Home>Finance>When Will Tesla Insurance Be Available In Other States?

Finance

When Will Tesla Insurance Be Available In Other States?

Published: November 16, 2023

Tesla Insurance is expanding its coverage beyond California. Find out when it will be available in other states and how it can benefit your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Tesla, the renowned electric vehicle manufacturer, has not only disrupted the automotive industry but has also set its sights on revolutionizing the insurance sector. Tesla Insurance, the company’s in-house insurance program, aims to offer Tesla owners affordable and comprehensive coverage tailored specifically to their vehicle’s unique features and capabilities. While Tesla Insurance is already available in some states, many Tesla owners eagerly await its expansion to other regions.

Tesla Insurance was first introduced in California in 2019 and has since expanded its availability to several other states, including Texas, Illinois, and Washington. This in-house insurance program is designed to provide Tesla owners with hassle-free coverage that considers the advanced safety features and specialized repairs of Tesla vehicles. By leveraging real-time data collected from Tesla’s fleet, the company claims that Tesla Insurance can offer competitive rates while ensuring high-quality service tailored to the needs of Tesla owners.

The expansion of Tesla Insurance to other states has been a topic of considerable interest and speculation. Tesla owners in states where Tesla Insurance is not yet available are eager to know when they can take advantage of this unique insurance program. In this article, we will explore the factors that affect the expansion of Tesla Insurance, the potential benefits it offers to other states, and the challenges that may arise in its expansion. Furthermore, we will delve into speculations surrounding the timeline for Tesla Insurance’s availability in states where it is not currently offered.

Current Availability of Tesla Insurance

As of now, Tesla Insurance is available in select states across the United States. The program initially launched in California in August 2019, and since then, Tesla has expanded its availability to a few additional states. Tesla owners in Texas, Illinois, and Washington have also been able to take advantage of the specialized coverage and benefits offered by Tesla Insurance.

One of the key selling points of Tesla Insurance is its integration with Tesla vehicles. The program utilizes the data collected from Tesla’s fleet to provide personalized quotes and coverage tailored to the specific features and performance capabilities of each Tesla model. By leveraging this data, Tesla Insurance aims to offer competitive rates while ensuring comprehensive coverage for Tesla owners.

Another benefit of Tesla Insurance is the seamless integration with the Tesla app. Tesla owners can easily manage their insurance policy and make changes directly through the Tesla app, making the whole process convenient and user-friendly.

However, it is important to note that Tesla Insurance is currently only available to Tesla owners. It is not yet open to owners of other electric vehicles or traditional combustion engine vehicles.

While the current availability of Tesla Insurance is limited to a handful of states, the interest and demand for the program are growing. Many Tesla owners in states where Tesla Insurance is not yet offered eagerly anticipate its expansion, hoping to benefit from the unique features and competitive rates it promises.

Factors Affecting the Expansion of Tesla Insurance

Several factors play a crucial role in the expansion of Tesla Insurance to other states across the United States. While Tesla has been steadily increasing the availability of its insurance program, certain considerations impact the speed and extent of its expansion.

1. Regulatory Approval: Each state has its own regulations and requirements for insurance providers. Before Tesla Insurance can be offered in a new state, it must go through the regulatory approval process. This involves obtaining the necessary licenses and ensuring compliance with state-specific insurance laws and regulations. The time and effort required to gain regulatory approval can vary from state to state, which affects the speed of the expansion.

2. Market Demand: Tesla will likely prioritize states with a substantial number of Tesla owners and a high demand for Tesla Insurance. This approach allows Tesla to focus on regions where there is a significant market for their insurance product, increasing the likelihood of success and attracting more customers. Areas with a large concentration of Tesla owners, such as California, may have been targeted first due to a higher demand for Tesla Insurance.

3. Infrastructure and Resources: The expansion of Tesla Insurance requires establishing the necessary infrastructure and allocating resources to support the program in new states. This includes setting up local customer support, claims processing centers, and partnering with repair shops that specialize in Tesla vehicles. Building this infrastructure takes time and careful planning, as Tesla aims to ensure that customers in new states receive the same level of service and support as those in states where the insurance program is already available.

