Finance

Why Do Businesses Use Cash Flow Forecast

Modified: December 29, 2023

Discover why businesses prioritize finance by utilizing cash flow forecast. Stay ahead of financial challenges and make informed decisions for business success.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Cash Flow Forecast

- Importance of Cash Flow Forecasting for Businesses

- Benefits of Cash Flow Forecasting

- Factors Affecting Cash Flow Forecast Accuracy

- Methods and Techniques for Cash Flow Forecasting

- Common Challenges in Cash Flow Forecasting

- Strategies to Improve Cash Flow Forecasting Accuracy

- Case Studies: How Businesses Use Cash Flow Forecasting

- Conclusion

Introduction

In the world of business and finance, cash flow forecasting is a vital tool that allows businesses to project and manage their financial health. It involves predicting the future inflows and outflows of cash within a specific period, typically on a monthly, quarterly, or annual basis. By accurately analyzing and forecasting cash flows, businesses can make informed decisions regarding budgeting, investing, and managing their financial resources.

Cash flow refers to the movement of money into and out of a business. It encompasses various transactions such as payments from customers, expenses for operations and investments, loan repayments, and other financial activities. Understanding and planning for these cash inflows and outflows is crucial for businesses of all sizes, as it provides insights into their financial stability and enables them to seize opportunities or address potential challenges.

Cash flow forecasting serves as a compass for businesses, providing a roadmap to navigate through financial uncertainties. It allows them to anticipate potential cash shortages and take proactive measures to manage their finances effectively. By forecasting cash flow, businesses can identify trends, patterns, and potential risks that may impact their financial performance.

Cash flow forecasting plays a pivotal role in financial planning and decision-making. It enables businesses to set realistic goals, allocate resources efficiently, and prioritize expenditures. Whether it’s allocating funds for new product development, planning for expansions, or ensuring the availability of funds for day-to-day operations, cash flow forecasting provides invaluable insights that drive smarter financial strategies.

In the following sections, we will delve deeper into the definition of cash flow forecasting, explore its importance, benefits, factors affecting accuracy, methods and techniques, as well as common challenges businesses may encounter. Furthermore, we will analyze real-life case studies to highlight how businesses effectively use cash flow forecasting to navigate their financial journeys.

