Home>Finance>In Perfect Capital Markets How Does Leverage Affect The Cost Of Equity?

Finance

In Perfect Capital Markets How Does Leverage Affect The Cost Of Equity?

Modified: December 30, 2023

Learn how leverage impacts the cost of equity in perfect capital markets. Explore the relationship between finance and leverage in this insightful article.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to finance, understanding the concept of leverage and its impact on the cost of equity is crucial. In the world of perfect capital markets, where information is freely available and there are no barriers to financial transactions, the cost of equity plays a significant role in determining the overall financial standing of a company.

In this article, we will delve into the details of perfect capital markets and leverage, and explore how leverage affects the cost of equity. By understanding this relationship, businesses can make informed decisions about their capital structure and optimize shareholder value.

Perfect capital markets, also known as efficient capital markets, are theoretical markets where all relevant information is fully and immediately reflected in the prices of financial assets. In these markets, investors have access to perfect information and can make rational and unbiased decisions. Furthermore, there are no restrictions on borrowing and lending, and transaction costs are negligible.

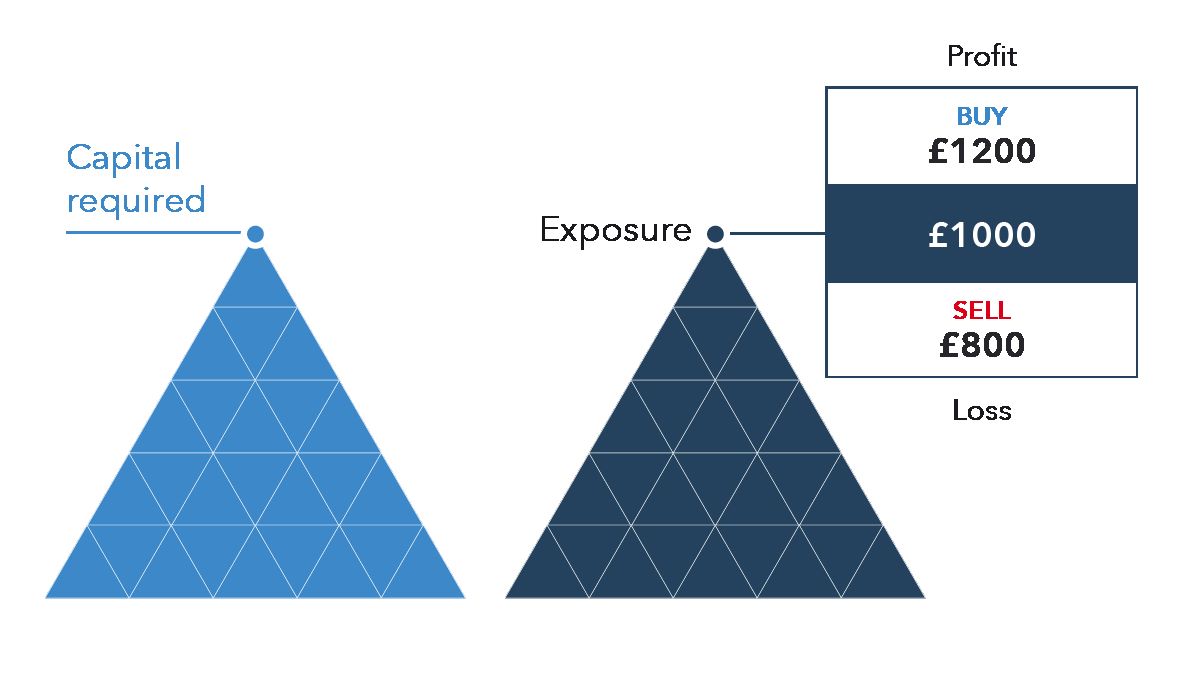

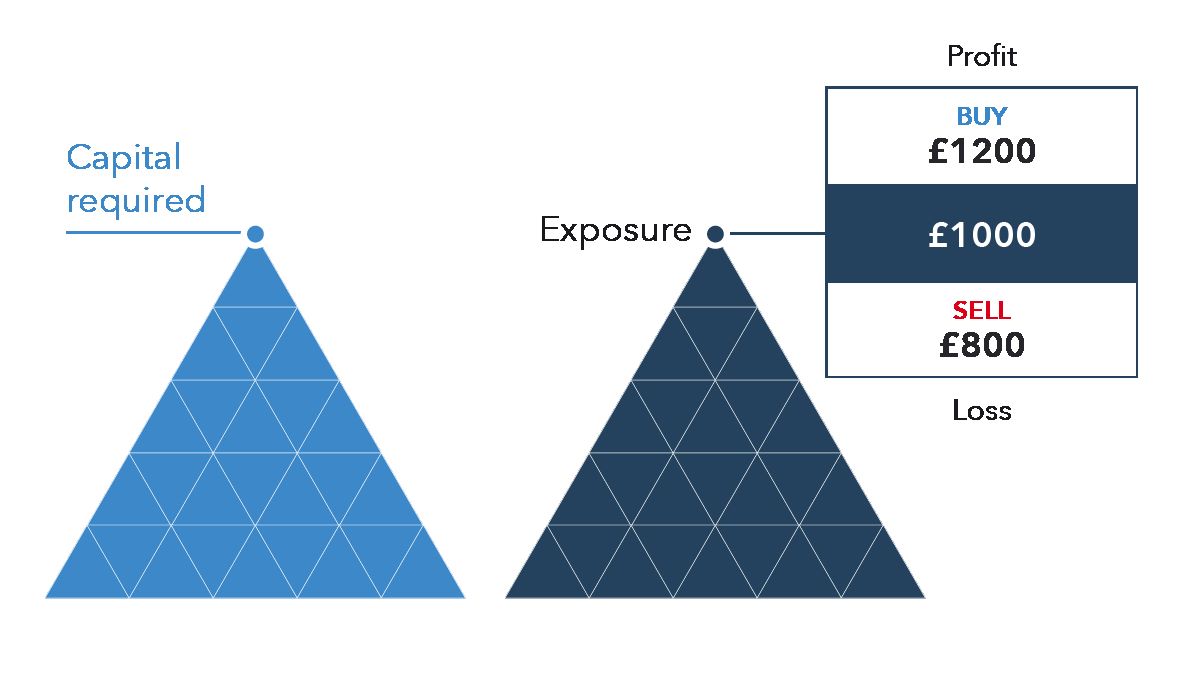

Leverage is the use of borrowed funds to finance investments or operations. It allows companies to magnify their potential returns but also exposes them to a higher level of risk. Leverage can be achieved through debt financing, where companies borrow money, or through the issuance of equity, where companies raise funds by selling shares of ownership.

The cost of equity, on the other hand, is the expected return that investors require for holding shares in a company. It is essentially the cost of financing the company through equity capital. The cost of equity is influenced by various factors, including the company’s risk profile, growth prospects, and market conditions.

Now, let’s explore how leverage affects the cost of equity in perfect capital markets.

Definition of Perfect Capital Markets

Perfect capital markets, also known as efficient capital markets, are theoretical markets in which all relevant information is readily available and efficiently incorporated into the prices of financial assets. In these idealized markets, investors can trade securities at any time without incurring transaction costs, and there are no barriers to capital flow or restrictions on borrowing and lending.

One key characteristic of perfect capital markets is that there are no impediments to the flow of information. This means that all investors have access to the same information simultaneously, and there are no informational advantages or disadvantages among market participants. Consequently, prices in these markets fully reflect all available information, making it impossible to consistently earn abnormal returns through trading strategies based on public information.

In a perfect capital market, there are no restrictions on borrowing and lending. This implies that investors can easily access capital to finance their investments or meet liquidity needs. Additionally, there are no transaction costs, such as brokerage fees or taxes, associated with trading securities. This frictionless environment allows for efficient capital allocation and smooth functioning of financial markets.

