Home>Finance>How To Withdraw Money From Chase A Investment Account

Finance

How To Withdraw Money From Chase A Investment Account

Published: October 16, 2023

Learn how to easily withdraw money from your Chase investment account and manage your finances efficiently. Simplify your financial transactions with our step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Chase Investment Accounts

- Eligibility Requirements

- Setting Up a Chase Investment Account

- Types of Investments Offered

- Benefits of a Chase Investment Account

- Overview of Withdrawal Options

- Preparing to Withdraw Money

- Online Withdrawal Process

- Requesting a Withdrawal by Phone

- Withdrawal by Check or Wire Transfer

- Taxes and Penalties for Withdrawals

- Frequently Asked Questions

- Conclusion

Introduction

Welcome to our guide on how to withdraw money from a Chase Investment account. Chase offers a wide range of investment options for individuals looking to grow their wealth and achieve their financial goals. Whether you’re saving for retirement, funding a college education, or simply building long-term wealth, Chase Investment accounts provide a variety of opportunities to invest your money wisely.

Understanding how to withdraw money from your Chase Investment account is essential for managing your finances effectively. Whether you need to access funds for a major purchase or are ready to start enjoying the fruits of your investment journey, the process of withdrawing money from your Chase Investment account is straightforward and convenient.

In this guide, we’ll explore the different types of Chase Investment accounts, the eligibility requirements for opening an account, and the various options available for withdrawing money. We’ll also discuss the important considerations you need to keep in mind, such as taxes and penalties that may apply to certain types of withdrawals.

Having a clear understanding of the withdrawal process will empower you to make informed financial decisions and take control of your investment journey. So, let’s get started and learn how to withdraw money from your Chase Investment account.

Understanding Chase Investment Accounts

Before diving into the details of withdrawing money from your Chase Investment account, it’s important to have a clear understanding of what exactly these accounts are. Chase Investment accounts are financial products that allow individuals to invest their money in various assets such as stocks, bonds, mutual funds, and more.

Chase offers a range of investment account options to suit different investment goals and risk tolerances. These options include individual retirement accounts (IRAs), brokerage accounts, and managed portfolios. Each type of account has its own features and benefits, tailored to meet the unique needs of investors.

Individual Retirement Accounts (IRAs) are popular for retirement savings. They offer potential tax advantages and allow investors to save for their golden years while enjoying potential growth on their investments. IRAs can be either traditional or Roth, depending on the individual’s tax situation and preferences.

Chase brokerage accounts, on the other hand, provide investors with the flexibility to buy and sell various securities, such as stocks, bonds, and mutual funds. These accounts are ideal for individuals who want to actively manage their investment portfolios and have more control over their investment decisions.

For those who prefer a more hands-off approach, Chase also offers managed portfolios. These professionally managed accounts are designed to meet specific investment objectives and risk tolerances. Investors can choose from a range of pre-built portfolios or work with a financial advisor to create a customized investment strategy.

Regardless of the type of Chase Investment account you have, it’s important to understand the rules and regulations governing withdrawals. Different account types may have specific requirements and restrictions when it comes to accessing your funds. By familiarizing yourself with these rules, you can ensure a smooth and efficient withdrawal process when the time comes.

Now that we have a basic understanding of Chase Investment accounts, let’s explore the eligibility requirements for opening an account in the next section.

Eligibility Requirements

If you’re interested in opening a Chase Investment account and eventually withdrawing money from it, it’s essential to meet certain eligibility requirements. While these requirements may vary depending on the type of account you wish to open, there are some general criteria to keep in mind.

First and foremost, you must be at least 18 years old to open an investment account with Chase. This is the legal age requirement for entering into financial agreements and managing investment assets.

In addition to the age requirement, you will need to have a Social Security number or an Individual Taxpayer Identification Number (ITIN) to open a Chase Investment account. This is necessary for tax reporting purposes and to comply with regulatory requirements.

