Home>Finance>What Is One Difference Between The New York Stock Exchange (NYSE) And The Nasdaq Stock Market?

Finance

What Is One Difference Between The New York Stock Exchange (NYSE) And The Nasdaq Stock Market?

Published: January 17, 2024

Discover the key distinction between the NYSE and Nasdaq stock markets in the realm of finance, and how it impacts traders and investors.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to the world of stock trading, the New York Stock Exchange (NYSE) and the Nasdaq Stock Market are two of the most well-known and influential exchanges. They serve as a platform for businesses to raise capital by offering shares of their stock to the public. While both exchanges facilitate the buying and selling of stocks, there are certain key differences that set them apart.

The NYSE, also referred to as “The Big Board,” is the oldest stock exchange in the United States. It was founded in 1792 and currently operates as a subsidiary of Intercontinental Exchange (ICE). On the other hand, the Nasdaq Stock Market, commonly known as Nasdaq, was established in 1971 and is now part of the Nasdaq, Inc. corporation. The NYSE is a traditional auction-style exchange, while Nasdaq operates as a dealer market.

The main difference between the NYSE and Nasdaq lies in their ownership structures. The NYSE is a publicly traded company, meaning that it is owned by shareholders who can buy and sell its stock on the exchange. In contrast, Nasdaq is primarily owned by its member firms, which include brokerage houses and market makers. This distinction in ownership can affect the decision-making process and governance of the exchanges.

Another important difference between the NYSE and Nasdaq is their listing requirements. Companies that want to be listed on the NYSE must meet strict financial criteria, including minimum thresholds for market capitalization, revenue, and earnings. In addition, they must have a minimum number of shareholders and a certain level of public float. Nasdaq, on the other hand, has relatively lower initial listing requirements, making it more accessible for smaller companies. However, both exchanges have stringent ongoing compliance standards that listed companies must adhere to.

One of the most notable distinctions between the NYSE and Nasdaq is the way trading takes place. The NYSE operates through a physical trading floor located on Wall Street in New York City. Traders gather on the floor to execute transactions using verbal and non-verbal communication. In contrast, Nasdaq is a virtual market, relying on electronic communication networks (ECNs) to match buyers and sellers. This difference in trading environments can impact the speed and efficiency of order execution.

Despite their differences, both the NYSE and Nasdaq play instrumental roles in the global financial markets. They provide liquidity, transparency, and a platform for investors to buy and sell stocks. Understanding the distinctions between these exchanges can help investors make informed decisions about where to trade and list their securities.

Ownership Structures

The ownership structures of the New York Stock Exchange (NYSE) and the Nasdaq Stock Market are one of the key differences between the two exchanges. These structures determine who owns and operates the exchanges, which can have implications for their governance and decision-making processes.

The NYSE is a publicly traded company, meaning that it is owned by shareholders who can buy and sell its stock on the exchange. This structure allows the general public to have a stake in the exchange, making it a more democratic ownership model. Shareholders of the NYSE are typically institutional investors, such as mutual funds and pension funds, as well as individual investors who purchase shares on the open market.

On the other hand, Nasdaq operates as a dealer market and is primarily owned by its member firms. These member firms include brokerage houses, market makers, and other financial institutions that are actively involved in trading on the exchange. While Nasdaq itself is a publicly traded company, its ownership is concentrated among these member firms.

The ownership structures of the NYSE and Nasdaq can have implications for decision-making within the exchanges. As a publicly traded company, the NYSE is accountable to its shareholders and must make decisions that align with their interests. This can include strategic decisions about market expansion, technology investments, and operational changes. Shareholders of the NYSE have the ability to influence the direction of the exchange through their voting rights and participation in shareholder meetings.

In contrast, the ownership concentration among member firms at Nasdaq gives them significant influence over the exchange’s operations. These member firms are actively involved in the day-to-day trading activities on Nasdaq and have a vested interest in maintaining the efficiency and competitiveness of the exchange. The governance structure of Nasdaq involves input and participation from these member firms, who play a role in shaping the exchange’s policies and initiatives.

