Finance

What Is P&I Insurance?

Published: November 10, 2023

Discover the benefits of P&I insurance in the finance industry. Protect your business from potential financial risks and liabilities.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of maritime insurance, where the unpredictable nature of the seas calls for comprehensive protection. Among the various types of marine insurance, Protection and Indemnity (P&I) insurance stands out as a vital coverage for ship owners, operators, and charterers. In this article, we will explore what P&I insurance is and why it is crucial for the maritime industry.

P&I insurance provides third-party liability coverage for shipowners and operators, protecting them from legal and financial risks resulting from their vessel’s operations. It complements the traditional hull and machinery insurance by covering a variety of liabilities, such as personal injury, property damage, cargo loss or damage, pollution, and collisions at sea.

With the ever-present risks and complexities of the maritime world, P&I insurance offers peace of mind and financial support to shipowners and operators in case of unforeseen incidents. Whether it is a tanker transporting hazardous cargo, a passenger ship catering to hundreds of people, or a cargo vessel transporting valuable goods across international waters, P&I insurance plays a crucial role in keeping the maritime industry afloat.

One key aspect that sets P&I insurance apart from other marine insurance policies is its mutual nature. P&I clubs are mutual insurance associations owned and operated by their insured members. Instead of being profit-driven, these clubs aim to provide reliable and cost-effective coverage, as they are owned by their policyholders themselves. The mutual structure fosters a sense of community within the maritime industry and allows for tailored coverage and prompt claims handling.

In the following sections, we will delve deeper into the definition, coverage, claims process, and other important aspects of P&I insurance. So, buckle up as we embark on a journey to uncover the intricacies of this essential maritime insurance coverage.

Definition of P&I Insurance

Protection and Indemnity (P&I) insurance is a type of marine insurance that provides comprehensive liability coverage to shipowners, operators, and charterers. It protects them from financial losses and legal liabilities arising from their vessel’s operations. P&I insurance is typically offered by mutual insurance associations known as P&I clubs, which are owned by their policyholders.

Unlike traditional hull and machinery insurance, which covers physical damage to the ship itself, P&I insurance focuses on covering liabilities arising from third-party claims. These claims can include personal injury or death of crew members or passengers, damage to other vessels or property, pollution incidents, and cargo loss or damage.

P&I insurance provides coverage for a wide range of liabilities that shipowners may face in the course of their operations. This includes liabilities arising from collisions, salvage operations, wreck removal, fines and penalties imposed by authorities, pollution incidents, and crew-related claims such as illness, injury, or death.

One unique aspect of P&I insurance is the “unlimited” nature of its coverage. This means that there is no maximum limit specified in the policy, unlike other types of insurance. However, the actual coverage amount is subject to the terms and conditions of the policy and may vary based on the specific circumstances and liabilities involved.

Shipowners and operators are required to obtain P&I insurance to comply with international conventions and regulations. It is also commonly required by charterers and cargo owners as a condition for doing business. P&I insurance provides financial protection and ensures that all parties involved in maritime operations are adequately covered in the event of accidents, incidents, or legal disputes.

In the next sections, we will explore the coverage and benefits of P&I insurance in more detail, as well as the various types of policies available and the claims process associated with this important form of maritime insurance.

Coverage and Benefits of P&I Insurance

P&I insurance offers comprehensive liability coverage to shipowners, operators, and charterers, protecting them from the financial risks associated with their vessel’s operations. Let’s take a closer look at the coverage and benefits provided by P&I insurance.

1. Third-Party Liability: P&I insurance covers liabilities arising from third-party claims, including personal injury or death, property damage, pollution incidents, cargo loss or damage, and wreck removal. This coverage ensures that shipowners are financially protected in the event of accidents, collisions, or any other incident involving their vessel.

2. Crew Liabilities: P&I insurance also extends coverage to the crew members of a ship. It provides benefits for illness, injury, or death of crew members, as well as repatriation expenses and compensation for loss of income. This ensures that shipowners fulfill their obligations towards their crew and provides peace of mind to the seafarers working on board.

