Finance

When Will I Be Charged A Late Fee For Internet

Published: February 23, 2024

Learn about late fees for internet payments and avoid finance charges. Find out when you'll be charged and how to manage your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Late fees for internet services can be a source of frustration for many consumers. Understanding when these fees are charged, how they are determined, and how to avoid them is crucial for maintaining a healthy financial standing. In this article, we will delve into the intricacies of late fees for internet services, providing valuable insights to help you navigate this aspect of personal finance with confidence.

Late fees are a common concern for individuals and families who rely on internet services for work, education, entertainment, and communication. Whether you're a busy professional, a student managing coursework online, or a household staying connected with loved ones, the impact of late fees can be significant. By gaining a deeper understanding of when late fees are charged, the factors that influence their imposition, and strategies for preventing them, you can proactively manage your internet service payments and avoid unnecessary financial strain.

In the following sections, we will explore the nuances of late fees for internet services, shedding light on the key considerations that every consumer should be aware of. By demystifying this aspect of billing, we aim to empower you to make informed decisions and take proactive steps to safeguard your financial well-being. Whether you're seeking to avoid late fees, resolve a billing discrepancy, or optimize your payment schedule, the insights shared in this article will equip you with the knowledge needed to navigate the realm of internet service fees with confidence and clarity.

Understanding Late Fees for Internet

Late fees for internet services are charges imposed when a customer fails to make their payment by the specified due date. These fees serve as a penalty for overdue payments and are designed to incentivize timely bill settlement. Understanding the specifics of late fees for internet services is essential for maintaining a clear grasp of your financial responsibilities and obligations.

Internet service providers often outline their late fee policies in the terms and conditions of their service agreements. It’s important to review these terms to gain insight into the late fee structure, including the amount charged and the grace period extended beyond the due date. By familiarizing yourself with the provider’s late fee policy, you can proactively plan your payments and mitigate the risk of incurring additional charges.

Late fees for internet services typically vary in amount and are often calculated as a percentage of the overdue balance or as a flat fee. Providers may also cap the late fee amount, ensuring that it does not exceed a predetermined threshold. Understanding the specific late fee calculation method employed by your internet service provider is crucial for accurately assessing the potential financial impact of delayed payments.

Moreover, being cognizant of the grace period provided by your internet service provider is instrumental in avoiding late fees. The grace period represents the additional time granted beyond the due date within which a payment can be made without incurring a late fee. By adhering to the payment deadline or utilizing the grace period effectively, you can steer clear of late fees and maintain a positive payment record.

By comprehending the fundamental principles governing late fees for internet services, you can approach your financial obligations with clarity and foresight. In the subsequent sections, we will delve into the factors that influence the imposition of late fees, equipping you with a comprehensive understanding of the dynamics at play in this domain.

Factors That Determine Late Fees

The calculation and imposition of late fees for internet services are influenced by several key factors, each playing a pivotal role in shaping the fee structure and its impact on consumers. Understanding these factors is essential for gaining insight into the dynamics governing late fee determination and its potential financial ramifications.

One of the primary factors that determine late fees is the terms outlined in the service agreement or contract. Internet service providers typically define the late fee structure, including the amount charged and the grace period afforded to customers. These terms are legally binding and serve as the foundation for the imposition of late fees, emphasizing the importance of reviewing and comprehending the terms and conditions governing your internet service.

Additionally, the duration of the overdue payment significantly influences the late fee amount. Providers may implement a tiered late fee structure, wherein the penalty increases in proportion to the duration of the delinquency. Understanding the escalation of late fees based on the length of the overdue period is crucial for gauging the potential financial consequences of delayed payments.

Furthermore, the method of late fee calculation, whether based on a percentage of the overdue balance or a flat fee, is a determining factor in the total amount charged. Providers may apply a specific percentage to the outstanding balance or impose a predetermined flat fee, with the calculation method often specified in the service agreement. By familiarizing yourself with this calculation method, you can anticipate the late fee amount and strategize your payment approach accordingly.

Moreover, the presence of a late fee cap, which limits the maximum amount that can be charged as a late fee, is a critical factor influencing the fee imposition. Providers may establish a cap to prevent excessively high late fees, offering consumers a safeguard against exorbitant penalties for overdue payments. Understanding the existence and extent of a late fee cap is instrumental in assessing the potential financial liability associated with late payments.

By comprehending the interplay of these factors, consumers can gain a comprehensive understanding of the determinants shaping late fees for internet services. In the subsequent section, we will explore actionable strategies for avoiding late fees, empowering you to navigate your internet service payments with prudence and foresight.

How to Avoid Late Fees

Avoiding late fees for internet services necessitates proactive financial management and adherence to structured payment practices. By implementing strategic measures and leveraging available resources, consumers can mitigate the risk of incurring late fees, thereby fostering a healthy financial standing and minimizing unnecessary expenses.