4. Underwriting Considerations: As an insurance provider, Tesla must carefully assess the risks associated with insuring vehicles in each state. Factors such as road conditions, driving habits, and the frequency of accidents and claims in a particular region can influence the underwriting process and the pricing of insurance policies. Tesla Insurance needs to evaluate these factors to determine the feasibility and pricing of expanding its coverage to new states.

5. Collaboration with Existing Insurance Partners: In some cases, Tesla may need to collaborate with existing insurance providers in states where it does not have a direct presence. This partnership allows Tesla to leverage the expertise and infrastructure of established insurers to enter new markets more quickly. However, forming these partnerships can involve negotiations and coordination, which may affect the timeline for expansion.

Considering these factors, the expansion of Tesla Insurance requires careful planning, regulatory compliance, market demand, and the allocation of resources. By strategically navigating these considerations, Tesla aims to gradually expand the availability of its insurance program to Tesla owners in more states across the country.

Potential Benefits of Tesla Insurance in Other States

Expanding Tesla Insurance to other states has the potential to bring a range of benefits to Tesla owners and the insurance market as a whole. Here are some of the potential advantages that Tesla Insurance could offer in other states:

1. Tailored Coverage: Tesla Insurance takes into account the unique features and capabilities of Tesla vehicles to provide customized coverage. By considering factors such as advanced safety technologies and specialized repairs, Tesla Insurance can offer policies specifically designed for Tesla owners. This tailored coverage ensures that Tesla owners have the protection they need, which may not be adequately addressed by traditional insurance providers.

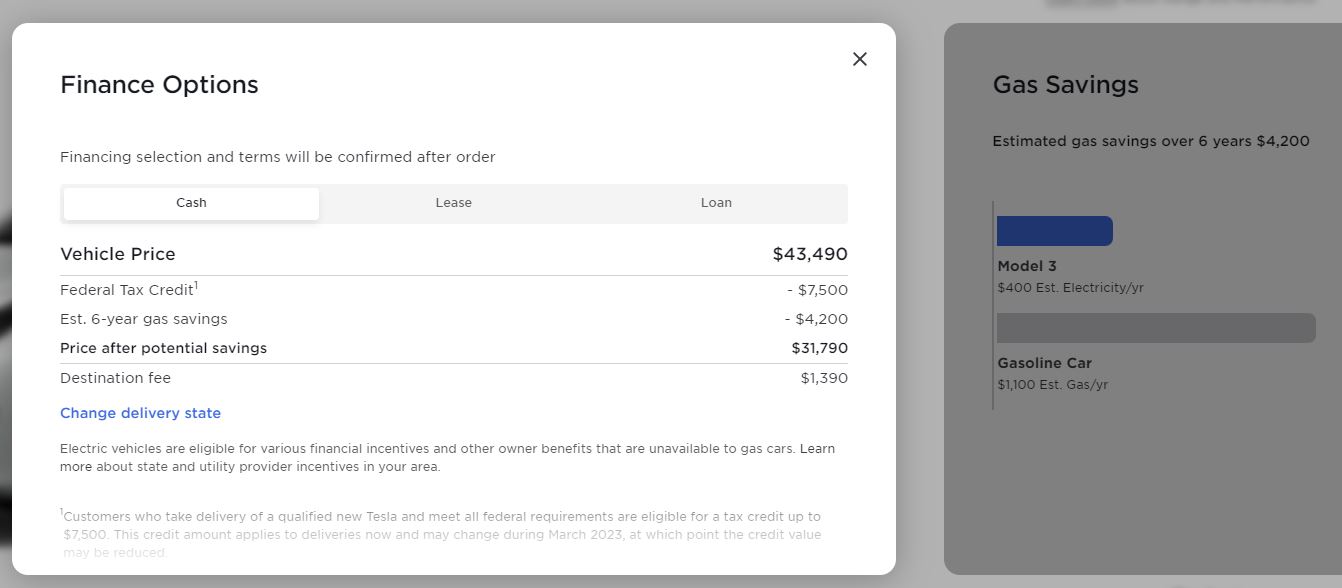

2. Competitive Pricing: Through real-time data collected from Tesla’s fleet, Tesla Insurance aims to offer competitive pricing. By leveraging the insights gained from a vast network of Tesla vehicles, the program can provide personalized quotes that consider individual driving patterns, vehicle performance, and safety statistics. This approach may result in more affordable premiums for Tesla owners, leading to potential cost savings compared to traditional insurance policies.

