bringing dividends forward can incentivize existing shareholders to hold onto their shares for a longer period. By receiving dividends earlier, shareholders can enjoy a steady income stream, potentially reducing the incentive to sell their shares. This can contribute to a more stable shareholder base and provide greater stability for the company’s stock price.

- Attracting income-focused investors: Companies that bring dividends forward can attract income-focused investors who prioritize regular and consistent returns. These investors often rely on dividend payments as a significant source of income. By offering accelerated dividends, companies can capture the interest of these investors and potentially increase demand for their shares in the market.

- Positive market perception: Publicly announcing the decision to bring dividends forward can create a positive perception in the market. Investors and analysts may interpret this move as a vote of confidence from the company’s management, signaling a positive outlook for future performance. The positive market sentiment can lead to an increase in the company’s stock price, benefiting both existing and new shareholders.

It is important to note that the advantages of bringing dividends forward may vary depending on the specific circumstances of each company. Factors such as financial stability, cash flow availability, and investor expectations should be carefully considered before implementing this practice.

By strategically bringing dividends forward, companies can not only attract and retain investors but also signal their commitment to delivering value to shareholders. It is a proactive move that can enhance the company’s reputation, boost investor confidence, and potentially contribute to long-term shareholder wealth.

Now that we’ve explored the advantages of bringing dividends forward, let’s turn our attention to the potential disadvantages and considerations associated with this practice.

Disadvantages of Bringing Dividends Forward

While bringing dividends forward can offer several advantages, it is important for companies to carefully consider the potential disadvantages and implications associated with this practice. Let’s explore some of the key drawbacks:

- Cash flow implications: One of the primary considerations when deciding to bring dividends forward is the company’s cash flow situation. Accelerating dividend payments requires sufficient funds to fulfill the obligations. If a company is facing cash flow constraints or has limited liquidity, bringing dividends forward may not be a viable option without compromising its financial stability or hindering future growth opportunities.

- Tax implications: Bringing dividends forward can have tax implications for both the company and its shareholders. Depending on the jurisdiction and tax regulations, there may be different tax rates or rules governing the early payment of dividends. Companies and shareholders should consult with tax professionals to ensure compliance and understand the potential tax consequences of accelerating dividend payments.

- Reduced flexibility: By bringing dividends forward, companies forego the flexibility of using the funds for other purposes, such as reinvestment in the business or pursuing growth opportunities. Once dividends are paid out, the company may have limited resources for strategic initiatives, potentially impacting its ability to adapt to market conditions or invest in long-term value creation.

- Market expectations: Announcing the acceleration of dividend payments may create market expectations for consistent early payments in the future. If a company is unable to meet these expectations due to changing market conditions or financial constraints, it may lead to disappointment among investors and potentially negatively impact the company’s reputation.

- Perception of volatility: Bringing dividends forward could inadvertently convey a perception of volatility or financial distress. Some investors may question why a company feels the need to accelerate dividend payments, speculating that the company may be facing financial challenges. It is crucial for companies to transparently communicate their motivations and financial position to ensure clarity and mitigate any negative perceptions.

These disadvantages highlight the need for careful evaluation and analysis before making the decision to bring dividends forward. Companies must assess their financial stability, cash flow situation, and future investment opportunities to ensure that accelerating dividend payments align with their long-term goals and financial health.

While bringing dividends forward can have its drawbacks, it is essential to note that these disadvantages are context-dependent. Each company has unique circumstances and must consider these factors in conjunction with the potential benefits of accelerating dividend payments.

Now that we’ve explored the potential disadvantages of bringing dividends forward, let’s move on to understanding the broader implications this practice can have on stock prices and shareholders’ wealth.

Implications on Stock Prices

Bringing dividends forward can have significant implications for stock prices. The announcement of accelerated dividend payments can create both short-term and long-term effects on the market value of a company’s shares. Let’s explore the key implications on stock prices:

Short-term price impact: When a company announces its intention to bring dividends forward, it often leads to increased demand for its shares in the market. Investors perceive this move as a positive signal, indicating the company’s financial strength and commitment to delivering value to shareholders. As a result, investors may rush to buy the company’s shares, leading to a temporary increase in its stock price. This short-term price impact reflects the positive sentiment and market optimism surrounding the accelerated dividend payments.

