Finance

When Are 401K Contributions Due

Modified: December 30, 2023

Learn about the deadlines for 401K contributions and how they can impact your personal finances. Plan ahead and maximize your savings potential

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to planning for retirement, one of the most popular and effective options available to individuals is the 401K plan. A 401K is an employer-sponsored retirement savings account that allows employees to contribute a portion of their salary on a pre-tax or after-tax basis, depending on the type of plan. These contributions are then invested in a variety of financial vehicles such as stocks, bonds, and mutual funds, allowing them to grow over time.

However, it’s not enough to simply contribute to a 401K account – it’s crucial to understand the deadlines and requirements associated with these contributions. Knowing when your 401K contributions are due is essential for maximizing the benefits of this retirement savings account.

In this article, we will delve into the specifics of 401K contributions and explore the deadlines and consequences associated with them. Whether you’re new to the world of retirement planning or a seasoned investor, understanding the timing of 401K contributions will help you make informed decisions and ensure you are taking full advantage of the available tax benefits and employer matching programs.

So, if you’re ready to take control of your retirement savings and make the most of your 401K plan, read on to find out when your contributions are due and how to stay on track!

Understanding 401K Contributions

Before diving into the deadlines for 401K contributions, it’s important to have a clear understanding of how they work. A 401K plan allows employees to set aside a portion of their income for retirement savings. The contributions are typically deducted from the employee’s paycheck on a pre-tax basis, meaning that the money is contributed before taxes are taken out. This provides an immediate tax advantage, as the contributions reduce the employee’s taxable income.

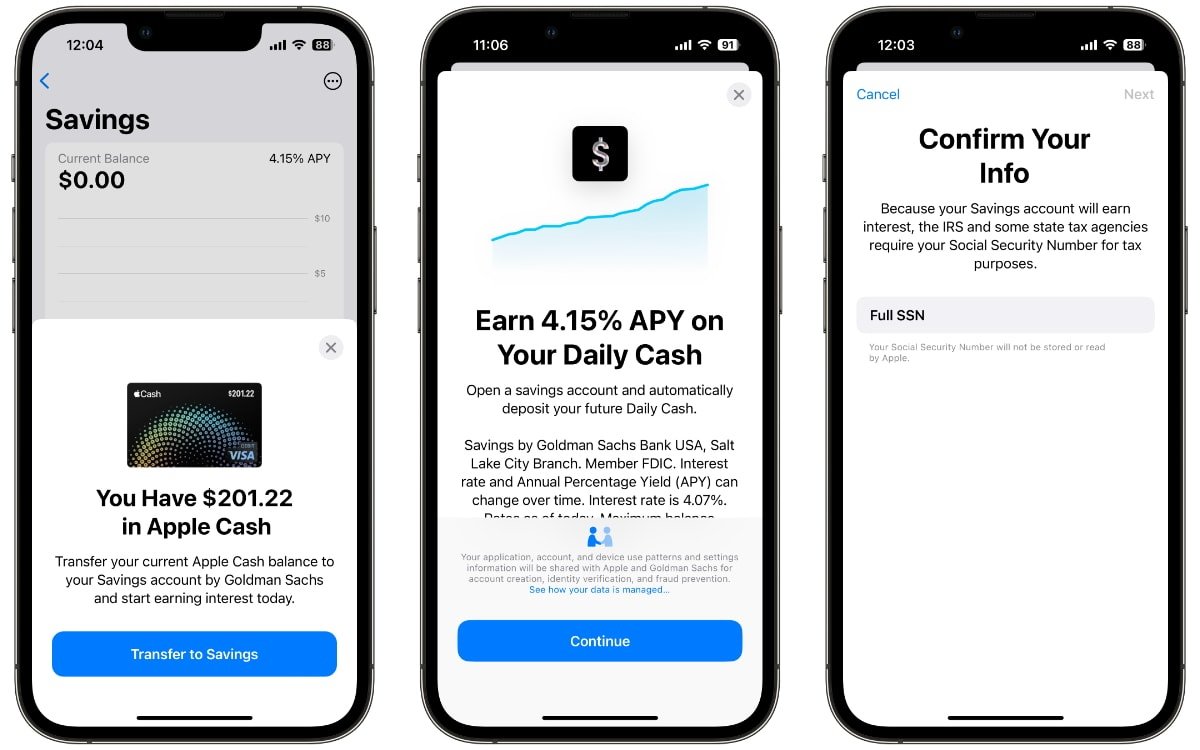

Some employers also offer the option of making after-tax contributions to a 401K plan, known as Roth 401K contributions. With Roth contributions, the money is taxed now, but qualifying withdrawals upon retirement are tax-free. This can be advantageous for individuals who anticipate being in a higher tax bracket in retirement.

