Home>Finance>When Does Wells Fargo Home Mortgage Charge A Late Fee

Finance

When Does Wells Fargo Home Mortgage Charge A Late Fee

Published: February 22, 2024

Learn about late fees for Wells Fargo home mortgages. Understand the financial implications and how to avoid late fees. Get expert advice on managing your mortgage payments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Late fees are a common concern for homeowners with mortgages, as they can add financial strain and complicate the management of personal finances. Understanding the specifics of late fees, including when they are charged and how they can be avoided, is crucial for maintaining a healthy financial standing. In the realm of home mortgages, Wells Fargo is a prominent player, and their late fee policy is of particular interest to many borrowers.

In this comprehensive guide, we will delve into the intricacies of late fees, focusing specifically on Wells Fargo Home Mortgage. By gaining a thorough understanding of when late fees are charged, the associated policies, and potential exceptions, borrowers can navigate their mortgage responsibilities with confidence and financial prudence.

Late fees can have a significant impact on a homeowner's budget, potentially leading to financial strain and affecting credit scores. Therefore, being well-informed about the specifics of late fees is essential for all mortgage holders. With a focus on Wells Fargo's policies, this guide aims to equip borrowers with the knowledge needed to navigate potential late fee scenarios and, ideally, avoid them altogether.

Understanding the nuances of late fees and the specific policies of major mortgage lenders such as Wells Fargo is an essential aspect of responsible homeownership. By exploring the details of late fees and how they are managed by Wells Fargo, borrowers can proactively address this aspect of their mortgage responsibilities, ultimately contributing to a more secure and stable financial future.

Understanding Late Fees

Late fees are charges imposed when a borrower fails to make a required payment within the specified timeframe. In the context of home mortgages, late fees typically apply when monthly mortgage payments are not received by the due date. These fees serve as a form of compensation to the lender for the inconvenience and additional administrative costs incurred due to late payments.

It’s important for borrowers to understand that late fees can vary depending on the lender and the terms outlined in the mortgage agreement. Typically, late fees are expressed as a percentage of the overdue payment. For example, a common late fee structure might entail a charge of 4% or 5% of the overdue amount. Additionally, there is often a grace period after the due date during which the payment can be made without incurring a late fee. Understanding the specific late fee structure outlined in the mortgage agreement is crucial for borrowers to anticipate and manage potential late fee scenarios.

Aside from the financial impact, late fees can also have implications for a borrower’s credit score. Late or missed mortgage payments can significantly affect creditworthiness and may remain on the borrower’s credit report for an extended period. As a result, understanding the implications of late fees and taking proactive measures to avoid them is essential for maintaining a healthy financial profile.

Furthermore, late fees can compound over time if payments continue to be delayed, leading to a cycle of financial strain and additional charges. Therefore, borrowers are encouraged to prioritize timely mortgage payments to avoid the accumulation of late fees and the associated financial repercussions.

By comprehensively understanding the nature of late fees and their potential impact, borrowers can approach their mortgage responsibilities with greater awareness and financial prudence. This understanding lays the groundwork for exploring the specific policies and considerations related to late fees within the context of Wells Fargo Home Mortgage.

Wells Fargo Home Mortgage Late Fee Policy

Wells Fargo Home Mortgage, a division of Wells Fargo Bank, outlines its late fee policy in the mortgage agreement provided to borrowers. The specifics of the late fee policy, including the amount charged and the grace period allowed, are typically detailed in this agreement. Borrowers are encouraged to thoroughly review this document to understand the implications of late payments and the associated fees.

Wells Fargo’s late fee policy commonly includes a grace period after the due date, during which the payment can be made without incurring a late fee. This grace period, typically around 15 days, provides borrowers with a window of opportunity to submit their payment without facing additional charges.

If the payment is not received within the specified grace period, Wells Fargo may impose a late fee, which is generally calculated as a percentage of the overdue amount. The exact percentage and the maximum late fee amount are outlined in the mortgage agreement. It’s important for borrowers to be aware of these details to anticipate the financial impact of late payments.

Wells Fargo’s late fee policy is designed to encourage timely payments while providing a reasonable window for borrowers to submit their payments without incurring additional charges. By adhering to the specified due dates and utilizing the grace period when necessary, borrowers can effectively manage their mortgage payments and avoid the imposition of late fees.