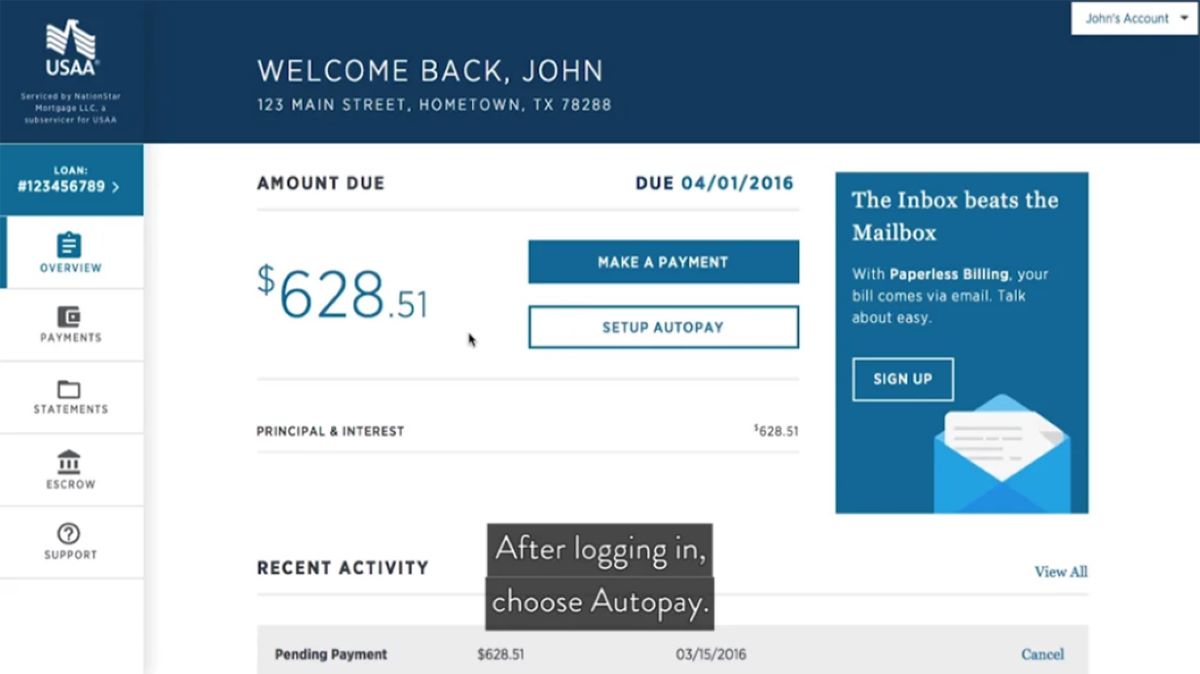

One effective strategy for evading late fees is to set up automatic payments through your bank or the internet service provider’s designated payment portal. Automating your payments ensures that the required amount is deducted from your account and remitted to the provider on the specified due date, eliminating the possibility of oversight or forgetfulness leading to late payments.

Another approach to sidestep late fees is to leverage calendar reminders or mobile applications to track payment due dates. By setting up timely reminders, you can proactively monitor your payment schedule and take preemptive action to settle your internet service bills before the due date, thereby avoiding the imposition of late fees.

Additionally, establishing a financial buffer or emergency fund can serve as a safeguard against unforeseen circumstances that may impede your ability to make timely payments. By setting aside funds specifically designated for bill payments, including internet services, you can mitigate the risk of incurring late fees during challenging financial periods.

It is also prudent to familiarize yourself with the grace period provided by your internet service provider. Understanding the duration of the grace period allows you to strategically time your payments, leveraging the additional time granted to settle your bills without incurring late fees.

Furthermore, maintaining open communication with your internet service provider can be instrumental in avoiding late fees. In the event of financial hardships or unexpected challenges that may impact your payment schedule, communicating proactively with the provider can facilitate the exploration of viable solutions, such as payment extensions or alternative arrangements, to prevent the imposition of late fees.

By incorporating these proactive strategies into your financial management approach, you can navigate your internet service payments with confidence and minimize the risk of incurring late fees. In the concluding section of this article, we will summarize the key insights and empower you to approach late fees for internet services with informed decision-making and financial prudence.

Conclusion

Late fees for internet services represent a consequential aspect of financial responsibility for consumers, necessitating a nuanced understanding of their implications and strategies for avoidance. By delving into the intricacies of late fees, including their determination and methods for prevention, individuals can proactively manage their internet service payments and safeguard their financial well-being.

Understanding the fundamental principles governing late fees for internet services is pivotal for maintaining financial clarity and foresight. By familiarizing oneself with the late fee policies outlined in service agreements, consumers can gain insight into the fee structure, grace periods, and potential penalties for overdue payments. This knowledge forms the foundation for informed decision-making and proactive financial management.

Factors such as the terms of the service agreement, duration of overdue payments, late fee calculation methods, and the presence of fee caps collectively influence the imposition of late fees. By comprehending these factors, consumers can accurately assess the potential financial impact of delayed payments and strategize their payment approach to mitigate the risk of incurring late fees.

To avoid late fees for internet services, individuals can leverage various proactive strategies, including setting up automatic payments, utilizing calendar reminders, maintaining financial buffers, understanding grace periods, and fostering open communication with service providers. These measures empower consumers to navigate their payment obligations with prudence and minimize the likelihood of incurring unnecessary late fees.

In essence, by integrating a comprehensive understanding of late fees with actionable strategies for avoidance, consumers can approach their internet service payments with confidence and financial acumen. Empowered with the insights shared in this article, individuals can proactively manage their financial responsibilities, mitigate the risk of late fees, and foster a resilient financial foundation.

Ultimately, by prioritizing financial diligence and leveraging available resources for structured payment management, consumers can navigate the realm of late fees for internet services with clarity, foresight, and proactive decision-making, thereby fostering a sustainable and responsible approach to their financial well-being.