Finance

What Is JV In Accounting

Published: October 10, 2023

Learn about JV in accounting and its significance in finance. Expand your knowledge of the financial aspects and implications of Joint Ventures with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance and accounting, joint ventures, also known as JVs, play a significant role. They are a strategic business arrangement where two or more organizations come together to collaborate on a specific project or venture. JVs can be found in various industries, ranging from manufacturing and technology to energy and finance.

Joint ventures enable organizations to combine their resources, expertise, and market presence to achieve mutual goals that they may not have been able to accomplish independently. By pooling their strengths, companies can tap into new markets, access specialized knowledge or technology, share risks, and create synergies.

In the field of accounting, JVs represent a unique set of financial transactions and treatments that require careful consideration and understanding. This article aims to provide a comprehensive overview of JVs in accounting, including their definition, types, accounting treatment, and the advantages and disadvantages they offer.

Whether you are an accounting professional or a business owner, understanding the intricacies of JVs is crucial to making informed financial decisions and evaluating potential opportunities. So, let’s delve into the world of JVs in accounting and explore their significance in the finance industry.

Definition of JV in Accounting

In the realm of accounting, a joint venture (JV) refers to a collaborative business arrangement where two or more companies join forces to undertake a specific project or venture. It is a partnership formed for a finite period, typically with a clear objective in mind. Unlike a merger or acquisition, JVs allow participating companies to maintain their separate legal identities while sharing resources and risks.

JVs can be established through a formal contractual agreement between the participating entities, outlining the terms and conditions of their collaboration. This agreement typically covers aspects such as the purpose of the joint venture, capital contributions, profit or loss sharing arrangements, decision-making processes, and exit strategies.

In accounting, JVs are treated as separate legal entities, distinct from the parent companies that form them. This means that JVs maintain their own financial records, prepare financial statements, and comply with accounting regulations just like any other business entity.

When a JV is created, each participant contributes assets, capital, or expertise to the venture. These contributions are recorded on the balance sheet of the JV. The financial performance of the JV, including revenue, expenses, and profit or loss, is also accounted for separately.

It is worth noting that the ownership share of each participant in the joint venture may vary depending on the terms of the agreement. In some cases, the ownership may be equal, with each participant having a 50% stake, while in others, it may be unevenly distributed based on factors such as capital investment or expertise.

Now that we have a clear understanding of what JVs are in the context of accounting, let’s explore the different types of JVs that exist and how they are treated from an accounting perspective.

Types of JV in Accounting

Joint ventures can take various forms depending on the nature of the collaboration and the objectives of the participating companies. Here are some common types of JVs that exist in the accounting realm:

- Equity Joint Venture: In this type of JV, the participating companies contribute capital and form a new entity together. The ownership and control of the joint venture are shared proportionately based on the equity invested by each party. The profits and losses are also distributed according to the agreed-upon equity participation.

- Contractual Joint Venture: Also known as a non-equity or cooperative joint venture, this type of JV is based on a contractual agreement between the participating companies. They cooperate and collaborate on a specific project without forming a separate legal entity. Each party retains its own legal status and contributes resources or expertise as outlined in the contract.

- Strategic Alliance: While not technically considered a joint venture in the traditional sense, a strategic alliance involves a partnership between two or more companies for a specific purpose, such as market expansion or product development. The participating companies collaborate closely and may share resources, knowledge, and risks, but there is no distinct legal entity created.

- Consortium: A consortium is a form of joint venture where multiple companies come together to bid on a large project or contract. Each company contributes its expertise and resources collectively to undertake the project. The participants may have equal or varying shares in the consortium, depending on the specific agreement.

Each type of joint venture has its own benefits and considerations. The choice of the JV structure depends on factors such as the objectives of the collaboration, the level of control desired by the participants, the degree of risk sharing, and the regulatory environment in which the venture operates.

Now that we have explored the different types of JVs, let’s dive into how these joint ventures are treated from an accounting perspective.