It’s worth noting that Wells Fargo’s late fee policy may be subject to periodic updates or adjustments, and borrowers are advised to stay informed about any changes to the late fee structure. Staying abreast of the late fee policy ensures that borrowers can proactively manage their mortgage payments in alignment with Wells Fargo’s guidelines and expectations.

Understanding the specific late fee policy of Wells Fargo Home Mortgage is an integral aspect of responsible mortgage management. By familiarizing themselves with the details of the late fee policy, borrowers can navigate their mortgage responsibilities with clarity and financial prudence.

Exceptions to Late Fees

While late fees are a standard component of mortgage agreements, there are certain circumstances in which borrowers may be eligible for exceptions to these fees. Wells Fargo Home Mortgage, like many lenders, may offer provisions for mitigating or waiving late fees under specific conditions.

One common scenario in which late fees may be waived is in the event of a natural disaster or unforeseen emergency that impacts the borrower’s ability to make timely payments. In such cases, Wells Fargo may exercise flexibility and compassion, recognizing the extraordinary circumstances that hindered the borrower’s payment schedule.

Additionally, if a borrower encounters financial hardship due to unexpected unemployment, medical emergencies, or other significant life events, they may be eligible to request a waiver or adjustment of late fees. Wells Fargo may have established procedures for borrowers to communicate and substantiate their hardship, potentially leading to a favorable consideration regarding late fee exceptions.

Furthermore, if a borrower has consistently maintained a strong payment record and encounters a one-time delay due to an isolated issue, such as a banking error or temporary financial constraint, Wells Fargo may exercise discretion in waiving the late fee as a gesture of goodwill.

It’s essential for borrowers facing potential late fees to proactively communicate with Wells Fargo’s mortgage servicing department, providing transparent and documented explanations for the circumstances leading to the late payment. By engaging in open and constructive dialogue, borrowers can present their case for late fee exceptions and explore potential solutions in collaboration with the lender.

Understanding the potential avenues for late fee exceptions empowers borrowers to navigate challenging situations with greater confidence and resilience. By being aware of the circumstances under which late fees may be mitigated or waived, borrowers can approach Wells Fargo Home Mortgage with a proactive and solution-oriented mindset, fostering a cooperative approach to addressing late payment challenges.

Avoiding Late Fees

Proactively managing mortgage payments is key to avoiding late fees and maintaining a healthy financial standing with Wells Fargo Home Mortgage. Borrowers can employ several strategies to mitigate the risk of late payments and the associated fees, ultimately fostering a smoother and more predictable mortgage payment experience.

