Home>Finance>What Happens When You Go Into A Higher Tax Bracket

Finance

What Happens When You Go Into A Higher Tax Bracket

Published: January 20, 2024

Discover what happens to your finances when you move into a higher tax bracket. Learn how it can impact your income and strategies to mitigate the effects.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

As individuals work hard to increase their income and move up in their careers, they may find themselves entering into higher tax brackets. While it signifies a milestone in one’s financial journey, it also comes with certain implications for tax obligations. Understanding what it means to go into a higher tax bracket is crucial for effectively managing finances and maximizing take-home pay.

In simple terms, tax brackets determine the percentage of income that individuals or households must pay in taxes. The tax system is designed with a progressive structure, which means that the tax rates increase as income rises. As a result, moving into a higher tax bracket means that a larger portion of an individual’s income will be subject to higher tax rates.

It’s important to note that tax brackets are not applied to the entire income. Instead, they are assessed in tiers. Let’s say that in a certain tax year, an individual falls into the 25% tax bracket. This does not mean that their entire income will be taxed at 25%. Rather, the income up to a specific threshold will be taxed at one rate, and the income above that threshold will be taxed at a higher rate.

The concept of tax brackets can seem complex, but understanding how they work is essential for financial planning. This article will explore in detail how tax brackets function and the implications of moving into a higher tax bracket. We will also provide strategies for managing higher tax brackets and minimizing the impact on overall tax liability.

Definition of Tax Brackets

Tax brackets are a system used by governments to determine the tax rates that individuals or households must pay based on their income. They are essentially a way to categorize earners into different income levels, with each level corresponding to a specific tax rate.

In most countries with progressive tax systems, such as the United States, tax brackets are designed to ensure that higher-income earners pay a larger proportion of their income in taxes compared to lower-income earners. This is based on the principle of fairness and the ability to pay.

Tax brackets are typically structured in ranges, or tiers, with each range representing a specific income level. The tax rates increase as income rises, and each tier applies to a different portion of the income. For example, in the United States, there are currently seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The income thresholds for each bracket may vary from year to year and are adjusted based on economic factors.

It’s important to note that tax brackets are marginal, which means that only the income within a specific bracket is taxed at that corresponding rate. The income in the lower brackets is taxed at the respective lower rates. This ensures that individuals are not penalized for moving into a higher tax bracket by paying a higher tax rate on all of their income.

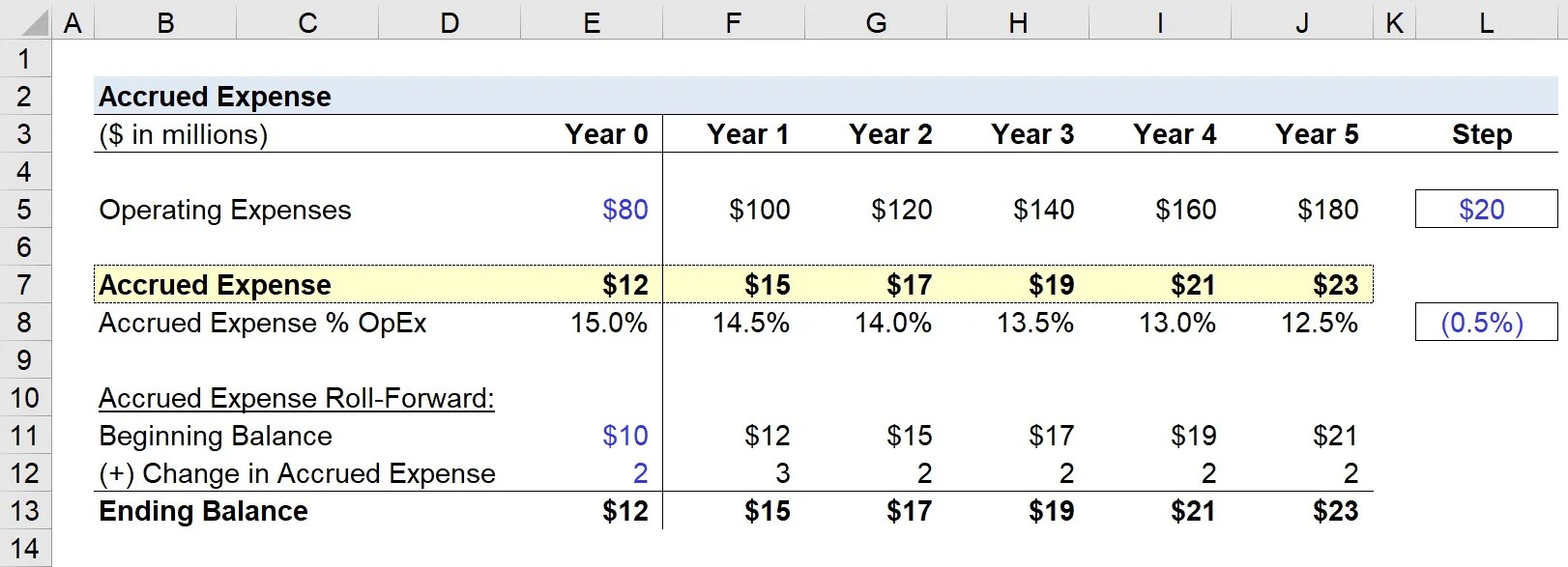

For example, let’s say the tax brackets are as follows:

- 10% for income up to $20,000

- 20% for income from $20,001 to $50,000

- 30% for income above $50,000

If an individual earns $60,000, they would fall into the 30% tax bracket. However, only the income above $50,000 would be taxed at 30%. The income up to $20,000 would be taxed at 10%, and the income from $20,001 to $50,000 would be taxed at 20%.