In these idealized markets, investors are assumed to be rational and risk-averse. They make investment decisions based on expected return and risk analysis, without any behavioral biases or emotions influencing their choices. This assumption facilitates the efficient pricing of securities, as market participants will adjust prices based on their assessment of the risks and returns associated with different investments.

It’s important to note that perfect capital markets are primarily a theoretical construct. In reality, markets are not perfectly efficient due to various factors such as transaction costs, imperfect information, and behavioral biases. However, the concept of perfect capital markets provides a theoretical benchmark for understanding the fundamental principles of financial markets and the implications for investment decision-making.

Now that we have a clear understanding of perfect capital markets, let’s explore the concept of leverage and its relationship with the cost of equity in these markets.

Definition of Leverage

In finance, leverage refers to the use of borrowed funds to finance investments or operations. It allows businesses to amplify their potential returns by using other people’s money, but it also exposes them to a higher level of risk.

Leverage can be achieved through debt financing or equity financing. Debt financing involves borrowing money from external sources, such as banks or bondholders, and promising to repay the borrowed amount with interest over a specified period. On the other hand, equity financing involves raising funds by selling shares of ownership in the company to investors.

When a company uses debt to finance its operations, it incurs interest expenses that need to be paid to creditors. These interest expenses reduce the company’s net income, which in turn affects the return on equity, a key measure of profitability. However, if the return on the company’s investments is higher than the cost of borrowing, leverage can result in higher returns for the shareholders.

Equity financing, on the other hand, does not involve borrowing funds but rather involves selling ownership in the company. By issuing shares of stock, the company raises capital from investors who become partial owners of the business. This capital then becomes part of the company’s equity, which can be used to finance its operations or invest in growth opportunities.

Both debt and equity financing have their advantages and disadvantages. Debt financing allows companies to benefit from tax advantages and fixed interest rates, but it also increases financial risk and can lead to financial distress if the company is unable to meet its debt obligations. Equity financing provides flexibility and does not require repayment, but it dilutes ownership and may result in a loss of control for existing shareholders.

Leverage is commonly measured using financial ratios such as the debt-to-equity ratio and the leverage ratio. The debt-to-equity ratio compares a company’s total debt to its total equity and provides an indication of the proportion of debt used in the company’s capital structure. The leverage ratio measures the company’s total debt relative to its assets and helps assess the company’s ability to meet its financial obligations.

Understanding leverage is crucial for businesses as it impacts their financial performance, risk profile, and cost of capital. In the next section, we will explore how leverage affects the cost of equity in perfect capital markets.

Cost of Equity in Perfect Capital Markets

The cost of equity is the expected return that investors require for holding shares in a company. It represents the cost of financing the company through equity capital. In perfect capital markets, where information is freely available and there are no barriers to financial transactions, the cost of equity plays a crucial role in determining a company’s financial standing.

In perfect capital markets, the cost of equity is influenced by several factors. One key factor is the risk profile of the company. Investors will demand a higher return for holding shares in a company that has a higher level of risk. The risk can be assessed through various means, such as analyzing the company’s historical financial performance, industry trends, and macroeconomic factors.

Another factor that influences the cost of equity is the company’s growth prospects. Investors are more likely to demand a higher return for holding shares in a company that has higher expected future growth. Companies with strong growth potential are seen as more attractive investments and therefore tend to have a higher cost of equity.

Market conditions also play a role in determining the cost of equity. In perfect capital markets, where all investors have access to perfect information, changes in market conditions such as interest rates, inflation rates, and overall market sentiment can influence the cost of equity. For example, if interest rates are high, investors may require a higher return on their investments, thus increasing the cost of equity.

The cost of equity is a crucial component of a company’s overall cost of capital. The cost of capital is the average rate of return that a company must generate from its investments to satisfy the expectations of various stakeholders, including shareholders, creditors, and other providers of capital. It represents the cost of funding the company’s operations and investments.