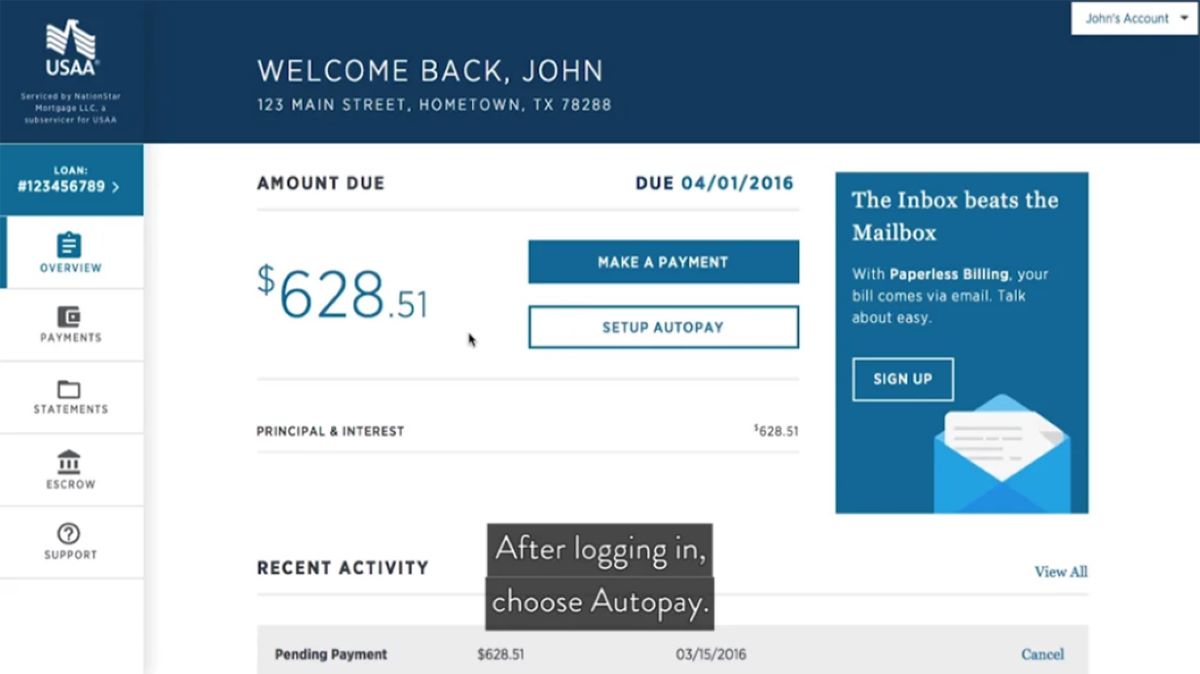

Setting up automatic payments through Wells Fargo’s online banking platform or automated clearing house (ACH) transfers can significantly reduce the likelihood of late payments. By scheduling automatic deductions from a designated bank account, borrowers can ensure that their mortgage payments are consistently submitted on time, thus minimizing the risk of incurring late fees.

Another effective approach to avoiding late fees is to establish reminders and alerts for upcoming mortgage payments. Leveraging digital calendar notifications, mobile apps, or email reminders can help borrowers stay vigilant about impending due dates, prompting timely action to submit their payments before the grace period expires.

Regularly reviewing the mortgage payment schedule and ensuring that sufficient funds are available in the designated payment account is essential for preventing late fees. By maintaining awareness of payment due dates and proactively managing financial resources, borrowers can uphold their payment commitments and sidestep the financial repercussions of late fees.

Should unforeseen circumstances arise that could potentially impact the timely submission of mortgage payments, proactive communication with Wells Fargo is crucial. By reaching out to the mortgage servicing department in advance and discussing the situation transparently, borrowers may be able to explore alternative payment arrangements or temporary solutions to mitigate the risk of late fees.

Additionally, staying informed about any updates to Wells Fargo’s late fee policy and mortgage payment procedures is vital for borrowers. Periodically reviewing the terms and conditions outlined in the mortgage agreement, as well as any communications from Wells Fargo regarding policy changes, enables borrowers to align their payment management strategies with the lender’s expectations and requirements.

By adopting a proactive and systematic approach to managing mortgage payments, borrowers can navigate their financial responsibilities with confidence and minimize the likelihood of incurring late fees. This proactive stance contributes to a more stable and predictable mortgage payment experience, fostering financial well-being and peace of mind for homeowners with Wells Fargo Home Mortgage.

Conclusion

Understanding the intricacies of late fees and the specific policies governing them is an essential aspect of responsible homeownership, particularly for individuals with mortgages through Wells Fargo Home Mortgage. By comprehensively exploring the nature of late fees, the specific late fee policy of Wells Fargo, potential exceptions, and strategies for avoiding late fees, borrowers can navigate their mortgage responsibilities with clarity and financial prudence.

Late fees, while serving as a mechanism for compensating lenders for delayed payments, can have significant financial implications and affect a borrower’s creditworthiness. Therefore, being well-informed about the circumstances under which late fees are charged, the associated policies, and potential avenues for mitigating or avoiding these fees is crucial for maintaining a healthy financial standing.

With a focus on Wells Fargo’s late fee policy, borrowers are encouraged to review their mortgage agreements thoroughly, familiarizing themselves with the specifics of the grace period, late fee calculations, and any provisions for exceptions. This proactive approach enables borrowers to anticipate potential late fee scenarios and take appropriate measures to prevent them.

Furthermore, understanding the potential exceptions to late fees and engaging in open communication with Wells Fargo in challenging circumstances empowers borrowers to address late payment challenges effectively. By exploring potential avenues for late fee mitigation and maintaining transparent dialogue with the lender, borrowers can seek constructive solutions and navigate temporary financial setbacks with greater resilience.

Ultimately, by adopting proactive strategies such as setting up automatic payments, establishing reminders, and staying informed about policy updates, borrowers can effectively avoid late fees and foster a more predictable and stable mortgage payment experience. This proactive stance contributes to financial well-being and reinforces a positive homeowner-lender relationship, positioning borrowers for greater confidence and security in managing their mortgage responsibilities.

In conclusion, a comprehensive understanding of late fees, coupled with proactive and informed approaches to managing mortgage payments, equips borrowers with the knowledge and strategies needed to navigate potential late fee scenarios and uphold their financial commitments with prudence and confidence.