Finance

When Can I Add A Spouse To Health Insurance?

Modified: February 21, 2024

Learn the financial implications of adding a spouse to health insurance. Discover when you can add them and ensure your financial well-being.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Legal Requirements for Adding a Spouse to Health Insurance

- Employer-sponsored Health Insurance Policies

- Open Enrollment Period

- Qualifying Life Events

- Marriage as a Qualifying Life Event

- Documentation Required for Adding a Spouse

- Adding a Spouse to Individual Health Insurance Plans

- Adding a Same-Sex Spouse to Health Insurance

- COBRA Coverage for Spouses

- Conclusion

Introduction

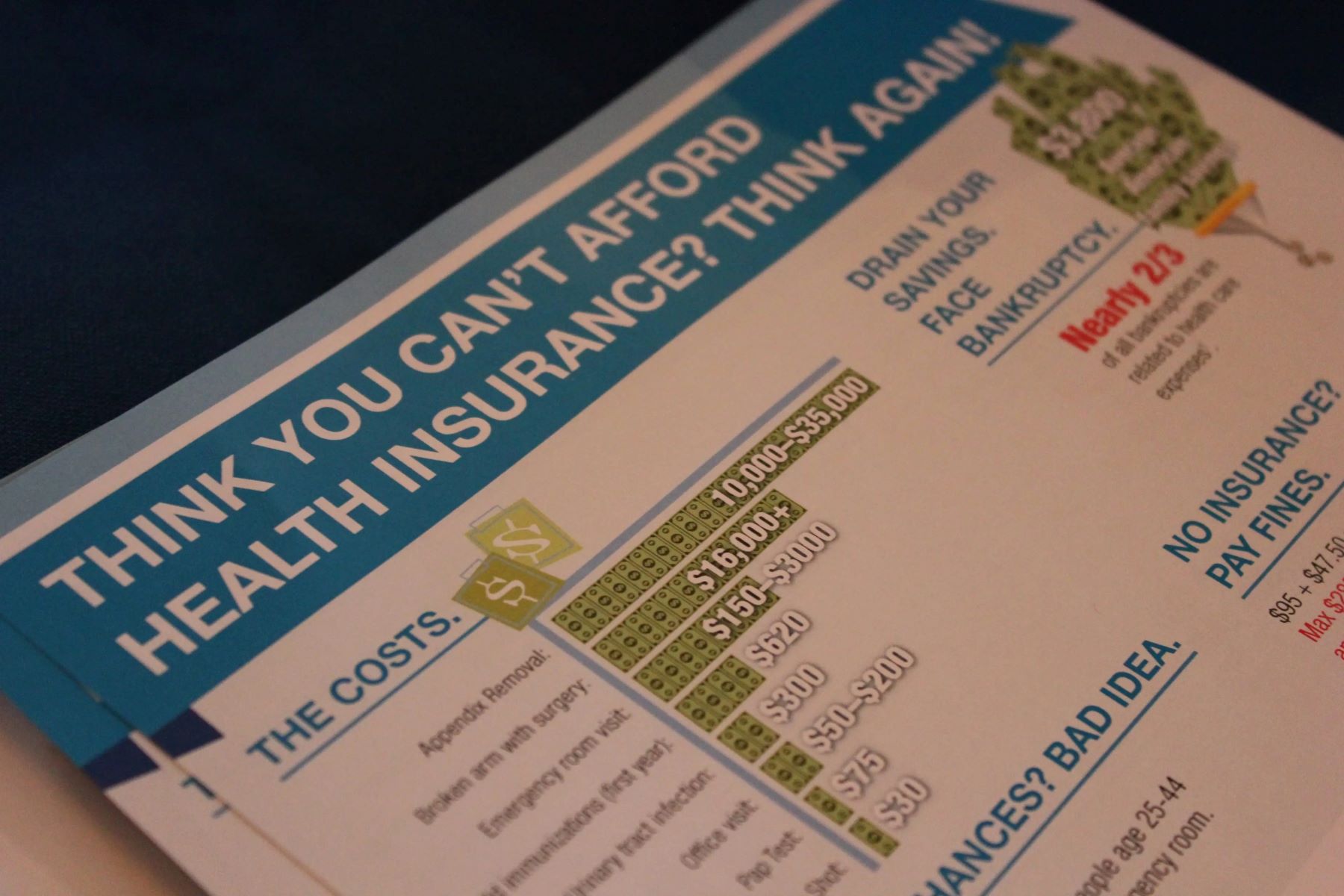

Health insurance plays a crucial role in safeguarding the well-being of individuals and their families. When it comes to adding a spouse to your health insurance policy, there are specific legal requirements and processes that need to be followed. Understanding these requirements can help ensure that your spouse is provided with the necessary coverage.