Definition of Cash Flow Forecast

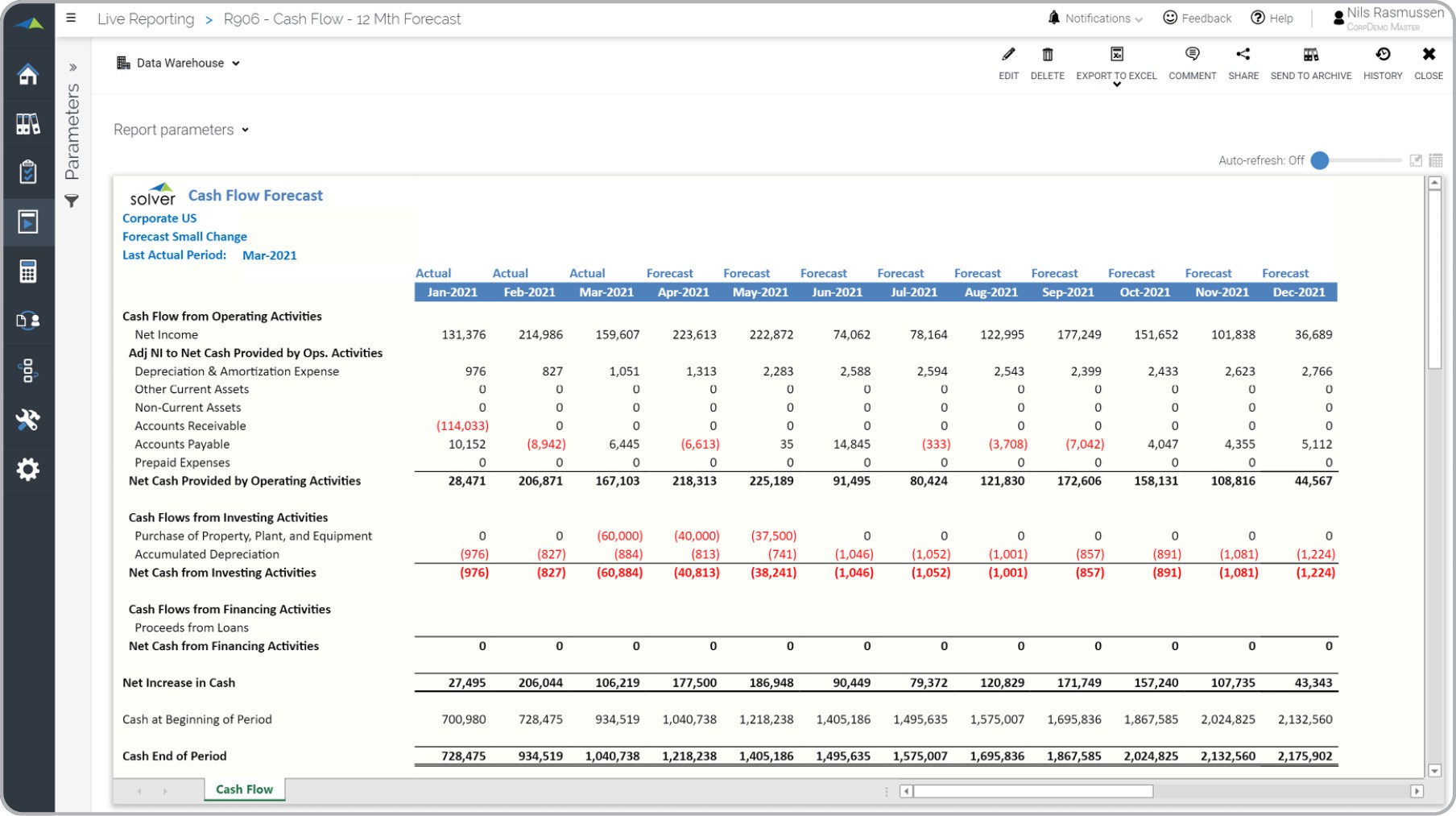

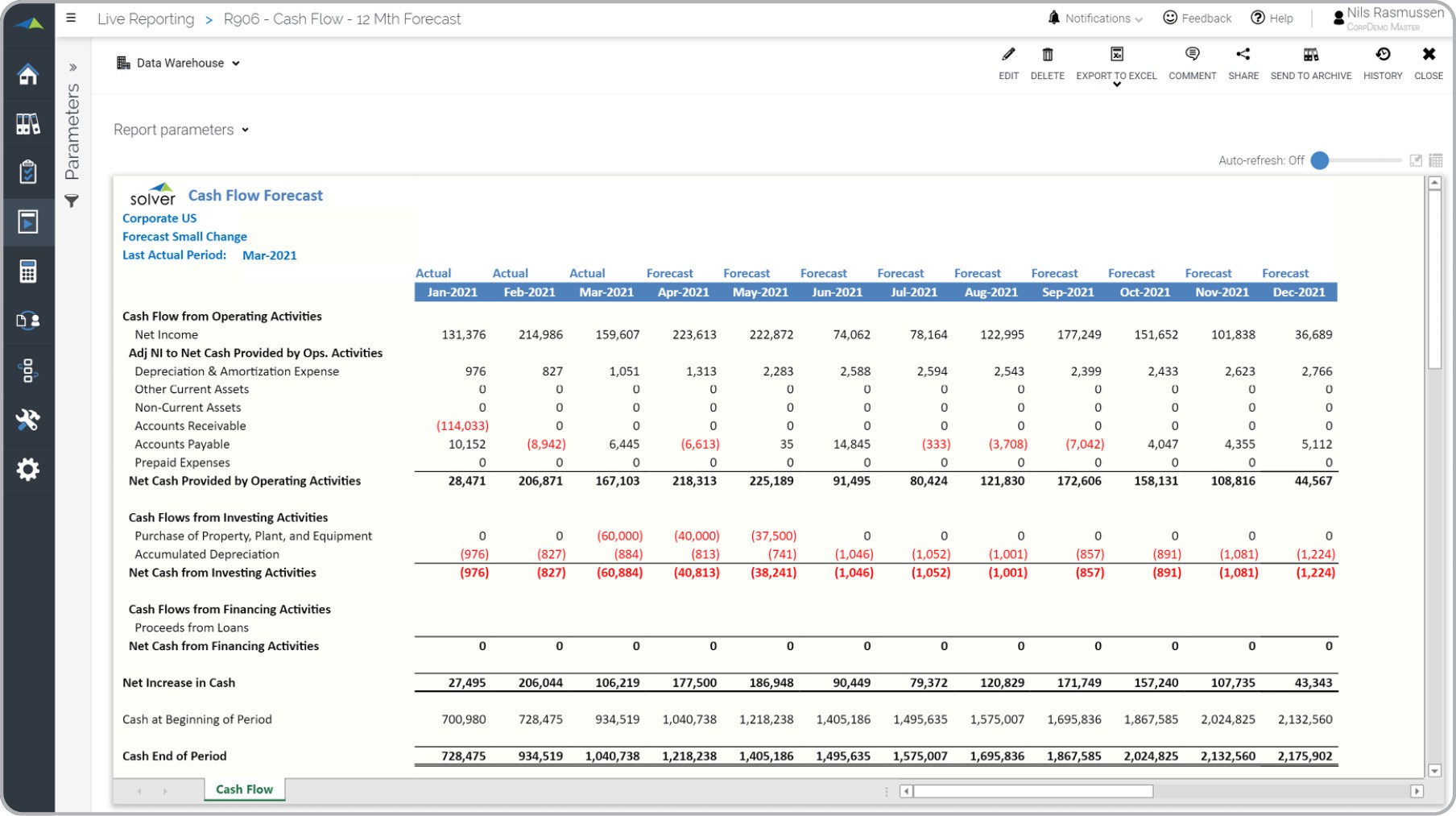

Cash flow forecasting is a financial planning process that involves estimating and predicting the future inflows and outflows of cash within a specific period. It provides businesses with a clear picture of their anticipated cash movements, enabling them to make informed decisions about their financial resources.

A cash flow forecast typically covers a defined period, such as a month, quarter, or year. It takes into account various sources of cash inflows, including sales revenue, investments, loans, and other income streams. On the other hand, it also considers cash outflows, such as operating expenses, loan repayments, taxes, and investments.

By analyzing and projecting cash flows, businesses can gain insights into their liquidity position, identify potential shortfalls or surpluses, and take necessary actions to ensure their financial stability. Cash flow forecasts provide a roadmap to effectively manage cash resources, allocate funds to different areas of the business, and make strategic decisions to drive growth and profitability.