Accounting Treatment of JV

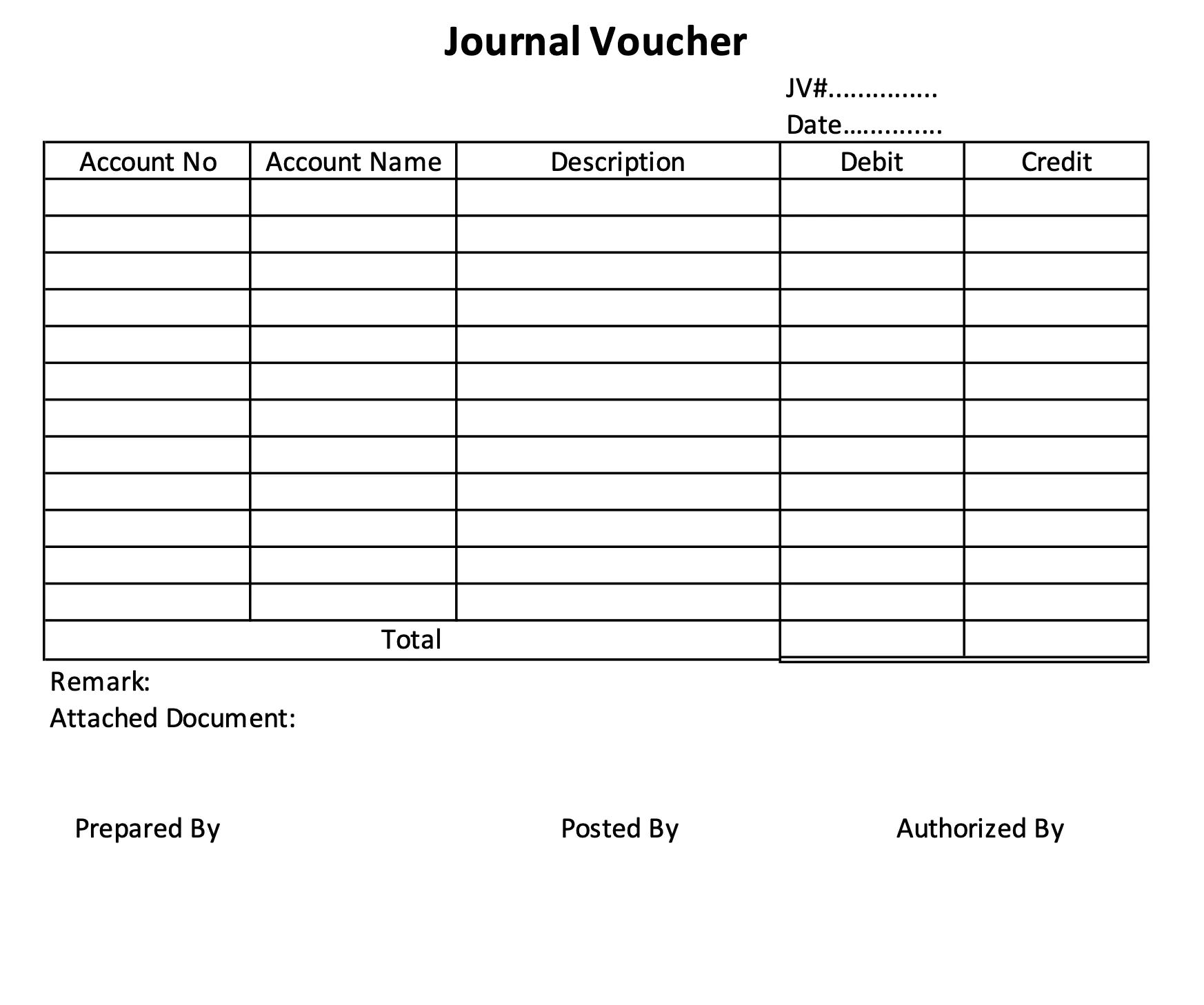

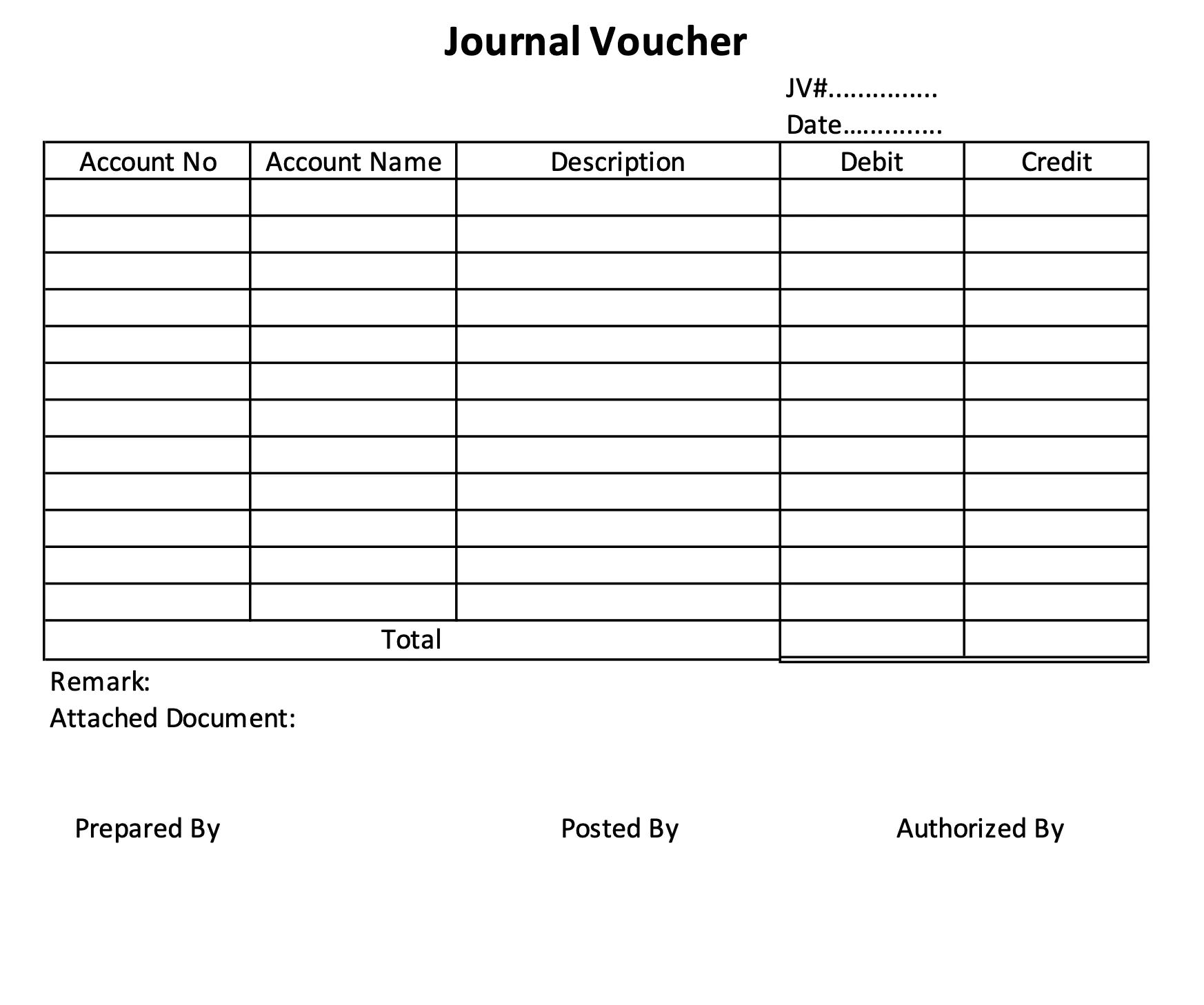

The accounting treatment of joint ventures involves recording the financial transactions and activities of the joint venture entity separately from the parent companies. This allows for a clear and accurate representation of the financial position and performance of the joint venture. Here are some key aspects of the accounting treatment of JVs:

- Separate Financial Statements: A joint venture prepares its own financial statements, including the balance sheet, income statement, and statement of cash flows. These statements reflect the financial position, results of operations, and cash flows of the joint venture entity.