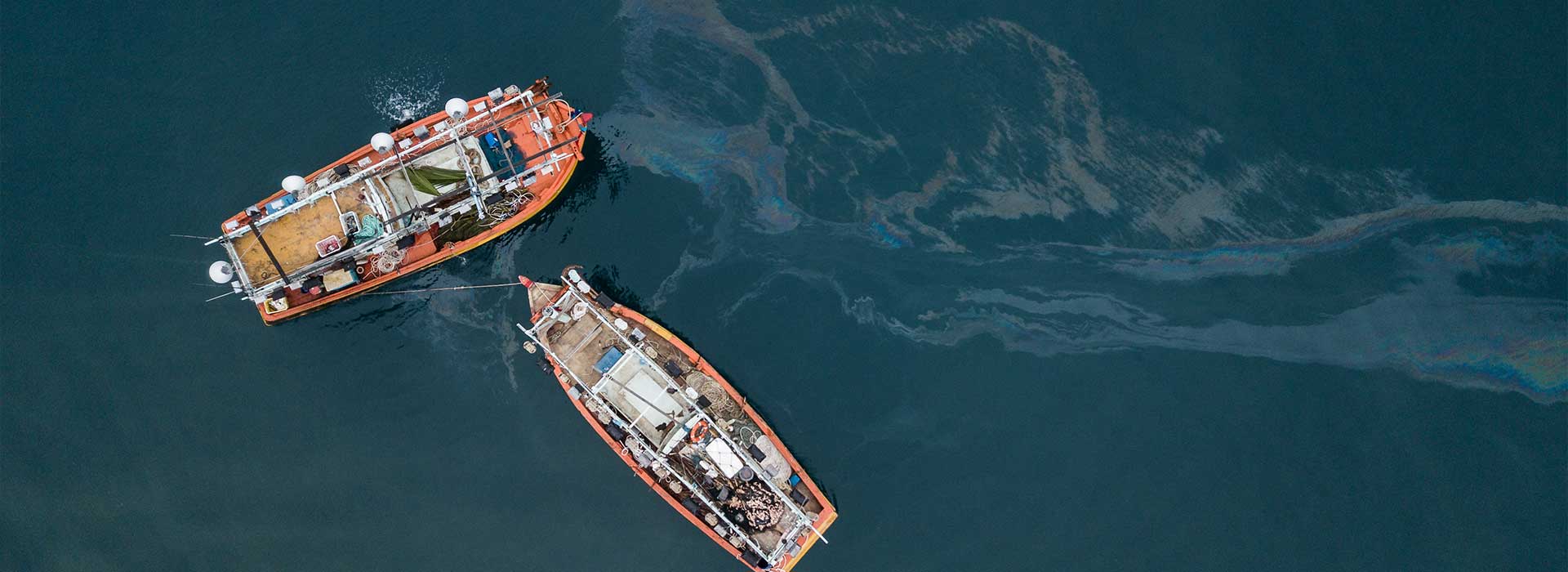

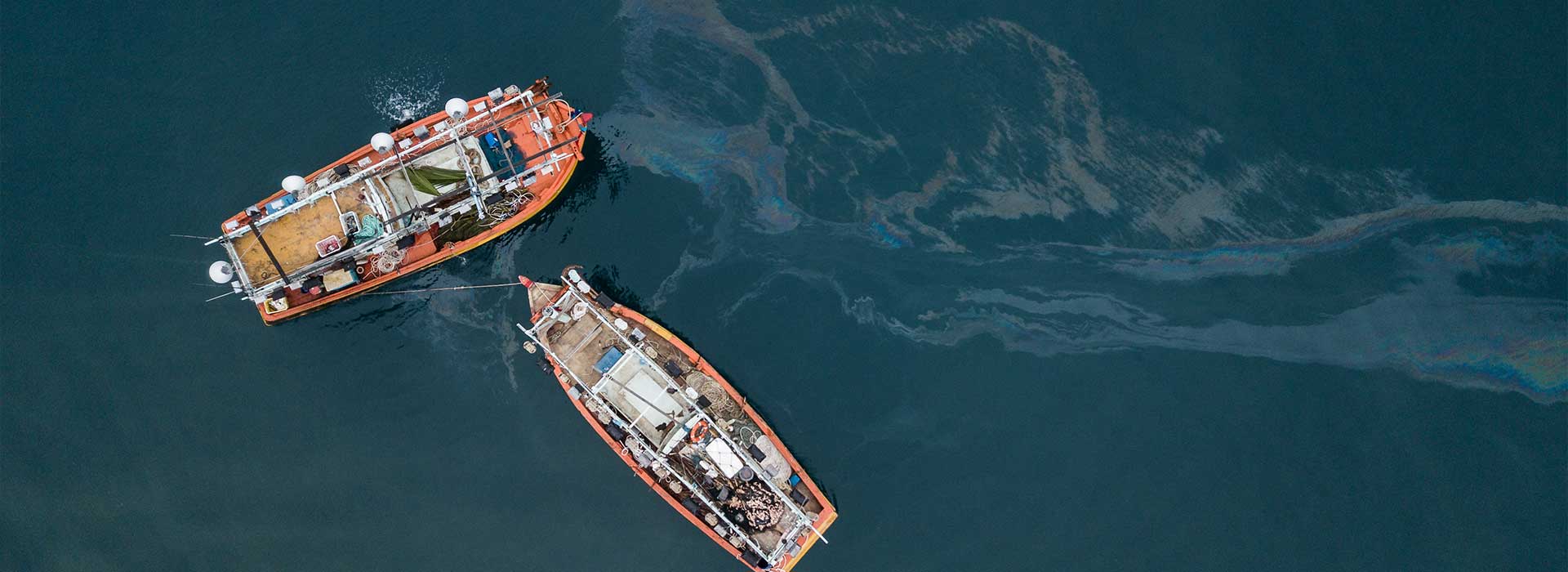

3. Pollution Coverage: With growing environmental concerns, P&I insurance plays a critical role in covering the costs associated with pollution incidents. This includes the cost of cleanup, damage to natural resources, fines, and legal expenses. Shipowners can navigate the complex legal landscape and mitigate the financial burden resulting from pollution events with the help of P&I insurance.

4. Legal Protection: P&I insurance offers legal assistance and support to policyholders in case of disputes or legal proceedings. This includes coverage for legal fees, defense costs, and representation in court. Shipowners can confidently navigate the legal complexities of the maritime industry, knowing that they have the backing of their P&I insurance provider.

5. Wreck Removal: In the unfortunate event of a shipwreck or vessel becoming a hazard to navigation, P&I insurance provides coverage for wreck removal expenses. This includes the cost of salvage operations, wreck removal, and any associated liabilities. The financial burden of removing wrecked vessels can be significant, and P&I insurance ensures that shipowners are protected in such situations.

P&I insurance offers a range of additional benefits and services, such as expert claims handling, risk management guidance, and loss prevention initiatives. P&I clubs often provide resources and support to help policyholders improve safety standards, reduce the likelihood of incidents, and minimize their exposure to liabilities.

In the next section, we will explore the different types of P&I insurance policies available to cater to the specific needs and requirements of shipowners and operators in the maritime industry.

Types of P&I Insurance Policies

P&I insurance policies are designed to provide tailored coverage to meet the specific needs of shipowners, operators, and charterers in the maritime industry. Let’s explore the different types of P&I insurance policies available.

1. Fixed Limit P&I Insurance: This type of policy provides coverage up to a predetermined limit for each category of liability. The limits are set based on the vessel’s size, trading area, and the risks involved. Fixed limit policies offer clarity and certainty regarding the coverage amount, ensuring that shipowners know the extent of their liability and the protection provided by the insurance.