There are two main components in a cash flow forecast: cash inflows and cash outflows. Cash inflows include sources such as sales revenue, accounts receivable collections, loans, investment returns, and any other sources of cash coming into the business. Cash outflows, on the other hand, include expenses such as salaries, rent, utilities, inventory purchases, loan payments, and any other cash leaving the business.

It is crucial to accurately estimate both cash inflows and outflows when creating a cash flow forecast. This involves analyzing historical data, market trends, customer payment patterns, industry dynamics, and economic indicators. By considering all these factors, businesses can make more accurate predictions of their future cash movements, which helps inform their financial decision-making process.

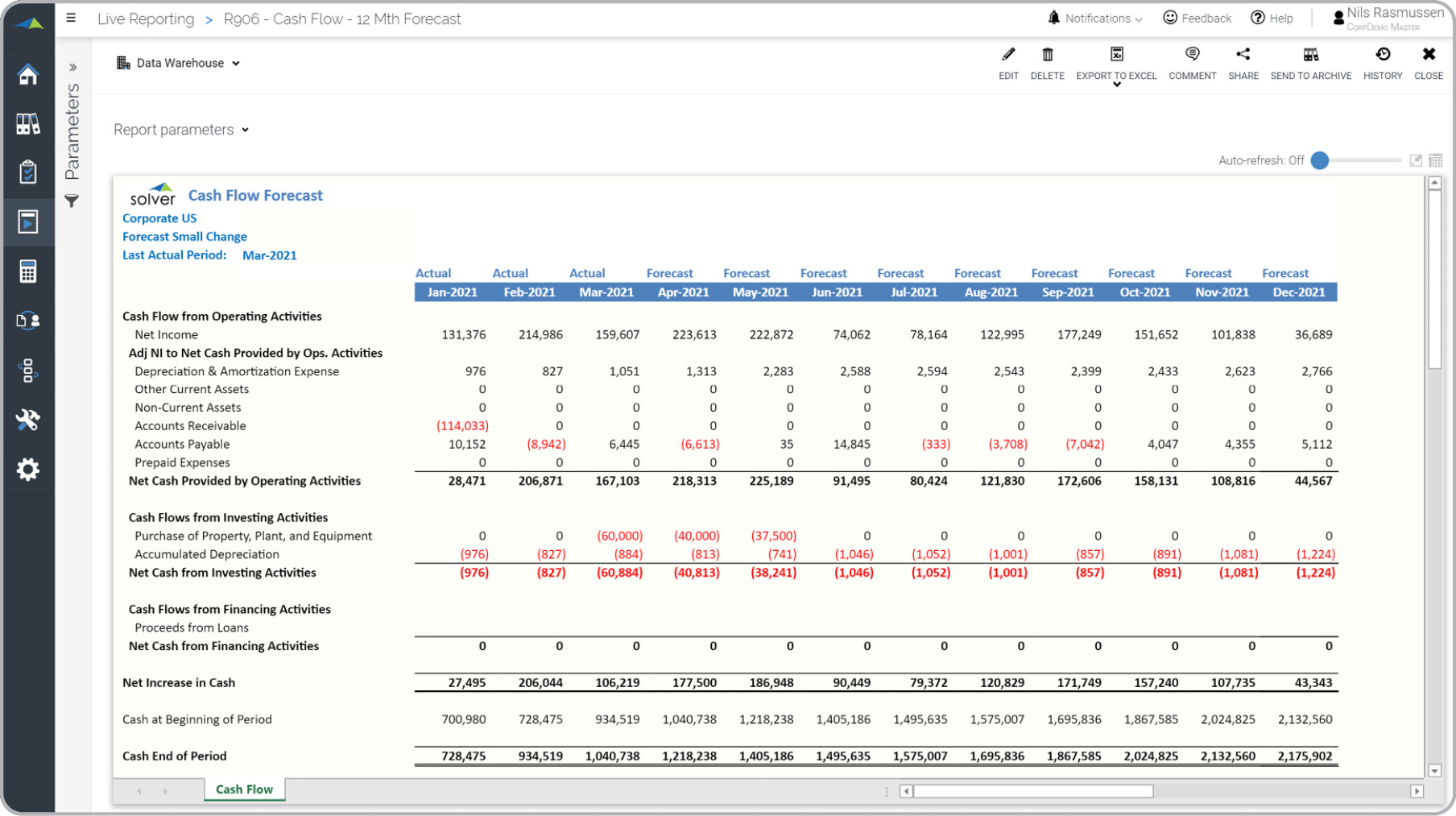

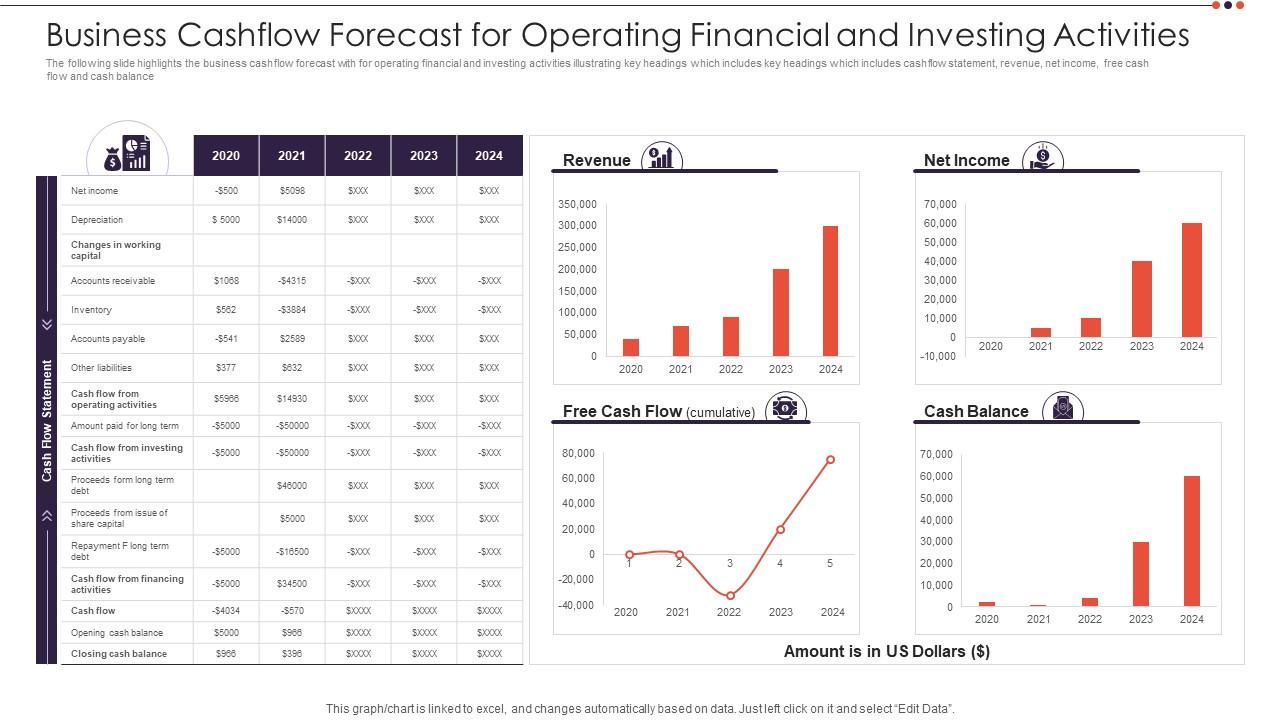

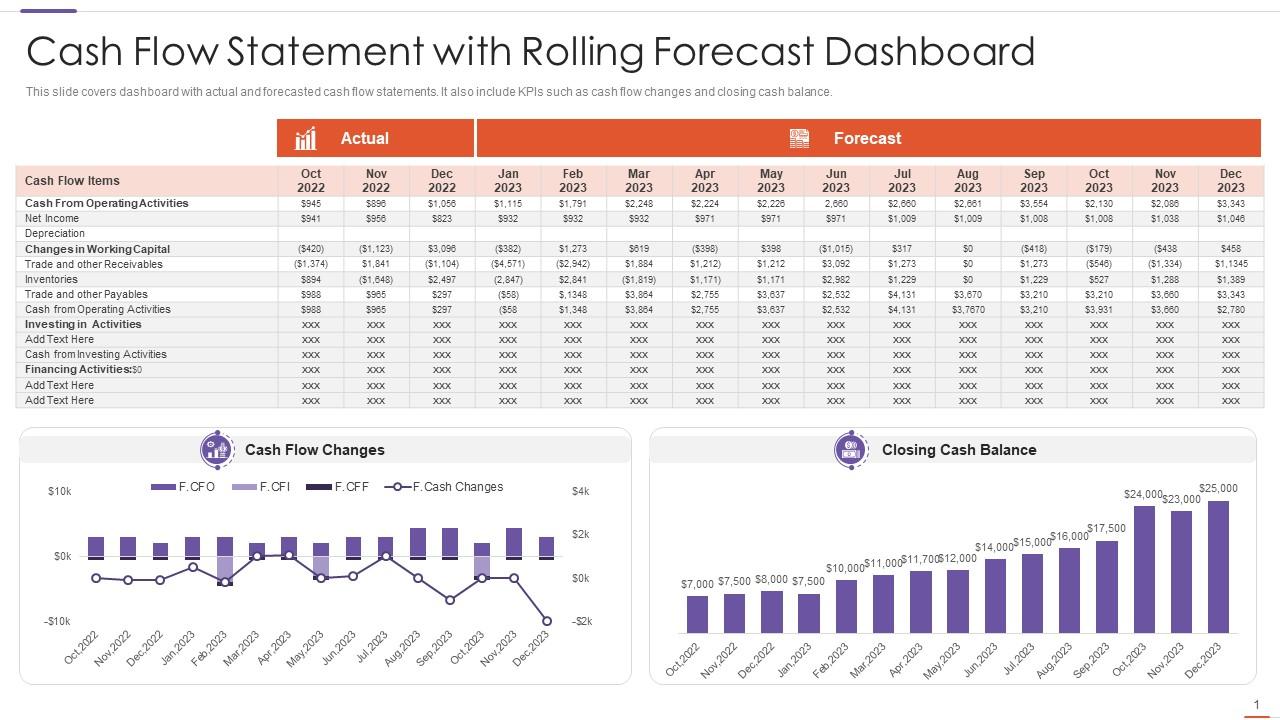

Cash flow forecasts can be created using various tools and techniques, such as spreadsheets, accounting software, or specialized cash flow forecasting software. These tools help automate the process, streamline data analysis, and provide clear visual representations of cash flow patterns.