- Equity Method Accounting: The equity method is commonly used to account for joint ventures. Under this method, the initial investment in the joint venture is recorded on the parent companies’ balance sheets as an investment. Over time, the investor recognizes its share of the joint venture’s profits or losses in its income statement, resulting in an adjustment to the investment value.

- Proportionate Consolidation: In some cases, particularly when the joint venture involves significant control or influence by the parent companies, proportionate consolidation may be used. This method combines the proportionate share of the joint venture’s assets, liabilities, revenues, and expenses with those of the parent companies in the consolidated financial statements.

- Recognition of Revenue and Expenses: The joint venture entity recognizes its own revenue and expenses based on the activities it undertakes. Revenue is recognized when goods or services are provided to customers, and expenses are recognized when incurred. These amounts are then allocated to the participating parties based on their ownership interests.

- Intercompany Transactions: Transactions between the joint venture entity and the parent companies are treated as intercompany transactions. These may include sales of goods or services, loans, or payment of management fees. Such transactions are eliminated in the consolidated financial statements to avoid double counting.

The accounting treatment of JVs ensures transparency and provides stakeholders with a clear understanding of the financial performance and position of the joint venture. It allows for accurate reporting and evaluation of the benefits and risks associated with the collaboration.

Next, let’s explore the advantages and disadvantages of utilizing JVs in accounting.

Advantages of JV in Accounting

Joint ventures offer several advantages when it comes to accounting and financial management. Here are some key benefits:

- Shared Resources and Expertise: By forming a joint venture, companies can pool their resources, knowledge, and expertise. This allows for efficient utilization of assets and capabilities, leading to cost savings and improved performance.

- Access to New Markets: Joint ventures often provide access to markets that would have been difficult to enter alone. By partnering with a local company or an industry expert, companies can benefit from their established distribution networks, customer base, and market knowledge.

- Risk Sharing: JVs enable companies to share risks associated with a particular project or venture. This helps in spreading the financial and operational risks among the participating parties, reducing the individual burden and increasing the likelihood of success.

- Opportunity for Innovation: Joint ventures foster collaboration and knowledge sharing between companies. This can lead to the generation of innovative ideas, product development, and streamlined processes, driving growth and competitiveness in the market.

- Cost Efficiency: By sharing resources and expenses, joint ventures can achieve cost efficiencies. This includes shared infrastructure, marketing costs, research and development expenses, and administrative costs. Companies can realize economies of scale and reduce overall operational expenses.

- Expanded Financial Capacities: Joint ventures allow companies to tap into additional financial resources. This can be particularly beneficial when undertaking large-scale projects that require significant investment. By sharing the financial burden, companies can access funds that may have been challenging to secure individually.

These advantages make joint ventures an attractive option for companies looking to expand their operations, diversify their offerings, and mitigate risks. However, it is essential to also consider the potential drawbacks of JVs, which we will discuss in the next section.

Disadvantages of JV in Accounting

While joint ventures have their share of benefits, there are also potential drawbacks that companies should be aware of when considering this collaborative business arrangement. Here are some disadvantages of JVs in accounting:

- Complex Decision-Making: In a joint venture, decision-making can become complex, especially when multiple parties with different priorities and objectives are involved. Disagreements may arise, leading to delays in crucial business decisions and hindering the overall progress of the venture.

- Shared Control and Management: Joint ventures require effective management and coordination among the participating companies. Balancing the interests and expectations of different parties can be challenging, potentially leading to conflicts over control and decision-making authority.

- Profit Sharing Challenges: Determining the distribution of profits and losses among the participating companies can be a complex task. Unequal contributions or differences in performance may create disagreements and potentially strain the relationship between the parties involved.

- Legal and Regulatory Compliance: Joint ventures often involve navigating complex legal and regulatory requirements, especially when operating in different jurisdictions. Compliance with various accounting standards, tax laws, and reporting obligations can be intricate and time-consuming.

