Home>Finance>What Happens When Private Equity Buys A Company

Finance

What Happens When Private Equity Buys A Company

Published: January 22, 2024

Discover the impact of private equity acquisitions on companies in the finance sector. Learn about the changes and challenges that arise from these transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Impact of Private Equity Acquisition on Companies

Private equity acquisitions have become a prevalent strategy for companies seeking financial restructuring and operational optimization. When a private equity firm acquires a company, it initiates a series of changes aimed at enhancing the company's performance and ultimately increasing its value. This process involves a myriad of strategic, operational, and financial maneuvers that significantly impact the acquired company's trajectory.

The journey of a company post-private equity acquisition is often marked by a blend of challenges, opportunities, and transformations. Understanding the intricacies of this process is crucial for stakeholders, including employees, investors, and industry observers. In this article, we will delve into the multifaceted impact of private equity acquisitions on companies, exploring the acquisition process, operational changes, financial restructuring, and the implications for employees. Through this exploration, we aim to provide a comprehensive understanding of the dynamics at play when a company undergoes a transition under private equity ownership.

Private equity acquisitions are not merely financial transactions; they are strategic endeavors that can reshape the future of a company. By examining real-world case studies, we will illuminate the tangible outcomes of such acquisitions, shedding light on the complexities and outcomes that arise when private equity buys a company. This examination will offer valuable insights into the mechanisms and implications of private equity acquisitions, enabling a deeper comprehension of the forces that drive change within the corporate landscape.

Understanding Private Equity

Private equity represents a distinct form of investment that involves the direct investment in private companies or the acquisition of public companies with the intention of delisting them from public stock exchanges, thereby making them privately held. Private equity firms raise capital from various sources, including institutional investors and high-net-worth individuals, to form investment funds. These funds are then deployed to acquire equity stakes in companies, with the overarching goal of generating substantial returns for investors.

One of the defining characteristics of private equity is the active involvement of the acquiring firm in the management and strategic direction of the acquired company. This hands-on approach distinguishes private equity from other forms of investment, such as venture capital or hedge funds. Private equity firms often seek to implement operational and strategic changes within the acquired companies to enhance their performance and drive value creation.

Private equity investments typically operate on a longer time horizon compared to other forms of investment. The investment lifecycle can span several years, during which the private equity firm collaborates with the company’s management to execute growth strategies, operational improvements, and, in some cases, restructuring initiatives. This extended investment horizon aligns with the objective of fundamentally transforming the acquired companies to achieve sustainable growth and profitability.