In the United States, health insurance can be obtained through various sources, such as employer-sponsored plans or individual health insurance policies. The rules for adding a spouse to health insurance can vary depending on the type of plan you have and the specific circumstances surrounding your situation. It’s important to be aware of the different options and requirements so you can make informed decisions.

One crucial aspect to consider is the timing of when you can add a spouse to your health insurance. There are specific enrollment periods, often known as open enrollment, during which individuals can make changes to their health insurance coverage. These enrollment periods typically occur once a year, and failing to add your spouse during this time can result in a delay in coverage.

However, there are exceptions to this rule. Certain qualifying life events, such as getting married, can trigger a special enrollment period that allows individuals to add or make changes to their health insurance outside of the standard open enrollment period. Understanding these qualifying events can help ensure that your spouse has access to health insurance coverage when they need it.

In this article, we will explore the legal requirements for adding a spouse to health insurance, the options available for both employer-sponsored and individual health insurance plans, and the documentation required for the enrollment process. We will also address the specific considerations regarding adding a same-sex spouse to health insurance and the availability of COBRA coverage for spouses. By understanding these aspects, you will be well-equipped to navigate the process of adding a spouse to your health insurance.

Legal Requirements for Adding a Spouse to Health Insurance

When it comes to adding a spouse to your health insurance, there are certain legal requirements that must be met to ensure eligibility and coverage. These requirements can vary depending on the type of health insurance plan you have. Let’s take a closer look at the common legal requirements you may encounter:

- Marital Status: Typically, to add a spouse to your health insurance, you must be legally married. This means that couples who are in a domestic partnership or civil union may not be eligible to add their partner to their health insurance.

- Proof of Marriage: In most cases, you will be required to provide proof of your marriage when adding a spouse to your health insurance. This can be done by providing a copy of your marriage certificate or a legally recognized marriage document. It’s essential to check with your health insurance provider or employer to determine the specific documentation requirements.

- Eligibility Criteria: Before adding a spouse to your health insurance, you must ensure that they meet the eligibility criteria set by your health insurance provider or employer. This can include factors such as age, residency status, and relationship to the policyholder. Each health insurance plan may have its own specific eligibility requirements, so it’s important to review the plan documents or speak with a representative to understand the criteria.

- Dependent Coverage: In some cases, spouses may be considered dependents for health insurance purposes. This means that they can be added to the policy as a dependent, similar to adding a child. However, not all health insurance plans classify spouses as dependents, so it’s important to check with your provider to determine the appropriate process for adding a spouse.

Meeting these legal requirements is crucial to ensure that your spouse is eligible for health insurance coverage. Failure to meet these requirements can result in delays or denials of coverage, leaving your spouse without the necessary health insurance protection.

It’s important to note that these requirements may differ for employer-sponsored health insurance plans and individual health insurance policies. Employer-sponsored plans often have specific rules and guidelines that must be followed, whereas individual health insurance plans may have more flexibility in terms of adding a spouse.

Being knowledgeable about the legal requirements for adding a spouse to health insurance can help you navigate the process smoothly and ensure that your spouse receives the necessary coverage. It’s always recommended to consult with your health insurance provider or employer to understand the specific requirements applicable to your situation.

Employer-sponsored Health Insurance Policies

Employer-sponsored health insurance is a common option for individuals and their families to obtain health coverage. Many employers offer health insurance benefits as part of their employee compensation package. Understanding how employer-sponsored health insurance works can help you navigate the process of adding a spouse to your policy.

Employer-sponsored health insurance policies typically have specific guidelines and rules regarding adding a spouse to the coverage. Here are some key points to know:

- Open Enrollment Period: Most employer-sponsored health insurance plans have an annual open enrollment period. This is the designated time when employees can make changes to their coverage, including adding a spouse. It’s important to be aware of your employer’s open enrollment period and follow the necessary steps to add your spouse during this time.

- Qualifying Life Events: If you miss the open enrollment period, you may still have the opportunity to add a spouse to your employer-sponsored health insurance. Certain qualifying life events, such as marriage, typically trigger a special enrollment period. This allows you to make changes to your health insurance outside of the standard open enrollment period.