While the ownership structures of the NYSE and Nasdaq differ, both exchanges have mechanisms in place to ensure fair and transparent operations. They are regulated by the Securities and Exchange Commission (SEC) in the United States, which oversees the functioning of the securities markets and enforces compliance with relevant laws and regulations.

Overall, the ownership structures of the NYSE and Nasdaq contribute to their unique characteristics and decision-making processes. Whether publicly traded or controlled by member firms, both exchanges provide a platform for investors to trade stocks and access the global financial markets.

Listing Requirements

Listing requirements are a crucial aspect of the New York Stock Exchange (NYSE) and the Nasdaq Stock Market. These requirements determine the criteria that companies must meet in order to have their stocks listed on the respective exchanges. The listing requirements play a significant role in attracting companies to list on an exchange and provide investors with confidence in the quality and integrity of the listed securities.

The NYSE has strict financial criteria that companies must meet to be eligible for listing. These criteria include minimum thresholds for market capitalization, revenue, and earnings. The NYSE requires companies to have a minimum global market capitalization of $200 million or a total market value of publicly held shares of $100 million. In addition, companies must have pre-tax earnings of at least $10 million over the last three years. The NYSE also requires a minimum number of shareholders and a certain level of public float, which is the portion of a company’s outstanding shares that is freely tradable on the open market.

Nasdaq, on the other hand, has relatively lower initial listing requirements compared to the NYSE, making it more accessible for smaller companies. To be listed on Nasdaq, companies must meet specific financial and liquidity requirements. These requirements include a minimum bid price, market value of publicly held shares, and a certain number of shareholders. Nasdaq also offers different tiers of listing, such as the Nasdaq Global Select Market, the Nasdaq Global Market, and the Nasdaq Capital Market, each with its own set of criteria based on market capitalization and financial performance.

Both the NYSE and Nasdaq have stringent ongoing compliance standards that listed companies must adhere to. These standards include timely filing of financial reports, maintaining minimum stock prices, and complying with corporate governance requirements. Non-compliance with these standards can result in delisting from the exchanges, which can have significant consequences for a company’s reputation and investor confidence.

Listing on either the NYSE or Nasdaq brings several benefits to a company. In addition to providing access to capital from public investors, being listed on a reputable exchange enhances a company’s visibility and credibility in the market. It can increase investor awareness, attract institutional investors, and potentially improve the liquidity of the company’s stock. Being listed on a major exchange can also offer opportunities for market exposure and media coverage.

It is important for companies to carefully evaluate the listing requirements of both the NYSE and Nasdaq. Factors such as the size of the company, financial performance, and long-term growth prospects should be taken into consideration. Ultimately, the decision to list on one exchange over the other depends on the specific needs and goals of the company.

Trading Floor vs. Virtual Market

One of the notable differences between the New York Stock Exchange (NYSE) and the Nasdaq Stock Market is the way trading takes place. The NYSE is known for its iconic trading floor, where traders gather to execute transactions using verbal and non-verbal communication. On the other hand, Nasdaq operates as a virtual market, relying on electronic communication networks (ECNs) to match buyers and sellers.

The NYSE’s trading floor is located on Wall Street in New York City and is often depicted in movies and television shows as a bustling hub of activity. Traders, known as specialists, gather in designated areas called “pits” where they represent specific stocks. They use hand signals, verbal cues, and electronic devices to communicate buy and sell orders. The open outcry system, where traders shout their bids and offers to each other, is one of the distinctive features of the NYSE’s trading floor.

The physical presence of traders on the NYSE’s trading floor can provide a unique atmosphere and sense of human interaction. It allows for immediate feedback and reaction to market conditions, enhancing price discovery and liquidity. Traders on the floor have the ability to use their experience and intuition to make split-second decisions. However, the reliance on human intervention can also lead to potential inefficiencies and slower execution speed compared to electronic trading.

In contrast, Nasdaq operates as a virtual market, where all trading takes place electronically. Buyers and sellers submit their orders through computer systems, which are then matched by the ECNs. The elimination of physical trading floors and reliance on technology allows for faster execution speed and potentially greater efficiency. It also enables trades to take place beyond the constraints of a specific location or time zone, making Nasdaq a truly global market.