- Dependency on Partner: Companies entering into a joint venture become dependent on the performance, reliability, and financial stability of their partners. If one partner fails to meet expectations or faces financial difficulties, it can have a significant impact on the joint venture’s operations and financial outcomes.

- Exit Challenges: Exiting a joint venture can be complicated and challenging. Disentangling assets, liabilities, and ongoing commitments may involve negotiation and potential disputes. It’s crucial to have a clear exit strategy in place to minimize disruption and protect the interests of all parties involved.

These disadvantages highlight the potential risks and complexities associated with joint ventures in accounting. It is important for companies to carefully assess the specific circumstances and conduct due diligence before entering into any joint venture arrangement.

Next, let’s explore some real-world examples of joint ventures in the accounting field to further illustrate their practical applications.

Examples of JV in Accounting

Joint ventures are prevalent in the accounting industry, facilitating collaborations between companies and expanding their market reach. Here are a few examples of joint ventures in accounting:

- Big Four Accounting Firms: Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY), and KPMG are the four largest accounting firms globally. While each of them operates independently, they also have various joint ventures and strategic alliances with other firms around the world. These joint ventures allow them to provide comprehensive services to clients on a global scale and gain deeper market penetration in specific regions.

- Technology and Accounting Partnerships: Many accounting firms have formed joint ventures or partnerships with technology companies to enhance their services and capabilities. For instance, partnerships between accounting firms and software companies enable the development and implementation of advanced accounting systems, automation of financial processes, and integration of artificial intelligence and data analytics into accounting practices.

- Insurance and Financial Services Collaborations: Joint ventures between accounting firms and insurance or financial services companies are also common. These collaborations aim to provide clients with comprehensive solutions that combine accounting, tax, and financial advisory services with insurance products or specialized financial offerings.

- Industry-Specific Consortia: In certain industries, joint ventures take the form of consortia where multiple companies collaborate on research, development, or infrastructure projects. These consortia are often driven by accounting and financial considerations, pooling resources to tackle industry challenges or capitalize on emerging opportunities collectively.

- International Accounting Networks: Leading accounting firms form international networks that facilitate knowledge-sharing, resource sharing, and joint ventures among member firms. These networks allow participating firms to expand their global capabilities, exchange best practices, and deliver seamless services to multinational clients.

These examples demonstrate the diverse applications of joint ventures in the accounting industry. Through collaborations and strategic partnerships, companies can leverage their collective strengths, enhance service offerings, and continuously innovate to meet the evolving needs of clients.

Now that we have explored various examples, let’s conclude our discussion on JVs in accounting.

Conclusion

Joint ventures in accounting serve as valuable strategic tools that enable companies to collaborate, share resources, and achieve mutual goals. They offer numerous advantages, including shared expertise, access to new markets, risk sharing, innovation opportunities, cost efficiency, and expanded financial capacities. However, it is crucial to consider the potential complexities and challenges associated with JVs, such as complex decision-making, shared control, profit sharing, legal compliance, dependence on partners, and exit challenges.

The accounting treatment of JVs involves maintaining separate financial statements, using the equity method or proportionate consolidation, recognizing revenue and expenses, and addressing intercompany transactions. This accounting approach ensures transparency, accurate reporting, and informed decision-making. It enables stakeholders to assess the financial performance, position, and risks of the joint venture independently.

Real-world examples showcase how joint ventures are utilized in the accounting industry, including collaborations between accounting firms, partnerships with technology companies, alliances with insurance and financial service providers, and industry-specific consortia. These examples demonstrate how joint ventures help organizations expand their capabilities, deliver comprehensive solutions, and navigate the complexities of the global market.

In conclusion, joint ventures play a vital role in accounting, enabling companies to unlock new opportunities, mitigate risks, and drive growth. By leveraging the strengths and resources of multiple organizations, JVs facilitate innovation, cost efficiency, and market expansion. However, it is essential for companies to carefully evaluate the advantages and disadvantages, conduct thorough due diligence, and establish clear terms and agreements before entering into any joint venture arrangement. With careful planning and effective management, joint ventures can be a powerful tool for success in the ever-evolving landscape of the accounting industry.