When it comes to certain types of investment accounts, such as Individual Retirement Accounts (IRAs), there may be additional eligibility criteria. For example, to open a Traditional IRA, you must have earned income, while the Roth IRA has income limits. It’s important to review and understand these criteria to ensure you qualify for the specific type of account you desire.

Lastly, you will need to have a valid form of identification and provide the necessary documents to verify your identity. This may include a government-issued ID, such as a driver’s license or passport, as well as proof of address, such as a utility bill or bank statement.

Meeting these eligibility requirements is crucial for successfully opening a Chase Investment account and gaining the ability to withdraw funds when needed. It’s important to note that while these are general eligibility criteria, there may be additional requirements or limitations based on the specific investment product or service you choose.

Now that we understand the eligibility requirements, let’s move on to the next section, where we’ll explore how to set up a Chase Investment account.

Setting Up a Chase Investment Account

If you’ve determined that you meet the eligibility requirements to open a Chase Investment account, the next step is to set up your account. Setting up a Chase Investment account is a relatively straightforward process that can be done online or by visiting a local branch.

To begin, you’ll need to gather the necessary information and documents. This includes your Social Security number or Individual Taxpayer Identification Number (ITIN), as well as a valid form of identification such as a driver’s license or passport.

If you choose to open an account online, you can visit the Chase website and navigate to the investment account section. There, you’ll find the option to open an account and will be prompted to provide your personal information, including your name, address, and contact details. You’ll also be asked to select the type of account you want to open, such as an IRA, brokerage account, or managed portfolio.

Once you’ve entered all the required information, you may be asked to review and accept the terms and conditions of the account. It’s important to carefully read and understand these terms before proceeding.

After submitting your application, you may be required to provide additional documentation to verify your identity. This can typically be done by uploading scanned copies or clear photos of your identification documents directly on the Chase website. Alternatively, you may be asked to visit a local branch to provide the necessary documents.

If you prefer to open an account in person, you can visit a Chase branch and speak with a representative. They will guide you through the account opening process, answer any questions you may have, and help ensure that you have all the necessary documentation.

During the account setup process, you may also have the option to select additional features or services, such as enrolling in online banking or setting up automatic contributions to your investment account. These features can help streamline your financial management and make it easier to track your investments and withdrawals.

Once your Chase Investment account is successfully set up, you’ll have the ability to start investing and, eventually, withdraw funds. In the next section, we’ll explore the different types of investments offered through Chase Investment accounts.

Types of Investments Offered

Chase Investment accounts provide a wide range of investment options to help you grow your wealth and achieve your financial goals. Depending on your risk tolerance, investment objectives, and personal preferences, you can choose from various types of investments offered through Chase.

Here are some of the common types of investments you can consider:

- Stocks: Investing in stocks allows you to own a stake in publicly traded companies. With Chase, you can buy individual stocks or invest in exchange-traded funds (ETFs), which provide diversification across multiple stocks within a specific market or sector.

- Bonds: Bonds are fixed-income investments where you lend money to a government or corporation in exchange for regular interest payments. Chase offers a selection of Treasury bonds, municipal bonds, and corporate bonds with different risk profiles and maturities.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Chase provides access to a wide variety of mutual funds from different fund families, allowing you to choose funds that align with your investment goals and risk tolerance.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, ETFs are investment funds that trade on stock exchanges like individual stocks. They offer diversification and can track specific market indexes or sectors, providing exposure to a broad range of securities.

- Options and Futures: For more advanced investors, Chase also offers options and futures trading. These derivative products allow you to speculate on the price movements of underlying assets and potentially achieve higher returns, but they also come with increased risks.

Additionally, Chase Investment accounts may offer access to professionally managed portfolios, which are comprised of a mix of different investments based on your risk tolerance and investment goals. These portfolios are typically managed by experienced investment professionals who actively monitor and adjust the asset allocation to maximize potential returns.

It’s important to carefully consider your investment objectives, risk tolerance, and time horizon when selecting the types of investments for your Chase Investment account. Diversification across asset classes and regular review of your investment portfolio can help mitigate risk and optimize returns.

