Finance

What Is Tail Malpractice Insurance

Published: November 22, 2023

Protect your financial future with tail malpractice insurance. Learn what it is, why it's crucial for finance professionals, and how to get covered.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Tail Malpractice Insurance

- Why is Tail Malpractice Insurance Needed?

- How Does Tail Malpractice Insurance Work?

- Coverage and Cost of Tail Malpractice Insurance

- Different Options for Obtaining Tail Malpractice Insurance

- Benefits and Drawbacks of Tail Malpractice Insurance

- Conclusion

Introduction

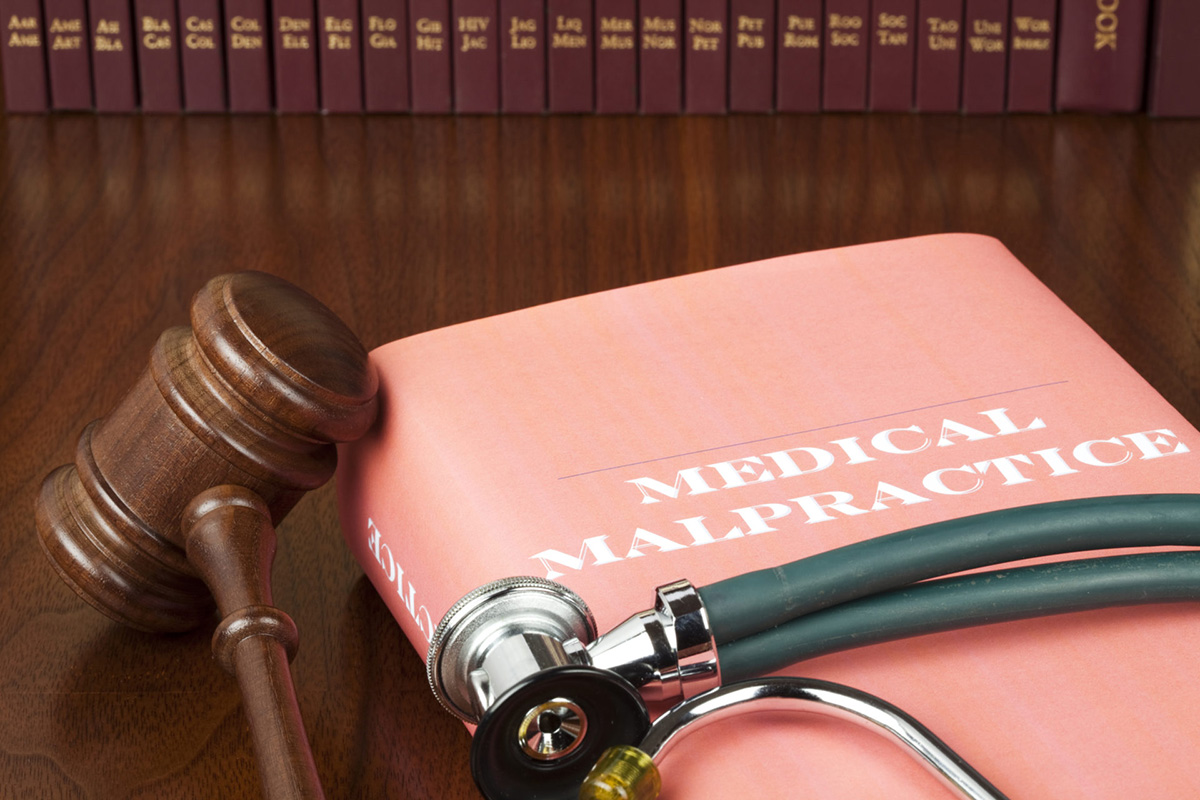

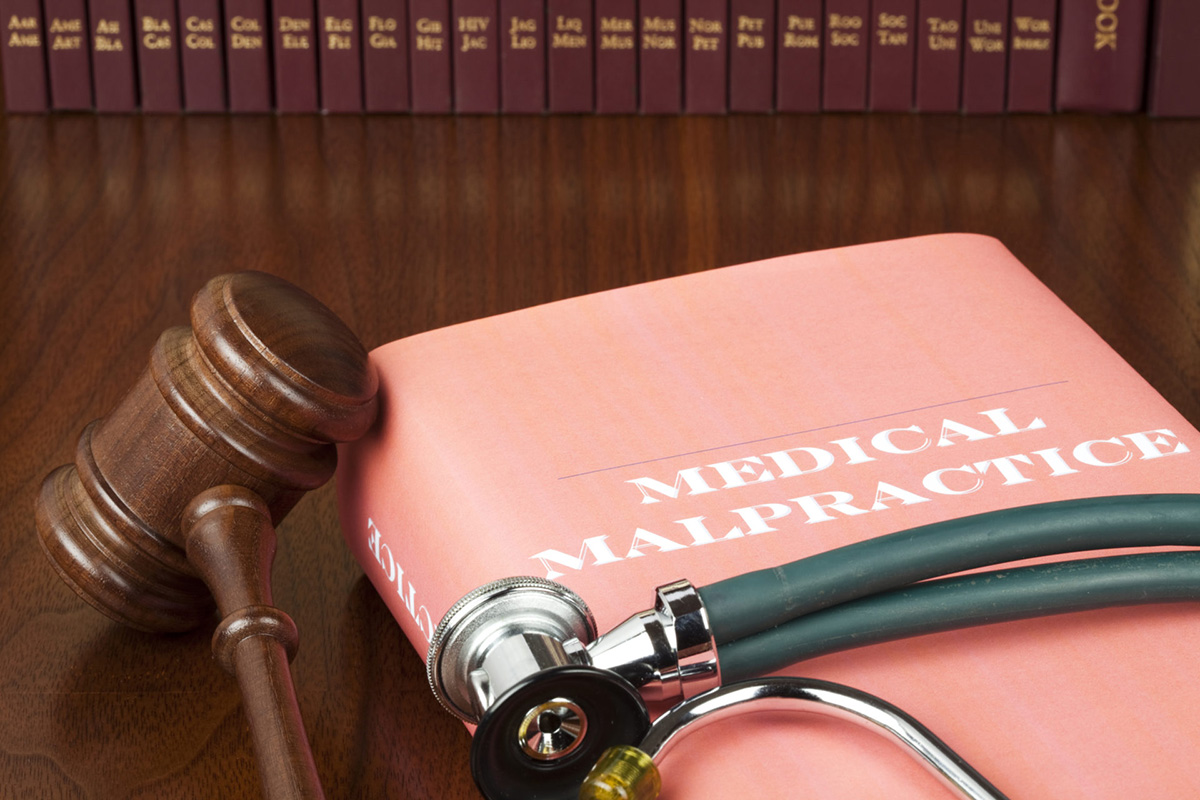

Welcome to an insightful exploration of a crucial aspect of professional liability insurance within the field of finance: tail malpractice insurance. In this article, we will delve into the intricacies of tail malpractice insurance, why it is necessary, how it works, the coverage it offers, the options available, and the potential benefits and drawbacks associated with it.

As financial professionals, we understand the importance of safeguarding ourselves against potential risks and liabilities. Professional liability insurance, commonly known as malpractice insurance, provides crucial protection against claims of negligence or errors and omissions in our professional services. While standard malpractice insurance covers claims filed during the policy period, tail malpractice insurance extends coverage even after the policy has expired.

Although tail malpractice insurance is particularly relevant for professionals in finance, our discussion will cater to a broader audience interested in understanding the fundamentals of this important coverage option. Whether you are a financial advisor, accountant, or any other finance professional, this article will provide valuable insights.

Join us as we explore the world of tail malpractice insurance, starting with a comprehensive definition of what it entails.

Definition of Tail Malpractice Insurance

Tail malpractice insurance, also known as extended reporting period coverage or “tail coverage,” is an insurance policy that provides continued protection to professionals even after their primary malpractice insurance policy has expired. It is specifically designed to cover claims that arise from incidents or events that occurred during the policy period but are only reported after the policy has lapsed.

