Home>Finance>Which Is The Best Way To Lower Credit Utilization To An Acceptable Level

Finance

Which Is The Best Way To Lower Credit Utilization To An Acceptable Level

Published: March 6, 2024

Learn effective strategies to lower credit utilization and improve your financial health. Discover the best ways to manage your finances and reduce credit utilization. Gain insights and tips to achieve a healthy credit utilization ratio.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Understanding Credit Utilization

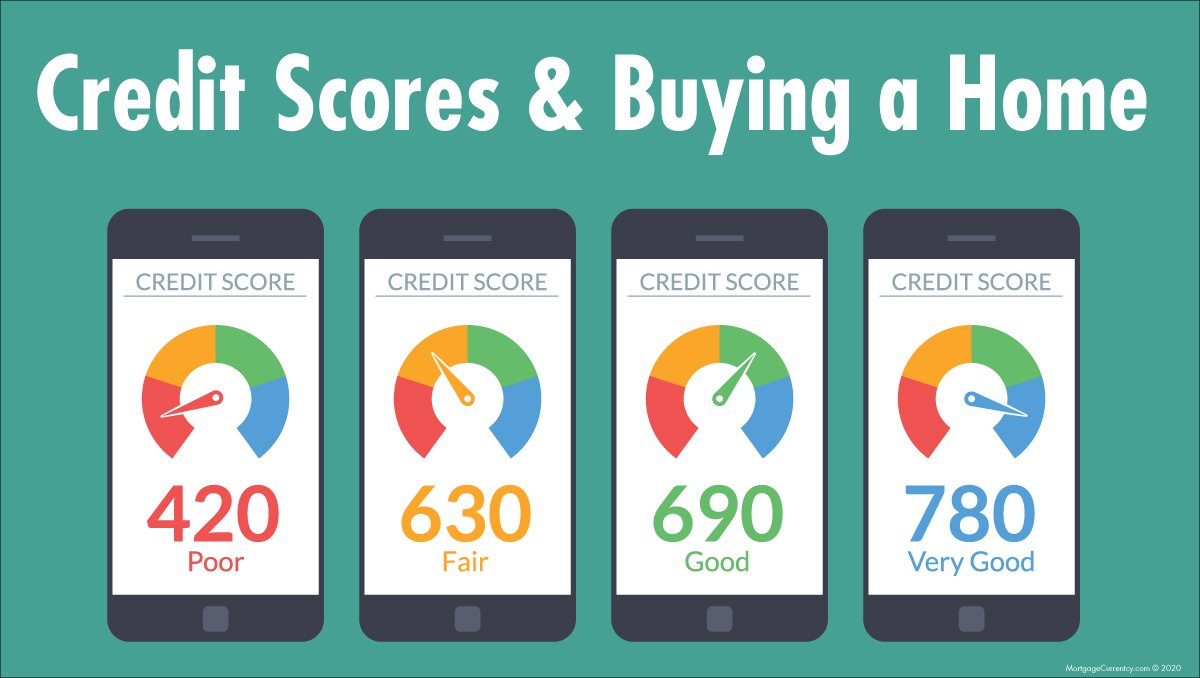

Credit utilization refers to the amount of credit you’re using compared to the total amount of credit available to you. It is a crucial factor in determining your credit score, and understanding it is essential for maintaining healthy financial standing. Your credit utilization ratio is calculated by dividing the total amount of credit you’re currently using by the total amount of credit available to you. For example, if you have a credit card with a $5,000 limit and you have a balance of $1,000, your credit utilization ratio would be 20%.

Why is credit utilization important? Well, it comprises a significant portion of your credit score, typically around 30%. Lenders and credit card issuers use this ratio to assess your ability to manage credit responsibly. A lower credit utilization ratio indicates that you’re not overly reliant on credit and can manage your finances effectively. On the other hand, a high credit utilization ratio may signal financial distress and could negatively impact your credit score.

It’s generally recommended to keep your credit utilization ratio below 30% to maintain a good credit score. However, the lower the ratio, the better. By understanding the significance of credit utilization and its impact on your financial well-being, you can take proactive steps to manage it effectively and improve your overall creditworthiness.

Paying Down Credit Card Balances

One of the most effective ways to lower credit utilization is by paying down your credit card balances. Start by assessing your current outstanding balances across all your credit cards. Prioritize paying off the cards with the highest utilization rates or those nearing their credit limits. By reducing these balances, you can swiftly lower your overall credit utilization ratio.