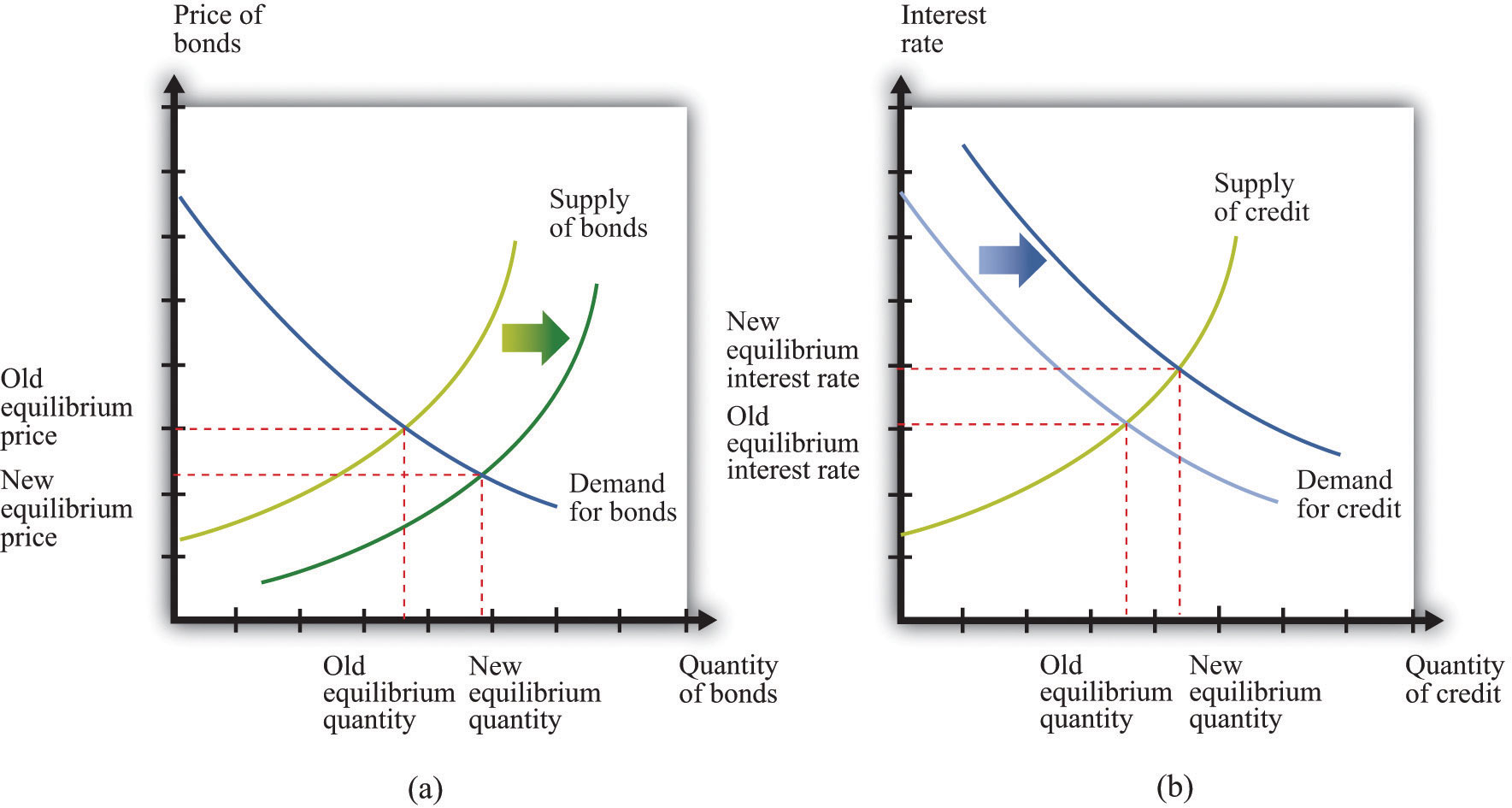

Moreover, private equity transactions often involve a significant amount of leverage, with the use of debt financing to fund a substantial portion of the acquisition. This leverage amplifies the potential returns on investment but also introduces financial complexities and risks. The strategic application of leverage is a critical aspect of private equity transactions, as it can influence the financial structure and performance of the acquired companies.

Understanding the core principles and mechanisms of private equity is essential for comprehending the subsequent impact of private equity acquisitions on companies. By grasping the dynamics of private equity investment, one can discern the strategic imperatives and operational levers that drive the transformation of companies under private equity ownership.

The Acquisition Process

The acquisition process in private equity entails a series of strategic and operational steps that culminate in the purchase and subsequent ownership of a company by a private equity firm. This process typically begins with the identification of potential target companies that align with the investment criteria and strategic objectives of the private equity firm. Once a target company is identified, the private equity firm conducts comprehensive due diligence to assess the company’s financial health, market position, operational capabilities, and growth potential.

Following due diligence, the private equity firm formulates a detailed acquisition proposal, outlining the terms of the transaction, the proposed valuation, and the strategic rationale behind the acquisition. Negotiations ensue between the private equity firm and the target company’s management or shareholders, aiming to reach an agreement on the terms of the acquisition. This negotiation phase often involves intricate discussions regarding the purchase price, governance structure, and post-acquisition strategic plans.

Upon reaching a definitive agreement, the acquisition is executed, and the target company transitions into the ownership of the private equity firm. This transition marks the initiation of a collaborative effort between the private equity firm and the company’s management to implement strategic initiatives and operational enhancements. The private equity firm typically takes an active role in guiding the strategic direction of the company, leveraging its industry expertise and network to drive growth and value creation.

Throughout the acquisition process, the private equity firm aims to align the interests of the company’s management with its own, often through the implementation of equity incentive plans and performance-based compensation structures. This alignment of interests is critical in fostering a unified approach toward achieving the agreed-upon strategic objectives and financial targets.

Ultimately, the acquisition process represents the commencement of a partnership between the private equity firm and the acquired company, with the shared goal of unlocking the company’s potential and positioning it for sustainable growth and value realization. The subsequent phases of operational and financial transformation are integral to realizing the full potential of the acquisition, as the private equity firm works in tandem with the company’s management to drive impactful changes and strategic evolution.

Operational Changes

Upon acquisition by a private equity firm, the acquired company often undergoes a series of operational changes aimed at optimizing its performance and positioning it for sustainable growth. These changes typically encompass strategic realignments, operational efficiencies, and enhancements in functional areas such as marketing, sales, supply chain management, and technology utilization.

One of the primary areas of focus for operational enhancement is the implementation of strategic initiatives to streamline business processes and improve overall efficiency. This may involve restructuring organizational hierarchies, optimizing production workflows, and deploying advanced technologies to automate and enhance operational functions. By fostering a culture of operational excellence, private equity firms seek to drive productivity gains and cost efficiencies within the acquired company.