Understanding the structure and function of tax brackets is essential for accurately calculating tax liability and effectively managing finances. It allows individuals to plan and strategize their income and deductions to optimize their tax situation and minimize their overall tax burden.

How Tax Brackets Work

Tax brackets work by applying different tax rates to specific ranges of income. As individuals earn more income, they move up the tax bracket ladder, resulting in a higher percentage of their earnings being subject to higher tax rates.

Let’s take a closer look at how tax brackets work with an example:

- Income up to $50,000 is taxed at 10%

- Income from $50,001 to $100,000 is taxed at 20%

- Income above $100,000 is taxed at 30%

If an individual earns $70,000, the first $50,000 of their income would be taxed at 10%, resulting in a tax liability of $5,000. The remaining $20,000 would be taxed at 20%, resulting in an additional $4,000 in taxes. In total, their tax liability would be $9,000.

This progressive tax system ensures that individuals with higher incomes pay a higher percentage of their earnings in taxes, while those with lower incomes pay less. It promotes fairness in the tax system and allows for a redistribution of wealth.

It’s important to remember that tax brackets are marginal. This means that each tax rate applies only to the income within that specific bracket, not the entire income. So, even if someone falls into a higher tax bracket, only the additional income above the threshold is taxed at the higher rate.

For example, if an individual’s income exceeds $100,000 and enters the 30% tax bracket, only the amount of income above $100,000 will be taxed at 30%. The income up to $50,000 will still be taxed at 10%, and the income from $50,001 to $100,000 will be taxed at 20%.

Understanding how tax brackets work is crucial for estimating tax liability, planning finances, and taking advantage of any available deductions or credits. It allows individuals to make informed financial decisions to optimize their tax situation and maximize their take-home pay.

Moving into a Higher Tax Bracket

Moving into a higher tax bracket occurs when an individual’s income surpasses the threshold for the current tax bracket they are in. This can happen due to various reasons, such as a promotion, salary increase, or additional income from investments or side businesses.

When someone moves into a higher tax bracket, it means that a larger portion of their income will now be subject to higher tax rates. This can have a significant impact on their overall tax liability and their take-home pay.

For example, let’s consider a hypothetical tax bracket structure:

- Income up to $50,000 is taxed at 25%

- Income from $50,001 to $100,000 is taxed at 30%

If an individual earns $55,000, they would fall into the 30% tax bracket. This means that their income up to $50,000 would still be taxed at 25%, but the portion of their income from $50,001 to $55,000 would now be taxed at 30%.

Moving into a higher tax bracket does not mean that all of the individual’s income is now taxed at the higher rate. It only affects the income within that specific bracket. Therefore, individuals will still pay the lower tax rate on the income in the lower brackets.

It’s important to note that moving into a higher tax bracket is not necessarily a negative outcome. It usually signifies an increase in income and financial progress. However, individuals should be aware of the potential impact on their overall tax liability and plan accordingly to ensure they are maximizing their take-home pay.

Understanding the concepts of tax brackets and how moving into a higher tax bracket can affect one’s finances is essential for effective financial planning. By anticipating these changes and strategizing accordingly, individuals can minimize the impact on their take-home pay and make informed decisions to optimize their overall financial situation.

Increased Tax Liability

When an individual moves into a higher tax bracket, their tax liability increases. This means that they will owe a higher amount of taxes to the government based on their income. The increase in tax liability is a direct result of the higher tax rates applied to the additional income earned in the higher tax bracket.

The impact of the increased tax liability will depend on the specific tax bracket structure and the individual’s income level. Generally, the higher the tax bracket, the greater the increase in tax liability.

For example, let’s consider a simplified tax bracket scenario:

- Income up to $50,000 is taxed at 20%

- Income from $50,001 to $100,000 is taxed at 30%

If an individual’s income increases from $45,000 to $55,000, they would move into the 30% tax bracket. This results in an increased tax liability of 10% on the additional $5,000 earned. So, their tax liability would increase by $500.

It’s crucial for individuals to be prepared for the potential increase in tax liability when moving into a higher tax bracket. Depending on their income level, this increase can have a significant impact on their overall financial situation.

That being said, it’s important to remember that the increased tax liability is not based on the individual’s entire income, but rather on the portion that falls within the higher tax bracket. The income below the threshold of the new tax bracket will still be taxed at the lower rate.

Managing increased tax liability requires careful financial planning. Individuals may need to consider adjusting their budget, exploring deductions and credits, maximizing tax-advantaged saving opportunities, or seeking professional advice to mitigate the impact on their finances.