The virtual trading environment of Nasdaq provides a level playing field for all market participants. It eliminates potential biases that may arise from physical interactions on a trading floor. A key benefit of electronic trading is the ability to match orders quickly and accurately, resulting in tighter bid-ask spreads and reduced transaction costs. The automation of trading processes also allows for greater transparency and real-time access to market data.

Both the NYSE and Nasdaq have embraced technological advancements over the years. The NYSE has introduced electronic trading platforms alongside its traditional floor-based trading. Similarly, Nasdaq has expanded its offerings to include other asset classes, such as options, futures, and commodities.

Ultimately, the choice between trading on the NYSE’s trading floor or in the virtual market of Nasdaq depends on a variety of factors. Some traders may prefer the human interaction and tangible atmosphere of the NYSE, while others may value the speed and efficiency of electronic trading on Nasdaq. Regardless of the trading venue, both exchanges play crucial roles in providing liquidity and facilitating the buying and selling of stocks.

Market Structure

The market structure of the New York Stock Exchange (NYSE) and the Nasdaq Stock Market differs in terms of how the exchanges operate, how orders are executed, and the types of securities traded.

The NYSE is a traditional auction-style market, where orders are matched on a centralized trading floor. Traders, known as specialists, represent specific stocks and are responsible for facilitating the trading of those stocks. The open outcry system, where traders shout their bids and offers, is one of the defining features of the NYSE’s market structure. This system allows for immediate price discovery and transparency, as traders can see and react to each other’s orders. It also provides an opportunity for human intervention and judgment in the execution of trades.

In contrast, Nasdaq operates as a dealer market, also known as a quote-driven market. Market makers, who are member firms of Nasdaq, provide liquidity by continuously quoting bid and ask prices at which they are willing to buy or sell specific securities. When a buyer and a seller agree on a price, the trade is executed. Nasdaq’s market structure relies heavily on electronic communication networks (ECNs) to match buyers and sellers, ensuring efficient and rapid order execution.

An important distinction between the NYSE and Nasdaq is the types of securities traded on each exchange. The NYSE primarily focuses on listing large, established companies with substantial market capitalization. These companies often have a long history of operations and are considered leaders in their respective industries. The NYSE is traditionally associated with companies in sectors such as finance, energy, and manufacturing.

In contrast, Nasdaq has historically been known for listing technology companies and emerging growth companies. Nasdaq has played a pivotal role in the listing of well-known tech giants such as Apple, Microsoft, and Amazon. Nasdaq’s market structure and reputation for innovation align with the needs and characteristics of technology-driven companies. However, Nasdaq has expanded beyond technology to include companies from various sectors, offering a diverse range of listings.

Both the NYSE and Nasdaq have evolved their market structures over time to incorporate electronic trading platforms and provide investors with greater flexibility. The NYSE introduced a hybrid model that combines electronic trading with its traditional floor-based trading. This allows for seamless order execution and enhances overall market efficiency. Nasdaq continues to invest in technology and expand its offerings to include other asset classes such as options and futures.

Ultimately, the market structure of the NYSE and Nasdaq reflects the needs and preferences of different types of market participants. The NYSE’s auction-style market emphasizes human interaction while Nasdaq’s dealer market leverages electronic trading for speed and efficiency. Both exchanges play integral roles in the global financial markets, providing a platform for investors to buy and sell securities and contribute to price discovery.

Market Participants

The New York Stock Exchange (NYSE) and the Nasdaq Stock Market are home to a diverse range of market participants who play crucial roles in the functioning of the exchanges. These participants include investors, traders, brokers, market makers, and regulatory bodies.

Investors are the backbone of the stock market, providing the capital that allows companies to raise funds and expand their operations. Individual investors, such as retail traders and high-net-worth individuals, and institutional investors, including mutual funds, pension funds, and hedge funds, are actively involved in buying and selling stocks on both the NYSE and Nasdaq.