Calculating the cost of equity in perfect capital markets involves estimating the expected return on equity using various methodologies such as the dividend discount model (DDM) or the capital asset pricing model (CAPM). These models take into account the company’s future expected earnings, dividends, and risk factors to determine the appropriate rate of return demanded by investors.

Understanding the cost of equity in perfect capital markets is essential for companies as it helps them assess the attractiveness of their investment opportunities, evaluate their cost of financing, and make informed decisions about their capital structure. In the next section, we will explore how leverage affects the cost of equity in perfect capital markets.

Impact of Leverage on the Cost of Equity

Leverage has a direct impact on the cost of equity in perfect capital markets. The use of leverage can affect a company’s overall risk profile and financial structure, which in turn influences the required return demanded by equity investors.

When a company uses leverage to finance its operations, it increases the proportion of debt in its capital structure. This higher level of debt increases the financial risk of the company, as it now has fixed interest payments to honor regardless of its financial performance. As a result, equity investors require a higher return to compensate for the increased risk associated with the company’s leverage.

Adding leverage to a company’s capital structure increases the variability of the returns to equity investors. In good times, when the company’s investments generate higher returns than the cost of borrowing, leverage amplifies the shareholders’ returns. However, in bad times, when the company’s earnings are lower than the interest expenses, leverage magnifies the losses suffered by equity investors.

Another impact of leverage on the cost of equity is the potential loss of control for existing shareholders. When a company raises debt, it typically needs to provide collateral or accept covenants that restrict its financial decision-making. This can affect the ability of existing equity shareholders to exercise control over the company’s operations and strategic direction. As a result, equity investors may demand a higher return to compensate for the potential loss of control.

It is important to note that the impact of leverage on the cost of equity in perfect capital markets can vary depending on the specific circumstances of the company and the market conditions. Companies with stable cash flows, low levels of debt, and strong growth prospects may experience a smaller increase in the cost of equity when using leverage compared to companies with higher levels of financial risk and weaker financial performance.

Understanding the impact of leverage on the cost of equity is crucial for companies when making decisions about their capital structure. By analyzing the trade-offs between the benefits and costs of leverage, companies can optimize their overall cost of capital and maximize shareholder value.

Factors Affecting the Relationship between Leverage and Cost of Equity

The relationship between leverage and the cost of equity in perfect capital markets is influenced by various factors. These factors determine the extent to which leverage affects the required return demanded by equity investors. Understanding these factors is crucial for companies to make informed decisions about their capital structure.

1. Financial Risk: The level of financial risk associated with a company’s leverage is a key determinant of the cost of equity. Higher leverage increases the financial risk as the company becomes more vulnerable to fluctuations in interest rates and faces higher interest payments. Equity investors will demand a higher return to compensate for the increased financial risk.

2. Business Risk: The nature of a company’s business and its industry can affect the relationship between leverage and the cost of equity. Companies operating in stable and less cyclical industries may experience a smaller increase in the cost of equity when using leverage compared to companies in volatile and cyclical industries. This is because stable businesses are less prone to financial distress and have more predictable cash flows.

3. Growth Prospects: The growth prospects of a company can also influence the impact of leverage on the cost of equity. Companies with strong growth potential and attractive investment opportunities may experience a smaller increase in the cost of equity when using leverage. This is because the potential for higher returns from the company’s investments can counterbalance the increased financial risk.

4. Market Conditions: The prevailing market conditions, including interest rates, inflation rates, and overall market sentiment, can affect the relationship between leverage and the cost of equity. In times of high interest rates or economic uncertainty, equity investors may demand a higher return to compensate for the increased risk associated with leverage. Conversely, in favorable market conditions, the cost of equity may be relatively lower.

5. Company Size and Reputation: The size and reputation of a company can play a role in the relationship between leverage and the cost of equity. Larger and more established companies with a solid track record may have better access to debt financing at lower interest rates, which can mitigate the impact on the cost of equity. Additionally, companies with a strong reputation may be perceived as less risky by equity investors, resulting in a lower increase in the cost of equity when using leverage.