3. Seamless Integration: Tesla Insurance seamlessly integrates with the Tesla app, allowing for easy policy management and adjustments. Tesla owners can conveniently access their insurance information and make changes directly through the app, eliminating the need for separate insurance portals or third-party providers. This streamlined experience enhances customer satisfaction and simplifies the insurance process for Tesla owners.

4. Efficient Claims Process: Tesla Insurance aims to ensure a smooth and efficient claims process. With access to real-time data from Tesla vehicles, the program can expedite the claims handling process and provide faster assessments and payouts. This efficiency reduces the hassle and inconvenience often associated with filing and processing insurance claims, allowing Tesla owners to get back on the road quickly.

5. Enhanced Customer Experience: By offering an in-house insurance program, Tesla can provide a comprehensive and seamless ownership experience. With the integration of insurance services alongside their vehicles, Tesla owners can have a one-stop-shop for purchasing, maintaining, and insuring their vehicles. This integrated approach simplifies the overall customer experience and strengthens the bond between Tesla and its customers.

It is important to note that the potential benefits of Tesla Insurance in other states are contingent upon its successful expansion and adaptation to meet the specific requirements and regulations of each region. By delivering tailored coverage, competitive pricing, seamless integration, efficient claims processing, and an enhanced customer experience, Tesla Insurance has the potential to reshape the insurance landscape and provide value to Tesla owners across the country.

Challenges and Obstacles to Tesla Insurance Expansion

While Tesla Insurance has demonstrated its potential benefits, there are several challenges and obstacles that can impact its expansion to other states. These challenges include:

1. Regulatory Hurdles: Each state has its own set of insurance regulations and requirements that Tesla Insurance must navigate. Gaining regulatory approval and obtaining the necessary licenses in new states can be a time-consuming and complex process. Tesla must ensure compliance with state-specific regulations while also meeting the unique criteria for insurance providers in each region.

2. Market Competition: The insurance industry is highly competitive, and Tesla Insurance faces fierce competition from traditional insurance companies that have longstanding relationships and established customer bases. Convincing Tesla owners to switch from their existing insurance providers to Tesla Insurance can be challenging, especially if they have satisfied with their current coverage or have loyalty to a particular insurer.

3. Risk Assessment and Underwriting: Insurance companies must assess and underwrite risks based on various factors, such as the likelihood of accidents and the cost of repairs in a specific region. Tesla Insurance needs to analyze and evaluate these risks accurately to offer competitive pricing and comprehensive coverage. Limited data or unfamiliarity with certain regions may pose challenges in accurately assessing risks and setting appropriate premiums.

4. Repair Network Expansion: Tesla Insurance relies on a network of authorized repair shops that specialize in Tesla vehicles for efficient claims processing and quality repairs. Expanding this repair network to new states can be a logistical challenge, as it requires establishing partnerships and ensuring a sufficient number of qualified repair facilities to meet the potential demand. The availability of authorized repair shops may impact the speed and extent of Tesla Insurance expansion.

5. Customer Education and Awareness: Tesla Insurance is a relatively new player in the insurance market, and many potential customers may not be fully aware of its benefits or the advantages it offers over traditional insurance providers. Educating customers about the tailored coverage, competitive pricing, and seamless integration provided by Tesla Insurance is crucial to expanding its customer base and overcoming any resistance or skepticism.

6. Evolving Regulations and Compliance: Insurance regulations are subject to change, and Tesla Insurance must stay updated and compliant with any new or modified requirements introduced by regulatory bodies. Adapting to evolving regulations and ensuring ongoing compliance is essential to expanding into new states and maintaining a strong presence in the insurance market.

Addressing these challenges requires strategic planning, regulatory expertise, effective marketing, and strong relationships with repair partners. By navigating these obstacles with careful consideration, Tesla Insurance can overcome these challenges and expand its coverage to Tesla owners in additional states, delivering its unique benefits and disrupting the traditional insurance landscape.