Traders are individuals or firms who execute trades on behalf of investors. They can be floor traders on the NYSE, using their expertise in specific stocks to facilitate transactions on the trading floor. Traders on Nasdaq, on the other hand, typically operate electronically using advanced trading systems and algorithms to execute orders efficiently.

Brokers act as intermediaries between investors and the exchanges. They help investors place buy and sell orders and provide guidance on investment decisions. Brokers can be full-service firms that offer a range of services, including research and wealth management, or discount brokers that focus on executing trades at a lower cost.

Market makers are key participants in the functioning of both the NYSE and Nasdaq. They play a crucial role in providing liquidity by continuously quoting bid and ask prices for specific securities. Market makers are typically brokerage firms or banks that are authorized to conduct transactions on behalf of investors. They ensure that there are willing buyers and sellers for a particular security, facilitating smooth trading and price discovery.

In addition to these participants, regulatory bodies such as the Securities and Exchange Commission (SEC) play a vital role in overseeing and regulating the operations of the NYSE and Nasdaq. The SEC ensures fair and transparent markets, enforces compliance with securities laws, and protects the rights of investors. By maintaining integrity and instilling confidence in the markets, regulatory bodies contribute to the overall stability and functioning of the exchanges.

Market participants on the NYSE and Nasdaq operate based on different trading strategies and investment goals. Some investors focus on long-term value investing, carefully analyzing company fundamentals and seeking undervalued stocks. Others engage in day trading, taking advantage of short-term price fluctuations to generate quick profits. High-frequency traders employ advanced algorithms to execute numerous trades within fractions of a second.

Understanding the roles and motivations of market participants is crucial for investors and traders. It provides insight into the dynamics of the market, the factors influencing price movements, and the potential risks and opportunities. By analyzing the behavior and actions of different participants, investors can make more informed decisions and navigate the stock market with greater confidence.

Types of Securities

The New York Stock Exchange (NYSE) and the Nasdaq Stock Market are well-known for their listings of various types of securities. Securities are financial instruments that represent ownership in a company or the right to a future payment. Understanding the different types of securities traded on these exchanges is essential for investors looking to diversify their portfolios and pursue various investment strategies.

1. Common Stocks: Common stocks are the most common type of security traded on both the NYSE and Nasdaq. When investors buy shares of common stock, they become partial owners of the company and have voting rights in proportion to their ownership. Common stocks provide the potential for capital appreciation and dividend income. They are often suitable for investors seeking long-term growth and willing to take on the potential risks and volatility associated with equity investments.

2. Preferred Stocks: Preferred stocks are a type of equity security that has characteristics of both stocks and bonds. Unlike common stocks, preferred stocks generally do not carry voting rights, but they have a higher claim on the company’s assets and earnings. Preferred stockholders receive dividends before common shareholders and have priority in the event of liquidation. Preferred stocks are popular among income-seeking investors who prefer a steady stream of dividend payments.

3. Bonds: Bonds are debt securities issued by companies, municipalities, and governments to raise funds. These fixed-income securities pay interest to investors over a specified period. The NYSE and Nasdaq trade various types of bonds, including corporate bonds, government bonds, municipal bonds, and convertible bonds. Bonds are typically considered less risky than stocks and provide a predictable stream of income, making them attractive to conservative investors seeking stable returns.

4. Exchange-Traded Funds (ETFs): ETFs are investment funds that trade on stock exchanges like individual stocks. They aim to replicate the performance of a specific index, sector, or asset class. ETFs provide investors with diversification, flexibility, and ease of trading. They can track various underlying assets, including stocks, bonds, commodities, and currencies. ETFs offer investors exposure to a wide range of markets and investment themes without having to buy individual securities.

5. Options: Options are derivative securities that give investors the right, but not the obligation, to buy (call option) or sell (put option) a specific asset at a predetermined price within a specified period. Options are popular among advanced traders who use them to hedge positions, speculate on price movements, or generate income through options strategies. The NYSE and Nasdaq facilitate options trading on various underlying assets, including stocks, indexes, and exchange-traded products.