It is important to note that the impact of these factors can vary depending on the specific circumstances of the company and the market conditions. Therefore, companies should carefully consider these factors when analyzing the trade-offs between the benefits and costs of leverage in order to make optimal decisions about their capital structure.

Empirical Studies on Leverage and Cost of Equity

Over the years, numerous empirical studies have been conducted to examine the relationship between leverage and the cost of equity in real-world settings. These studies have provided valuable insights into the dynamics of this relationship and have informed corporate finance decision-making. Here are some key findings from these studies:

1. Trade-off Theory: One prominent theory that has been supported by empirical evidence is the trade-off theory. According to this theory, there is an optimal level of leverage at which the benefits of debt, such as tax advantages and increased returns on investment, are balanced with the costs, such as higher financial risk and potential financial distress. Empirical studies have shown that companies with moderate levels of debt tend to have a lower cost of equity compared to companies with either too much or too little debt.

2. Modigliani-Miller Theorem: The Modigliani-Miller theorem, which suggests that the capital structure of a firm is irrelevant in a perfect capital market, has also been tested empirically. While real-world markets may not be perfectly efficient, studies have generally found that the cost of equity does not significantly vary with changes in leverage within a certain range. This implies that, in practice, the impact of leverage on the cost of equity may not be as pronounced as predicted by theoretical models.

3. Market Timing Hypothesis: Some studies have investigated the market timing hypothesis, which suggests that companies time their debt issuances to take advantage of favorable market conditions. These studies have found that companies tend to issue debt when market conditions are favorable, such as when interest rates are low. This suggests that companies are aware of the impact of market conditions on the cost of equity and strategically time their debt issuances to minimize the increase in the cost of equity.

4. Firm-specific Factors: Empirical studies have also examined the impact of firm-specific factors on the relationship between leverage and the cost of equity. Factors such as profitability, asset tangibility, growth opportunities, and business risk have been found to interact with leverage and influence the cost of equity. For example, companies with higher profitability and tangible assets may experience lower increases in the cost of equity when using leverage.

While empirical studies have provided insights into the relationship between leverage and the cost of equity, it is important to note that the results may vary depending on the sample size, time period, and methodology used. Additionally, factors such as market conditions, industry dynamics, and company-specific characteristics can significantly influence the findings.

Overall, these empirical studies have contributed to the understanding of how leverage affects the cost of equity in real-world settings. They have underscored the importance of considering various factors and making informed decisions about capital structure to optimize the overall cost of capital and maximize shareholder value.

Conclusion

Understanding the relationship between leverage and the cost of equity is paramount for businesses operating in perfect capital markets. Leverage, defined as the use of borrowed funds to finance operations, has a direct impact on a company’s financial structure and risk profile, which in turn affects the required return demanded by equity investors.

In perfect capital markets, where information is freely available and transaction costs are negligible, the cost of equity plays a vital role in determining a company’s financial standing. Factors such as financial risk, business risk, growth prospects, and market conditions influence the cost of equity. Leverage amplifies these factors, leading to an increase in the cost of equity.

Empirical studies have supported theories such as the trade-off theory, which suggests an optimal level of leverage that balances the benefits and costs of debt. Additionally, the Modigliani-Miller theorem provides insights into the irrelevance of capital structure in perfect capital markets. However, real-world market conditions, along with firm-specific factors, can influence the relationship between leverage and the cost of equity.

It is essential for companies to carefully analyze the trade-offs between the benefits and costs of leverage when making decisions about their capital structure. Optimal capital structure involves finding the right balance that maximizes shareholder value, considering factors such as financial risk, business risk, growth prospects, and market conditions.

In conclusion, understanding the impact of leverage on the cost of equity allows companies to make informed decisions about their capital structure. By considering the trade-offs and factors affecting the relationship between leverage and the cost of equity, businesses can optimize their overall cost of capital, strengthen their financial position, and ultimately enhance shareholder value in perfect capital markets.