It’s important to note that there are limits to how much you can contribute to your 401K plan each year. For 2021, the maximum contribution limit is $19,500 for individuals under the age of 50. Individuals who are 50 or older can make catch-up contributions of an additional $6,500, for a total maximum contribution of $26,000. These limits are set by the IRS and are subject to change from year to year.

Another important aspect of 401K contributions is employer matching. Many employers offer a matching program, wherein they contribute a certain percentage of the employee’s salary to the 401K plan. For example, an employer may match 50% of the employee’s contributions up to a certain percentage of their salary. This is essentially free money and can significantly boost your retirement savings.

Now that we have a grasp of how 401K contributions work, let’s explore the deadlines associated with these contributions and the potential consequences of missing them.

Contribution Deadlines

Understanding the deadlines for making 401K contributions is essential to ensure that you don’t miss out on the tax advantages and employer matching offered by these retirement savings plans. The deadlines for contributing to a 401K plan can vary based on several factors, including your employer’s policies and the type of contributions you are making.

Generally, the deadline for making 401K contributions is the end of the calendar year. This means that you must make contributions by December 31st to qualify for tax benefits for that year. However, some employers may have an earlier deadline, so it’s crucial to check with your HR department or plan administrator to confirm the specific date. It’s important to remember that contributions must be made and processed by the deadline, not just sent or postmarked.

In addition to the general deadline, there are specific rules for different types of 401K contributions. Traditional 401K contributions, which are made on a pre-tax basis, must be withheld from your paycheck throughout the year and deposited into your 401K account by the deadline. These contributions are reported on your annual tax return and reduce your taxable income for that year.

Roth 401K contributions, on the other hand, are made on an after-tax basis. While the deadline for making Roth contributions is the same as the general contribution deadline, it’s important to note that the account must be open for at least five years before you can withdraw any tax-free earnings. This means that if you plan to make Roth contributions and take advantage of tax-free withdrawals, it’s beneficial to start the account as early as possible.

It’s crucial to adhere to these deadlines and make your contributions on time, as missing the deadline can have significant consequences on your retirement savings. Let’s explore the potential consequences of missing the contribution deadlines in the next section.

Traditional 401K Contributions

Traditional 401K contributions are one of the most common types of contributions made to a 401K plan. These contributions are made on a pre-tax basis, meaning that the money is deducted from your paycheck before taxes are taken out. This provides an immediate tax advantage as it reduces your taxable income for the year.

The deadline for making traditional 401K contributions is typically the end of the calendar year, although some employers may have an earlier deadline. It’s important to check with your HR department or plan administrator to confirm the specific deadline for your plan.

One of the benefits of traditional 401K contributions is that they lower your taxable income, which can potentially lower your overall tax liability. For example, if your annual salary is $50,000 and you contribute $5,000 to your traditional 401K, your taxable income for the year would be reduced to $45,000. This means you would owe less in taxes for that year.

In addition to the tax advantages, traditional 401K contributions also allow your investments to grow tax-deferred until you withdraw them in retirement. This means that you won’t pay taxes on the earnings or gains from your investments until you start taking distributions.

It’s important to note that there are limits to how much you can contribute to your traditional 401K account each year. For 2021, the maximum contribution limit is $19,500 for individuals under the age of 50. If you are 50 or older, you can make catch-up contributions of an additional $6,500, for a total maximum contribution of $26,000. These limits are imposed by the IRS and may change from year to year.

Employer matching is another important aspect of traditional 401K contributions. Many employers offer a matching program wherein they will contribute a certain percentage of your salary to your 401K account. For example, if your employer offers a 50% matching program and you contribute 6% of your salary, they would match 3% of your salary. This matching contribution is essentially free money and can significantly boost your retirement savings.

