Finance

What Is Business Investment?

Published: October 17, 2023

Learn about business investments and how they relate to finance. Discover the importance of investment strategies and their impact on financial success.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Business investment plays a vital role in driving economic growth and prosperity. It refers to the allocation of funds or resources to undertake activities that are expected to generate profits or achieve long-term goals. Whether it’s funding a start-up, expanding an existing business, or investing in new technologies, business investment is a fundamental pillar of the modern economy.

Investing in a business can take various forms, such as purchasing stocks, acquiring assets, funding research and development, or even investing in human capital. The decision to invest in a business is based on factors like potential returns, market conditions, and the overall economic climate.

In this article, we will delve into the concept of business investment, explore its importance, discuss the various types of investments, examine the factors that influence investment decisions, highlight the benefits and risks involved, and provide strategies for successful business investment.

Understanding business investment is crucial for entrepreneurs, investors, business owners, and policymakers alike. By grasping the fundamentals and intricacies of this subject, individuals can make informed decisions, maximize returns, and contribute to the growth of their businesses and the economy at large.

Definition of Business Investment

Business investment refers to the allocation of financial resources, time, or other assets to pursue economic activities that have the potential to generate profits or fulfill long-term objectives. It involves the commitment of funds to acquire or develop assets, expand operations, conduct research and development, or invest in human capital.

Investments in the business context can take various forms. One common form is equity investment, where individuals or companies purchase ownership stakes in a business in exchange for a share of its profits and assets. Debt financing is another form where businesses obtain loans or issue bonds to fund their operations or investments. Additionally, businesses can invest in tangible assets like real estate, machinery, or equipment, or intangible assets such as patents, trademarks, or copyrights.

Business investment is driven by the expectation of achieving financial returns. Investors carefully evaluate the feasibility and profitability of their investment opportunities, considering factors such as market conditions, competition, technological advancements, and potential risks.

Successful business investment requires a comprehensive understanding of the industry, market trends, and financial management. It involves analyzing risks, assessing potential rewards, and making informed decisions that align with the long-term goals of the business.

In summary, business investment encompasses the allocation of resources to undertake economic activities with the objective of generating profits or achieving long-term goals. It involves acquiring assets, financing operations, or investing in intangibles that contribute to the growth and success of a business.

Importance of Business Investment

Business investment plays a crucial role in driving economic growth and development. It is a key catalyst for innovation, job creation, increased productivity, and wealth generation. Here are some of the key reasons why business investment is important:

- Economic Growth: Business investment is one of the main drivers of economic growth. When businesses invest in new projects, expand operations, or adopt new technologies, they contribute to increased production, employment, and overall economic activity.

- Innovation: Business investment fuels innovation. When companies invest in research and development, they drive technological advancements, improve products and services, and develop new solutions. This enhances competitiveness and drives progress in various industries.

- Job Creation: Business investment leads to job creation. As businesses expand and invest in new projects, they create employment opportunities, reducing unemployment rates and improving livelihoods within communities.

- Increased Productivity: Business investment often involves upgrading infrastructure, adopting new technologies, or improving processes. These investments result in increased productivity, efficiency, and competitiveness, which contribute to the overall growth and prosperity of the business.

- Wealth Generation: Business investment offers the potential for wealth generation. When individuals invest in businesses, they have the opportunity to profit from the success and growth of those businesses, whether through dividends, capital appreciation, or other forms of returns on investment.

Furthermore, business investment plays a critical role in attracting foreign direct investment (FDI). Countries that offer attractive investment opportunities and favorable business environments tend to attract more FDI, which brings in external capital, expertise, and technology, benefiting the domestic economy.

Overall, business investment is vital for economic growth, innovation, job creation, increased productivity, and wealth generation. It fosters entrepreneurial activity, drives competitiveness, and fuels progress in various industries. Governments, policymakers, and businesses alike recognize the importance of promoting and facilitating business investment to stimulate economic development and improve living standards.