2. Hybrid or Tiered Limit P&I Insurance: This type of policy combines the features of both fixed limit and mutual insurance. It offers a fixed limit for certain categories of liability, such as collision or pollution, while the remaining liabilities are covered by the mutual aspect of the policy. Hybrid policies provide a balanced approach, offering the advantages of both fixed limits and the financial benefits of mutual coverage.

3. Open Form P&I Insurance: Open Form policies provide “all risks” coverage, meaning they cover all liabilities, except those specifically excluded. These policies offer broad coverage, providing comprehensive protection for a wide range of liabilities that shipowners may encounter in their day-to-day operations. Open Form policies are flexible and adaptable, ensuring that shipowners are protected from various risks without the need for separate endorsements or policy modifications.

4. Chartered Ship P&I Insurance: This type of policy is specifically designed for charterers who have assumed liability for the vessel or specific operations under a charter party agreement. It covers liabilities that arise from the charterer’s activities, such as cargo damage, pollution, and collisions. Chartered Ship P&I Insurance provides essential coverage to charterers and ensures that they are protected from potential financial risks associated with their charter party obligations.

5. Specialist P&I Insurance: Some P&I insurance policies cater to specific sectors or types of vessels within the maritime industry. For example, there are specialized policies for offshore energy operations, passenger ships, tankers, and other specific types of vessels. These policies offer targeted coverage and address the unique risks and liabilities faced by these specialized sectors.

It’s important for shipowners, operators, and charterers to carefully assess their needs and consult with insurance brokers or P&I clubs to determine the most appropriate type of P&I insurance policy for their specific circumstances. Policyholders can customize their coverage to ensure that they have the necessary protection and peace of mind while operating in the maritime industry.

In the next section, we will discuss the process of filing a claim and the steps involved in the P&I insurance claims process.

P&I Insurance Claims Process

When an incident occurs that may give rise to a claim under a P&I insurance policy, it is important for policyholders to understand and navigate the claims process effectively. Let’s take a closer look at the typical steps involved in the P&I insurance claims process.

