Home>Finance>Federal Deposit Insurance Corp. (FDIC): Definition & Limits

Finance

Federal Deposit Insurance Corp. (FDIC): Definition & Limits

Published: November 22, 2023

Learn about the Federal Deposit Insurance Corp. (FDIC) definition and limits in finance. Safeguard your deposits with this important financial protection.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the FDIC: Definition & Limits

Have you ever wondered what happens to your money in the bank if the financial institution fails? The Federal Deposit Insurance Corp. (FDIC) was established to address this concern and provide deposit insurance to safeguard depositors’ funds. In this blog post, we will dive into the definition and limits of FDIC coverage, providing you with a comprehensive understanding of its importance.

Key Takeaways:

- FDIC insures deposits in participating banks up to $250,000 per depositor, per account category.

- Deposits covered by FDIC include checking and savings accounts, certificates of deposit (CDs), and money market deposit accounts.

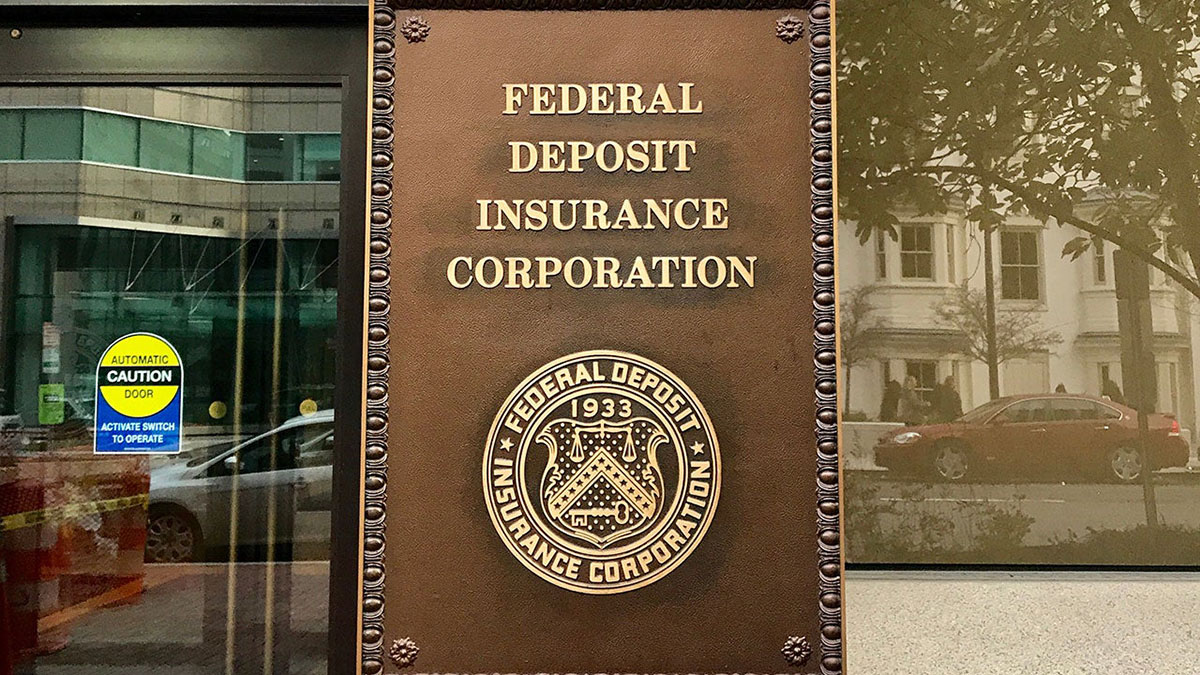

So, what exactly is the FDIC? The Federal Deposit Insurance Corp. is an independent federal agency created by the United States Congress in 1933, during the Great Depression. The primary purpose of the FDIC is to provide stability and public confidence in the nation’s financial system by guaranteeing deposits in banks that are members of the FDIC.

FDIC insurance provides depositors with protection against the loss of their qualifying deposits if an FDIC-insured bank fails. To put it simply, if the bank where you hold your money were to fail, the FDIC would step in to provide insurance for your deposited funds, up to certain limits.

So, how much coverage does the FDIC provide? Currently, the standard insurance amount is $250,000 per depositor, per account category. This means that each depositor is insured up to $250,000 for their individual deposits, and this coverage extends across different account categories, such as single accounts, joint accounts, certain retirement accounts, and more.

It’s essential to understand that the $250,000 limit applies to each depositor and not per account. For example, if you have a checking account with $100,000 and a savings account with $200,000 at the same bank, both accounts together would fall under the $250,000 coverage limit.

What types of deposits are covered by the FDIC? The FDIC covers a wide range of deposit accounts, including checking accounts, savings accounts, certificates of deposit (CDs), and money market deposit accounts. These are the most common types of accounts held by individuals at banks.

It’s important to note that not all investments or financial products are covered by the FDIC. Items such as stocks, bonds, mutual funds, annuities, and life insurance policies are not insured by the FDIC, even if they are purchased through an FDIC-insured bank.

By understanding the definition and limits of FDIC coverage, you can make informed decisions regarding your banking and savings. It’s crucial to be aware of the insurance limits to ensure that your deposits are properly protected within the FDIC guidelines. Remember, in the unlikely event that your bank fails, the FDIC is there to provide peace of mind and financial protection.