- Spousal Eligibility: Employer-sponsored health insurance plans have specific rules regarding spousal eligibility. Some employers may require that the spouse does not have access to other health insurance coverage through their own employer. Additionally, you may need to provide proof of your marital status, such as a marriage certificate, to add your spouse to the policy.

- Supplemental Cost: Adding a spouse to your health insurance policy may result in additional costs, such as higher premiums or deductibles. Employers often require employees to contribute a portion of the cost for spousal coverage. It’s important to review the details of your employer-sponsored plan to understand any potential additional expenses.

Each employer-sponsored health insurance plan may have its own specific guidelines and requirements for adding a spouse. It’s essential to review the plan documents or speak with your human resources department to understand the process and any associated costs.

Additionally, it’s worth noting that employer-sponsored health insurance plans often provide comprehensive coverage that includes benefits for both preventive care and major medical expenses. This can offer peace of mind knowing that you and your spouse have access to necessary healthcare services.

By understanding the intricacies of employer-sponsored health insurance policies, you can effectively navigate the process of adding a spouse to your coverage. It’s crucial to stay informed about open enrollment periods, qualifying life events, eligibility criteria, and any associated costs to ensure proper health insurance coverage for your spouse.

Open Enrollment Period

The open enrollment period is a designated time during which individuals can make changes to their health insurance coverage. This includes adding a spouse to your health insurance policy. Understanding the open enrollment period is essential to ensure that your spouse is timely and appropriately added to your coverage.

The open enrollment period is typically offered once a year, and the specific dates can vary depending on your health insurance plan or employer. It is essential to be aware of these dates and take prompt action to add your spouse to your health insurance policy. Here are some key points to keep in mind:

- Timing: The open enrollment period usually has a fixed duration, ranging from a few weeks to a few months. It’s important to mark your calendar and be proactive during this period to add your spouse to your health insurance.

- Changes Allowed: During the open enrollment period, you have the opportunity to make changes to your health insurance coverage. This can include adding a spouse, removing dependents, or selecting different coverage options. It’s important to review your current health insurance plan and consider any changes that best meet the needs of you and your spouse.

- Deadlines: The open enrollment period has specific deadlines that must be adhered to. Missing these deadlines can result in your spouse being unable to be added to your health insurance until the following year’s open enrollment period. It’s crucial to understand and comply with the deadlines to ensure your spouse receives the necessary coverage.

- Supporting Documentation: Adding a spouse to your health insurance during the open enrollment period may require providing supporting documentation, such as a marriage certificate. It’s important to gather all necessary documentation in advance to expedite the enrollment process and avoid any delays.

It’s important to note that the open enrollment period may differ for employer-sponsored health insurance plans and individual health insurance policies. Often, employer-sponsored plans have a specific open enrollment period designated by the employer, while individual health insurance policies typically follow the open enrollment period set by the government or the insurance provider.

It is recommended to familiarize yourself with the open enrollment period specific to your health insurance plan. This information can usually be found in your plan documents, through your health insurance provider’s website, or by contacting their customer service.

Understanding and taking advantage of the open enrollment period is crucial for adding a spouse to your health insurance. By being proactive and adhering to the specified deadlines, you can ensure that your spouse has the necessary coverage for their healthcare needs.

Qualifying Life Events

While the open enrollment period is the primary timeframe for making changes to health insurance coverage, certain life events can trigger a special enrollment period. These events, known as qualifying life events, allow individuals to make changes to their health insurance outside of the standard open enrollment period. Understanding these qualifying life events is essential for adding a spouse to your health insurance outside of the designated enrollment period.

Qualifying life events can vary depending on your health insurance plan or the regulations set by your state. However, some common qualifying life events that may allow you to add a spouse to your health insurance include:

- Marriage: Getting married is considered a significant life event that often triggers a special enrollment period. Once married, you typically have a limited timeframe during which you can add your spouse to your health insurance plan.

- Divorce or Legal Separation: If you are currently married and going through a divorce or legal separation, it can be considered a qualifying life event. This allows you to make changes to your health insurance coverage, which may include removing your spouse from your policy.

- Birth or Adoption of a Child: Welcoming a new child into your family through birth or adoption is another qualifying life event that typically allows you to add your child to your health insurance. In some instances, this qualification may also extend to adding your spouse to the coverage.

- Loss of Other Health Insurance Coverage: If your spouse loses their health insurance coverage due to job loss or other reasons, it may be considered a qualifying life event. This event can allow you to add your spouse to your health insurance outside of the open enrollment period.