Furthermore, private equity ownership often catalyzes a renewed focus on growth strategies and market expansion. This may entail exploring new market segments, expanding the company’s geographic footprint, or diversifying its product or service offerings. The private equity firm collaborates with the company’s management to identify growth opportunities and develop robust strategies to capitalize on them, thereby stimulating revenue growth and market penetration.

Operational changes also extend to talent management and organizational development. Private equity firms frequently work with the company’s leadership to strengthen the management team, attract top-tier talent, and cultivate a high-performance culture. This may involve the recruitment of seasoned executives, the implementation of leadership development programs, and the establishment of performance-driven incentives to align the interests of key personnel with the company’s strategic objectives.

Moreover, private equity ownership often instigates a heightened focus on customer-centric initiatives and the enhancement of customer experiences. This may involve refining customer service processes, developing innovative product offerings, and leveraging data analytics to gain deeper insights into customer preferences and behaviors. By prioritizing customer satisfaction and loyalty, the acquired company can fortify its market position and drive sustainable revenue growth.

Through these operational changes, private equity firms endeavor to instill a culture of continuous improvement and strategic agility within the acquired company. By optimizing operational capabilities, fostering growth-oriented strategies, and nurturing a high-performance organizational culture, private equity ownership aims to position the company for long-term success and value creation.

Financial Restructuring

Financial restructuring is a pivotal facet of the transformation that unfolds when a company is acquired by a private equity firm. This process involves a comprehensive reevaluation and reconfiguration of the company’s financial structure, capital allocation, and financial management practices with the objective of optimizing financial performance, enhancing liquidity, and fortifying the company’s financial position.

One of the primary areas of focus in financial restructuring is the optimization of the company’s capital structure. Private equity firms often collaborate with the company’s management to assess the existing debt and equity composition, evaluating opportunities to restructure the balance sheet and capitalize on favorable financing options. This may involve refinancing existing debt, negotiating more favorable lending terms, or injecting additional equity to bolster the company’s financial resilience and flexibility.

Furthermore, private equity ownership frequently entails a rigorous assessment of the company’s cost structure and working capital management. This examination aims to identify opportunities for cost containment, working capital optimization, and the enhancement of cash flow management. By implementing robust financial controls and working capital improvement initiatives, the acquired company can bolster its financial stability and mitigate liquidity risks.

Financial restructuring also encompasses the implementation of robust financial reporting and performance measurement systems. Private equity firms often advocate for the adoption of advanced financial analytics and reporting mechanisms to facilitate informed decision-making and enhance transparency. This emphasis on financial visibility and accountability enables the company’s management to gain deeper insights into the financial drivers of the business and make data-informed strategic choices.

Moreover, private equity ownership frequently catalyzes a heightened focus on financial discipline and value-based management. This may involve the establishment of key performance indicators (KPIs), the implementation of incentive structures tied to financial targets, and the cultivation of a financial mindset across the organization. By fostering a culture of financial prudence and value creation, private equity firms aim to instill a results-driven ethos within the company.

Through these financial restructuring initiatives, private equity firms endeavor to enhance the financial resilience, agility, and performance of the acquired company. By optimizing the capital structure, fortifying financial controls, and fostering a value-centric financial culture, private equity ownership seeks to position the company for sustained financial success and long-term value creation.

Impact on Employees

When a company undergoes a transition under private equity ownership, the impact on employees is a critical aspect that warrants attention. The changes initiated by private equity firms often reverberate throughout the organizational landscape, influencing the work environment, employee engagement, and career trajectories. Understanding the implications for employees is essential for comprehending the broader ramifications of private equity acquisitions.

One of the primary areas of impact on employees is the potential for organizational restructuring and realignment. Private equity ownership may precipitate changes in the organizational structure, including the consolidation of business units, the redefinition of roles and responsibilities, and the implementation of new reporting relationships. While these changes can yield operational efficiencies and strategic focus, they may also engender uncertainties and apprehensions among employees regarding their positions and career paths.

Moreover, private equity ownership often introduces a heightened emphasis on performance management and accountability. This may involve the implementation of performance metrics, the establishment of performance-based incentives, and a greater emphasis on results-driven outcomes. While this focus can incentivize high performance and meritocracy, it may also create a more competitive and demanding work environment, impacting the dynamics of teamwork and collaboration.

Private equity acquisitions can also bring about changes in employee benefits, compensation structures, and HR policies. The private equity firm may seek to optimize employee benefits programs, introduce new compensation models, and refine human resource practices to align with the strategic objectives of the company. While these changes may offer opportunities for enhanced rewards and career development, they can also evoke concerns and adjustments among employees accustomed to the previous frameworks.