Now that we have explored the types of investments offered through Chase Investment accounts, let’s move on to the benefits of having a Chase Investment account in the next section.

Benefits of a Chase Investment Account

Opening a Chase Investment account offers numerous benefits for individuals seeking to grow their wealth and achieve their financial goals. Here are some key advantages of having a Chase Investment account:

- Wide Range of Investment Options: Chase provides access to a diverse selection of investment options, including stocks, bonds, mutual funds, ETFs, and managed portfolios. This allows you to build a customized investment portfolio that aligns with your risk tolerance and investment objectives.

- Expert Guidance: Chase offers access to experienced financial advisors who can provide personalized investment advice and guidance. Whether you’re a novice investor or an experienced one, having the expertise of a professional can help you make informed decisions and navigate the complexities of the investment world.

- Convenience and Accessibility: With Chase Investment accounts, you can conveniently manage your investments online or through the Chase mobile app. This means accessing your account, monitoring your portfolio, and making investment decisions from the comfort of your own home or on the go.

- Integrated Banking and Investing: If you already have a Chase bank account, opening a Chase Investment account allows you to enjoy a seamless integration of banking and investing services. You can easily transfer funds between your accounts and have a consolidated view of your finances.

- Tax Advantages: Certain types of Chase Investment accounts, such as IRAs, offer potential tax advantages. For example, traditional IRAs may provide tax-deductible contributions, while Roth IRAs offer tax-free withdrawals in retirement. These tax benefits can help you optimize your savings and minimize your tax liability.

- Tools and Resources: Chase provides a range of tools and resources to help you make informed investment decisions. These include research reports, educational materials, investment calculators, and portfolio analysis tools. Access to these resources can empower you to make educated investment choices that align with your financial goals.

Having a Chase Investment account can not only help you grow your wealth but also provide peace of mind knowing that you have access to professional guidance and robust investment options. Whether you’re investing for retirement, building wealth for the future, or saving for specific financial goals, a Chase Investment account can be a valuable tool on your financial journey.

Now that we understand the benefits of having a Chase Investment account, let’s move on to the next section, where we’ll delve into the withdrawal options available to account holders.

Overview of Withdrawal Options

When it comes to withdrawing money from your Chase Investment account, you have several options to choose from. The specific options available to you may depend on the type of investment account you have and any restrictions or rules associated with it. Here’s an overview of the common withdrawal options:

- Online Withdrawal: One of the most convenient ways to withdraw money is through the online banking portal or mobile app. This allows you to initiate a withdrawal request and have the funds transferred directly to your linked bank account. Online withdrawals are usually processed quickly, making it a hassle-free option.

- Phone Withdrawal: Alternatively, you can call the customer service number provided by Chase and request a withdrawal over the phone. A representative will assist you with the process and ensure that your funds are transferred to the desired account.

- Check Withdrawal: If you prefer a traditional method, you can request a check withdrawal from your Chase Investment account. Once the check is issued, you can either deposit it into your bank account or cash it at a Chase branch or other financial institution.

- Wire Transfer: In certain circumstances, such as for larger withdrawal amounts or international transfers, you may opt for a wire transfer from your Chase Investment account. This allows for a direct and secure transfer of funds to another bank account.

- Systematic Withdrawal Plan (SWP): If you are looking to establish a steady stream of income from your investment account, you can set up a systematic withdrawal plan. This allows you to schedule regular withdrawals at specified intervals to meet your financial needs. SWPs can be customized based on the amount and frequency of withdrawals.

It’s important to note that certain withdrawal options, such as wire transfers or SWPs, may have specific requirements or associated fees. It’s advisable to review the terms and conditions of your account and consult with a financial advisor or representative from Chase to understand the specifics of each withdrawal method.

Additionally, it’s important to consider the tax implications of withdrawing funds from your investment account. Depending on the account type and the nature of the investments, withdrawals may be subject to tax liabilities. It’s always recommended to consult with a tax professional to understand the tax consequences of your withdrawals and ensure compliance with relevant regulations.