- Relocation or Change of Residence: Certain health insurance plans may consider a change in residence or relocation to be a qualifying life event. This can provide an opportunity to make adjustments to your health insurance coverage, including adding a spouse.

It’s important to note that each health insurance plan may have its own specific list of qualifying life events, and the documentation requirements may vary as well. Therefore, it’s crucial to review your plan documents or speak with your health insurance provider to understand the specific qualifying life events and the necessary documentation required for adding a spouse outside of the open enrollment period.

By being aware of qualifying life events, you can take advantage of special enrollment periods to add your spouse to your health insurance as soon as the event occurs. This ensures that your spouse has access to the necessary health coverage without waiting for the next open enrollment period.

Marriage as a Qualifying Life Event

Marriage is a significant life milestone that often comes with various changes, including the opportunity to make adjustments to your health insurance coverage. In the realm of health insurance, marriage is considered a qualifying life event that can trigger a special enrollment period. Understanding the implications of marriage as a qualifying life event can help you navigate the process of adding your spouse to your health insurance coverage.

When you get married, it typically opens up a window of time, outside of the standard open enrollment period, during which you can make changes to your health insurance. This includes adding your spouse to your existing health insurance policy. Here are some key points to consider:

- Timeframe: The timeframe during which you can add your spouse to your health insurance may vary depending on your health insurance plan or employer. Typically, it ranges from 30 days to 60 days from the date of your marriage. It’s important to check with your health insurance provider or plan administrator for the specific timeframe applicable to your situation.

- Documentation Requirements: When adding your spouse to your health insurance, you will likely be required to provide documentation of your marriage. This can include a copy of your marriage certificate, a marriage license, or any other legally recognized document that proves your marital status. It’s essential to gather the necessary documentation in advance to ensure a smooth enrollment process.

- Coverage Effective Date: The effective date of your spouse’s coverage will depend on the specific rules of your health insurance plan. In some cases, the coverage may be retroactive to the date of your marriage, while in others, it may start on the date of enrollment. It’s important to clarify this with your health insurance provider or plan administrator to avoid any gaps in coverage.

- Cost Considerations: Adding your spouse to your health insurance may result in additional costs, such as higher premiums or deductibles. Some employer-sponsored plans require employees to contribute a portion of the cost for spousal coverage. It’s crucial to review your health insurance plan details to understand any potential additional expenses.

Marriage as a qualifying life event provides you with the opportunity to add your spouse to your health insurance outside of the standard open enrollment period. It ensures that your spouse has access to the necessary health coverage as soon as you are officially married.

As with any life event, it’s crucial to take prompt action and adhere to the specific timeframe provided by your health insurance plan or employer. Failing to add your spouse within the designated period may result in a delay in coverage until the following open enrollment period.

By understanding the significance of marriage as a qualifying life event, you can proactively navigate the process of adding your spouse to your health insurance coverage and ensure that their health needs are met in a timely manner.

Documentation Required for Adding a Spouse

Adding a spouse to your health insurance requires providing proper documentation to verify your marital status and ensure eligibility for coverage. The specific documentation required may vary depending on your health insurance plan or employer. Understanding the necessary documents can help streamline the process of adding your spouse to your health insurance coverage.

Here are some common documents that may be required when adding a spouse:

- Marriage Certificate: A marriage certificate is a legally recognized document that confirms your marriage. It serves as proof of your marital status and is typically required when adding a spouse to your health insurance. Ensure that you have a certified copy of your marriage certificate, as some health insurance plans may not accept photocopies.

- Marriage License: In some instances, a marriage license may be required as part of the documentation process. The marriage license is typically obtained prior to the marriage ceremony and serves as proof that you are legally allowed to get married. Check with your health insurance provider or plan administrator to see if a marriage license is necessary.

- Government-issued Identification: You and your spouse will likely need to provide government-issued identification, such as a driver’s license or passport, to verify your identities. This helps confirm that the individuals being added to the health insurance policy are the legal spouses.

- Social Security Numbers: Health insurance providers or employers may require both you and your spouse’s Social Security numbers to ensure accurate recordkeeping and compliance with legal requirements.

- Additional Documentation: Depending on the specific circumstances and requirements of your health insurance plan, additional documentation may be needed. This could include documents such as birth certificates, proof of residency, or legal documentation in the case of a name change. It’s important to carefully review the instructions provided by your health insurance provider or employer to ensure you have all the necessary documents in order.

It’s important to gather the required documentation in advance and ensure that you have certified copies or originals where necessary. Keep in mind that submitting incomplete or incorrect documentation can lead to delays in adding your spouse to your health insurance coverage.