Types of Business Investment

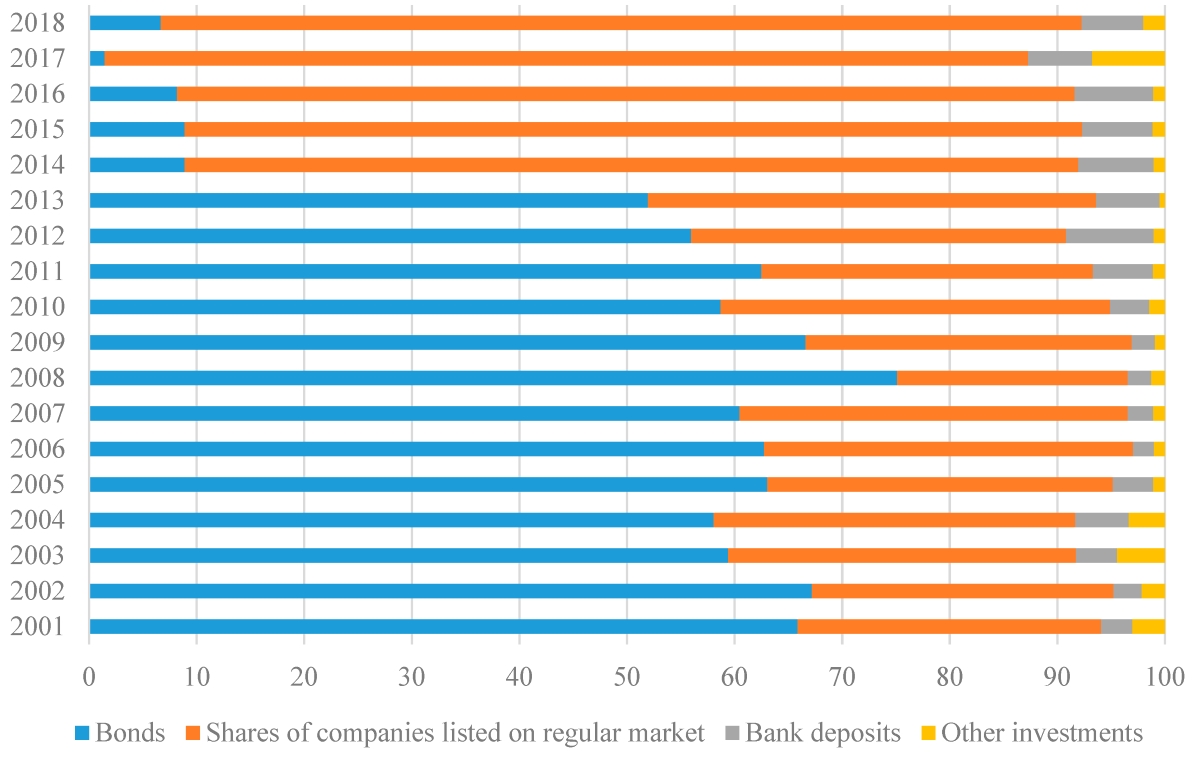

Business investments can be categorized into various types based on their nature, purpose, and financial structure. Understanding the different types of business investment is crucial for making informed decisions and diversifying investment portfolios. Here are some common types of business investments:

- Equity Investments: Equity investments involve purchasing ownership stakes in a business. Investors become shareholders and have the potential to earn returns through dividends, capital appreciation, or the sale of their shares. This type of investment gives investors a voice in the decision-making process and exposes them to the risks and rewards of the business.

- Debt Investments: Debt investments involve providing funds to a business in exchange for regular interest payments and the repayment of the principal amount at a specified time. This can be in the form of loans, bonds, or other debt instruments. Debt investors are considered lenders and have a fixed claim on the business’s assets.

- Real Estate Investments: Real estate investments involve purchasing properties or investing in real estate development projects. This can include residential, commercial, or industrial properties. Real estate investments can provide a steady stream of rental income and the potential for capital appreciation.

- Angel Investments: Angel investments refer to early-stage investments made by individuals, known as angel investors, in start-up ventures. Angel investors often provide not just financial capital, but also mentorship, expertise, and networks to help the start-up grow. They typically take an equity stake in the business.

- Venture Capital Investments: Venture capital investments are made by venture capital firms or investors in high-growth start-ups or early-stage companies. These investments provide funding for business expansion, product development, or market entry. In return, venture capital investors receive an equity stake in the company.

- Private Equity Investments: Private equity investments involve investing in established companies that are not publicly traded. Private equity firms provide capital to support the company’s growth, financing acquisitions, or restructuring efforts. Private equity investors typically take a majority stake in the company.

- Research and Development Investments: Research and development (R&D) investments involve allocating funds to innovation, product development, or technological advancements. These investments are crucial for industries focused on innovation and require long-term vision and patience.

- Foreign Direct Investments: Foreign direct investments (FDI) occur when a business or individual invests in a business located in a foreign country. FDI can take the form of establishing new subsidiaries, acquiring existing businesses, or forming strategic partnerships.