Creating a strategic repayment plan can help you systematically tackle your credit card debt. Consider allocating a portion of your monthly budget specifically for paying down credit card balances. Additionally, if you receive any windfalls such as tax refunds or bonuses, consider using a portion of these funds to make extra payments towards your credit card debts.

Another approach is to make more frequent payments throughout the month, rather than waiting for the statement due date. By reducing the outstanding balance more frequently, you can keep your credit utilization in check, even if you’re using your credit cards regularly. This method can be particularly beneficial for individuals who rely on credit cards for daily expenses but want to maintain a low credit utilization ratio.

Ultimately, paying down credit card balances not only helps lower your credit utilization but also demonstrates responsible financial behavior to creditors and credit bureaus. By actively reducing your outstanding balances, you can positively impact your credit score and enhance your overall financial health.

Increasing Credit Limits

Another effective strategy for lowering credit utilization is to request an increase in your credit card limits. When your credit limits are raised, the total amount of credit available to you increases, subsequently reducing your credit utilization ratio if your spending remains consistent. However, it’s crucial to approach this option with caution and responsibility, as a higher credit limit can potentially lead to increased debt if not managed prudently.

To request a credit limit increase, reach out to your credit card issuer and inquire about the process. Many issuers allow you to submit a request online or through their customer service department. When making your request, emphasize your responsible credit card usage, consistent on-time payments, and improved financial stability. Highlighting these factors can bolster your case for a credit limit increase.

It’s important to note that some credit card issuers may conduct a hard inquiry on your credit report when evaluating your request for a credit limit increase. While this inquiry may have a minor and temporary impact on your credit score, it’s essential to consider this potential effect before proceeding with your request.

Increasing your credit limits can be a viable option for lowering your credit utilization ratio, especially if you’re disciplined in managing your credit card spending. By responsibly utilizing the additional credit made available to you, you can effectively reduce your credit utilization and potentially improve your credit score over time.

Opening a New Credit Account

Opening a new credit account can be a strategic approach to lowering your credit utilization ratio. When you open a new credit card or line of credit, you increase the total amount of credit available to you, thereby reducing your overall credit utilization if you maintain the same level of spending. However, it’s crucial to approach this option thoughtfully and consider the potential implications on your credit profile.

Prior to opening a new credit account, carefully assess your financial situation and credit management practices. It’s essential to avoid accumulating excessive debt or overspending simply because of the additional credit available to you. Responsible use of the new credit account is paramount to leveraging this strategy effectively.

When selecting a new credit account, explore options that offer favorable terms, such as low annual percentage rates (APRs), minimal fees, and potential rewards or benefits that align with your financial goals. Additionally, consider the impact of a new credit inquiry on your credit score, as the application process typically involves a hard inquiry, which can have a temporary effect on your credit profile.

By opening a new credit account and using it responsibly, you can effectively lower your credit utilization ratio and demonstrate prudent credit management to credit bureaus and potential lenders. However, it’s crucial to approach this strategy with caution and ensure that it aligns with your overall financial objectives and capabilities.

Transferring Balances to a New Card

Transferring balances to a new credit card can be a strategic method for managing credit utilization, especially if the new card offers favorable terms and conditions. Balance transfers involve moving existing credit card balances to a new card, often with an introductory period featuring low or 0% annual percentage rates (APRs). This approach can provide temporary relief from high interest charges and facilitate more efficient debt repayment.

Before initiating a balance transfer, carefully evaluate the terms and fees associated with the new credit card. Look for cards that offer an extended 0% APR introductory period and minimal balance transfer fees. By transferring balances to a new card with a lower APR or a promotional 0% APR period, you can effectively reduce the interest expenses associated with your credit card debt, allowing you to allocate more funds towards paying down the principal balance.

It’s important to note that balance transfers may involve a balance transfer fee, typically calculated as a percentage of the amount being transferred. While this fee should be factored into your decision, the potential savings from reduced interest charges can often outweigh the transfer fee, especially if you’re able to pay off the transferred balance during the promotional 0% APR period.

When executing a balance transfer, it’s crucial to continue making at least the minimum payments on your existing credit card until the transfer is complete. Additionally, strive to avoid accumulating new debt on the original card to prevent exacerbating your credit utilization ratio.

By transferring balances to a new credit card with favorable terms, you can effectively manage your credit utilization and reduce the financial burden associated with high-interest credit card debt. However, it’s essential to approach this strategy prudently and ensure that the new card aligns with your long-term financial objectives.