1. Incident Notification: The first step is for the policyholder to notify their P&I club or insurance provider about the incident. This should be done promptly and in accordance with the policy’s guidelines. The notification should include all relevant details of the incident, such as the nature of the claim, parties involved, and any damages or injuries suffered.

2. Claims Documentation: The policyholder should gather all necessary documentation to support the claim. This may include photographs, witness statements, police or incident reports, medical reports, invoices, and any other evidence that can substantiate the claim. It is important to provide accurate and comprehensive documentation to support the claim and facilitate the claims handling process.

3. Claims Handling: Once the claim is submitted, it is assigned to a claims handler or adjuster who will manage the process. The claims handler will assess the claim, conduct investigations if necessary, and determine the liability and coverage under the policy. They may request additional information or documentation during the process.

4. Settlement Negotiation: The claims handler will engage in negotiations with the claimant or their representatives to reach a fair settlement. The aim is to resolve the claim amicably and efficiently, avoiding prolonged legal proceedings. The claims handler will review the policy terms, applicable laws, and any relevant precedents to determine the appropriate settlement amount.

5. Claims Payment: Once a settlement is reached, the P&I club or insurance provider will issue a payment to the claimant, reimbursing them for the agreed-upon amount. The payment may cover damages, medical expenses, legal costs, or any other compensation as specified in the policy. The claims handler will facilitate the payment process and ensure that it is completed in a timely manner.

6. Claims Resolution: Once the claim is settled and the payment is made, the claims process is considered resolved. However, in some cases, ongoing monitoring or follow-up may be required, especially for claims involving long-term medical treatment or ongoing legal proceedings.

It is important for policyholders to maintain open communication with their P&I club or insurance provider throughout the claims process. Timely and accurate information exchange, cooperation, and transparency are key to ensuring a smooth and successful claims resolution. Policyholders should also consult with their P&I club or insurance provider for guidance and support during the claims process to facilitate a satisfactory outcome.

In the next section, we will discuss the factors that influence P&I insurance premiums and how policyholders can manage their insurance costs effectively.

Factors Influencing P&I Insurance Premiums

Several factors influence the premiums of P&I insurance policies. Understanding these factors can help policyholders manage their insurance costs effectively. Let’s explore some of the key factors that determine P&I insurance premiums.

1. Vessel Details: The characteristics of the insured vessel play a significant role in determining the premium. Factors such as the type, size, age, and condition of the vessel are taken into account. Newer vessels with modern safety features and well-maintained ships generally attract lower premiums compared to older or poorly maintained vessels.

2. Trading Area: The geographical area in which the vessel operates also affects the premium. High-risk areas, such as war zones or regions prone to natural disasters, may attract higher premiums due to the increased likelihood of incidents and claims. The trading area determines the exposure to potential risks, including piracy, political unrest, or adverse weather conditions.

3. Claims History: The claims history of the shipowner or operator has a direct impact on the premium. A history of frequent or significant claims may increase the premium as it indicates a higher level of risk. Conversely, a clean claims history with minimal or no incidents can contribute to lower premiums as it demonstrates responsible and safe operations.

4. Risk Management Measures: Shipowners that implement effective risk management measures are often rewarded with lower premiums. Proactive measures such as safety training programs, regular maintenance, adherence to industry regulations, and robust safety protocols can help mitigate risks and improve the overall safety profile of the insured vessel.

5. Vessel Operations: The nature of the vessel’s operations and the types of cargo carried can impact the premium. Specialized operations or cargoes with higher risk profiles, such as hazardous materials, may lead to increased premiums. Similarly, vessels engaged in passenger transport or offshore activities may attract higher premiums due to the heightened liability exposures associated with these operations.

6. P&I Club Experience: The experience and financial stability of the P&I club or insurance provider also influence the premium. Well-established clubs with a strong track record of claims management, financial strength, and excellent service may offer competitive premiums. The reputation and rating of the P&I club are important considerations for shipowners when selecting their insurance provider.

7. Market Conditions: The overall market conditions and trends in the insurance industry can impact P&I insurance premiums. Factors such as the frequency and severity of claims within the industry, changes in regulations, global economic conditions, and supply and demand dynamics can all influence premium rates.

It is important for shipowners and operators to work closely with their insurance brokers and P&I clubs to assess their specific risk profiles and determine the most appropriate coverage at the best possible premium rates. Implementing effective risk management measures, maintaining a good claims history, and staying informed about market trends can all contribute to managing P&I insurance premiums effectively.

