Finance

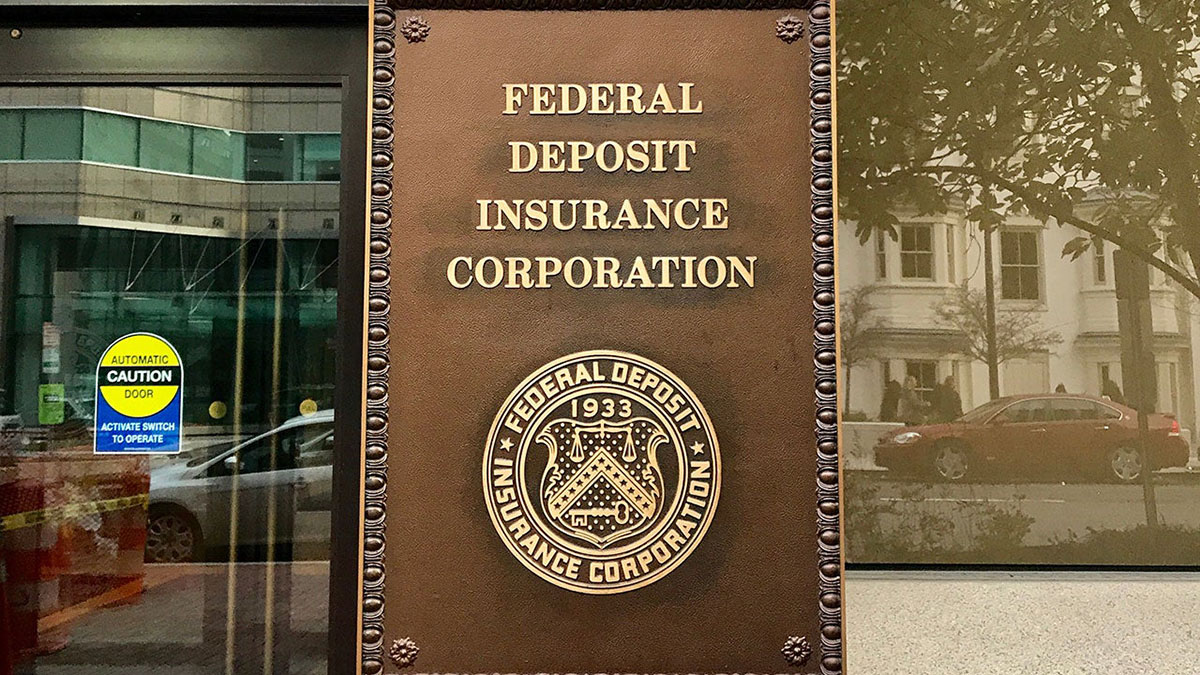

Risk-Based Deposit Insurance Definition

Published: January 21, 2024

Find out the meaning of risk-based deposit insurance and how it impacts the finance industry. Stay informed on the latest developments in finance with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Risk-Based Deposit Insurance Definition: Understanding the Basics

When it comes to managing your finances, it’s essential to have a clear understanding of the different aspects of the industry. One important concept in the world of finance is risk-based deposit insurance. In this blog post, we’ll delve into the definition of risk-based deposit insurance and how it impacts you as a consumer. So, let’s get started!

Key Takeaways:

- Risk-based deposit insurance takes into account the level of risk associated with different financial institutions and determines the amount of coverage provided.

- Depositors can feel more secure knowing that their deposits are protected to a certain extent, even in the event of a bank failure.

What is Risk-Based Deposit Insurance?

Risk-based deposit insurance is a system that aims to provide protection to depositors in the event of a bank failure. It takes into account the risk profile of different financial institutions and determines the level of coverage provided to depositors based on that assessment.

- Assessing Risk: Financial institutions are evaluated based on various factors, such as their capital adequacy, asset quality, management efficiency, and earnings stability. These factors help determine the level of risk associated with a particular bank.

- Providing Coverage: Based on the risk assessment, deposit insurance organizations determine the amount of coverage that depositors will receive if a bank fails. The coverage may vary from one institution to another based on their risk profile.

- Enhancing Stability: Risk-based deposit insurance helps promote stability within the banking industry. By providing a safety net for depositors, it reduces the likelihood of a bank run or mass withdrawals during times of financial uncertainty.

- Encouraging Sound Practices: Financial institutions are incentivized to adopt prudent risk management practices to maintain a favorable risk profile. This helps safeguard depositors’ funds and ensures the overall stability of the financial system.

How Does Risk-Based Deposit Insurance Impact Depositors?

As a depositor, understanding risk-based deposit insurance is crucial because it affects the level of protection you have for your funds. Here are a couple of key takeaways:

- Protection: Risk-based deposit insurance provides depositors with some level of protection in the event of a bank failure. While the coverage may not guarantee the full recovery of your deposits, it offers a safety net that can help mitigate potential losses.

- Choosing Financial Institutions: By being aware of the risk profiles and associated coverage levels, depositors can make more informed decisions when choosing where to deposit their funds. Depositing money into financial institutions with a stronger risk profile may offer greater peace of mind.

In conclusion, risk-based deposit insurance is an integral part of the finance industry that aims to protect depositors in the event of a bank failure. It considers the risk profiles of financial institutions to determine the level of coverage provided to depositors. Understanding this concept allows you to make informed decisions about where to deposit your hard-earned money.

Remember, while risk-based deposit insurance can provide a safety net for depositors, it is still important to conduct thorough research and consult with financial professionals to make the best possible decisions for your financial well-being.