When professionals retire, change careers, or switch insurance carriers, their standard malpractice insurance policy usually comes to an end. However, there may still be a risk of potential claims arising from past services provided. Tail malpractice insurance bridges this coverage gap and ensures that professionals are protected from any liabilities they may face due to incidents that occurred while the original policy was in force.

The term “tail” refers to the extended reporting period for filing claims. Depending on the insurer, tail coverage can typically range from one to five years or even longer, providing professionals with ample time to report any potential claims that may arise from their past services.

It is important to note that tail malpractice insurance is an optional coverage that must be purchased separately. It is not automatically included in standard malpractice insurance policies. Professionals must proactively consider the need for tail coverage and make arrangements to secure it before their primary policy expires.

The specific terms and conditions of tail malpractice insurance can vary depending on the insurance provider and the policy chosen. It is essential for professionals to carefully review the coverage details, limitations, and exclusions of the policy they are considering to ensure they are adequately protected.

Now that we have a clear understanding of what tail malpractice insurance entails, let us explore why it is necessary in the next section.

Why is Tail Malpractice Insurance Needed?

Tail malpractice insurance is necessary for several reasons, offering critical protection and peace of mind to professionals in the finance industry.

1. Extended Reporting Period: When professionals retire, change careers, or switch insurance carriers, their standard malpractice insurance policy typically ceases to provide coverage. However, claims may still arise from past services provided during the policy period. Tail malpractice insurance ensures that professionals have an extended reporting period during which they can file claims for incidents that occurred while the original policy was in effect.

2. Retroactive Coverage: Tail malpractice insurance also provides retroactive coverage, which means it covers claims arising from past incidents that may not have been reported during the policy period. This is particularly beneficial in situations where a claim arises well after the service was provided, such as in cases where the impact of the service is not immediately apparent or when a client decides to pursue legal action at a later date.

3. Continuity of Coverage: We live in a litigious society, and professionals in the finance industry are not immune to potential lawsuits. Tail malpractice insurance ensures continuity of coverage, allowing professionals to protect themselves from claims that may arise after their primary policy has expired. It offers a safety net, eliminating the worry of being personally liable for claims related to past services.

4. Reputation Protection: One of the main benefits of tail malpractice insurance is safeguarding professional reputation. A lawsuit or claim can have a significant impact on a finance professional’s standing in the industry, potentially affecting future career opportunities. Tail coverage helps mitigate these risks and shields professionals from the potential financial and reputational damage that can result from claims arising from prior services.

5. Compliance Requirements: In some cases, tail malpractice insurance may be a regulatory or contractual requirement. Certain financial institutions, regulatory bodies, or client contracts may mandate professionals to maintain tail coverage even after the cessation of their primary policy. Failing to comply with these requirements can lead to legal and reputational consequences.

By addressing these needs, tail malpractice insurance plays a vital role in protecting finance professionals and ensuring that they have comprehensive coverage in the event of a claim. In the next section, we will explore how tail malpractice insurance works.

How Does Tail Malpractice Insurance Work?

Tail malpractice insurance works by providing an extended reporting period for professionals to file claims for incidents that occurred during the policy period but are only reported after the primary policy has expired. Here’s how it typically functions:

1. Policy Purchase: Professionals must purchase tail malpractice insurance separately before their primary policy expires. It is important to consider the duration of coverage needed and select a policy that aligns with individual requirements. The cost of tail coverage will vary depending on factors such as the type of profession, claims history, and the desired length of the reporting period.

2. Reporting of Claims: During the extended reporting period, if a claim arises related to professional services rendered in the past, professionals must promptly report it to the insurance company. It is crucial to adhere to any notification and reporting requirements as outlined in the policy to ensure that the claim is eligible for coverage.

3. Retroactive Coverage: Tail malpractice insurance also covers claims arising from past incidents that were not reported during the primary policy period. This retroactive coverage allows professionals to address any claims that may arise even after the policy has expired. It is essential to review the specific terms and conditions of the policy to understand the scope and limitations of this retroactive coverage.

4. Coverage Limitations: It is important to note that tail malpractice insurance has certain limitations. It typically covers claims related to incidents that occurred during the original policy period, but it may not extend coverage to claims arising from services rendered after the expiration of the primary policy. Additionally, tail coverage is usually specific to the individual or business named in the original policy, and it may not cover claims related to work performed by other individuals or entities.