6. Warrants: Warrants are derivative securities that give investors the right to buy a company’s stock at a specified price within a particular period. They are typically issued by a company alongside other securities, such as bonds or preferred stocks, to enhance their attractiveness. Warrants can provide investors with the potential for higher returns if the underlying stock price appreciates.

These are just a few examples of the types of securities traded on the NYSE and Nasdaq. Each security has its own characteristics, risk profile, and potential for returns. Understanding the nuances of these securities can help investors make informed decisions, diversify their portfolios, and achieve their investment objectives.

Price Discovery Mechanism

The price discovery mechanism is a crucial aspect of the New York Stock Exchange (NYSE) and the Nasdaq Stock Market, as it determines the prices at which securities are bought and sold. Both exchanges employ different methods to facilitate price discovery, ensuring that buyers and sellers can transact at fair and transparent prices.

On the NYSE, the price discovery process primarily takes place on its iconic trading floor. Traders, known as specialists, represent specific stocks and facilitate the matching of buy and sell orders. The open outcry system, where traders shout their bids and offers, allows for immediate price discovery. When a buyer and seller agree on a price, the trade is executed, and that price becomes the prevailing market price for the security. The constant interaction between traders and their monitoring of market conditions contribute to the efficient discovery of prices.

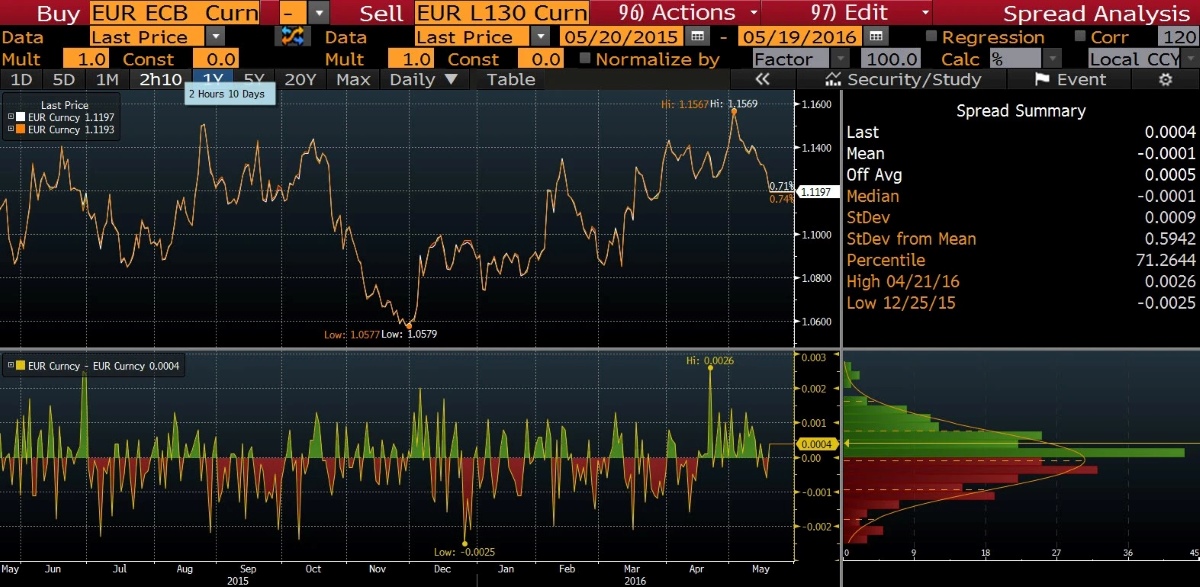

Nasdaq, on the other hand, utilizes electronic communication networks (ECNs) and market makers to facilitate the price discovery process. Market makers continuously quote bid and ask prices for specific securities, creating liquidity in the market. Buyers and sellers can access these quotes electronically and decide at what price they are willing to trade. When a buyer’s bid matches a seller’s ask, the transaction is executed, and the agreed-upon price becomes the prevailing market price. The interaction between investors and the electronic market allows for rapid and efficient price discovery.