Long-term price impact: The long-term impact on stock prices due to bringing dividends forward is contingent upon various factors, including the fundamentals of the company, market conditions, and investor sentiment. If the market perceives the company’s decision to accelerate dividend payments as a positive signal, the increased demand for its shares may persist beyond the initial announcement. This can contribute to a sustained increase in the company’s stock price, reflecting the improved market perception of its financial performance and shareholder-friendly practices.

Investor expectations: The announcement of bringing dividends forward can also shape investor expectations and influence future stock price movements. If investors develop the perception that the company will consistently deliver early dividend payments in the future, it may lead to increased demand for the stock and potentially drive its price higher. Conversely, failing to meet these expectations may result in disappointment and a negative impact on the stock price.

Market reaction to performance: The stock price response to bringing dividends forward can also reflect the market’s assessment of the company’s performance. If investors recognize the accelerated dividend payments as a reward for strong financial performance, it may contribute to a positive market reaction, potentially driving the stock price up. On the other hand, if the market believes that the early dividend payments are an attempt to compensate for weaker performance or financial difficulties, it may lead to a negative market response and a potential decline in the stock price.

It is crucial to note that stock price implications due to bringing dividends forward are not solely determined by this practice. They are influenced by various market factors, including broader economic conditions, industry trends, and investor sentiment. Each company’s stock price is subject to its unique circumstances, financial performance, and investor perceptions.

Overall, bringing dividends forward can have both short-term and long-term effects on stock prices. The initial announcement often leads to a temporary increase in demand and a positive price impact. Over the long term, sustained market perception, investor expectations, and the company’s financial performance play a crucial role in determining the stock price implications of accelerating dividend payments.

Now that we’ve explored the implications on stock prices, let’s delve into the impact of bringing dividends forward on shareholders’ wealth.

Impact on Shareholders’ Wealth

Bringing dividends forward can have a significant impact on shareholders’ wealth. The decision to accelerate dividend payments can affect the financial well-being of investors in several ways. Let’s explore the key impacts on shareholders’ wealth:

Immediate income boost: One of the primary benefits for shareholders is the immediate boost to their income. By bringing dividends forward, shareholders receive their dividend payments sooner than expected, providing them with a timely injection of cash. This additional income can contribute to improved financial stability and liquidity for individual investors, especially those who rely on dividend payments for regular expenses or investment goals.

Opportunity for reinvestment: Accelerated dividend payments can provide shareholders with the opportunity to reinvest the funds into the market. By receiving dividends earlier, investors have the flexibility to allocate the proceeds towards other investment opportunities, potentially maximizing their returns. This can be especially beneficial for shareholders who actively manage their portfolios and seek to capitalize on market opportunities.

Compound growth potential: Bringing dividends forward allows shareholders to potentially capitalize on the power of compounding. When investors reinvest their dividend payments, they can purchase additional shares of the company’s stock. Over time, this reinvestment can lead to an accumulation of more shares, resulting in increased dividend payouts in subsequent periods. The compounding effect can significantly enhance long-term wealth accumulation for shareholders.

Perception of shareholder value: The decision to bring dividends forward can enhance the perception of shareholder value, contributing to an increased market valuation of the company’s stock. This positive market sentiment can result in price appreciation, potentially benefiting shareholders who hold the company’s stock. The appreciation of stock value can directly contribute to an increase in shareholders’ wealth.

Long-term income stream: Accelerated dividend payments can also provide shareholders with a consistent and reliable income stream over the long term. By receiving dividends earlier, investors can continue to benefit from regular cash flow from their investments. This steady income can contribute to financial stability and support investors in meeting their financial goals or covering their expenses.

It is worth noting that the impact on shareholders’ wealth due to bringing dividends forward may vary depending on individual circumstances and investment strategies. Factors such as the size of their holdings, investment goals, and tax treatment may influence the actual financial gains experienced by shareholders.

Additionally, the impact on wealth accumulation is not limited to the accelerated dividend payments themselves. Shareholders’ total wealth and investment returns also depend on other factors, such as overall market conditions, company performance, and diversification of their investment portfolios.

