Home>Finance>What Is The Threshold Securities List? Definition And Criteria

Finance

What Is The Threshold Securities List? Definition And Criteria

Published: February 8, 2024

Learn the definition and criteria of the threshold securities list in finance. Understand how this list impacts securities trading and market regulations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the Threshold Securities List: Definition and Criteria

When it comes to navigating the world of finance, there are numerous terms and concepts that can often seem confusing or overwhelming. One such term is the Threshold Securities List, which is a category of securities that plays a significant role in regulating the market. In this article, we will dive into the definition and criteria of the Threshold Securities List, shedding light on its importance within the realm of finance.

Key Takeaways:

- The Threshold Securities List is a compilation of securities that have been flagged for potential market manipulation or abusive trading activities.

- To make it onto the list, a security must meet specific criteria, including a high trading volume and a significant number of failed trades.

What Is the Threshold Securities List?

The Threshold Securities List, also known as the Threshold List or the Regulation SHO Threshold List, is a compilation of securities that have been identified as candidates for potential market manipulation or abusive trading practices. The list is maintained by the U.S. Securities and Exchange Commission (SEC) and is designed to ensure fair and transparent trading in the financial markets.

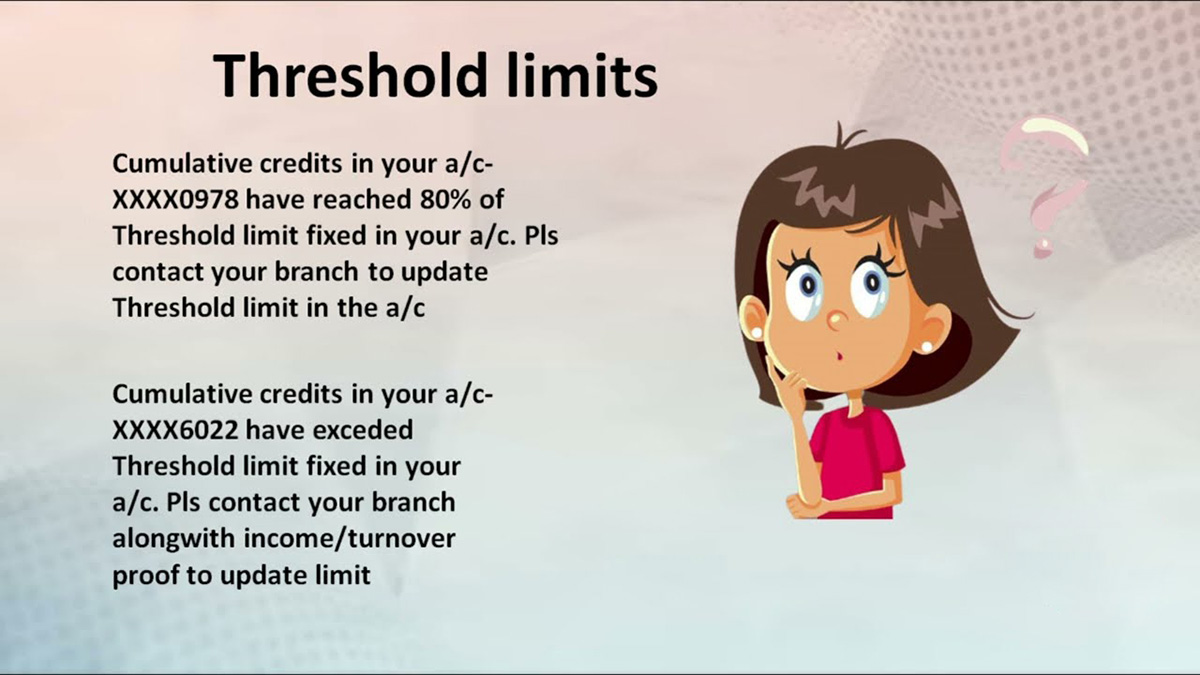

The inclusion of a security on the Threshold Securities List indicates that it meets certain criteria that suggest it may be prone to manipulation or abusive trading practices. These criteria are primarily based on trading volume and the number of failed trades associated with the security.

Criteria for Inclusion on the Threshold Securities List:

Securities are added to the Threshold Securities List when they meet the following criteria:

- High Trading Volume: Securities with a significant trading volume, indicating active market participation. This criterion helps identify securities that may be more susceptible to manipulation due to their high liquidity.

- Number of Failed Trades: Securities with a considerable number of failed trades, indicating potential short selling or other abusive trading practices.

It’s important to note that being included on the Threshold Securities List does not necessarily imply any wrongdoing on the part of the company issuing the security. Instead, it serves as an early warning system to safeguard the integrity of the financial markets and enables regulators to monitor and investigate potential manipulative or abusive activities.

Why Is the Threshold Securities List Important?

The Threshold Securities List plays a crucial role in maintaining fair and orderly markets. By identifying securities that may be at higher risk for manipulation or abusive trading practices, regulators can closely monitor these securities and take necessary actions to protect investors and uphold market integrity.

Furthermore, the Threshold Securities List serves as a valuable tool for market participants, including investors and traders. By having access to the list, they can make more informed decisions regarding the securities they choose to trade or invest in.

Conclusion

The Threshold Securities List is an important aspect of the financial market infrastructure. It helps to maintain transparency, prevent market manipulation, and protect investors. By understanding the definition and criteria for inclusion on the list, market participants can navigate the financial markets with greater knowledge and confidence.

For more insights and information on finance-related topics, please explore our Finance category.