Contributing to your traditional 401K plan is a smart way to save for retirement while taking advantage of tax benefits and potential employer matches. However, it’s important to be aware of the contribution limits and deadlines to maximize the benefits of this type of contribution.

Roth 401K Contributions

Roth 401K contributions are a popular alternative to traditional pre-tax contributions. With Roth contributions, the money is contributed on an after-tax basis, meaning that taxes are paid on the amount before it goes into the 401K account. However, the key advantage of Roth contributions is that qualified withdrawals, including both contributions and earnings, are tax-free in retirement.

The deadline for making Roth 401K contributions is typically the end of the calendar year, similar to traditional contributions. It’s important to check with your HR department or plan administrator to confirm the specific deadline for your plan.

One of the main benefits of Roth 401K contributions is the tax-free withdrawals in retirement. By paying taxes on the contributions upfront, you can enjoy tax-free distributions when you retire. This can be especially advantageous if you anticipate being in a higher tax bracket during retirement or if you expect tax rates to increase in the future.

Another benefit of Roth contributions is that there are no mandatory minimum distributions (RMDs) during the account owner’s lifetime. Traditional 401K plans require individuals to start taking distributions once they reach a certain age, generally 72 years old. However, Roth 401K accounts are not subject to RMDs, allowing you to let your investments grow tax-free for a longer period if you don’t need the funds.

Similar to traditional contributions, there are limits to how much you can contribute to a Roth 401K account each year. The maximum contribution limit for 2021 is $19,500 for individuals under the age of 50. Those who are 50 or older can make catch-up contributions of an additional $6,500, bringing the total maximum contribution limit to $26,000.

It’s worth noting that Roth 401K contributions also have income eligibility limits. If your income exceeds a certain threshold set by the IRS, you may not be eligible to make direct Roth contributions. However, many employers offer a workaround known as a “backdoor” Roth 401K, which allows high-income earners to contribute to a Roth IRA and then convert it to a Roth 401K.

Choosing between traditional and Roth 401K contributions depends on your personal financial situation and anticipated tax circumstances. It’s important to consider factors such as your current and future tax brackets, potential tax law changes, and retirement goals to decide which type of contribution will best suit your needs.

Catch-Up Contributions

If you’re approaching retirement age and feel like you haven’t saved enough, catch-up contributions allow you to turbocharge your retirement savings. Catch-up contributions are additional contributions that individuals aged 50 and older can make to their 401K plans above and beyond the regular contribution limits.

The catch-up contribution limit for 2021 is $6,500, in addition to the regular contribution limit of $19,500. This means that individuals aged 50 and older can contribute a total of $26,000 to their 401K accounts. Catch-up contributions provide an opportunity to make up for lost time and boost your retirement savings.

It’s important to note that catch-up contributions can only be made if your employer’s 401K plan allows for them. Not all 401K plans offer catch-up contribution options, so it’s crucial to check with your HR department or plan administrator to confirm if you are eligible to make catch-up contributions.

Catch-up contributions can be made regardless of whether you are making traditional or Roth contributions to your 401K account. This means that individuals aged 50 and older can take advantage of the additional savings opportunity regardless of the contribution type they have chosen.

One of the benefits of catch-up contributions is that they can significantly accelerate your retirement savings. By contributing the maximum catch-up amount each year, you can potentially boost your nest egg and bridge the savings gap that may exist as you approach retirement age.

Additionally, catch-up contributions can provide some tax advantages. If you are making traditional catch-up contributions, they will reduce your taxable income for the year, just like regular pre-tax contributions. On the other hand, if you are making catch-up Roth contributions, you won’t get an immediate tax deduction, but you will enjoy the tax-free withdrawals in retirement.

Catch-up contributions can be a valuable tool for individuals who have lagged behind in their retirement savings or who simply want to supercharge their nest egg as they approach retirement. If you are eligible to make catch-up contributions, take advantage of this opportunity to maximize your savings and work towards a more secure and comfortable retirement.

Consequences of Missed Deadlines

Missing the deadlines for 401K contributions can have significant consequences on your retirement savings. It’s important to understand the potential repercussions of failing to make timely contributions to your 401K account.

One consequence of missing contribution deadlines is the loss of tax benefits. Contributions to traditional 401K plans are made on a pre-tax basis, reducing your taxable income for the year. If you fail to make contributions by the deadline, you will miss out on the immediate tax savings that come with those contributions.