If you have any questions or uncertainties about the specific documentation required, it’s recommended to reach out to your health insurance provider’s customer service department or contact your employer’s human resources representative for clarification.

Having the proper documentation readily available will streamline the process of adding your spouse to your health insurance and ensure that they have access to necessary healthcare coverage in a timely manner.

Adding a Spouse to Individual Health Insurance Plans

Individual health insurance plans provide coverage for individuals and their families outside of employer-sponsored options. If you have an individual health insurance plan and want to add your spouse to the policy, there are specific steps and considerations to keep in mind.

Here are some key points to consider when adding a spouse to an individual health insurance plan:

- Eligibility: It’s important to check with your health insurance provider to ensure that your spouse is eligible for coverage under your individual health insurance plan. Some plans may have specific eligibility criteria that need to be met, such as residency requirements or age limitations.

- Special Enrollment Period: Individual health insurance plans generally have an annual open enrollment period, during which you can make changes to your coverage. However, if you experience a qualifying life event such as marriage, it can trigger a special enrollment period. This allows you to add your spouse outside of the standard open enrollment period.

- Application Process: To add a spouse to your individual health insurance plan, you will typically need to fill out an application form. The application will require information about your spouse, including their personal details, such as their name, date of birth, and Social Security number.

- Effective Date of Coverage: The effective date of your spouse’s coverage will depend on the rules of your individual health insurance plan. It may be retroactive to the date of marriage or the date of application, or it could start on the first day of the following month. It is important to clarify this with your health insurance provider to ensure continuous coverage for your spouse.

- Premium Changes: Adding a spouse to your individual health insurance plan may result in an increase in premiums. The cost will depend on the specific plan and the additional coverage being added. Make sure to review the updated premium amount and understand any changes to your financial obligations.

It’s crucial to communicate with your health insurance provider to fully understand the process and requirements for adding a spouse to your individual health insurance plan. They can guide you through the application process, provide information about any required documentation, and answer any questions you may have.

Remember, adding a spouse to an individual health insurance plan typically follows the special enrollment period triggered by marriage. It’s important to take timely action and submit the necessary application and documentation to ensure that your spouse has access to health insurance coverage when they need it.

By understanding the steps involved and staying informed about the specific requirements of your individual health insurance plan, you can smoothly add your spouse to your coverage and provide them with the necessary health insurance protection.

Adding a Same-Sex Spouse to Health Insurance

With the progress of LGBTQ+ rights, the recognition of same-sex marriages has become widespread. If you are in a same-sex marriage and wish to add your spouse to your health insurance, it is important to understand the specific rules and considerations that apply. Here are some key points to know when adding a same-sex spouse to your health insurance:

- Legal Recognition: Same-sex marriages are legally recognized in many countries and states. Therefore, if you are legally married to your same-sex partner, you should have the same rights and privileges as opposite-sex marriages when it comes to adding a spouse to health insurance coverage.

- Eligibility: Your same-sex spouse should be eligible to be added to your health insurance plan, assuming your plan extends coverage to spouses. Health insurance providers generally do not discriminate based on gender when it comes to adding a spouse to coverage.

- Documentation: Like any other marriage, you may be required to provide documentation of your same-sex marriage when adding your spouse to your health insurance. This typically includes a marriage certificate or any other legally recognized document that confirms your marital status.

- Open Enrollment or Special Enrollment: Adding a same-sex spouse to your health insurance will typically follow the same enrollment periods as opposite-sex marriages. You may have the opportunity to add your spouse during the annual open enrollment period, or if you experience a qualifying life event, such as marriage, a special enrollment period may be triggered to allow you to make changes outside of the open enrollment period.

- Employer-Sponsored Plans: If you have employer-sponsored health insurance, the process of adding a same-sex spouse should be the same as adding an opposite-sex spouse. The employer’s policies and documentation requirements should apply equally to all legally recognized marriages.

- Individual Health Insurance Plans: Same-sex couples have the same rights to obtain individual health insurance plans as opposite-sex couples. You can add your same-sex spouse to your individual health insurance plan through the special enrollment period triggered by marriage.

- Legal Protections: It’s important to note that same-sex spouses are protected under the Affordable Care Act (ACA), which prohibits discrimination based on gender or sexual orientation. This ensures that same-sex couples have equal access to health insurance coverage and benefits.

It’s important to stay informed about the specific regulations and policies of your health insurance plan. By understanding your rights and the documentation required, you can successfully add your same-sex spouse to your health insurance coverage and ensure they have access to the necessary healthcare benefits.