In the next sections, we will explore the importance of cash flow forecasting for businesses, the benefits it offers, factors that affect forecast accuracy, methods and techniques for creating cash flow forecasts, common challenges faced, and strategies to improve accuracy.

Importance of Cash Flow Forecasting for Businesses

Cash flow forecasting is a critical tool for businesses of all sizes and industries. It provides key insights into the financial health and stability of a company, enabling effective financial planning and decision-making. Here are some reasons why cash flow forecasting is important for businesses:

1. Managing liquidity: Cash flow forecasting helps businesses assess their cash position, ensuring they have sufficient liquidity to meet day-to-day expenses, pay suppliers, and cover other financial obligations. It allows businesses to identify potential cash shortfalls in advance and take proactive measures to secure additional funding if necessary.

2. Budgeting and planning: Cash flow forecasting provides businesses with a clear picture of their expected cash inflows and outflows. This allows them to create accurate budgets and financial plans, enabling better resource allocation and setting realistic goals. It helps businesses track their performance against projections and make adjustments as needed.

3. Optimizing financial resources: Cash flow forecasts help businesses identify opportunities for optimizing their financial resources. By analyzing cash flow projections, businesses can determine the best time to invest in growth initiatives, expand operations, or pay down debts. It helps in making strategic financial decisions that maximize returns and minimize costs.

4. Managing working capital: Cash flow forecasting helps businesses assess their working capital needs. It provides insights into the timing and magnitude of cash inflows and outflows, allowing businesses to anticipate and manage their inventory, accounts receivable, and accounts payable effectively. This ensures a smooth supply chain and minimizes the risk of cash flow disruptions.

5. Securing financing: Cash flow forecasts play a crucial role in securing external financing. Lenders and investors often require cash flow projections to assess the financial viability and repayment capacity of a business. Accurate cash flow forecasts provide credibility and transparency, making it easier to attract funding for growth and expansion.

6. Risk management: Cash flow forecasting helps businesses identify potential risks and financial vulnerabilities. By analyzing cash flow patterns, businesses can anticipate factors that may impact their cash flow, such as changes in market conditions, customer payment delays, or unexpected expenses. This allows businesses to develop contingency plans and mitigate potential risks.

7. Monitoring financial performance: Cash flow forecasts provide a benchmark for monitoring and evaluating financial performance. By comparing actual cash flows with projected cash flows, businesses can identify areas of improvement or areas that need attention. It enables businesses to track their progress, measure their financial health, and make informed decisions based on accurate and up-to-date information.

In summary, cash flow forecasting is an essential tool for businesses to effectively manage their finances, make informed decisions, and navigate through financial uncertainties. It helps businesses maintain liquidity, optimize resources, secure financing, and mitigate risks. By incorporating cash flow forecasting into their financial planning, businesses can enhance their financial stability and drive long-term success.

Benefits of Cash Flow Forecasting

Cash flow forecasting offers numerous benefits for businesses, allowing them to make informed financial decisions, enhance their financial stability, and drive growth. Here are some key benefits of cash flow forecasting:

1. Improved financial planning: Cash flow forecasting enables businesses to effectively plan their finances by providing a clear understanding of expected cash inflows and outflows. This helps in creating accurate budgets, setting realistic goals, and allocating resources efficiently. It allows businesses to align their financial activities with their strategic objectives, resulting in more effective financial planning.

2. Enhanced cash management: By forecasting cash flows, businesses can proactively manage their cash resources. It helps in identifying potential cash shortages or surpluses, enabling businesses to take necessary actions to prevent cash flow disruptions or better utilize excess funds. Effective cash management improves liquidity, reduces the risk of financial constraints, and enhances overall financial stability.

3. Optimized resource allocation: Cash flow forecasting helps businesses allocate their financial resources more effectively. It provides insights into the timing and amounts of expected cash inflows and outflows, enabling businesses to allocate funds to critical areas such as operating expenses, investments, debt repayments, and business development initiatives. This ensures that resources are allocated where they are needed most, maximizing returns and minimizing wasteful spending.

4. Decision-making support: Cash flow forecasts serve as a valuable tool for informed decision-making. By analyzing projected cash flows, businesses can make strategic decisions such as expanding operations, investing in new projects, or modifying payment terms with customers or suppliers. Cash flow forecasts provide a financial roadmap that guides decision-making, minimizing uncertainties and allowing businesses to make sound financial choices.

5. Identification of financial risks: Cash flow forecasting helps businesses identify potential risks and vulnerabilities in their financial operations. By analyzing cash flow patterns, businesses can anticipate factors that may impact their cash flow, such as changes in market conditions, customer payment delays, or unexpected expenses. This allows businesses to develop risk mitigation strategies and ensure the financial health and stability of the organization.

6. Credibility with lenders and investors: Accurate cash flow forecasts are crucial when seeking external financing or attracting investors. Lenders and investors rely on cash flow projections to assess the financial viability and repayment capacity of a business. A well-prepared cash flow forecast demonstrates financial discipline, transparency, and credibility, increasing the chances of securing financing or attracting potential investors.

7. Monitoring of financial performance: Cash flow forecasts provide a benchmark for monitoring and evaluating financial performance. By comparing actual cash flows with projected cash flows, businesses can assess their financial health, identify areas of improvement, and make necessary adjustments. It enables businesses to track the progress of their financial goals and make data-driven decisions to improve performance.