These are just a few examples of the types of business investments available. Each type carries its own risks and potential rewards, and investors should carefully consider their investment goals, risk tolerance, and financial situation before choosing the most suitable investment type.

Factors Affecting Business Investment

Several factors influence business investment decisions. Understanding these factors is essential for businesses and investors to evaluate investment opportunities, assess risks, and make informed decisions. Here are some key factors that can significantly impact business investment:

- Economic Conditions: The overall state of the economy, including GDP growth, inflation rates, interest rates, and employment levels, can influence business investment. In times of economic expansion and favorable conditions, businesses are more likely to invest in new projects and expansion. Conversely, during economic downturns or periods of uncertainty, businesses may reduce investment to mitigate risks.

- Market Demand: The demand for products or services in the market is a critical factor in investment decisions. Businesses consider factors such as consumer preferences, market trends, and competition to assess the potential demand for their offerings. High market demand can encourage businesses to invest in production capacity, research and development, and market presence.

- Government Policies and Regulations: Government policies and regulations have a significant impact on business investment. Favorable policies, such as tax incentives or subsidies for investment, can encourage businesses to invest. On the other hand, burdensome regulations or uncertain policy environments may deter investment.

- Technological Advancements: Rapid technological advancements can influence investment decisions. Businesses need to continually innovate and adopt new technologies to stay competitive. Investments in research and development, automation, digitalization, and other technological upgrades can significantly shape investment strategies.

- Access to Capital: The availability of capital and financing options can affect business investment. Businesses with limited access to capital may face challenges in financing new projects or expansions. Access to loans, venture capital, or private equity can play a crucial role in enabling businesses to make strategic investments.

- Political and Geopolitical Factors: Political stability, geopolitical tensions, and government policies in different regions can impact business investment decisions, especially for international investments. Businesses assess factors like trade agreements, currency stability, and political risks to determine the feasibility and potential returns of their investments.

- Industry and Competitive Landscape: Industry-specific factors, such as market saturation, competitive intensity, and barriers to entry, influence investment decisions. Businesses assess industry dynamics and competitive forces to determine the potential profitability and sustainability of their investments.

It’s important to note that these factors may interact with each other, and their significance may vary depending on the specific context and industry. Businesses and investors must thoroughly analyze and consider these factors before making investment decisions to mitigate risks and maximize returns.

Benefits and Risks of Business Investment

Business investment comes with both benefits and risks. Understanding these potential outcomes is crucial for investors and businesses to assess the viability of investment opportunities and make informed decisions. Let’s explore the benefits and risks associated with business investment:

Benefits of Business Investment:

- Potential for High Returns: Business investment offers the potential for significant financial returns. Successful investments can lead to profit generation through capital appreciation, dividends, or other forms of returns on investment.

- Capital Growth and Wealth Accumulation: Investing in a business can provide an avenue for wealth accumulation over time. As the business grows and expands, the value of the investment may increase, resulting in capital growth and increased net worth.

- Passive Income Streams: Business investments, such as owning shares in a company, can provide a source of passive income through regular dividend payments. This can contribute to financial stability and diversification of income streams.

- Stimulates Economic Growth and Job Creation: Business investment fuels economic growth and job creation. By investing in new projects, expanding operations, or adopting new technologies, businesses contribute to increased productivity, employment opportunities, and overall economic activity.

- Tax Benefits: Depending on the jurisdiction and applicable tax laws, business investments may offer tax advantages. These may include deductions, exemptions, or preferential tax rates for certain types of investments or investment vehicles.

Risks of Business Investment:

- Financial Loss: Business investments are inherently associated with the risk of financial loss. The value of an investment can decrease due to poor business performance, economic downturns, market volatility, or other unforeseen circumstances.

- Market Volatility and Uncertainty: Business investments are subject to market fluctuations and uncertainty. Changes in market conditions, consumer preferences, or technological advancements can impact the profitability and viability of an investment.

- Operational Risks: Investments in businesses carry operational risks. Changes in management, supply chain disruptions, regulatory changes, or unforeseen operational challenges can have a negative impact on the performance and returns of an investment.

- Industry-specific Risks: Different industries have unique risks that can affect business investments. These may include regulatory changes, technological obsolescence, competitive pressures, or industry-specific challenges that can impact the profitability and sustainability of an investment.

- Liquidity Risk: Investing in businesses often involves tying up capital for an extended period. This lack of liquidity can limit the ability to access funds quickly or exit the investment if needed, potentially impacting investment flexibility.