Now that we have covered the overview of withdrawal options, let’s move on to the next section, where we’ll explore the process of preparing to withdraw money from your Chase Investment account.

Preparing to Withdraw Money

Before you initiate a withdrawal from your Chase Investment account, it’s important to take some preparatory steps to ensure a smooth and efficient process. These steps can help you avoid any unnecessary delays or complications when accessing your funds. Here are some key considerations to keep in mind:

- Review Your Investment Portfolio: Take a moment to review your investment portfolio and determine the specific investments from which you wish to withdraw. Consider your investment objectives, risk tolerance, and the overall performance of your investments to make an informed decision.

- Evaluate your Financial Needs: Assess your financial needs to determine the amount of money you need to withdraw. Consider any upcoming expenses or financial goals you need to fund with the withdrawal, such as a down payment on a house or paying for college tuition.

- Consider Tax Implications: Understand the potential tax implications of the withdrawal. Depending on the type of account and investments, withdrawals may be subject to income tax or early withdrawal penalties. Consult with a tax professional to ensure you are aware of the tax consequences and to plan accordingly.

- Verify Account Details: Ensure that your account details, including your bank account information, are up to date and accurate. This is crucial to ensure that the funds are deposited into the correct account without any issues.

- Be Mindful of Withdrawal Restrictions: Some investment accounts may have specific withdrawal restrictions, such as holding periods or minimum balance requirements. Familiarize yourself with these restrictions to avoid any surprises or penalties when attempting to withdraw your funds.

- Keep Documentation and Statements: Maintain copies of your account statements and withdrawal requests for your records. These documents can serve as proof of your transactions and may be needed for tax reporting purposes or future reference.

By taking the time to prepare and consider these factors, you can ensure a smoother withdrawal process and better align your financial needs with your investment strategy.

Now that you’ve prepared to withdraw money from your Chase Investment account, let’s explore the step-by-step process of initiating an online withdrawal in the next section.

Online Withdrawal Process

Initiating an online withdrawal from your Chase Investment account is a convenient and user-friendly process. By following a few simple steps, you can easily request a withdrawal and have the funds transferred to your linked bank account. Here’s a step-by-step guide to the online withdrawal process:

- Login to your Chase Account: Start by logging into your Chase investment account through the Chase online banking portal or the mobile app. Enter your username and password to access your account.