Both the NYSE and Nasdaq have advanced technological infrastructure and real-time data feeds that enable participants to access and react to market information. This information includes trade prices, bid and ask sizes, order depth, and recent trade history. Traders and investors can monitor these data points to make informed decisions about their bids and offers.

The price discovery mechanism on both exchanges is influenced by various factors, including supply and demand dynamics, market sentiment, company news, economic indicators, and global events. Buyers and sellers adjust their bids and offers based on these factors, leading to changes in the prevailing market prices of securities. Market participants with different investment strategies and time horizons contribute to the continuous process of price discovery.

Transparency is a key aspect of the price discovery process. Both the NYSE and Nasdaq provide real-time market data to participants, ensuring that they have access to the best available information to make informed trading decisions. This transparency helps promote fair and efficient markets, instills investor confidence, and helps prevent manipulative practices.

Overall, the NYSE and Nasdaq employ different methods to discover prices, with the NYSE relying on the direct interaction of traders on its trading floor and Nasdaq utilizing electronic trading and market making. However, both exchanges are committed to ensuring fair, transparent, and efficient price discovery mechanisms that allow for the smooth functioning of the markets and the creation of liquidity for investors.

Regulatory Oversight

Regulatory oversight is a critical aspect of the New York Stock Exchange (NYSE) and the Nasdaq Stock Market. Both exchanges operate under the supervision and regulation of various regulatory bodies to ensure fair and transparent markets, protect investors, and maintain the integrity of the financial system.

The primary regulatory body overseeing the U.S. securities markets, including the NYSE and Nasdaq, is the Securities and Exchange Commission (SEC). The SEC’s mission is to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation. The SEC sets rules and regulations governing the registration, reporting, and disclosure requirements for companies, investment advisors, brokers, and other market participants. It also has enforcement powers to prosecute individuals and entities engaged in securities fraud or other violations.

The SEC’s oversight includes reviewing and approving the rules and regulations of the exchanges, such as the listing requirements and trading rules. It also conducts periodic examinations of the exchanges to ensure compliance with securities laws, preventing market abuses, and maintaining market fairness.

In addition to the SEC, other regulatory bodies play significant roles in overseeing specific aspects of the NYSE and Nasdaq. For example, the Financial Industry Regulatory Authority (FINRA) is a self-regulatory organization that oversees brokerage firms and their registered representatives. FINRA establishes and enforces rules to protect investors and ensure fair and ethical practices in the securities industry.

Regulatory oversight also extends to market surveillance and enforcement. Exchanges have their own internal surveillance systems to monitor trading activities for suspicious or manipulative behavior. Nasdaq, for instance, operates sophisticated surveillance tools that detect irregular trading patterns and unusual activities in real-time. Internal regulatory departments within the exchanges work closely with regulatory bodies to investigate potential violations, maintain market integrity, and take appropriate disciplinary actions.

Additionally, the NYSE and Nasdaq adhere to specific listing rules and requirements set by the exchanges themselves. These rules are designed to ensure the quality and integrity of the listed securities. Exchanges exercise due diligence in reviewing prospective listings and ongoing compliance of listed companies. They may delist a security if it no longer meets the listing requirements or if there are violations of the exchange’s rules.

Global standards and regulations also influence the regulatory oversight of the NYSE and Nasdaq. International organizations such as the International Organization of Securities Commissions (IOSCO) work to develop global standards for securities regulation and foster cooperation among regulatory bodies worldwide.

In summary, regulatory oversight plays a crucial role in maintaining the integrity and transparency of the NYSE and Nasdaq. The SEC, along with other regulatory bodies, ensures compliance with securities laws, establishes rules, and safeguards investor interests. Through rigorous market surveillance, enforcement actions, and ongoing monitoring, regulatory bodies contribute to the overall integrity and confidence in the operations of these exchanges.

Global Reach and Reputation

The New York Stock Exchange (NYSE) and the Nasdaq Stock Market are renowned worldwide for their global reach and reputable standing in the financial industry. These exchanges serve as key platforms for companies to raise capital, attract investors, and facilitate trading of securities.