If you encounter any obstacles or discrimination when adding a same-sex spouse to health insurance, it’s recommended to seek support from LGBTQ+ advocacy organizations or legal experts who can help ensure your rights are upheld.

COBRA Coverage for Spouses

COBRA (Consolidated Omnibus Budget Reconciliation Act) is a federal law that provides continuation of group health insurance coverage to certain individuals who experience a qualifying event that would result in a loss of coverage. This coverage extension also applies to spouses who lose their health insurance due to specific events. Understanding COBRA coverage for spouses is essential to ensure that they have access to continued healthcare benefits when facing a loss of coverage.

Here are some key points to know about COBRA coverage for spouses:

- Qualifying Events: To be eligible for COBRA coverage as a spouse, your spouse must experience a qualifying event that results in a loss of health insurance. Common qualifying events include termination of employment, reduction in work hours, or other circumstances that lead to a loss of employer-sponsored health insurance.

- Notification and Enrollment: If your spouse experiences a qualifying event, they should receive a notice explaining their rights under COBRA. This notice provides information on how to enroll in temporary continuation coverage. Your spouse typically has 60 days to elect COBRA coverage once the notice is received.

- Coverage Duration: COBRA coverage typically lasts for up to 18 months for spouses who lose their health insurance due to termination or reduction in work hours. In certain cases, such as disability or divorce, coverage can be extended to 36 months. It’s crucial to check the specific COBRA regulations that apply to your situation to understand the duration of coverage.

- Cost of Coverage: COBRA coverage for spouses can be more expensive than employer-sponsored coverage. This is because individuals are responsible for the full premium without the employer subsidy. However, it is important to compare the cost of COBRA coverage with other available options to determine the most suitable healthcare coverage strategy for your spouse.

- Alternative Options: In addition to COBRA coverage, it is important to explore other healthcare coverage options for your spouse. This can include employer-sponsored coverage through a new job, individual health insurance plans, or coverage through government programs like Medicaid or the Health Insurance Marketplace.

If your spouse experiences a qualifying event and is eligible for COBRA coverage, it is crucial to carefully consider the options available and make an informed decision regarding their healthcare coverage. While COBRA can provide temporary continuation of coverage, it is essential to evaluate the cost and duration of coverage to ensure that it aligns with your spouse’s needs.

Consulting with your employer’s human resources department or a healthcare insurance professional can provide valuable guidance on understanding the specific details and options available under COBRA for your spouse.

Remember, COBRA coverage provides a crucial safety net for spouses who experience a loss of health insurance. By understanding the regulations and exploring alternative healthcare coverage options, you can make the best decision for your spouse’s continued access to healthcare benefits.

Conclusion

Adding a spouse to your health insurance is an important step in ensuring the well-being and protection of your loved one. Understanding the legal requirements, enrollment periods, and documentation necessary for this process is essential to navigate it successfully.

Employer-sponsored health insurance policies often have specific guidelines for adding a spouse, including open enrollment periods and eligibility criteria. It’s crucial to familiarize yourself with your employer’s policies and take advantage of the designated enrollment periods.

Qualifying life events, such as marriage, can trigger a special enrollment period that allows you to add a spouse to your health insurance outside of the open enrollment period. Being aware of these events can help you act promptly and ensure uninterrupted coverage for your spouse.

Proper documentation, such as marriage certificates, is often required to add a spouse to health insurance. Gathering the necessary documents ahead of time helps expedite the enrollment process and ensures accurate and timely coverage for your spouse.

For individual health insurance plans, special enrollment periods also apply, and it’s important to check eligibility and follow the application process to add your spouse to your coverage.

Additionally, for same-sex couples, the legal recognition of same-sex marriages ensures that they have equal rights and protections when adding a spouse to health insurance coverage.

In cases where a spouse loses their health insurance due to specific events, COBRA coverage can provide temporary continuation of group health insurance. Understanding the qualifying events, notification requirements, and cost considerations associated with COBRA coverage for spouses is crucial in maintaining uninterrupted healthcare protection.

In conclusion, adding a spouse to your health insurance involves understanding the legal requirements, enrollment periods, documentation, and options available. By being aware of these factors and taking proactive steps, you can ensure that your spouse has the necessary health insurance coverage and access to healthcare services when they need them the most.

Remember to consult with your health insurance provider, employer, or a healthcare insurance professional to clarify any questions or concerns you may have during the process of adding a spouse to your health insurance.