Furthermore, private equity ownership often catalyzes a renewed emphasis on talent development and leadership succession. This may involve the identification of high-potential employees, the implementation of leadership development programs, and the cultivation of a talent pipeline to support the company’s growth trajectory. While these initiatives can create avenues for career advancement and skill enhancement, they may also introduce heightened performance expectations and career progression criteria.

It is imperative for private equity firms to navigate these employee-centric changes with sensitivity and transparency, fostering open communication and providing support mechanisms for employees during the transition. By acknowledging and addressing the impact on employees, private equity ownership can cultivate a culture of trust, resilience, and shared commitment, ultimately fostering an environment conducive to sustained performance and employee satisfaction.

Case Studies

Examining real-world case studies provides valuable insights into the tangible outcomes and dynamics of private equity acquisitions. Two notable examples illustrate the multifaceted impact of private equity ownership on companies and the subsequent transformations that unfold.

Case Study 1: Company A

Company A, a mid-sized manufacturing firm, was acquired by a prominent private equity firm with a focus on industrial investments. Following the acquisition, the private equity firm initiated a comprehensive operational overhaul, leveraging its industry expertise to optimize the company’s production processes and supply chain management. This involved the implementation of advanced manufacturing technologies, the streamlining of production workflows, and the expansion of the company’s product portfolio to capitalize on emerging market trends. As a result, Company A experienced a notable increase in production efficiency and a strengthened market position, leading to enhanced profitability and sustained growth.

Financial restructuring was also a pivotal component of the transformation, with the private equity firm collaborating with the company’s leadership to optimize its capital structure and working capital management. This involved refinancing high-cost debt, negotiating favorable credit terms, and implementing robust financial controls to enhance cash flow visibility. The financial restructuring initiatives bolstered the company’s financial resilience and positioned it for sustained performance amidst market uncertainties.

Case Study 2: Company B

Company B, a technology services provider, underwent a private equity acquisition aimed at accelerating its market expansion and product innovation. The private equity firm facilitated strategic realignments within the company, fostering a customer-centric approach and enhancing its service offerings to cater to evolving client needs. This involved the development of proprietary technology solutions, the expansion of the company’s service portfolio, and a renewed focus on customer relationship management. As a result, Company B achieved significant revenue growth and solidified its position as a market leader in its segment.

Employee impact was a focal point of the transformation, with the private equity firm emphasizing talent development and leadership succession. The company implemented robust talent management programs, leadership training initiatives, and performance-based incentives to cultivate a high-performance culture and align employee efforts with the company’s strategic vision. These employee-centric initiatives fostered a culture of innovation and collaboration, driving sustained success and employee satisfaction.

These case studies underscore the diverse strategies and outcomes that accompany private equity acquisitions, highlighting the multifaceted impact on operational, financial, and employee dimensions. By analyzing these real-world examples, stakeholders can glean valuable insights into the mechanisms and implications of private equity ownership, enriching their understanding of the transformative forces at play.

Conclusion

Private equity acquisitions exert a profound influence on companies, reshaping their operational, financial, and employee landscapes. The journey of a company post-private equity acquisition unfolds as a tapestry of strategic initiatives, operational optimizations, and financial realignments, culminating in tangible transformations that redefine the company’s trajectory. Understanding the holistic impact of private equity ownership is imperative for stakeholders, offering valuable insights into the dynamics and outcomes that accompany such transitions.

From the strategic acquisition process to the implementation of operational changes and financial restructuring, private equity firms orchestrate a comprehensive evolution within the acquired companies. These transformations are geared toward enhancing operational efficiencies, driving sustainable growth, and fortifying financial resilience, ultimately positioning the companies for long-term success and value creation.

Moreover, the impact on employees represents a pivotal dimension of private equity acquisitions, necessitating a nuanced approach to talent management, organizational realignment, and employee engagement. By acknowledging and addressing the implications for employees, private equity firms can foster a culture of trust, resilience, and shared commitment, underpinning sustained performance and employee satisfaction.

Real-world case studies serve as illuminating testaments to the diverse strategies and outcomes that unfold under private equity ownership, offering valuable insights into the mechanisms and implications of such acquisitions. These examples underscore the transformative potential of private equity ownership and the multifaceted impact it engenders across operational, financial, and employee dimensions.

In conclusion, private equity acquisitions represent strategic endeavors that transcend financial transactions, embodying a collaborative journey toward operational excellence, financial resilience, and employee empowerment. By comprehending the intricate dynamics at play when private equity buys a company, stakeholders can glean a deeper understanding of the forces that drive change within the corporate landscape, enriching their perspectives on the transformative potential of private equity ownership.