In summary, cash flow forecasting offers a range of benefits that are critical for the financial stability and success of businesses. From improved financial planning and cash management to informed decision-making and risk identification, businesses can leverage cash flow forecasting to optimize their resources, enhance their financial stability, and drive sustainable growth.

Factors Affecting Cash Flow Forecast Accuracy

While cash flow forecasting is a valuable tool for businesses, it is essential to recognize that several factors can impact the accuracy of the forecast. Being aware of these factors allows businesses to refine their forecasting methods and improve the reliability of their cash flow projections. Here are some key factors that can affect cash flow forecast accuracy:

1. Market conditions: External factors such as changes in the market dynamics, industry trends, and economic conditions can significantly impact cash flow forecasts. For example, a downturn in the economy or a shift in consumer behavior can result in lower-than-expected sales revenue, affecting cash inflows. Businesses need to stay updated on market conditions and adjust their forecasts accordingly.

2. Customer payments: The timing and consistency of customer payments can greatly affect cash flow forecasts. Delays in customer payments or a high number of overdue invoices can result in a cash flow shortfall. Businesses should closely monitor their accounts receivable and implement strategies to incentivize prompt payment, such as offering discounts for early payment or implementing stricter credit terms.

3. Supplier payments: The timing of payments to suppliers and the ability to negotiate favorable payment terms can impact cash flow forecasts. Negotiating extended payment terms with suppliers can provide businesses with more breathing room for cash flow management. Failure to pay suppliers on time can strain relationships and potentially disrupt the supply chain.

4. Inventory management: Effective inventory management is crucial for accurate cash flow forecasting. Holding excessive inventory ties up cash, while stockouts can lead to lost sales. By optimizing inventory levels and monitoring ordering patterns, businesses can avoid unnecessary cash flow fluctuations and ensure a more accurate forecast.

5. Expenses and costs: Accurate estimation of expenses and costs is essential for cash flow forecasting. Unexpected expenses, unforeseen fluctuations in operating costs, or rising interest rates can impact cash flow projections. Businesses should regularly review and update their expense forecasts to reflect any changes in the cost of goods, overhead expenses, interest rates, or other relevant factors.

6. Seasonal fluctuations: Seasonal businesses may experience significant fluctuations in cash flows throughout the year. For example, a retail business may have higher cash inflows during holiday seasons. It is important to account for these seasonal patterns when creating cash flow forecasts to avoid inaccuracies and properly plan for periods of lower cash flow.

7. Internal changes: Any changes within the business, such as expansion plans, new product launches, or shifts in pricing strategies, can impact cash flow forecasts. These changes can affect sales projections, operating costs, and capital expenditures, consequently influencing cash flow patterns. Businesses should regularly reassess and update their forecast models to incorporate these internal changes.

To improve the accuracy of cash flow forecasting, businesses should utilize historical data, closely monitor and analyze cash flow patterns, and incorporate feedback from relevant stakeholders within the organization. Regularly reviewing and refining forecasting methods based on actual performance can help businesses achieve more accurate cash flow projections and make informed financial decisions.

Methods and Techniques for Cash Flow Forecasting

Cash flow forecasting involves using various methods and techniques to estimate and predict future cash inflows and outflows. The choice of methods depends on the complexity of the business, available data, and the level of accuracy required. Here are some commonly used methods and techniques for cash flow forecasting:

1. Direct Method: The direct method is a straightforward approach that involves projecting cash inflows and outflows based on known or anticipated transactions. It relies on historical data and future expectations to estimate cash flows. This method is useful for businesses with simple cash flow structures and predictable patterns.

2. Indirect Method: The indirect method calculates cash flow by adjusting net income using non-cash items such as depreciation and changes in working capital. This method starts with the net income figure from the income statement and adjusts it to reflect cash inflows and outflows. It provides a more accurate representation of cash flow by considering non-cash items.

3. Percentage of Sales Method: The percentage of sales method forecasts cash flows by applying a predetermined percentage to projected sales revenue. This method assumes that cash flows are directly proportional to sales. The percentage is based on historical cash flow patterns or industry benchmarks. It is a quick and simple method but may not account for changes in expenses or working capital.

4. Seasonal Cash Flow Method: Seasonal businesses can utilize the seasonal cash flow method to forecast cash flows based on historical seasonal patterns. This method considers the seasonality of cash flows, adjusting for fluctuations in sales, expenses, and working capital during different periods of the year. It is especially useful for businesses that experience significant variations in cash flow throughout the year.

5. Moving Averages Method: The moving averages method uses historical data to calculate average cash inflows and outflows over a specific period. It smooths out fluctuations and provides a more stable forecast. By taking the average of previous periods, this method eliminates extreme highs and lows, providing a more realistic projection of future cash flows.

6. Regression Analysis: Regression analysis involves using mathematical models to analyze the relationship between cash flows and other variables, such as sales, expenses, or economic indicators. This method helps identify trends, patterns, and correlations that can be used to forecast cash flows. It is a more advanced technique and requires statistical expertise.

7. Scenario Analysis: Scenario analysis involves developing multiple cash flow projections based on different scenarios or assumptions. It helps businesses evaluate the potential impact of various factors on cash flows. By creating best-case, worst-case, and medium-case scenarios, businesses can assess the potential risks and opportunities they might face and make informed decisions accordingly.

