Home>Finance>Box-Jenkins Model: Definition, Uses, Timeframes, And Forecasting

Finance

Box-Jenkins Model: Definition, Uses, Timeframes, And Forecasting

Published: October 18, 2023

Learn about the Box-Jenkins model, its applications in finance, timeframes, and how it can be used for accurate forecasting.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Box-Jenkins Model: Definition, Uses, Timeframes, and Forecasting

Finance plays a critical role in our lives, and understanding financial models is essential for making informed decisions. One such model that has gained popularity is the Box-Jenkins Model. In this blog post, we will explore the definition, uses, timeframes, and forecasting capabilities of the Box-Jenkins Model. By the end, you’ll have a clear understanding of how this model can help you in your financial endeavors.

Key Takeaways:

- The Box-Jenkins Model is a popular time series forecasting model used in finance.

- It utilizes past data to identify trends and patterns, allowing for accurate predictions of future outcomes.

Definition

The Box-Jenkins Model, also known as the ARIMA model, stands for Autoregressive Integrated Moving Average. It is a statistical model used to analyze and forecast time series data. Time series data refers to a sequence of observations recorded over time, typically at regular intervals. By examining past data patterns and trends, the Box-Jenkins Model helps identify underlying relationships and predict future data points.

Uses

The Box-Jenkins Model has broad applications in finance. Here are a few ways it is used:

- Stock Market Analysis: Traders and investors often use the Box-Jenkins Model to analyze historical stock prices and predict future trends. This helps them make informed decisions about buying or selling stocks.

- Macroeconomic Forecasting: Governments and policymakers use the Box-Jenkins Model to analyze economic indicators, such as GDP, inflation, or interest rates. This information aids in making economic forecasts and policy decisions to ensure stable economic growth.

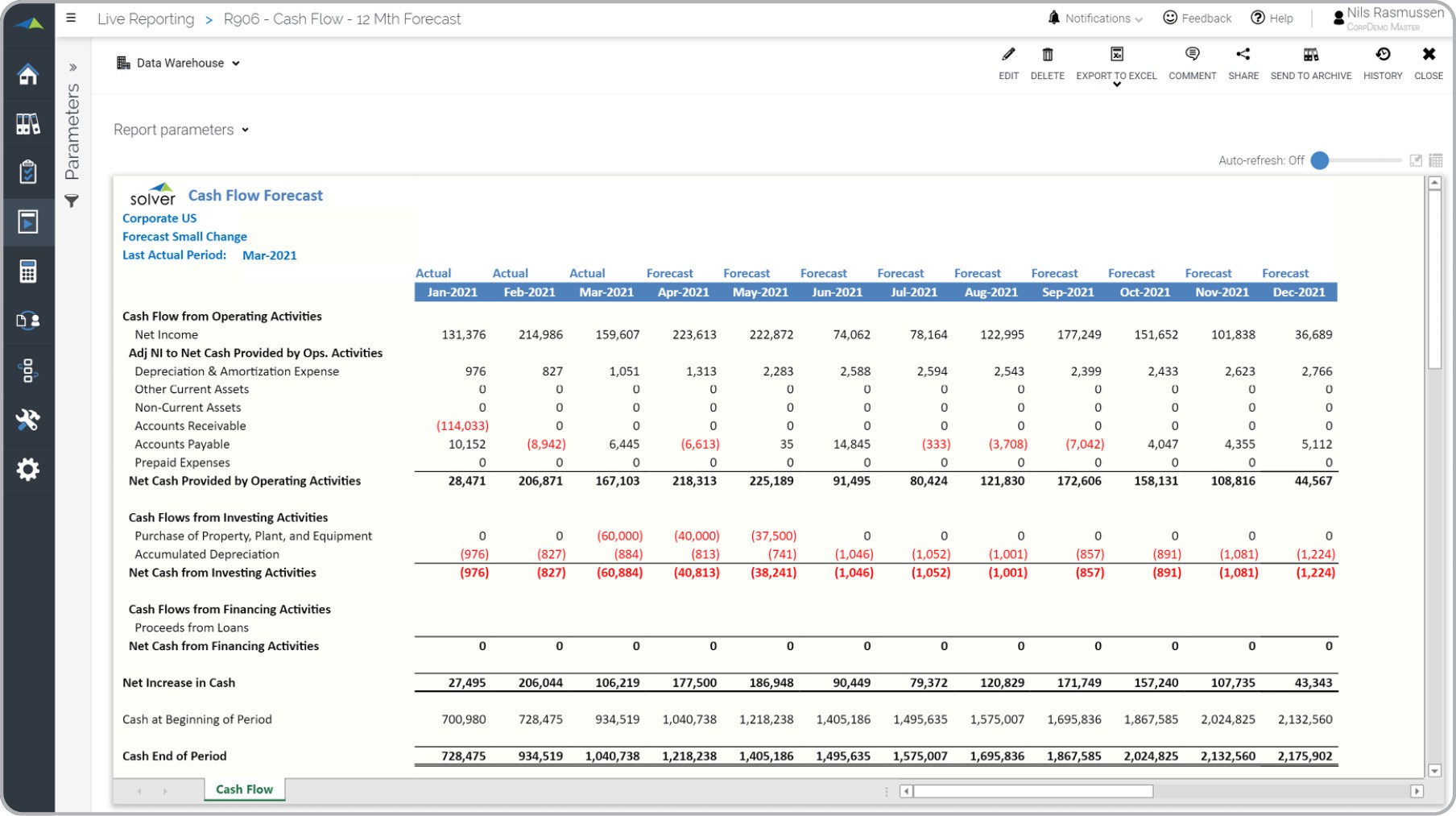

- Business Forecasting: Companies use the Box-Jenkins Model to forecast demand for their products or services. By accurately predicting future sales, businesses can optimize production, inventory management, and pricing strategies.

Timeframes

The Box-Jenkins Model is applicable to various timeframes, depending on the scope of analysis. These timeframes include:

- Short-Term: Analyzing patterns in minutes, hours, or days, such as stock price fluctuations within a trading day.

- Medium-Term: Examining patterns in weeks, months, or quarters, like analyzing monthly sales data.

- Long-Term: Studying patterns over years, decades, or centuries, for example, forecasting annual economic growth rates.

Forecasting

Forecasting is a crucial aspect of the Box-Jenkins Model. By utilizing historical data and identifying relationships between past observations and the target variable, it can generate accurate predictions for the future. The model accounts for factors such as seasonality, trend, and random fluctuations to provide reliable forecasts. These forecasts can assist individuals and businesses in making informed financial decisions and managing risks.

In conclusion, the Box-Jenkins Model, also known as the ARIMA model, plays a vital role in finance. With its ability to analyze time series data and predict future outcomes, it provides valuable insights for stock market analysis, macroeconomic forecasting, and business planning. Whether you are a trader, investor, policymaker, or business owner, understanding and utilizing the Box-Jenkins Model can enhance your financial decision-making capabilities.

Key Takeaways:

- The Box-Jenkins Model is a popular time series forecasting model used in finance.

- It utilizes past data to identify trends and patterns, allowing for accurate predictions of future outcomes.