5. Cost and Payment: Tail malpractice insurance is usually more expensive than the primary malpractice insurance policy due to the extended coverage it provides. The cost will depend on factors such as the type of profession, the claims history, and the desired length of the reporting period. Professionals need to consider this cost when evaluating their insurance needs and budgeting for ongoing coverage.

By understanding how tail malpractice insurance works, finance professionals can make informed decisions about whether to obtain this coverage to protect their interests. In the next section, we will delve into the coverage and cost considerations associated with tail malpractice insurance.

Coverage and Cost of Tail Malpractice Insurance

Tail malpractice insurance offers valuable coverage for professionals in the finance industry, but it is important to understand its scope and associated costs.

Coverage:

Tail malpractice insurance typically provides coverage for claims arising from incidents that occurred during the original policy period but are reported after the policy expires. It offers an extended reporting period, allowing professionals to address potential liabilities from their past services. The specific coverage details may vary depending on the insurance provider and the policy selected.

It is crucial to review the policy terms and conditions to understand what is covered and any exclusions or limitations that may apply. Professionals should ensure that the coverage aligns with their specific needs and addresses the potential risks they may face in their finance-related practice.

Cost:

The cost of tail malpractice insurance is determined by various factors, including the type of profession, the claims history of the individual or business, and the desired length of the reporting period.

Professionals should expect that tail coverage will be more expensive than their primary malpractice insurance policy. This is because tail insurance provides extended coverage for claims that may arise in the future, even after the primary policy has expired. The cost of tail coverage can vary significantly depending on individual circumstances, so it is essential to obtain quotes from different insurance providers and compare them to find the most suitable option.

When considering the cost of tail malpractice insurance, professionals should take into account the potential financial repercussions of not having coverage. The expenses associated with defending against a claim and any potential damages or settlements can far outweigh the cost of tail coverage. It is crucial to strike a balance between affordability and ensuring adequate protection.

Additionally, professionals should factor in the potential regulatory or contractual requirements for tail coverage. Failure to comply with these obligations can result in legal and reputational consequences.

By understanding the coverage provided and considering the associated costs, professionals can make informed decisions about obtaining tail malpractice insurance. In the next section, we will explore different options for obtaining this type of coverage.

Different Options for Obtaining Tail Malpractice Insurance

When it comes to obtaining tail malpractice insurance, finance professionals have several options to consider. Here are some common routes to explore:

1. Purchase from Current Insurance Provider: The first option is to inquire with your current malpractice insurance carrier. They may offer tail coverage as an extension to your existing policy. This can be a convenient option as it allows you to maintain continuity with your current insurer. However, it is essential to compare the cost and coverage terms with other providers to ensure you are getting the best possible deal.

2. Purchase from a Different Insurance Provider: Another option is to shop around and obtain tail malpractice insurance from a different insurance provider. By exploring the offerings from multiple carriers, you can compare terms, coverage limits, and costs to find the most suitable option for your needs. Working with an insurance broker who specializes in professional liability can help you navigate the market and find the best available options.

3. State or Specialty Association Programs: Some states or professional associations offer tail malpractice insurance programs specifically tailored to professionals within the finance industry. These programs may provide competitive rates and comprehensive coverage tailored to the unique needs of finance professionals. It is worth researching if such programs exist in your jurisdiction or in professional organizations you belong to.

4. Claims-Made Policy with Prior Acts Coverage: An alternative to tail malpractice insurance is a claims-made policy with prior acts coverage. This type of policy extends coverage for claims arising from incidents that occurred during the policy period, even if they are filed after the policy expires. It eliminates the need for separate tail coverage, but it may require continuous coverage to maintain the prior acts coverage. It is vital to carefully review and understand the terms of such a policy, as it may have limitations and specific conditions.

5. Negotiate Coverage with New Employer: If you are transitioning to a new employer or practice, you may be able to negotiate tail malpractice insurance coverage as part of your employment or contract terms. This can provide you with peace of mind knowing that you are protected from potential claims that may arise from your previous services.