8. Cash Flow Forecasting Software: Cash flow forecasting software automates the process of generating cash flow forecasts. These software applications gather and analyze financial data, generate visual reports, and provide real-time updates. Cash flow forecasting software helps businesses streamline the forecasting process, improve accuracy, and save time.

It is important for businesses to select the most appropriate method or combination of methods based on their specific needs and the nature of their cash flows. Regularly reviewing and updating cash flow forecasts with actual financial data will further enhance accuracy and reliability. Additionally, seeking the expertise of financial professionals can provide valuable insights and guidance in choosing the most suitable methods and techniques for cash flow forecasting.

Common Challenges in Cash Flow Forecasting

Even with the best forecasting methods and techniques in place, businesses often encounter challenges when forecasting cash flows. Understanding and addressing these challenges is crucial for improving the accuracy and reliability of cash flow forecasts. Here are some common challenges in cash flow forecasting:

1. Uncertain market conditions: Market conditions can be volatile and unpredictable, making it challenging to forecast cash flows accurately. Changes in consumer behavior, economic downturns, or industry-specific factors can significantly impact cash flow projections. It is important for businesses to regularly monitor market trends and adjust forecasts accordingly.

2. Limited historical data: Accurate cash flow forecasting relies on historical data to identify trends and patterns. However, startups or businesses in unique industries may have limited historical data to base their forecasts on. In such cases, businesses can rely on market research, industry benchmarks, or comparable businesses to make reasonable estimates.

3. Seasonal fluctuations: Businesses that experience seasonal sales patterns may struggle to accurately forecast cash flows throughout the year. Seasonal fluctuations can result in uneven cash inflows and outflows, making it challenging to project cash flow trends accurately. Businesses must consider seasonal variations when designing their forecasting models and make adjustments accordingly.

4. Inaccurate revenue projections: Estimating future sales revenue is often a challenge. It requires a deep understanding of the market, customer behavior, and other factors that can influence sales. Incorrect revenue projections can lead to overestimation or underestimation of cash inflows, impacting cash flow forecasts. Regularly reviewing sales pipelines and incorporating market trends can help improve revenue projections.

5. Delayed or unpredictable payments: Late or unpredictable customer payments can disrupt cash flow forecasts. Delays in receiving payments can cause a cash flow shortfall, affecting the ability to meet financial obligations. Implementing effective accounts receivable management strategies, such as offering incentives for prompt payment or stricter credit terms, can help minimize the impact of delayed or unpredictable payments.

6. Inaccurate expense estimation: Estimating expenses accurately is crucial for cash flow forecasting. Overestimating or underestimating expenses can lead to inaccurate cash flow projections. It is essential for businesses to regularly review and update expense forecasts based on current market conditions, inflation rates, and changing business needs.

7. External factors beyond control: Unforeseen external events, such as natural disasters, regulatory changes, or political instability, can significantly impact cash flow forecasts. These events can disrupt supply chains, alter customer behavior, or change market dynamics. While it may not be possible to predict or control external factors, businesses should consider potential scenarios and develop contingency plans to mitigate their impact.

8. Lack of collaboration and communication: Cash flow forecasting involves multiple stakeholders within the organization, such as finance, sales, and operations teams. A lack of collaboration and communication between these departments can lead to inaccurate cash flow forecasts. Regular meetings, sharing of information, and coordination between teams are vital to ensure that forecasts incorporate input from all relevant parties.

By acknowledging these common challenges, businesses can take proactive measures to mitigate their impact on cash flow forecasting. Implementing robust forecasting techniques, leveraging technology, regularly reviewing and updating forecasts, and maintaining open communication within the organization can help improve the accuracy and reliability of cash flow projections.

Strategies to Improve Cash Flow Forecasting Accuracy

Accurate cash flow forecasting is crucial for effective financial management and decision-making. Businesses can employ several strategies to enhance the accuracy and reliability of their cash flow forecasts. Here are some key strategies to improve cash flow forecasting accuracy:

1. Regularly update forecasts: Cash flow forecasts should not be static documents. Regularly update and revise forecasts based on actual financial data and changes in market conditions. This ensures that forecasts reflect the most current information and provide more accurate predictions of future cash flows.

2. Improve data collection: Accurate cash flow forecasting relies on reliable and comprehensive data. Implement systems to capture and track all relevant financial data, including sales, expenses, and cash transactions. Utilize accounting software or enterprise resource planning (ERP) systems to streamline data collection and ensure data accuracy.

3. Segment cash flow forecasts: Break down cash flow forecasts into different segments, such as revenue streams, customer groups, or product lines. This segmentation provides deeper insights into the factors driving cash flows and helps identify any areas of potential risk or opportunity. It allows for more accurate forecasting by considering the unique characteristics of each segment.

4. Analyze historical data: Analyze historical data to identify trends and patterns in cash flow. Look for seasonal fluctuations, sales cycles, or any consistent changes over time. This analysis provides a basis for forecasting future cash flows and allows businesses to make more informed predictions based on historical trends and patterns.

5. Consider scenario analysis: Conduct scenario analyses to assess the potential impact of different situations on cash flow. Create multiple scenarios, such as best-case, worst-case, and medium-case, to evaluate the range of possible outcomes. This analysis helps businesses understand the potential risks and opportunities and allows for more accurate forecasting under different circumstances.