Both the NYSE and Nasdaq have a significant global presence. International companies from various countries seek listings on these exchanges to access the deep pools of liquidity and tap into the vast network of global investors. The NYSE has a long-established international reputation and is known for listing large, established companies with global recognition. It has historically been a preferred choice for companies seeking prestige and visibility in the international market.

Nasdaq, on the other hand, has developed a strong reputation for listing technology companies and emerging growth companies. It has gained recognition as a hub for innovation and has attracted numerous prominent technology firms. With its focus on cutting-edge industries, Nasdaq has positioned itself as a platform for companies pursuing growth and transformation within the global marketplace.

The reach of these exchanges extends beyond the United States, as they attract investors from around the world. The NYSE and Nasdaq offer global investors the opportunity to invest in U.S. companies, providing exposure to the world’s largest economy and access to a diverse array of industries. Additionally, both exchanges have expanded their reach by offering the listing of international companies through American depositary receipts (ADRs) or global depositary receipts (GDRs), allowing investors to trade securities of non-U.S. companies.

The global reputation of the NYSE and Nasdaq is further enhanced by their commitment to upholding regulatory standards and market integrity. These exchanges, under the oversight of regulatory bodies such as the Securities and Exchange Commission (SEC), are seen as trusted platforms that prioritize investor protection and fair market practices. The adherence to robust regulations and transparency requirements strengthens their reputation and attracts both domestic and international investors.

In addition to their reputations as marketplaces, the NYSE and Nasdaq offer a range of value-added services to support issuers and investors. They provide educational resources, research reports, and investor relations programs that help companies effectively communicate with the investment community. These exchanges also serve as networking hubs, hosting events and conferences that bring together key market participants, fostering collaboration and knowledge sharing.

Furthermore, the global reach of the NYSE and Nasdaq is bolstered by the technology-driven nature of their operations. Both exchanges have invested heavily in advancing their trading platforms, data analytics, and market connectivity. The use of advanced trading technologies has facilitated seamless trading and attracted a significant number of high-frequency traders and algorithmic trading firms to these exchanges.

Overall, the global reach and reputation of the NYSE and Nasdaq stem from their long-standing histories, commitment to regulatory compliance, diverse listings, and technological advancements. These exchanges provide unparalleled access to global capital markets, enabling businesses to attract investment and investors to participate in a wide range of securities, ultimately adding to their global appeal and stature.

Closing Remarks

The New York Stock Exchange (NYSE) and the Nasdaq Stock Market are two of the most prominent exchanges in the world, offering investors a platform to trade securities and companies a venue to access capital. While they share common goals of facilitating the buying and selling of stocks, the NYSE and Nasdaq differ in ownership structures, listing requirements, trading mechanisms, market structures, and global reach.

The NYSE, with its long history and iconic trading floor, appeals to companies seeking the prestige of the world’s oldest stock exchange. Its ownership structure as a publicly traded company ensures a broad base of shareholders, while rigorous listing requirements attract mostly established companies with substantial market capitalization.

Nasdaq, on the other hand, has a reputation for innovation and technology, serving as a preferred platform for listing emerging growth companies and technology firms. Its ownership structure primarily consists of member firms, allowing for strong involvement and industry expertise.

Both exchanges play vital roles in global capital markets, offering investors diverse investment opportunities and access to companies representing various sectors and sizes. Understanding the differences between the NYSE and Nasdaq can help investors make informed decisions based on their investment objectives, risk tolerance, and preferences.

As with any investment, it is essential to conduct thorough research and consider one’s individual financial goals and circumstances. Consulting with a financial advisor can provide valuable insights and guidance tailored to specific investment needs and objectives.

Overall, the NYSE and Nasdaq serve as critical components of the global financial landscape. They contribute to economic growth, provide liquidity, and assist businesses in raising capital, while offering investors a platform to participate in the dynamic world of stock trading. Whether a company seeking to list its shares or an investor looking to invest, understanding the distinctions between these exchanges ensures informed decision-making and maximizes opportunities in the ever-evolving market.