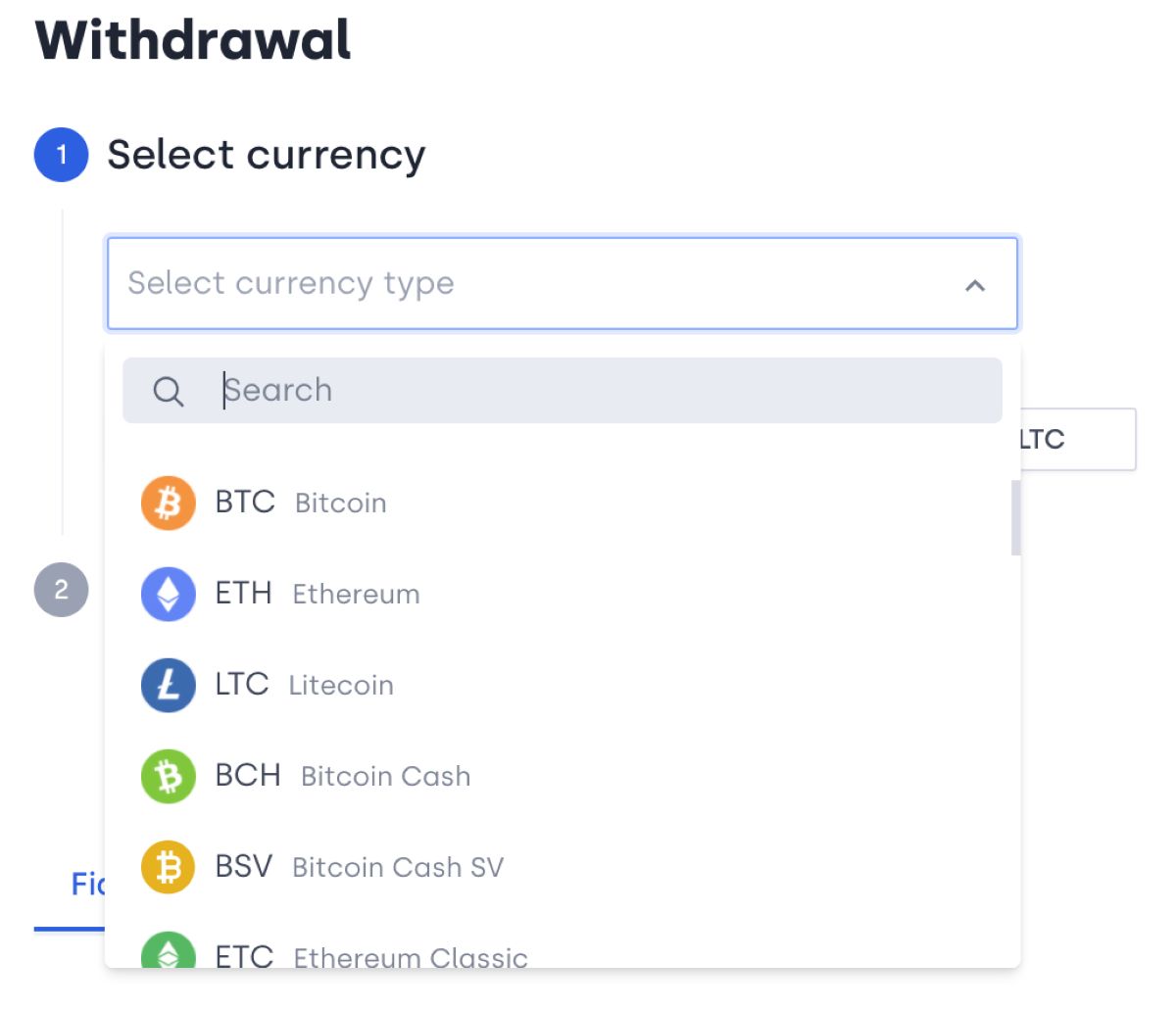

- Navigate to the Withdrawal Section: Once logged in, navigate to the withdrawal section of your account. Depending on the layout and design of the online banking platform, you may find it under “Transfers & Payments” or a similar tab.

- Select the Source Account: Choose the investment account from which you want to withdraw funds. If you have multiple investment accounts with Chase, ensure that you select the correct one.

- Specify the Withdrawal Amount: Enter the amount of money you wish to withdraw from your investment account. Ensure that the amount aligns with your financial needs and goals.

- Select the Destination Account: Choose the linked bank account where you want the withdrawn funds to be deposited. Verify that the account information is accurate to ensure a successful transfer.

- Review and Confirm: Take a moment to review the withdrawal details to ensure accuracy. Check the withdrawal amount, source account, destination account, and any associated fees or terms. Once you’re satisfied, confirm the withdrawal request.

- Monitor the Transaction: After confirming the withdrawal request, monitor your account for any updates or notifications. You may receive confirmation emails or messages regarding the status of your withdrawal.

- Wait for the Funds to Be Transferred: Typically, funds from an online withdrawal are transferred to your linked bank account within a few business days. Depending on the processing time and any external factors, it may take slightly longer for the funds to reflect in your bank account.