It’s essential for investors and businesses to carefully assess and manage these risks to minimize potential losses and maximize returns. Diversification, thorough research and analysis, staying informed about market trends, and maintaining a long-term investment perspective are key strategies for managing the risks associated with business investment.

Strategies for Successful Business Investment

Successful business investment requires careful planning, analysis, and implementation. Whether you are an individual investor or a business looking to invest, utilizing effective strategies can increase your chances of success. Here are some key strategies for successful business investment:

- Thorough Research and Due Diligence: Conducting thorough research and due diligence is essential before making any investment decisions. This includes analyzing the industry, market trends, competition, financial statements, and growth potential of the business you are considering investing in. Understanding the risks and opportunities associated with the investment is crucial for making informed decisions.

- Define Investment Goals and Risk Tolerance: Clearly define your investment goals and assess your risk tolerance. Determine whether you are seeking short-term gains or long-term growth, and evaluate your willingness and ability to take on risk. This will help guide your investment decisions and align them with your overall financial objectives.

- Diversification: Diversification is a key strategy to manage risk and enhance investment returns. Spreading investments across different industries, asset classes, and geographical regions can help mitigate the impact of any single investment’s performance. Diversification can reduce the overall investment risk and increase the potential for long-term gains.

- Stay Informed and Adapt to Market Changes: Continuously monitor market trends, economic conditions, and regulatory developments relevant to your investments. Stay informed about industry news, technological advancements, and competitive dynamics. Adjust your investment strategy as needed to align with market changes and optimize your returns.

- Seek Professional Advice: Consider seeking advice from financial advisors, investment professionals, or consultants with expertise in the specific industry or market you are interested in. Their insights and experience can provide valuable guidance and help you make well-informed investment decisions.

- Long-Term Investment Perspective: Successful business investment often requires a long-term perspective. Instead of chasing short-term gains, focus on the long-term growth potential of your investments. Avoid making hasty decisions based on short-term market fluctuations and stay committed to your investment strategy.

- Review and Monitor Investments: Regularly review and monitor your investments to ensure they align with your goals and objectives. Monitor the performance of your investments, review financial statements, and assess market conditions. If needed, make adjustments to your portfolio to optimize performance and manage risk.

- Stay Disciplined and Patient: Successful business investment requires discipline and patience. Avoid succumbing to emotional investment decisions driven by market hype or fear. Stick to your investment strategy, make rational decisions based on thorough analysis, and have the patience to let your investments grow over time.

Implementing these strategies can help increase the likelihood of successful business investment. However, it’s important to recognize that investing always carries some level of risk, and there are no guarantees of profitable outcomes. Adapting these strategies to your specific circumstances, risk appetite, and investment objectives is essential for maximizing your chances of success.

Conclusion

Business investment is a fundamental driver of economic growth, innovation, and wealth generation. Understanding the concept of business investment, its importance, and the various factors that influence investment decisions is crucial for entrepreneurs, investors, and businesses.

Throughout this article, we explored the definition of business investment, emphasizing its role in allocating resources to pursue economic activities that generate profits or fulfill long-term objectives. We discussed the importance of business investment, highlighting how it stimulates economic growth, job creation, and innovation.

Furthermore, we discussed the different types of business investment, including equity investments, debt investments, real estate investments, and venture capital investments. Understanding these investment options provides individuals and businesses with the flexibility to choose the most suitable investment type based on their goals and risk tolerance.

We also touched upon the factors that can significantly influence business investment decisions. Economic conditions, market demand, government policies, and technological advancements were among the factors highlighted, emphasizing their impact on investment opportunities and outcomes.

Additionally, we explored the benefits and risks associated with business investment. While business investment offers the potential for high returns, capital growth, and passive income streams, it also carries the risks of financial loss, market volatility, and operational challenges. Recognizing and managing these risks plays a crucial role in maximizing investment success.

Lastly, we provided strategies for successful business investment, including thorough research, diversification, staying informed, seeking professional advice, and maintaining a long-term perspective. Implementing these strategies can help individuals and businesses make informed investment decisions and navigate the dynamic landscape of business investment effectively.

In conclusion, business investment is a key driver of economic growth and prosperity. By understanding its nuances, factors, benefits, and risks, individuals and businesses can enhance their chances of achieving profitable and sustainable investment outcomes. Wise investment decisions contribute not only to the growth and success of businesses but also to the overall development of economies and societies.