In the final section, we will compare P&I insurance with other types of marine insurance to provide a comprehensive understanding of the different coverage options available in the maritime industry.

P&I Insurance vs. Other Types of Marine Insurance

When it comes to marine insurance, there are various types of coverage available to protect the interests of shipowners, operators, and charterers. Let’s compare P&I insurance with other types of marine insurance to understand their differences and advantages.

Hull and Machinery (H&M) Insurance: H&M insurance covers physical damage to the insured vessel itself, including the hull, machinery, and equipment. It provides protection against risks such as collisions, grounding, fire, and structural damage. In contrast, P&I insurance focuses on covering liabilities arising from third-party claims resulting from the vessel’s operations, such as personal injury, pollution, and cargo damage. P&I insurance complements H&M insurance by covering liabilities that H&M insurance does not address.

Cargo Insurance: Cargo insurance protects the interests of cargo owners by providing coverage for loss or damage to the cargo being transported by the insured vessel. It covers risks during transit, such as theft, damage due to handling, or accidents. While P&I insurance may cover cargo liabilities in certain circumstances, its primary focus is on protecting shipowners and operators from liabilities arising from their vessel’s operations, rather than the cargo itself.

War Risk Insurance: War risk insurance provides coverage against damages or losses resulting from war-related risks, such as acts of war, terrorism, or political violence. It is typically obtained as an additional coverage to address the specific risks associated with operating in high-risk areas. P&I insurance may cover certain liabilities arising from acts of war, but specialized war risk insurance policies offer more comprehensive protection for war-related risks.

Protection and Indemnity (P&I) Insurance: P&I insurance, as discussed earlier, offers liability coverage for shipowners and operators. It protects them from claims and financial risks resulting from their vessel’s operations, such as personal injury, property damage, pollution, and collision liabilities. P&I insurance addresses a wide range of liabilities that are not covered by other marine insurance types, focusing on third-party claims rather than physical damage to the vessel or cargo.

While specific insurance policies address different aspects of maritime risks, it is common for shipowners and operators to have a combination of coverage to ensure comprehensive protection. P&I insurance, in particular, is an essential component in the insurance portfolio of maritime entities, as it complements other types of insurance by providing crucial liability coverage.

By having P&I insurance in place, shipowners and operators can manage their financial exposure and legal obligations, ensuring smoother operations and mitigating potential risks. It is important to work with experienced insurance brokers and P&I clubs to assess the specific needs and risks, thereby obtaining the most suitable coverage to safeguard the interests of all parties involved.

After exploring the different types of marine insurance and their respective coverage options, it is clear that P&I insurance plays a critical role in protecting the maritime industry’s interests. In the next section, we will conclude our discussion on P&I insurance, highlighting its significance and the vital role it plays in maritime risk management.

Conclusion

Protection and Indemnity (P&I) insurance is a vital component of the maritime industry, providing essential liability coverage for shipowners, operators, and charterers. It complements other types of marine insurance by focusing on third-party claims and protecting against financial risks arising from vessel operations. Throughout this article, we have explored the definition, coverage, claims process, and other important aspects of P&I insurance.

P&I insurance offers comprehensive protection against a wide range of liabilities, including personal injury, property damage, pollution, and cargo-related risks. It ensures that shipowners and operators are financially secure and can fulfill their legal obligations. The mutual structure of P&I clubs fosters a sense of community within the industry, providing tailored coverage and prompt claims handling.

The claims process involves incident notification, documentation, claims handling, settlement negotiation, claims payment, and ultimately, claims resolution. By understanding the claims process and working closely with their P&I club or insurance provider, policyholders can navigate the process successfully and achieve satisfactory outcomes.

Several factors influence P&I insurance premiums, such as vessel details, trading area, claims history, risk management measures, P&I club experience, and market conditions. Shipowners and operators can effectively manage their insurance costs by implementing risk management measures, maintaining a good claims history, and choosing a reputable and reliable P&I club.

When comparing P&I insurance with other types of marine insurance, it is evident that P&I insurance focuses on liability coverage rather than physical damage to vessels or cargo. It complements hull and machinery insurance, cargo insurance, and war risk insurance by addressing third-party claims and providing comprehensive protection.

In conclusion, P&I insurance is an indispensable part of the maritime industry, providing financial security, legal protection, and peace of mind. It enables shipowners, operators, and charterers to navigate the complex marine environment with confidence, knowing that their liabilities and risks are adequately covered. By understanding the intricacies of P&I insurance and working closely with reputable providers, stakeholders in the maritime industry can safeguard their interests and ensure the sustainable and safe operation of their vessels.