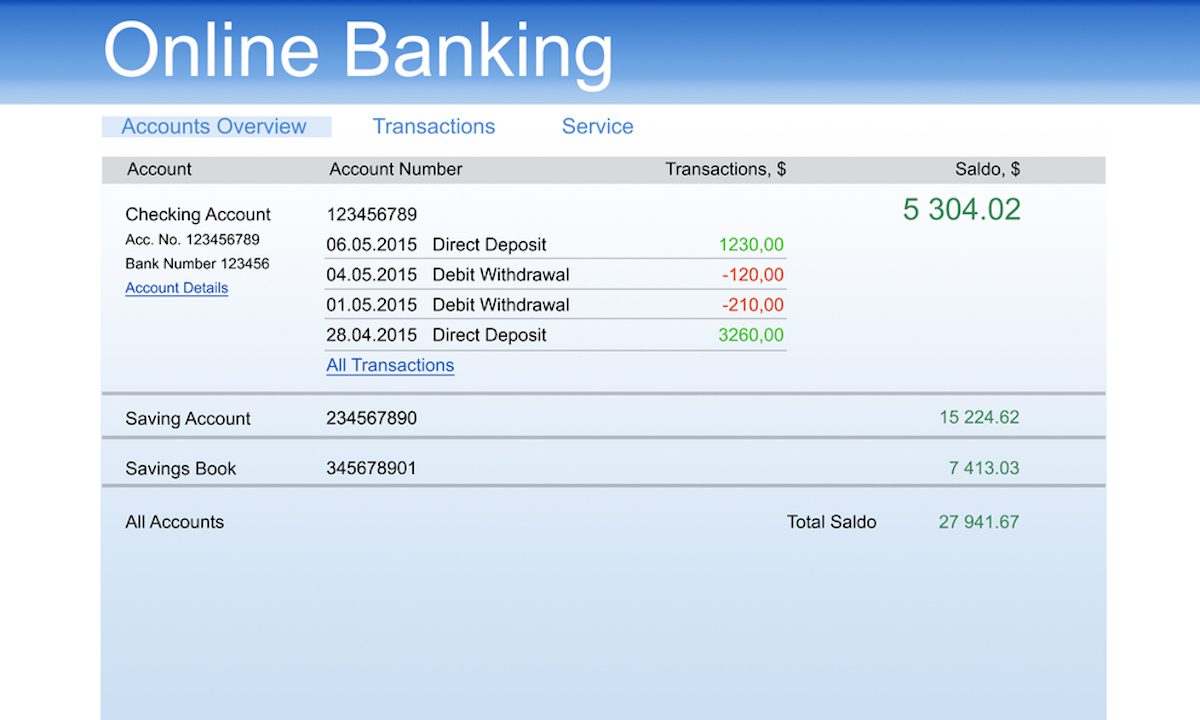

- Review your Bank Account Statement: Once the funds are transferred, review your bank account statement to ensure that the correct amount has been deposited. If there are any discrepancies or issues, contact Chase customer support for assistance.

It’s important to keep in mind that the online withdrawal process may vary slightly depending on your specific Chase investment account and the online banking platform. If you encounter any difficulties or have questions, don’t hesitate to reach out to Chase customer support for guidance and assistance.

In the next section, we’ll discuss an alternative option for initiating a withdrawal from your Chase Investment account: requesting a withdrawal by phone.

Requesting a Withdrawal by Phone

If you prefer a more personalized approach or encounter any issues with the online withdrawal process, you have the option to request a withdrawal from your Chase Investment account by phone. By speaking with a customer service representative, you can easily initiate the withdrawal and get the necessary assistance. Here’s how you can request a withdrawal by phone:

- Gather Your Account Information: Before making the call, have your account details on hand, including your Chase investment account number and any other relevant information the representative may require.

- Contact Chase Customer Service: Call the customer service number provided by Chase to connect with a representative. It’s advisable to have your account number ready to provide to the representative for verification purposes.

- Verify Your Identity: The representative will ask you to confirm your identity by providing personal information associated with your account. This can include your full name, Social Security number, and other identifying details.

- Request the Withdrawal: Clearly communicate your intention to withdraw funds from your Chase Investment account. Specify the desired withdrawal amount and any specific instructions or preferences you have for the withdrawal process.