Missing the deadline for traditional contributions may also mean missing out on employer matching funds. Many employers offer a matching program, wherein they contribute a certain percentage of an employee’s salary to their 401K account. However, employers often have rules in place regarding contribution deadlines. If you fail to contribute by the deadline, you may not be eligible to receive the matching funds.

For Roth 401K contributions, missing the deadline means missing out on the opportunity for tax-free withdrawals in retirement. Roth contributions allow you to pay taxes on the contributions upfront, so that qualified withdrawals in retirement are tax-free. If you fail to make contributions by the deadline, you may not be able to take advantage of this tax benefit.

Another consequence of missing contribution deadlines is the potential loss of investment growth. By contributing to your 401K regularly, you give your investments more time to grow and compound over the long term. Missing contributions means missing out on potential investment gains, which can have a significant impact on your overall retirement savings.

Moreover, missing contribution deadlines can disrupt your retirement savings goals and potentially delay your retirement timeline. Consistent and timely contributions to your 401K account are crucial for building a solid foundation for your retirement. Falling behind on contributions can make it more challenging to catch up and achieve your desired retirement lifestyle.

To avoid these consequences, it’s crucial to stay on top of your 401K contribution deadlines. Set reminders, automate contributions if possible, and make it a priority to contribute regularly. By doing so, you can ensure that you take full advantage of the tax benefits, employer matches, and potential investment growth offered by your 401K plan.

Strategies to Ensure Timely Contributions

To ensure that you make timely contributions to your 401K account and avoid the consequences of missed deadlines, consider implementing the following strategies:

- Create a Budget: Establish a budget that includes a line item for your 401K contributions. This will help you prioritize your retirement savings and ensure that you allocate the necessary funds each month.

- Automate Your Contributions: Set up automatic contributions from your paycheck to your 401K account. This ensures that your contributions are made consistently and on time, without the need for manual intervention.

- Set Reminders: Use calendar alerts or mobile apps to remind yourself of upcoming contribution deadlines. This will help you stay on track and avoid any last-minute scrambling to make contributions.

- Maximize Employer Matches: Take advantage of any employer matching programs by contributing at least the minimum amount required to receive the full matching contribution. This essentially gives you free money and boosts your retirement savings.

- Consider Making Lump Sum Contributions: If you have the financial means, you may choose to make one or more lump sum contributions throughout the year. This can help ensure that you reach the maximum annual contribution limit and take full advantage of tax benefits and potential investment growth.

- Review Contribution Limits: Stay informed about the annual contribution limits set by the IRS. Regularly reviewing the limits will help you make necessary adjustments to your contributions to ensure compliance.

- Take Advantage of Catch-Up Contributions: If you are 50 or older, take advantage of the catch-up contribution option to accelerate your retirement savings. Maximize your contributions to bridge any savings gaps and make up for lost time.

- Stay Informed: Keep yourself updated with any policy changes or updates related to your 401K plan. This includes contribution deadlines, eligibility criteria, and any adjustments to contribution limits.

By implementing these strategies, you can ensure that you make timely and consistent contributions to your 401K account. This will help you maximize the benefits of your retirement savings plan and stay on track towards achieving your retirement goals.

Conclusion

Understanding the deadlines and requirements associated with 401K contributions is essential for anyone planning for a secure retirement. Knowing when your contributions are due and taking the necessary steps to make timely contributions can significantly impact the growth of your retirement savings.

In this article, we discussed the importance of understanding 401K contributions and the potential consequences of missing contribution deadlines. We explored the differences between traditional and Roth contributions and highlighted the benefits of employer matching and catch-up contributions for individuals nearing retirement age.

To ensure timely contributions, we provided strategies such as creating a budget, automating contributions, setting reminders, maximizing employer matches, and considering lump sum contributions. By utilizing these strategies, you can make regular contributions and take full advantage of the tax benefits and potential investment growth offered by your 401K plan.

Ultimately, the goal is to maximize your retirement savings and build a solid foundation for a comfortable retirement. By understanding the deadlines and requirements for 401K contributions and following the suggested strategies, you can take control of your financial future and work towards a secure retirement.

Remember, every contribution counts, and the earlier you start contributing and stay consistent, the more time your investments have to grow. So, take action today and seize the opportunity to build a better tomorrow.