Each option has its merits and considerations, so it is important to carefully review and compare the terms and costs associated with each. Taking the time to evaluate your options and seek professional advice can help you make an informed decision that aligns with your specific needs and circumstances.

In the next section, we will analyze the benefits and drawbacks associated with tail malpractice insurance to provide a balanced perspective.

Benefits and Drawbacks of Tail Malpractice Insurance

As with any insurance coverage, tail malpractice insurance comes with its own set of benefits and drawbacks. Understanding these can help finance professionals make informed decisions about whether to obtain this type of coverage. Let’s explore the advantages and disadvantages:

Benefits:

1. Extended Protection: The primary benefit of tail malpractice insurance is the extended coverage it provides for claims arising from past services. It offers professionals peace of mind, knowing they are protected even after their primary policy has expired.

2. Continuity of Coverage: By securing tail coverage, professionals ensure there are no coverage gaps, protecting them from potential liabilities related to past services provided. This is particularly important in fields where claims may arise years after services were rendered, such as in investments or financial planning.

3. Reputation Protection: A claim or lawsuit can damage a professional’s reputation. Tail malpractice insurance helps safeguard professional standing by providing coverage for potential claims and mitigating reputational harm that may result from such claims.

4. Compliance Requirements: In some cases, tail coverage may be required by regulators, financial institutions, or client contracts. By obtaining this coverage, professionals ensure compliance with such requirements to avoid legal and reputational consequences.

Drawbacks:

1. Cost: Tail malpractice insurance is generally more expensive than primary coverage due to the extended reporting period it offers. The cost can be a significant investment for professionals, and it is essential to assess whether the benefits justify the expense.

2. Limited Coverage Period: Tail coverage usually has a predefined duration, typically ranging from one to five or more years. Once the tail coverage period expires, professionals are no longer protected from claims arising from past services. This limitation necessitates careful planning and consideration of future liabilities.

3. Unique Coverage Needs: Each professional’s coverage needs are unique. Tail malpractice insurance may not suit every situation or profession. It is important to assess the specific risks associated with the finance industry and evaluate whether tail coverage adequately addresses those risks.

4. Coverage Limitations: Tail coverage may have certain exclusions, limitations, or conditions that professionals should be aware of. These may include limitations on coverage amounts, retroactive date restrictions, or exclusions for certain types of claims. It is crucial to review the policy details carefully to fully understand the scope of coverage.

By weighing the benefits and drawbacks, professionals can determine whether tail malpractice insurance is the right choice for their needs. Understanding the specifics of the coverage and considering individual circumstances is essential to make an informed decision.

In the final section, we will conclude our exploration of tail malpractice insurance and summarize the key takeaways.

Conclusion

Tail malpractice insurance is a crucial consideration for finance professionals who want comprehensive protection in a litigious environment. This coverage option extends the reporting period for filing claims beyond the expiration of the primary policy, ensuring continued protection from potential liabilities arising from past services.

In this article, we explored the definition of tail malpractice insurance and why it is needed in the finance industry. We discussed how tail coverage works, including the reporting of claims and the retroactive coverage it provides. In addition, we examined the coverage and cost considerations when obtaining tail insurance, as well as the different options available for professionals to secure this type of coverage.

Some of the benefits of tail malpractice insurance include extended protection, continuity of coverage, reputation protection, and compliance with regulatory or contractual requirements. However, it also has drawbacks, such as the cost, limited coverage period, and unique coverage needs for each individual or profession.

Ultimately, the decision to obtain tail malpractice insurance should be based on a careful evaluation of individual circumstances, risks, and financial considerations. It is important to review policy terms, compare options from different providers, and seek professional advice if needed.

By understanding the fundamentals of tail malpractice insurance and taking the necessary steps to secure appropriate coverage, finance professionals can protect their interests and ensure peace of mind in the face of potential liabilities.

Remember, the world of finance is constantly evolving, and it is crucial to stay informed about the latest trends and developments in the field. Keeping up with changes not only helps professionals better serve their clients but also enables them to make informed decisions about their risk management and insurance needs.