- Confirm the Details: During the call, the representative will review the withdrawal details with you. Make sure to carefully listen and confirm the accuracy of the information provided. If necessary, ask any questions or seek clarification before proceeding.

- Follow Any Additional Instructions: The representative may provide you with additional instructions or inform you of any associated fees or processing times. Make sure to follow these instructions accordingly to ensure a successful withdrawal.

- Keep Track of the Transaction: After requesting the withdrawal, make note of any reference or confirmation numbers provided by the representative. This will help you track the status of the withdrawal and reference it if needed in the future.

- Monitor Your Account: Keep an eye on your Chase Investment account and your linked bank account for any updates or notifications regarding the withdrawal. You should see the funds transferred to your bank account within a few business days, depending on the processing time.

- Review Your Bank Account Statement: Once the funds are deposited into your linked bank account, review your bank account statement to ensure that the correct amount has been credited. If there are any discrepancies or issues, contact Chase customer support for assistance and resolution.

Requesting a withdrawal by phone allows you to speak directly with a representative who can guide you through the process and address any concerns or questions you may have. It’s a reliable option for those who prefer a more personalized touch when managing their investment accounts.

In the next section, we’ll explore an alternative to online and phone withdrawals: withdrawing funds from your Chase Investment account by check or wire transfer.

Withdrawal by Check or Wire Transfer

In addition to online and phone withdrawals, another option for accessing your funds from a Chase Investment account is through a withdrawal by check or wire transfer. This method allows you to receive the funds directly in your hands or transfer them to another bank account. Here’s what you need to know about withdrawing funds by check or wire transfer:

Withdrawal by Check:

To request a withdrawal by check, you can contact the Chase customer service number or visit a local branch. Indicate your desire to withdraw funds by check and provide the necessary details, including the amount you wish to withdraw and the address where you want the check to be sent.

Once the check is issued, it will be sent to the specified address. You can then deposit the check into your bank account or cash it at a Chase branch or another financial institution. It’s important to note that the processing and delivery of the check may take a few business days.

Withdrawal by Wire Transfer:

If you need to withdraw funds quickly or transfer them to another bank account, a wire transfer is a suitable option. To initiate a wire transfer, contact Chase customer service and provide the necessary information, including the amount to be transferred and the recipient’s bank account details.

The representative will guide you through the wire transfer process and may require additional verification to ensure the security of the transaction. It’s essential to double-check the accuracy of the recipient’s bank account information to prevent any errors or delays.

Depending on the location and banking system, wire transfers may incur additional fees, so it’s important to inquire about the associated costs beforehand.

Both withdrawal by check and wire transfer provide flexibility in accessing your funds and transferring them to other accounts. Consider your specific needs and preferences when choosing between these options. It’s important to keep in mind that fees or processing times may vary depending on the type of withdrawal you choose.

In the next section, we’ll discuss the potential tax implications and penalties that may arise when making withdrawals from your Chase Investment account.

Taxes and Penalties for Withdrawals

When making withdrawals from your Chase Investment account, it’s important to be aware of the potential tax implications and penalties that may arise. The specific tax treatment and penalties will depend on the type of investment account and the nature of the withdrawals. Here are some important considerations to keep in mind:

Tax Treatment:

Withdrawals from taxable investment accounts, such as brokerage accounts, may be subject to capital gains tax. The tax is typically based on the profit you’ve made from the investments. If you held the investments for more than a year before making the withdrawal, it may qualify for long-term capital gains tax rates, which are generally lower than short-term rates.

When it comes to tax-advantaged accounts, such as Individual Retirement Accounts (IRAs), the tax treatment depends on the type of IRA. With a traditional IRA, withdrawals are generally taxable as ordinary income, whereas qualified withdrawals from a Roth IRA are tax-free.

Early Withdrawal Penalties:

For certain retirement accounts, like traditional IRAs and 401(k) plans, early withdrawals made before the age of 59½ may trigger early withdrawal penalties. These penalties are imposed by the Internal Revenue Service (IRS) to discourage premature withdrawals and preserve retirement savings.