6. Collaborate with stakeholders: Involve key stakeholders, including finance, sales, and operations teams, in the cash flow forecasting process. Collaborate regularly to gather input, align strategies, and ensure that forecasts incorporate different perspectives. This cross-functional collaboration enhances the accuracy of forecasts by leveraging the expertise and insights of various departments.

7. Monitor and track cash flow: Continuously monitor and track actual cash flow against forecasted amounts. Regularly compare forecasted and actual data to identify variances and analyze the reasons behind discrepancies. This feedback loop enables businesses to learn from past forecasting errors and make necessary adjustments to improve accuracy over time.

8. Leverage technology: Utilize cash flow forecasting software or financial management tools to automate the process and enhance accuracy. These tools help aggregate and analyze financial data, generate visual reports, and provide real-time updates. They streamline the forecasting process, reduce manual errors, and improve the reliability of cash flow projections.

9. Seek professional expertise: If cash flow forecasting is complex or beyond the capabilities of internal resources, consider seeking assistance from financial professionals or consultants with expertise in cash flow management. Their experience and knowledge can provide valuable insights and guidance in improving the accuracy of cash flow forecasting.

By implementing these strategies, businesses can enhance the accuracy and reliability of their cash flow forecasts. This, in turn, allows for more effective financial planning, better resource allocation, and improved decision-making for long-term growth and financial stability.

Case Studies: How Businesses Use Cash Flow Forecasting

Cash flow forecasting plays a vital role in the financial management of businesses across various industries. Let’s explore a couple of case studies that highlight how businesses effectively utilize cash flow forecasting:

Case Study 1: Retail Business

A retail business that experiences seasonal sales patterns relies on cash flow forecasting to manage its cash flow effectively. By analyzing historical sales data and considering market trends, the business creates a cash flow forecast that reflects the peaks and troughs in sales throughout the year. This allows them to prepare for periods of low cash flow and ensure they have enough liquidity to cover expenses during those times. The cash flow forecast also helps them plan for inventory needs, optimize marketing efforts, and adjust staffing levels based on anticipated sales. With accurate cash flow projections, the business can make informed decisions about financing options, such as securing a line of credit during slower sales periods, to maintain a steady cash flow and meet its financial obligations.

Case Study 2: Technology Startup

A technology startup in the software-as-a-service (SaaS) industry relies heavily on cash flow forecasting to manage its growth and attract investor funding. Since SaaS businesses often have a long sales cycle, accurate cash flow forecasting is crucial for managing operational expenses, hiring and retaining talent, and supporting ongoing product development. By forecasting cash flows, the startup can make informed decisions about resource allocation, identify potential funding gaps, and plan for future investments. The cash flow forecast also helps in projecting the company’s runway, which is the amount of time before the business runs out of cash based on current cash flow projections. This information is crucial when seeking investor funding or negotiating with venture capitalists, as it demonstrates financial stability and a clear path to profitability.

Case Study 3: Construction Company

A construction company leverages cash flow forecasting to navigate the unique challenges of its industry. With projects spanning several months or even years, managing cash flow becomes critical for the company’s financial stability. By accurately projecting cash inflows and outflows, the construction company can assess its financing needs, plan for material purchases, equipment rentals, and subcontractor payments in advance. Additionally, the business uses cash flow forecasting to monitor payment schedules from clients, ensuring prompt collections to maintain cash flow. With a clear cash flow forecast, the construction company can negotiate better payment terms with suppliers and subcontractors, manage scheduling conflicts, and make informed decisions about resource allocation to optimize project profitability.

These case studies emphasize the importance of cash flow forecasting across different industries. Whether managing seasonal sales, supporting startup growth, or navigating the challenges of a specific sector, businesses can leverage cash flow forecasting to optimize financial resources, plan for cash needs, and enhance financial stability.

Conclusion

Cash flow forecasting is a powerful financial tool that empowers businesses to plan, manage, and optimize their cash flow effectively. By accurately projecting future cash inflows and outflows, businesses can make informed decisions, allocate resources efficiently, and navigate through financial uncertainties.

In this article, we explored the definition of cash flow forecasting and its importance in financial planning. We discussed the benefits it offers, such as improved financial planning, optimized resource allocation, and better decision-making support. We also examined the factors that can affect cash flow forecast accuracy, including market conditions, customer and supplier payments, and internal changes.

Furthermore, we explored various methods and techniques for cash flow forecasting, including the direct and indirect methods, percentage of sales method, and moving averages method. We also highlighted the value of scenario analysis and the utilization of cash flow forecasting software to streamline the process.

We acknowledged the common challenges businesses may encounter in cash flow forecasting, including uncertain market conditions, limited historical data, and seasonal fluctuations. However, we provided strategies to address these challenges, such as regularly updating forecasts, improving data collection, and leveraging technology.

Finally, we presented case studies illustrating how businesses use cash flow forecasting in different industries. These examples showcased the importance of accurate cash flow forecasting for managing seasonal sales, supporting startups’ growth, and navigating industry-specific challenges. These cases demonstrated the practical application and benefits of cash flow forecasting.

In conclusion, cash flow forecasting is a critical tool for businesses to sustain financial stability, make informed decisions, and drive growth. By implementing the strategies and techniques outlined in this article, businesses can enhance the accuracy of their cash flow forecasts and capitalize on the numerous benefits it offers. With reliable cash flow projections, businesses can confidently navigate their financial journeys and achieve long-term success.