Understanding the potential increase in tax liability when moving into a higher tax bracket allows individuals to make informed financial decisions and proactively manage their tax obligations. By doing so, they can ensure they are prepared for the resulting changes and minimize any adverse effects on their overall financial situation.

Impact on Take-Home Pay

Moving into a higher tax bracket can have a direct impact on an individual’s take-home pay. As the tax rates increase, a larger portion of the individual’s income is allocated towards taxes, resulting in a reduction in the amount of money they bring home after taxes are deducted.

When individuals move into a higher tax bracket, their take-home pay may decrease in two ways:

- Increased tax withholding: Employers typically withhold taxes from an employee’s paycheck based on their tax bracket and information provided in their W-4 form. Moving into a higher tax bracket may lead to a higher percentage of taxes being withheld from each paycheck, reducing the amount of money received.

- Higher tax liability at filing: At the end of the tax year, individuals are required to file their tax returns and settle any remaining tax liability. When moving into a higher tax bracket, individuals may owe more taxes when they file their returns, further impacting their overall financial situation.

It’s important to note that the impact on take-home pay will depend on the individual’s income level, the specific tax bracket structure, and other variables such as deductions and credits. Additionally, factors such as changes in family size, marital status, and other personal circumstances can also affect take-home pay.

To manage the impact on take-home pay, individuals can consider adjusting their tax withholding by updating their W-4 form with their employer. This allows them to withhold a higher or lower amount of taxes from each paycheck to align with their current tax situation. Seeking advice from a financial professional can provide guidance on optimizing tax withholdings.

Overall, the impact on take-home pay will vary from person to person. Understanding the potential reduction in take-home pay when moving into a higher tax bracket helps individuals effectively plan their finances and make any necessary adjustments to accommodate for the increased tax obligations.

Strategies to Manage Higher Tax Brackets

Moving into a higher tax bracket doesn’t have to be overwhelming. There are several strategies individuals can employ to effectively manage their tax obligations and optimize their financial situation:

- Maximize tax-deferred retirement accounts: Contributing to tax-deferred retirement accounts, such as a 401(k) or traditional IRA, allows individuals to reduce their taxable income. By contributing pre-tax dollars, individuals can potentially lower their tax liability and effectively manage their higher tax bracket.

- Explore tax deductions and credits: Take advantage of available tax deductions and credits to reduce taxable income and potential tax liability. Items such as mortgage interest, student loan interest, medical expenses, and charitable contributions may qualify for deductions or credits, thus lowering overall tax obligations.

- Consider tax-efficient investments: Invest in tax-efficient investment vehicles, such as index funds or tax-managed mutual funds, to minimize taxes on investment gains. These investments are designed to be tax-efficient, potentially reducing the impact of higher tax rates on investment returns.

- Utilize tax-advantaged savings accounts: Make use of tax-advantaged savings accounts, such as a Health Savings Account (HSA) or a Flexible Spending Account (FSA), to reduce taxable income and save money on healthcare expenses.

- Strategize timing of income and deductions: Depending on personal circumstances, individuals can strategically time their income and deductions to minimize the impact of a higher tax bracket. For example, delaying a year-end bonus or accelerating deductions into the current tax year can help manage taxable income.

- Consult with a tax professional: Seeking guidance from a tax professional can provide valuable insights and personalized advice on managing higher tax brackets. They can help individuals navigate complex tax laws, identify opportunities for deductions and credits, and develop a customized strategy to optimize their tax situation.

Each individual’s financial situation is unique, so it’s important to consider these strategies in the context of personal circumstances. Consulting with a financial advisor or tax professional can provide tailored guidance based on specific needs and goals.

By adopting these strategies and actively managing their tax obligations, individuals can effectively navigate higher tax brackets and minimize the impact on their overall financial well-being. With careful planning and informed decision-making, it’s possible to optimize finances and make the most of the opportunities that moving into a higher tax bracket may present.

Conclusion

Navigating higher tax brackets is an important aspect of managing personal finances and maximizing take-home pay. Understanding the concept of tax brackets, how they work, and their implications is crucial for making informed financial decisions.

As individuals progress in their careers and increase their income, they may move into higher tax brackets. This means a larger portion of their income will be subject to higher tax rates. However, it’s important to remember that tax brackets are marginal, and only the income within each bracket is taxed at the corresponding rate.

Moving into a higher tax bracket can lead to increased tax liability and an impact on take-home pay. However, by implementing effective strategies, individuals can proactively manage their tax obligations:

- Maximizing contributions to tax-deferred retirement accounts

- Exploring tax deductions and credits

- Considering tax-efficient investments

- Utilizing tax-advantaged savings accounts

- Strategizing the timing of income and deductions

- Seeking guidance from a tax professional

These strategies can help individuals minimize the impact of higher tax brackets and optimize their overall financial situation. It’s important to remember that everyone’s financial circumstances are unique, and consulting with a financial advisor or tax professional can provide personalized recommendations.

By staying informed about tax regulations, planning strategically, and adapting to changing circumstances, individuals can effectively manage their higher tax brackets, maximize their take-home pay, and achieve their financial goals.