The early withdrawal penalty for a traditional IRA is typically 10% of the amount withdrawn. However, there are exceptions to this penalty, such as using the funds for specific purposes like higher education expenses or purchasing a first home.

Roth IRAs have different rules regarding withdrawals. Contributions can be withdrawn at any time without penalty, but withdrawing earnings before the account has been open for at least five years and before the age of 59½ may result in taxes and penalties.

It’s crucial to consult with a tax advisor or financial professional to understand the specific tax implications and penalties that may apply to your particular situation. They can help you navigate the rules and make informed decisions regarding your withdrawals.

Now that we’ve covered the potential tax implications and penalties, let’s address some common questions in the next section.

Frequently Asked Questions

1. Can I withdraw money from my Chase Investment account at any time?

Yes, in most cases, you can withdraw money from your Chase Investment account at any time, subject to any specific restrictions or penalties that may apply. However, it’s important to consider the tax implications and potential penalties associated with early withdrawals from retirement accounts.

2. How long does it take to process a withdrawal from a Chase Investment account?

The processing time for a withdrawal from a Chase Investment account can vary. Online withdrawals are typically processed within a few business days, while check withdrawals may take a bit longer to arrive by mail. Wire transfers are generally faster but may come with additional fees.

3. Are there any fees associated with withdrawing money from a Chase Investment account?

Chase may charge certain fees for withdrawing money from your investment account, depending on the type of account and withdrawal method. It’s important to review the fee schedule provided by Chase or consult with a customer service representative to understand any associated fees.

4. Can I set up automatic withdrawals from my Chase Investment account?

Yes, you may have the option to set up automatic withdrawals, also known as systematic withdrawal plans (SWPs), from your Chase Investment account. SWPs allow you to schedule regular withdrawals at specified intervals to meet your financial needs.

5. How can I track my withdrawals and monitor my Chase Investment account?

Chase provides online access to your investment account, allowing you to monitor your investments, track your withdrawals, and view your account statements. You can log in to the online banking portal or use the Chase mobile app to access your account information and keep track of your transactions.

6. What if I need assistance or have questions about withdrawing money from my Chase Investment account?

If you need assistance or have questions about withdrawing money from your Chase Investment account, you can contact Chase customer service. They can provide guidance, answer your questions, and help ensure a smooth withdrawal process.

It’s important to remember that the answers provided here are general in nature. The specific details and requirements for withdrawals may vary depending on your individual circumstances and the type of investment account you have with Chase. Therefore, it’s always recommended to consult with a professional advisor or contact Chase directly for personalized guidance and accurate information.

Now, let’s conclude our guide in the final section.

Conclusion

Congratulations! You have now gained a comprehensive understanding of how to withdraw money from your Chase Investment account. Through this guide, we explored various aspects of Chase Investment accounts, including eligibility requirements, setting up an account, types of investments offered, benefits, withdrawal options, and important considerations such as taxes and penalties.

Chase Investment accounts provide individuals with a range of investment options, expert guidance, and convenient access to their funds. Whether you choose to withdraw money online, by phone, through a check, or via a wire transfer, you have flexibility and control over your funds.

However, it’s important to consider the tax implications and potential penalties associated with withdrawals, especially from retirement accounts. Consult with a tax advisor or financial professional to ensure you make informed decisions and avoid any unexpected consequences.

Always keep in mind that individual circumstances may vary, and it’s advisable to contact Chase directly or consult with a professional advisor for personalized guidance based on your specific needs and goals.

As you navigate your investment journey, don’t forget to regularly review your investment portfolio, evaluate your financial needs, and stay informed about market trends and conditions. The world of investments can be complex, but with the right knowledge and careful planning, you can make the most of your Chase Investment account and work towards achieving your financial aspirations.

We hope this guide has provided you with valuable insights and empowered you to confidently manage your Chase Investment account. Cheers to your financial success!