Home>Finance>What Is Cryptocurrency Difficulty? Definition And Bitcoin Example

Finance

What Is Cryptocurrency Difficulty? Definition And Bitcoin Example

Published: November 6, 2023

Learn about cryptocurrency difficulty and its definition in the world of finance. Explore the concept with a Bitcoin example.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Cryptocurrency Difficulty: A Closer Look at its Definition and Bitcoin Example

Have you ever wondered why mining cryptocurrency becomes more challenging over time? Welcome to the world of cryptocurrency difficulty! In this article, we will dive deeper into what cryptocurrency difficulty is, what it means for miners, and how it affects the Bitcoin network specifically.

Key Takeaways

- Cryptocurrency difficulty refers to the complexity of solving mathematical problems required for mining new blocks in a blockchain network.

- Higher difficulty levels make it harder to mine new coins, resulting in increased computational power and electricity consumption.

Understanding Cryptocurrency Difficulty

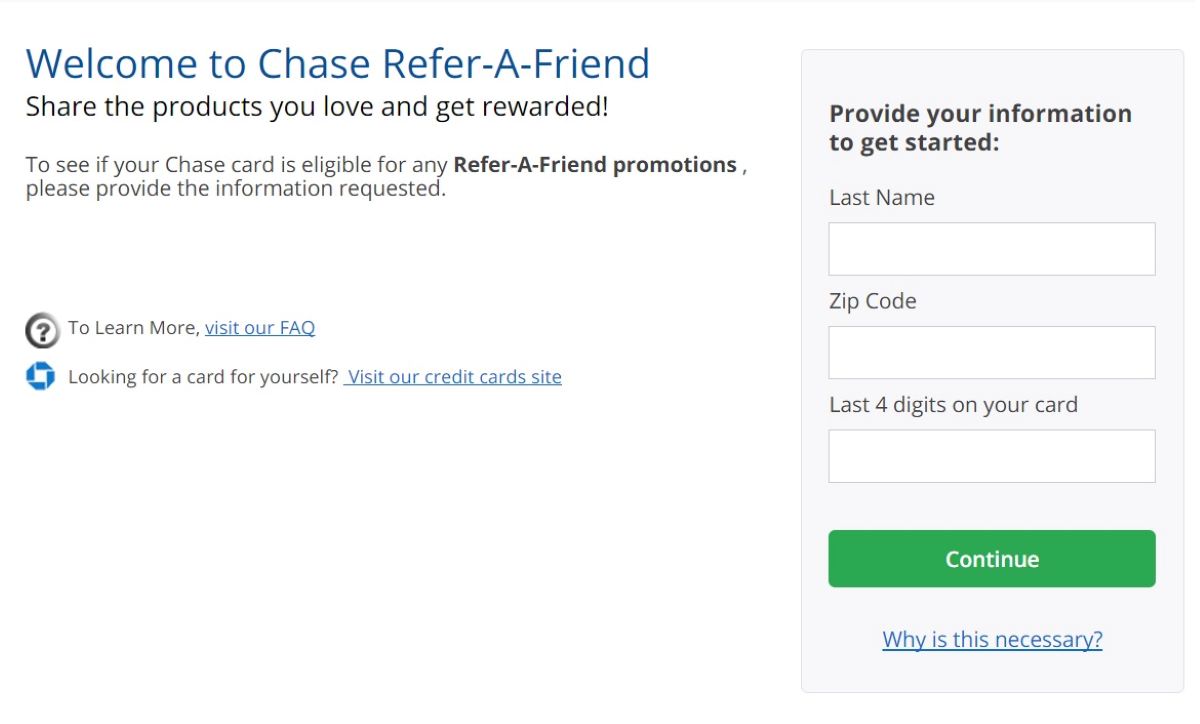

When Satoshi Nakamoto, the creator of Bitcoin, introduced the concept of cryptocurrency, they implemented a mechanism called “proof-of-work” to ensure the security and integrity of the network. Proof-of-work involves miners solving complex mathematical puzzles in order to validate transactions and add them to the blockchain.

However, these puzzles are not static; their difficulty is adjusted regularly to maintain a consistent block creation rate. This dynamic adjustment is known as cryptocurrency difficulty.

So, what determines the difficulty? The difficulty level of mining new blocks is determined by the total computational power of the network. As more miners join the network and collectively contribute their computational power, the difficulty increases to maintain the targeted block creation rate.

Let’s take a closer look at how cryptocurrency difficulty impacts the Bitcoin network, the most well-known cryptocurrency:

The Bitcoin Example

Bitcoin’s difficulty adjusts approximately every 2 weeks or 2016 blocks. This adjustment aims to keep the block generation time around 10 minutes. If blocks are being created faster or slower than the targeted time, the difficulty will be adjusted accordingly.

Here’s how it works:

- If blocks are generated too quickly, the difficulty will increase.

- If blocks take longer than 10 minutes to mine, the difficulty will decrease.

By maintaining a consistent block creation rate, Bitcoin ensures that new coins are added to the network at a predictable pace. This prevents inflation and provides security against double-spending and other malicious activities.

However, as the difficulty increases, miners need more computational power and energy to solve the mathematical problems required to mine new blocks. This increase in computational requirements drives up costs and makes mining less profitable for individual miners.

It is also worth mentioning that as the difficulty increases, it becomes harder for attackers to overpower the network, as they would need a significant amount of computational power to do so.

Conclusion

Cryptocurrency difficulty plays a crucial role in maintaining security, controlling inflation, and preventing malicious activities in blockchain networks. It dynamically adjusts based on the computational power of the network to ensure a consistent block creation rate.

Understanding cryptocurrency difficulty helps us appreciate the complexity of mining and the environmental impact it can have due to the increasing energy consumption. As the popularity of cryptocurrencies continues to rise, finding more sustainable and efficient mining solutions becomes paramount.