Speculations on the Timeline for Tesla Insurance Expansion

While Tesla has been gradually expanding the availability of Tesla Insurance to more states, the timeline for its future expansion remains largely speculative. The exact sequence and speed of Tesla Insurance’s expansion to new states will depend on a variety of factors, including regulatory approvals, market demand, infrastructure development, and strategic considerations. Here are some speculations on the timeline for Tesla Insurance expansion:

1. Prioritizing High-Demand States: Tesla may prioritize states with a significant concentration of Tesla owners and high demand for Tesla Insurance. These states could include populous regions like New York, Florida, and Massachusetts, which have a large number of Tesla vehicles on the roads. Expanding into states with substantial market potential allows Tesla to quickly gain a significant customer base and establish a stronger foothold in the insurance market.

2. Focus on Regulatory Approvals: The regulatory approval process can significantly impact the timeline for Tesla Insurance expansion. Obtaining the necessary licenses and complying with state-specific insurance regulations can take time. Tesla will need to proactively work with regulatory bodies in each state to ensure a smoother and faster approval process. However, the timeline for regulatory approvals is dependent on various factors and may vary from state to state.

3. Incremental Expansion: Tesla may choose to expand Tesla Insurance gradually, targeting a few states at a time. This approach allows them to carefully manage the expansion and ensure that the necessary infrastructure, such as repair facilities and customer support services, is in place to serve customers effectively. By taking a step-by-step approach, Tesla can maintain quality service and seamlessly scale up its operations as it expands into new territories.

4. Collaboration with Insurance Partners: In some cases, Tesla may choose to collaborate with existing insurance providers to expedite its expansion. By partnering with established insurers in states where Tesla Insurance is not yet available, Tesla can leverage their expertise, infrastructure, and customer base to enter new markets more quickly. Collaborations can facilitate faster expansion into additional states while still providing Tesla owners with the unique benefits of Tesla Insurance.

5. Market Response and Feedback: Tesla will continually assess the response and feedback from Tesla owners in states where Tesla Insurance is currently available. The company will likely take into account customer satisfaction, demands, and preferences to refine its insurance program and make any necessary adjustments before expanding into new states. Incorporating customer feedback ensures that Tesla Insurance continues to meet the evolving needs and expectations of Tesla owners.

While these are speculations, it is important to remember that Tesla’s expansion plans for Tesla Insurance are determined by various internal and external factors. The exact timeline for its availability in new states may be subject to change based on market conditions, regulatory requirements, and strategic considerations. Nonetheless, with the increasing popularity of Tesla vehicles and the demand for Tesla Insurance, it is reasonable to expect further expansion in the coming years.

Conclusion

Tesla Insurance, the in-house insurance program offered by Tesla, has gained traction in select states, providing Tesla owners with tailored coverage, competitive pricing, and a seamless experience. Although Tesla Insurance is currently available in limited regions, there is a growing interest and anticipation for its expansion to other states across the United States.

Various factors impact the timeline and extent of Tesla Insurance’s expansion. Regulatory approvals, market demand, infrastructure development, and partnerships with insurance providers play a crucial role in determining the availability of Tesla Insurance in new states. Challenges such as navigating insurance regulations, competition from traditional insurers, assessing risks, expanding the repair network, and educating customers must be addressed to ensure a successful expansion.

Despite these challenges, the potential benefits of Tesla Insurance in other states are significant. Tailored coverage that considers the unique features of Tesla vehicles, competitive pricing backed by real-time data, seamless integration with the Tesla app, efficient claims processing, and enhanced customer experience are some of the advantages that Tesla Insurance offers. These benefits can reshape the insurance landscape, provide cost savings for Tesla owners, and simplify the overall ownership experience.

While the exact timeline for Tesla Insurance expansion remains speculative, it is likely that Tesla will prioritize high-demand states and incrementally expand its coverage. Collaborations with insurance partners and customer feedback will also influence the expansion plans. Tesla’s commitment to delivering innovative solutions and the increasing popularity of Tesla vehicles suggest that further expansion of Tesla Insurance is on the horizon.

In conclusion, the expansion of Tesla Insurance to more states holds the potential to revolutionize the insurance sector and deliver personalized coverage to Tesla owners across the country. As Tesla continues to disrupt various industries, the expansion of its in-house insurance program reinforces its commitment to providing a holistic and seamless experience for its customers.