Overall, bringing dividends forward can have a positive impact on shareholders’ wealth by providing immediate income, reinvestment opportunities, compounding potential, and enhancing the perception of shareholder value. However, the actual impact may vary based on individual circumstances and broader market factors.

Now that we’ve explored the impact on shareholders’ wealth, let’s take a look at some real-world examples of companies that have brought dividends forward.

Examples of Companies Bringing Dividends Forward

Bringing dividends forward is a strategic move that some companies employ to enhance investor appeal and demonstrate their commitment to delivering value to shareholders. While not all companies choose to accelerate dividend payments, there have been notable examples where companies have adopted this practice. Let’s explore a few examples of companies that have brought dividends forward:

1. Apple Inc.: In April 2020, Apple announced that it would bring dividends forward for its shareholders. The company accelerated its dividend payment by a month, resulting in shareholders receiving their dividends earlier than expected. This move aimed to provide immediate financial support to investors during challenging economic conditions and signal the company’s commitment to rewarding shareholders even in uncertain times.

2. Walmart Inc.: In March 2015, Walmart accelerated its dividend payments for the year. The company made the decision to bring dividends forward by several days, allowing shareholders to receive their dividend payments earlier than initially scheduled. This move was part of an ongoing effort by Walmart to enhance shareholder value and provide timely income to its investors.

3. Procter & Gamble Co.: Procter & Gamble, a multinational consumer goods corporation, has also brought dividends forward in the past. In 2008, the company announced that it would accelerate dividend payments for its shareholders. This decision was made to provide financial support to investors during the global financial crisis and demonstrate the company’s commitment to its dividend policy.

4. Coca-Cola Company: Coca-Cola, a leading beverage company, has adopted the practice of bringing dividends forward on multiple occasions. In 2020, the company accelerated its dividend payment by a month, ensuring that shareholders received their dividends earlier in the year. This move aimed to provide stability and support to investors during the uncertain times caused by the COVID-19 pandemic.

These examples demonstrate how companies from diverse industries have made the decision to bring dividends forward. In each case, the companies aimed to provide immediate financial support to their shareholders, enhance investor appeal, and communicate their commitment to delivering value.

It is important to note that the decision to bring dividends forward is made on a case-by-case basis and is influenced by various factors, including the company’s financial position, cash flow availability, and investor expectations.

Now that we’ve explored examples of companies that have brought dividends forward, let’s conclude our discussion on the practice of accelerating dividend payments.

Conclusion

Bringing dividends forward is a strategic move that companies can employ to enhance investor appeal, demonstrate their commitment to shareholder value, and provide immediate financial support to investors. By accelerating dividend payments, companies can capture the attention of income-focused investors, boost shareholder confidence, and potentially attract new shareholders.

There are advantages to bringing dividends forward, including enhanced investor appeal, increased shareholder confidence, and improved shareholder retention. By offering early access to dividends, companies can position themselves as income-friendly investments and strengthen their relationships with shareholders.

However, there are also considerations to be mindful of, such as cash flow implications, tax considerations, and potential market expectations. Companies must carefully evaluate their financial stability, liquidity, and growth opportunities before deciding to bring dividends forward. It is important to strike a balance between meeting shareholder expectations and maintaining the company’s long-term financial health.

The decision to bring dividends forward can have implications on stock prices, with initial short-term price impacts and potential long-term benefits if the market perceives the move positively. It can also impact shareholders’ wealth by providing immediate income, offering reinvestment opportunities, and potentially contributing to long-term wealth accumulation through compounding.

While not all companies choose to accelerate dividend payments, there have been notable examples where companies have brought dividends forward to enhance shareholder value. These examples demonstrate the various reasons companies may decide to implement this practice.

In conclusion, bringing dividends forward is a strategic maneuver that companies carefully consider to align with their financial goals and provide value to shareholders. By understanding the advantages, disadvantages, implications on stock prices, and impact on shareholders’ wealth, companies can make informed decisions that benefit both the business and its investors.

Now that we’ve explored the concept of bringing dividends forward comprehensively, we have gained insights into how this practice can shape the dynamics of the financial landscape and contribute to the prosperity of shareholders and companies alike.